The increasingly worldwide development of power tool gears market has been encouraged by the growing need for more effective, resilient tools in use across construction, manufacturing and other do it yourself applications.

Power tool gears are an integral part of the electric and cordless drill, as well as other power tools, and they directly impacts and dictate how efficient the tool is, how much torque it transmits, and much more. Mounting investments in infrastructure projects, coupled with the upsurgence of home improvement activities, are boosting the market demand.

Use of high-strain lightweight materials & technological advancement in manufacturing systems are improving the functioning of gears. Moreover, rise of the cordless power tools are contributing the demand for compact and robust gear mechanisms in modern tools.

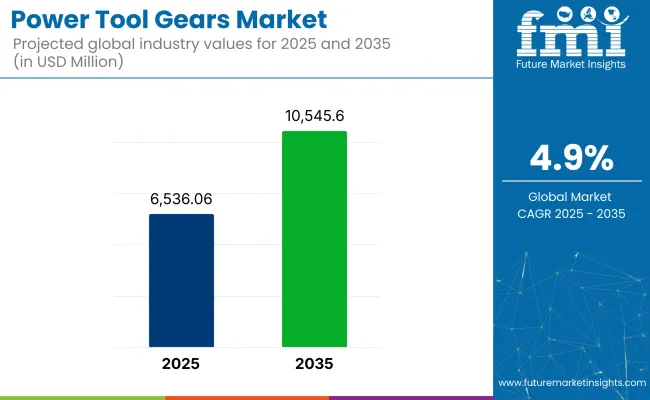

In 2025, the power tool gears market size is estimated at approximately USD 6,536.06 million. By 2035, it is projected to reach USD 10,545.60 million, growing at a compound annual growth rate (CAGR) of 4.9%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,536.06 million |

| Projected Market Size in 2035 | USD 10,545.60 million |

| CAGR (2025 to 2035) | 4.9% |

Growth is fueled by the rising adoption of power tools in emerging economies, technological innovations in gear design, and increased consumer preference for high-performance, durable tools. The expansion of the e-commerce sector also provides manufacturers wider market reach, making power tools more accessible to both professional and amateur users globally.

In North America, the power tool gears market is largely driven by the construction industry and the culture of DIY home projects driving a large share of the market in this region. The USA and Canada are leading the way, reaping the rewards of rapid urbanization and advancements in tool technology.

Moreover, Eco-friendly and battery-powered equipment adoption is supporting for the need for more efficient gears system. Moreover, collaboration between manufacturers and e-commerce in order to improve availability of products in the region is expected to fuel the product demand, propelling the regional market growth.

Thanks to strong demand from end-use industries like automotive, aerospace, and construction, the European demand for power tool gears remains neutral. France Germany and the UK, among others, are rolling out smart manufacturing technologies that call for precise and durable implement of power.

Sustainable campaigns to urge energy-efficient cogs. The new composites and materials under development are also leading to lighter weight, modular designs, as well as new opportunities for gear manufacturers to address new demands from their industrial and consumer markets.

Fastest growing in the power tool gears market in Asia-pacific region owing to rapid industrialization, urbanization and infrastructure development in countries such as China, India & Japan. The growing construction and automotive industries are fuelling the demand for power tools with advanced gear systems in these sectors.

Additionally, local manufacturers are focusing on product innovation and reaching out to customers through online sale channels, enabling them to access high-quality tools and equipment. The power tools gears market is expected to be sustainable and account for a significant compound annual growth rate (CAGR) during the forecast period.

Evolving materials, novel manufacturing processes, and innovative gear designs are all redefining what tools can do. As things like cordless tools and the do-it-yourself culture come into their own, gear makers will have to innovate from the ground up to remain competitive. Increase in construction activities and modernization projects around the world will create lucrative opportunities for professionals and companies operating in this dynamic market.

Challenges

High Manufacturing Costs

Manufacturing power tool gears is an expensive process since top quality materials and machine tools are needed to come up with durable and precision-engineered components. Many smaller manufacturers find it difficult to compete with large, vertically integrated players. So too are soaring energy prices and labor costs around the world, which are adding to the operational challenges facing gear manufacturers.

Intense Competitive Pressure

Competition in the market has been intense with both entrenched brands and newcomers competing for offering more for less. This cutthroat competition compresses margins and forces firms to continually pour money into R&D. Frequent technological advancements also reduce the product life cycle and created a pressure to offer fast innovations.

Opportunities

Rising DIY Culture and Home Improvement Trends

The rising trend of do-it-yourself and home improvement projects among consumers (particularly post-pandemic) has driven the demand for compact, powerful tools. This trend creates significant opportunities for gear makers to produce lightweight and high torque durable gear solutions for cordless and portable power tools.

Growth in Industrial and Construction Sectors

The industrial application of power tools is being propelled by the rapid urbanization trend and infrastructure development projects, especially in developing countries such as India, China, and Brazil. As noted, this rise in construction and manufacturing activities leads to steady demand for high-performance gears that can sustain heavy-duty operations.

The power tool gears market observed a boom in home improvement activities witnessed during 2020 to 2024, accelerated urbanization, and technological advancements such as brushless motors. During this time, companies invested heavily in conducting research that allowed them to create lighter and more efficient gears suited for battery-powered tools, which fueled even more growth in the market.

From 2025 to 2035, the market will demand smart gears with IoT features enabling predictive maintenance and better performance. Sustainable manufacturing practices and emerging gears using recycled and composite materials will be facilitated due to the global economy regulations as well as circular economy efforts.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Aspect | 2020 to 2024 Trends |

|---|---|

| Key Growth Driver | DIY boom, infrastructure development |

| Material Innovations | Lightweight alloys and composites |

| Technological Advancements | Brushless motor integration |

| Main Application Areas | Residential, construction sectors |

| Dominant Regions | North America, Europe |

| Regulatory Landscape | Focus on energy efficiency standards |

| Investment Trends | R&D in lightweight durable gears |

| Customer Base | Homeowners, construction firms |

| Competitive Strategy | Product quality improvement, cost reduction |

| Market Aspect | 2025 to 2035 Projections |

|---|---|

| Key Growth Driver | Smart tools adoption, sustainability focus |

| Material Innovations | Recycled materials, bio-based composites |

| Technological Advancements | IoT -enabled smart gears |

| Main Application Areas | Smart manufacturing, predictive maintenance |

| Dominant Regions | Asia-Pacific, Latin America |

| Regulatory Landscape | Emphasis on sustainable production and recycling |

| Investment Trends | Smart gear systems and green technologies |

| Customer Base | Smart factories, green builders |

| Competitive Strategy | Smart innovation, sustainability branding |

The USA power tool gears market is benefiting from robust growth in construction, automotive repair, and do-it-yourself (DIY) sectors. Strong gear manufacturing advancements are driven by growing home renovation trends and demand for cordless power tools.

Further, the introduction of smart technologies and lightweight materials are improving the efficiency and durability of the gear. Manufacturing excellence in the country and the surge of e-commerce for power tools to further propel growth in all major regions of the market.

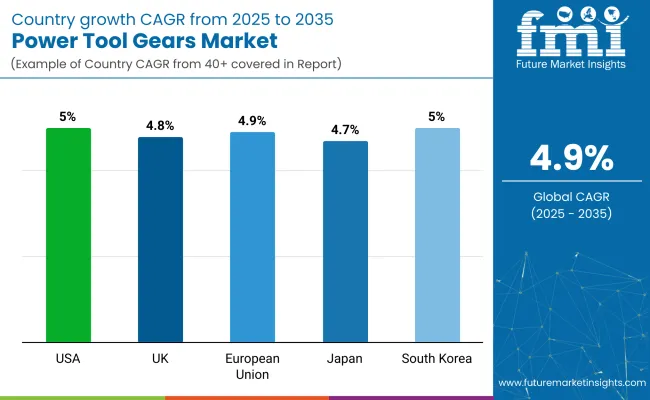

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The growth of infrastructure projects, industrial automation, and a flourishing do-it-yourself culture are the major causes of the expansion of the power tool gears market in the UK This is driving gear innovations, with increasing emphasis on ergonomic, lightweight, and energy-efficient power tools.

Development in the field of technology is bringing system, parts, or motors in brushless type as per demanding precision engineering, so, generating a high demand for these kinds of durable gear systems. Additionally, supportive government regulations encouraging construction activities and energy-efficient manufacturing practices are expected to drive the market growth robustly over the projected timeframe.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The automotive, aerospace, and construction industries are expected to fuel the growth of the power tool gears market in the European region due to the increasing demand for the European Union. And gear production is booming as countries like Germany, France and Italy pour money into modernizing industrial manufacturing.

To meet stringent environmental standards, businesses are designing power tool gears with greater durability and efficiency. YET, increasing adoption of modular, interchangeable power tools used in consumer and business applications is also generating demand for high-performance, low-maintenance gears in the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Japan power tool gears market is benefitting from the robust manufacturing ecosystem in the country along with skills` development in the country and high rate of precision tool adoption. I still remember how the country’s major industries like electronics, automotive manufacturing, and shipbuilding rely heavily on specialized power tools with advanced gears.

The need for compact, lightweight and high-torque powertrain systems is geared up with the advancements in metallurgy and material science. Japanese manufacturers have also been aggressively making technological investments in sustainable manufacturing to meet global carbon footprint reduction goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

As industrialization continues to gain pace in South Korea, the market potential of power tool gears is considerable, especially due to electronics production at large, alongside bigger investments from smart manufacturing. Domestic and export market demand for high-efficiency tools is driving gear innovations.

Furthermore, automotive repair, shipbuilding, and aerospace industries are witnessing growth, driving the demand for advanced power tool gears. Tapping the new opportunities for the gear manufacturers in the country, Government initiatives are also encouraging Industry 4.0 adoption in the manufacturing process.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

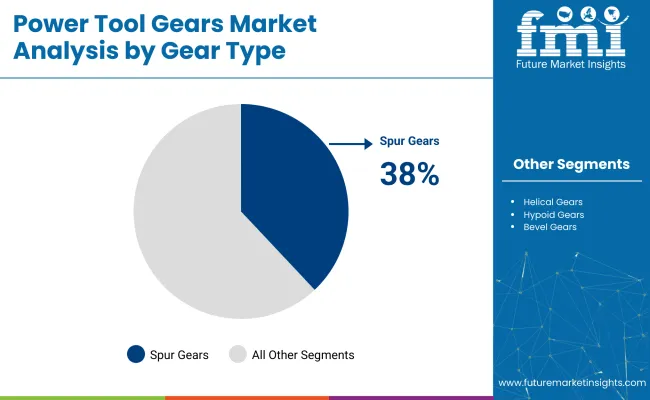

| Gear Type | Market Share (2025) |

|---|---|

| Spur Gears | 38% |

On the other hand, spur gears occupy a major space in the power tool gears market as they are simple, efficient, easy to manufacturer, and inexpensive when used in common tools such as drills, saws, and grinders.

One of the oldest and most common types of gears, spur gears have straight teeth and parallel shafts. The simple design allows them to transmit power with high efficiency so they are a good fit for power tools that require high torque and moderate rpm.

Spur gears are simple in design, which leads to lower costs of manufacturing, making them ideal for manufacturing in bulk, which is important in the competitive field of power tools. For drills, they offer the required torque multiplication to allow efficient drilling and consistent operation in differing load conditions.

In saws and grinders, spur gears also enable accurate rotational speeds and constant torque output, which are essential for smooth cutting and grinding action. Durability is another major benefit of spur gears. Since they only create axial loads (unlike helical gears, which also create radial loads), they are easier to align, maintain and repair.

That reliability makes them particularly well-suited for both professional-grade power tools and consumer products, where ease of maintenance and long service life are significant selling points. With the recent drive for more cordless and more compact power tools, manufacturers are consistently steering toward spur gears, as they also provide the ability to reduce weight while also improving energy efficiency and production costs.

Furthermore, improvements in gear materials and manufacturing technologies, including powder metallurgy and precision forging, have also enhanced the strength and performance of spur gears, solidifying their place as the leading design choice in gear systems.

These benefits of spur gears are likely to solidify their dominance in the global power tool gears market as demand for lightweight, durable and economic power tools continues to increase for both professional and DIY applications.

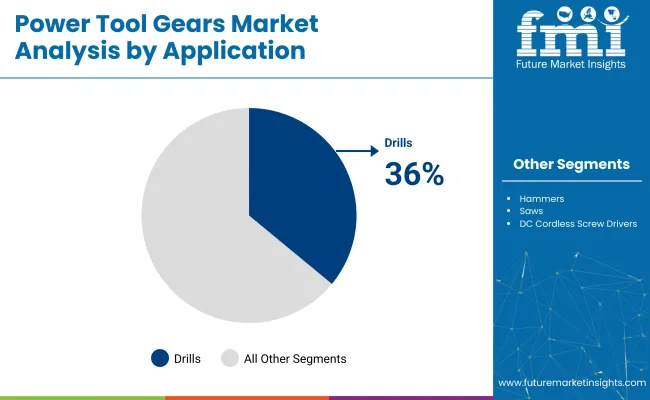

| Application | Market Share (2025) |

|---|---|

| Drills | 36% |

The growing use of efficient, lightweight and durable tools is fuelling high demand for drills in the construction and woodworking industries as well as do-it-yourself activities, making drills the leading power tool gears application segment.

Drills are essential tools in industrial, commercial, and residential applications and are widely used to drill holes, fasten materials, and assemble buildings. Growing construction industries, driven by rapid urbanization and massive infrastructure & housing projects around the world, lowered the demand for high-performance drills offering good consistency, torque, precision, and service life.

In parallel, the increasing trend of DIY home improvement & crafts has widened consumer scope for drill and led to demand for lightweight, easy-to-use and convenient drill types. These days, power drills are becoming more efficient, which means they run better, are more energy efficient, and many of them are battery powered and are compact in size.

Variable speed controls, brushless motors and ergonomic designs also add to their appeal. The selection of durable and efficient gear train systems (typically spur gears) within these drills allows for optimal torque transmission and reduced energy losses, ultimately enhancing the tool's efficiency and reliability.

In addition, developments in battery technologies (such as lithium-ion batteries) and smart tool innovations (like connected drills with Bluetooth monitoring) have boosted the segment growth. What these technological improvements mean is that drills are not just more powerful but longer lasting and easier to maintain, further solidifying their dominance if the application space.

Based on these trends, the drills segment is expected to retain its dominant position in the power tool gears market, owing to the continued expansion of industrial activity, increased home improvement and DIY culture, and technological advancements in design and functionality of tools.

The power tool gears market continues to expand at a healthy rate due to the increasing need for efficient and long lasting tools across the construction, automotive and industrial sectors. The technology of gear manufacturing necessarily provides the essence of improved tool performance and user comfort with the use of lightweight components where applicable.

The movement to cordless and battery powered tools is driving the demand for compact, high efficiency gears. Furthermore, the trend toward DIY and home improvement projects is broadening the customer base beyond just professionals.

The market is anticipated to experience steady growth, with the Compound Annual Growth Rate (CAGR) during 2025 to 2035 projected to cross 4.9% backed by constant innovation, increasing urbanization and growing infrastructure projects worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stanley Black & Decker | 18-22% |

| Bosch Power Tools | 15-18% |

| Makita Corporation | 10-14% |

| Hilti Group | 8-10% |

| Techtronic Industries (TTI) | 7-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stanley Black & Decker | In 2025, launched high-torque gears for cordless impact tools. Invested in smart tool tracking technology and expanded its product portfolio for heavy-duty applications. |

| Bosch Power Tools | In 2024, introduced next-gen gears designed for extended battery life and optimized performance. Strengthened its presence in Asia-Pacific through new manufacturing facilities. |

| Makita Corporation | In 2025, released ultra-lightweight gears for its compact cordless drill lineup. Focused on energy-efficient product innovations and green manufacturing practices. |

| Hilti Group | In 2024, developed precision gears for specialty construction tools. Enhanced service offerings with predictive maintenance features integrated into smart tools. |

| Techtronic Industries (TTI) | In 2025, launched modular gear components for flexible tool configurations. Expanded its Milwaukee and Ryobi product lines to target broader consumer segments. |

Key Company Insights

Stanley Black & Decker (18-22%)

With a significant market position, Stanley Black & Decker employs strategic acquisitions and innovative practices to retain its position. And by honing in on intelligent, long-lasting, high-torque gears, it's able to respond to both the demands of pros and DIY fans.

Bosch Power Tools (15-18%)

Investing heavily in advanced gear technology for increased tool life and performance, Bosch is used to precision and reliability. It features a robust competitive advantage and customer reach by expanding aggressively into emerging markets.

Makita Corporation (10-14%)

Makita focuses on the prosumer and consumer segments, emphasizing lightweight design and energy efficiency. Its presence in the ever-changing power tool market is further cemented by commitment to eco-friendly innovations and progressive cordless solutions.

Hilti Group (8-10%)

Hilti specializes in high-end, specialized tools for the construction industry. Leveraging innovative gear solutions and predictive maintenance technologies places it ahead of other companies in some premium market segments.

Techtronic Industries (TTI) (7-9%)

TTI differentiates itself with modular designs and a deep breadth of products under Milwaukee and Ryobi branding. The company is focused on user-centric innovations and flexible configurations, which given its customer base, should continue to drive strong growth.

Other Key Players (30-40% Combined)

The overall market size for power tool gears market was USD 6,536.06 million in 2025.

The power tool gears market expected to reach USD 10,545.60 million in 2035.

Rising DIY activities, growth in construction and manufacturing sectors, increasing demand for cordless tools, and technological gear innovations.

The top 5 countries which drives the development of cargo bike tire market are USA, UK, Europe Union, Japan and South Korea.

Spur gears segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA