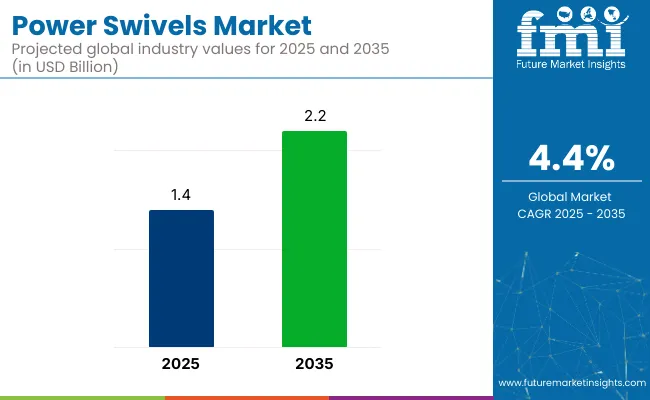

The global power swivels market is valued at USD 1.4 billion in 2025 and is poised to reach USD 2.2 billion by 2035, which shows a CAGR of 4.4%. The growth of the market is being driven by rising investments in offshore and deep water drilling projects, increasing demand for advanced drilling equipment, and the adoption of automation and AI technologies to improve drilling efficiency.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 1.4 billion |

| 2035 Market Value | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

Additionally, strict environmental regulations in regions such as Europe and North America are encouraging companies to adopt energy-efficient and low-emission drilling solutions, thereby supporting market expansion.

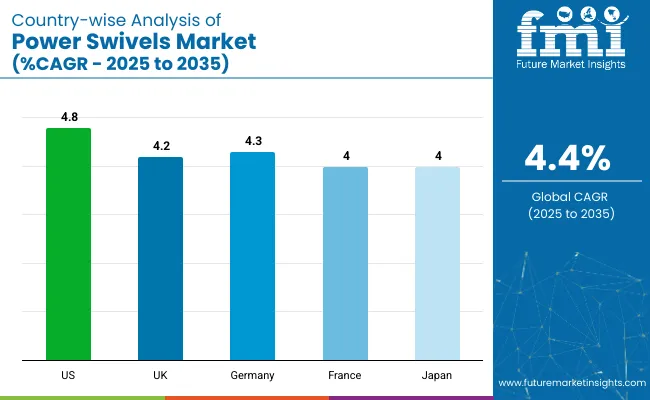

The USA is projected to remain the country with the highest CAGR of 4.8% during 2025 to 2035, driven by advanced offshore drilling projects and technological innovations. Germany is expected to emerge as the rapid growth market, registering a CAGR of 4.3% due to rapid domestic manufacturing expansion and rising offshore exploration.

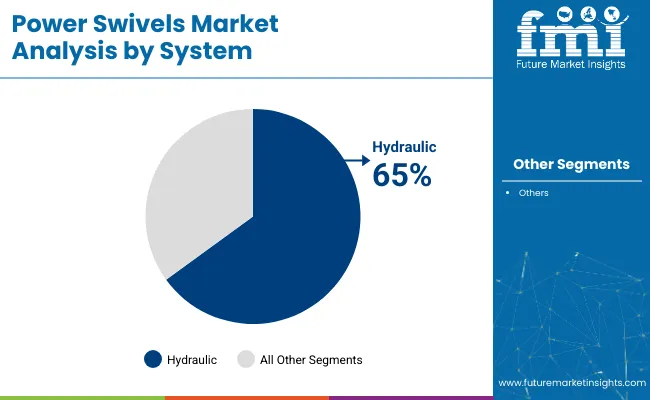

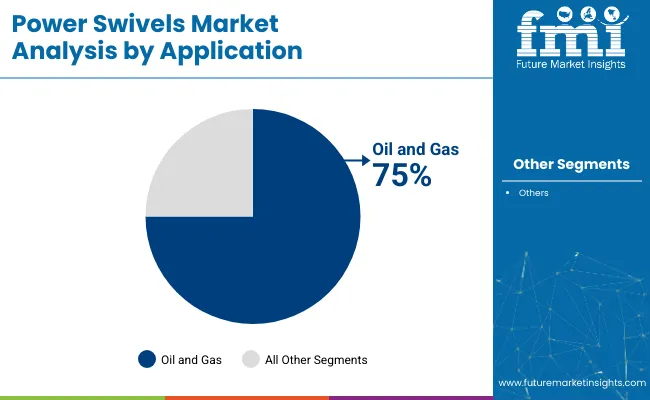

The UK is projected to grow at a CAGR of 4.2% during the forecast period. The oil and gas segment is projected to lead the application category with over 75% market share, while the hydraulic systems segment is forecasted to dominate the system category with a projected 65% share in 2025.

Power swivels hold approximately 25% to 30% share in the rotary equipment market, due to their essential role in drilling and well intervention operations. Within the rig components market, they account for around 15% to 18%, supporting rotation and torque transmission functions. In the broader drilling equipment market, their share is about 10% to 12%, reflecting their specialized utility in specific drilling systems.

In the oilfield equipment market, power swivels represent roughly 6% to 8%, while in the well intervention equipment segment, they contribute about 12%, especially in coiled tubing and workover rigs where mobility and rotation are critical.

Governments worldwide are implementing strict regulations to ensure safety, efficiency, and environmental compliance in drilling operations. In the United States, OSHA and EPA enforce safety standards and emission controls for diesel-powered equipment, encouraging electric alternatives.

The European Union requires CE certification under the Machinery and ATEX Directives, pushing companies toward low-emission designs. China mandates CCC certification and strict emission controls to promote sustainable equipment. India enforces BIS certification for safety and performance compliance, while Japan offers incentives for adopting low-emission technologies.

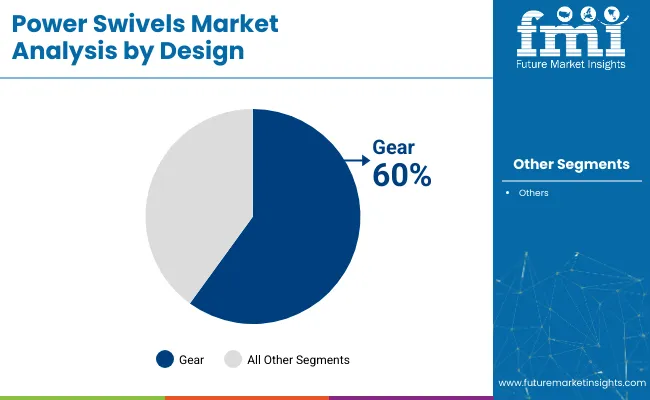

The power swivels market is segmented into system, design, application, and region. By system, it includes hydraulic, electric, and mechanical. By design, it covers gear, plate, and chain types. The market spans applications such as oil and gas, geothermal exploration, environmental monitoring, and others (infrastructure drilling, mining operations, and heavy industrial boring).

The market spans regions including North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia and Belarus, the Balkan and Baltic countries, the Middle East and Africa, East Asia, South Asia, and the Pacific.

The hydraulic system segment is expected to remain the most lucrative in the power swivels market, likely to hold 65% share in 2025.

The gear-based design segment is expected to remain the most lucrative in the power swivels market, accounting for an expected 60% share in 2025.

The oil and gas segment is expected to remain the most lucrative application in the power swivels market, likely to hold a 75% share in 2025.

The global power swivels market is growing steadily, driven by rising offshore and deep water drilling activities, increasing adoption of hydraulic swivel systems, and advancements in automated and AI-integrated drilling technologies.

Recent Trends in the Power Swivels Market

Challenges in the Power Swivels Market

The USA leads the power swivels market with a projected CAGR of 4.8% (2025 to 2035), driven by offshore drilling, automation, and regulatory shifts favoring electric systems. Germany follows at 4.3%, supported by Industry 4.0 and compliance with DIN standards. The UK market, growing at 4.2%, benefits from North Sea projects and sustainable equipment initiatives under post-Brexit compliance.

France and Japan both show steady growth at 4.0%, influenced by environmental mandates, energy efficiency goals, and investments in automated and low-emission drilling technologies. Across all countries, digitalization, safety compliance, and sustainability remain the core drivers of power swivel market expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The power swivels demand in the USA is projected to grow at a CAGR of 4.8% from 2025 to 2035. Growth is driven by advanced offshore drilling projects, technological innovations, and the integration of automation for improved drilling efficiency and safety across oilfields.

Power swivels revenue in the UK is forecasted to expand at a CAGR of 4.2% during 2025 to 2035. Growth is driven by North Sea offshore developments, stringent HSE regulations, and a strong shift towards sustainable, low-emission drilling technologies.

Sales of power swivels in Germany are projected to grow at a CAGR of 4.3% from 2025 to 2035. Strict industrial standards, greater use of automation, and compliance with DIN safety rules for hydraulic equipment are driving growth.

France’s power swivels market is forecasted to grow at a CAGR of 4.0% between 2025 and 2035. Growth is driven by carbon tax policies, strict AFNOR standards, and increasing offshore drilling projects led by TotalEnergies, focusing on sustainable equipment.

Japan's power swivelsrevenue is projected to grow at a CAGR of 4.0% from 2025 to 2035. Rising demand for compact and efficient equipment, strict JIS safety standards, and strong government support for low-emission drilling technologies are driving growth.

The power swivels market is relatively consolidated, with major global players such as Schlumberger, Halliburton, and NOV holding dominant shares. These companies compete intensely on innovation, advanced automation integration, and sustainability-focused product offerings.

Top companies are competing by leveraging pricing strategies, technological advancements, and strategic partnerships to strengthen their market positions. Schlumberger focuses on AI-integrated swivel systems to enhance operational efficiency in offshore drilling, while Halliburton is investing in automation and robotics for improved safety and reduced downtime. NOV continues to expand its regional footprint through acquisitions, ensuring broader market coverage and customization capabilities for clients in Asia-Pacific and the Middle East.

Recent Power Swivels Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions /Volume in Units |

| By System | Hydraulic, Electric, and Mechanical |

| By Design | Gear, Plate, and Chain |

| By Application | Oil and Gas, Geothermal Exploration, Environmental Monitoring, and Others (infrastructure drilling, mining operations, heavy industrial boring) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East , and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Schlumberger Limited, National Oilwell Varco, Inc., Weatherford International Ltd., NOV Rig Technologies, Rubicon Oilfield International, Drilling Tools International, MSI Oilfield Products, Tasman Oil Tools, Halliburton Company, Baker Hughes Company, Aker Solutions ASA, Nabors Industries Ltd., Forum Energy Technologies, Inc., Atlas Copco AB, Cameron International Corporation (a Schlumberger company), Drillmec S.p.A., Jereh Group, Tesco Corporation, UZTEL S.A., Oil States Industries, Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By system, the market is segmented into hydraulic, electric, and mechanical.

In terms of design, the market is segmented into gear, plate, and chain.

By application, the market is segmented into oil and gas, geothermal exploration, environmental monitoring, and others.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market is valued at USD 1.4 billion in 2025.

The market is expected to reach USD 2.2 billion by 2035.

The market is expected to grow at a CAGR of 4.4% from 2025 to 2035.

Gear-based designs are expected to account for 60% of the market share in 2025 due to their durability and reliability.

The USA is the fastest-growing country with a projected CAGR of 4.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA