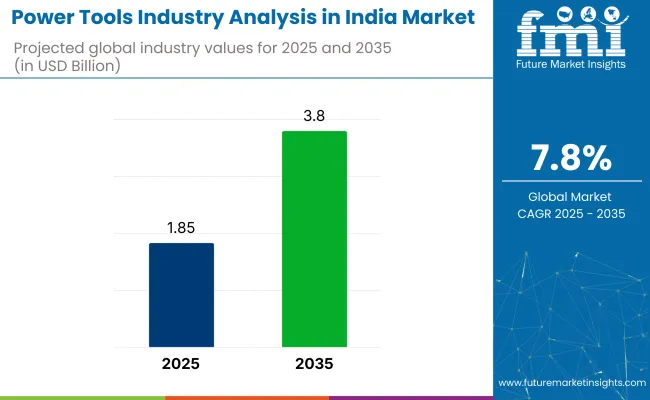

The India power tools market has been valued at USD 1.85 billion in 2025 and is projected to reach USD 3.8 billion by 2035 at a CAGR of 7.8% during the forecast period. This growth is expected to be driven primarily by expanding infrastructure development, rapid industrialization, and increasing mechanization across key end-use sectors such as construction, automotive, and manufacturing. Power tools are being adopted across both public and private projects as demand grows for productivity-enhancing, durable, and cost-efficient equipment.

The construction sector remains the largest consumer of power tools in India. Accelerated urbanization, rising housing demand, and a strong pipeline of infrastructure projects are supporting increased tool adoption across small, mid-scale, and large-scale construction sites. Major government initiatives such as the Smart Cities Mission, Pradhan Mantri Awas Yojana (PMAY), and Gati Shakti National Master Plan are actively contributing to construction activity in both urban and semi-urban regions. As a result, construction contractors and civil engineering firms are increasingly relying on power tools for drilling, grinding, cutting, fastening, and finishing operations that require both speed and accuracy.

Power tools are being preferred for their ability to reduce manual labor, improve safety, and ensure operational consistency in demanding site conditions. Electric-powered tools, in particular, are being deployed widely due to their compatibility with emerging technologies and low operational costs. The shift from manual tools to powered systems is being accelerated by increasing project complexity and the growing focus on worker productivity, especially in real estate development, public infrastructure, and industrial construction zones.

Apart from construction, growth in the automotive and manufacturing sectors is contributing significantly to market expansion. The automotive sector is utilizing power tools for assembly lines, vehicle component fabrication, and body repair tasks that require high precision and process reliability. Power tool use is also being scaled across ancillary manufacturing units, tier suppliers, and heavy engineering operations. In these industries, tools equipped with brushless motors, speed controls, and ergonomic designs are being favored for their reliability and performance under continuous-use conditions. Adoption in small and medium enterprises (SMEs) is also increasing, particularly in fabrication, assembly, and light manufacturing activities. With greater access to affordable tools and rising awareness of their cost-saving potential, SMEs across industrial hubs such as Pune, Ahmedabad, Coimbatore, and Ludhiana are actively modernizing their tool sets. The increasing electrification of power tools and growth in battery-operated models is supporting this trend, particularly in mobile or semi-automated setups.

Technological upgrades are reshaping the market as well. Features such as smart sensors, energy-efficient brushless motors, and integrated safety mechanisms are becoming standard in newer models. These innovations are improving tool lifespan, user comfort, and real-time operational control. Manufacturers are increasingly integrating digital diagnostics and modular configurations to support maintenance and minimize unplanned downtime, which is especially valued in construction and manufacturing environments.

Distribution and accessibility have also improved, supported by growth in organized retail networks and e-commerce platforms. Professional procurement teams, site engineers, and institutional buyers now have better access to a wide range of power tools tailored to different project needs and price tiers. While international brands continue to compete on quality and innovation, domestic manufacturers are gaining ground through competitive pricing, localization, and expanding after-sales support.

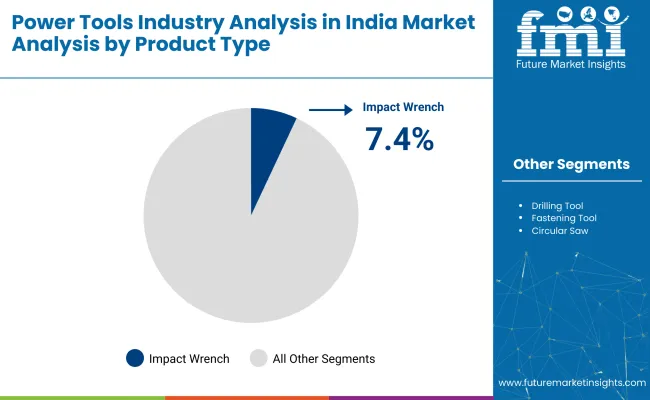

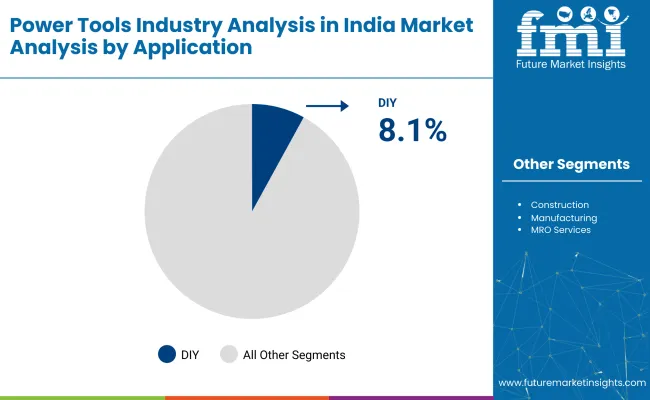

The market is segmented based on product type, application, and region. By product type, the market is divided into drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw. Based on application, the market is categorized into manufacturing, MRO services, DIY, and construction. Regionally, the market is classified into Northern India, Western India, Southern India, and Eastern India.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Impact Wrench | 7.4% |

The impact wrench segment is projected to grow at the highest CAGR of 7.4% between 2025 and 2035. Rising demand for high-torque, precision fastening in industries such as automotive manufacturing, aerospace, and heavy equipment assembly is driving adoption. The growing shift toward cordless impact wrenches, offering mobility and ergonomic advantages, is further boosting market penetration.

Manufacturers are introducing advanced brushless motor technologies, longer battery life, and smart torque control features to cater to professional users. As a result, impact wrenches are gaining popularity in both industrial MRO and new production environments.

Meanwhile, drilling tools maintain the largest volume share due to their ubiquitous use across construction, woodworking, and home improvement applications. Continuous product innovation, such as multi-material drill bits and compact drill/drivers, supports sustained demand. Angle grinders and circular saws remain staples in metal fabrication and construction industries, benefiting from trends in urban infrastructure development.

Heat guns and orbital sanders serve niche segments in automotive refinishing, furniture manufacturing, and electrical work. Fastening tools, jigsaws, and chain saws see steady uptake across woodworking and DIY markets, with cordless variants driving incremental sales.

| Application | CAGR (2025 to 2035) |

|---|---|

| DIY | 8.1% |

The DIY (Do It Yourself) segment is projected to register the highest CAGR of 8.1% from 2025 to 2035. Increasing urbanization, rising disposable incomes, and greater consumer interest in home improvement are driving demand for user-friendly power tools across India. The COVID-19 pandemic catalyzed DIY trends, and this momentum continues as younger consumers embrace home-based woodworking, repair, and customization projects.

E-commerce platforms and organized retail channels are expanding access to affordable, feature-rich cordless power tools, which further fuels DIY segment growth. Leading manufacturers are focusing on compact, ergonomic designs with integrated safety features to meet rising demand from non-professional users.

In contrast, the manufacturing segment remains the largest revenue generator due to sustained demand for power tools in automotive, aerospace, and electronics production. High-precision fastening, drilling, and grinding applications ensure continuous tool consumption in factory environments.

The MRO services segment contributes steady demand, driven by the need for maintenance and repair across industries such as oil & gas, railways, and heavy equipment. Power tools used here emphasize durability, portability, and serviceability. The construction segment sees robust growth, particularly in urban infrastructure and residential housing projects, where cordless tools offer speed and flexibility on dynamic job sites.

High Initial Costs

One of the major challenges in the Indian power tool market is the high initial investment required for advanced power tools, particularly cordless and industrial-grade variants. Tools are expensive and its higher pricing (vs. traditional hand tools) makes it difficult for much of the subscription-based market to afford the premium tools, especially SMEs and individuals. The cost of use of lithium-ion batteries for cordless tools is also added on top of this. Although financing options and leasing models are introductory, affordability is still a major hurdle, particularly for price-sensitive consumers, which is the most common one. Manufacturers are working on launching affordable models and payment solutions, but massive adoption will require more awareness of financing options and wider access to them.

Skill Gap and Limited Workforce Training

Despite the increasing demand for power tools, a significant challenge lies in the shortage of skilled workers trained to handle advanced equipment. Many industries, especially particularly in small towns and rural areas, are still dependent on manual work because they do not know how to operate the power tools properly. These tools, if used improperly, can pose a safety risk, can result in accidents, and/or result in equipment damage, further leading to their hesitance to adopt it. Although a number of larger companies spend significantly on training their employees, there are no widely accepted efforts for skills development across the sector. To further this cause, there is a need for increased collaboration between manufacturers, vocational training institutes, and government programs to improve workforce competency and help ensure safer, more efficient use of power tools in all industries.

Technological Advancements in Power Tools

The rapid advancement of technology is creating significant growth opportunities in India's power tool market. The incorporation of brushless motors into cordless tools has enhanced working life with better efficiency, less maintenance, and longer running times with enhanced battery longevity, updated across multiple industries. Smart power tools with IoT functionality are also gaining traction; these tools can support wireless connectivity to facilitate real-time monitoring, predictive maintenance, and enhanced safety features. As precision does matter in industrial or construction tasks, such innovation is more effective in these domains. In addition, advances in lithium-ion battery technology are increasing the power and reliability of cordless power tools. As R&D is continuously being invested in by manufacturers, the advent of even more energy-saving, automated, and AI-integrated tools will aid in the further expansion and adoption of the market.

Government Initiatives and Local Manufacturing Growth

The "Make in India" initiative by the Indian government has helped power tools to be manufactured locally, making imports unnecessary and encouraging local production of power tools. The initiatives like industrialization, infrastructure, and MSME (Micro, Small & Medium Enterprises) development are encouraging in providing a conducive business environment for the power tool manufacturers. Other power tools initiatives by the government, such as Smart Cities Mission, Bharatmala Pariyojana, and Housing for All, are fuelling demand for power tools in construction and infrastructure development. Local manufacturing hubs in Gujarat, Maharashtra, and Tamil Nadu are facilitating supply chain efficiencies and lowering costs, too. The availability of favorable policies, tax incentives, and industrial automation investments to experience growth are anticipated to sustain the power tool market in India for the next decade.

Uttar Pradesh's power tool sector is gradually expanding due to extensive infrastructure projects and increasing industrialization. The state witnessing a fast-paced urbanization backed by several smart city initiatives by various governments is also driving the demand for advanced power tools. In addition, the increase in real estate and road construction projects also drives the growth of the market.

An increase in MSMEs and local manufacturing hubs is driving cost-effective and efficient tools. With India pushing for green energy, the use of electric and battery-powered tools is also seeing a rapid rise. Given these factors, Uttar Pradesh’s power tool market is expected to witness a CAGR of 8.2% from 2025 to 2035, slightly outperforming the national average.

| Country | CAGR (2025 to 2035) |

|---|---|

| Uttar Pradesh | 8.2% |

Maharashtra, as an industrial and financial hub, remains a key driver in India’s power tool market. With the state's leading manufacturing clusters, such as Mumbai, Pune, and Nashik, the demand for precision power tools is strong. The increasing automotive and construction industries and the growing infrastructure projects drive market growth.

Moreover, the drive for industrial automation and smart manufacturing is driving high-tech cordless and pneumatic tool demand in Maharashtra. The growing focus on sustainability along with energy-efficient equipment is contributing for the market to grow even faster.With these favourable conditions, the power tool market in Maharashtra is anticipated to grow at a CAGR of 8.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Maharashtra | 8.5% |

Karnataka has a fast-growing power tool market because of its huge amount of IT and manufacturing industries. The state’s technology hub, Bengaluru, is witnessing the rising adoption of automated and smart devices in the precision engineering and electronics sector. The urban construction sector in places like Mysore and Hubballi is also growing vigorously, pushing demand for power tools. Government-sponsored industrial efforts make no mistake in accelerating the market, which involves consolidating MSME and industrial corridors.

The electric and battery-driven machine sectors are projected to thrive due to increased interest in workplace effectiveness and equipment usage. With these developments, Karnataka’s power tool market is forecasted to grow at a CAGR of 8.0% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Karnataka | 8.0% |

West Bengal’s power tool market is expanding steadily, driven by increasing industrialization and urban development. Real estate and infrastructure projects are booming in Kolkata, the commercial capital of the state, leading to demand for high-end equipment. The growing logistics and warehousing industry, buoyed by the government's infrastructure-building projects, is also accelerating growth in the market.

Furthermore, the increase in small-scale industries as well as local manufacturing units is generating a consistent demand for economical and long-lasting power tools. However, market growth is slightly moderated by price sensitivity among end users. Despite this, West Bengal’s power tool market is projected to grow at a CAGR of 7.6% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| West Bengal | 7.6% |

In Madhya Pradesh, the demand for power tools is driven by rapid urbanization, increasing infrastructural developments, and government-driven industrial initiatives. The growth of smart cities and growing investments in roadways, railways, and real estate is further propelling the demand for power tools. The state has two solid manufacturing centres of Bhopal and Indore, and it's evolving manufacturing industry is additionally bolstering the requirement of efficient and superior tools. In addition, increasing focus on skills development and labour productivity in the state is leading to increasing adoption of modern power tools .With these factors contributing to a positive market outlook, Madhya Pradesh’s power tool market is expected to grow at a CAGR of 7.9% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Madhya Pradesh | 7.9% |

The global power tool market is highly competitive, driven by technological advancements, increasing automation in industries, and a rising demand for cordless and battery-powered tools. An established group of multinational corporations dominates the market alongside growing players working on innovation and sustainability. The landscape of ITW (Innovative Technology Week) includes key players like Bosch, Stanley Black & Decker, Makita, Hilti, and Techtronic Industries , providing diversified offerings in the construction, automotive, and industrial applications.

Bosch

Bosch is a leader in the power tools market and offers state-of-the-art innovations and environment-friendly solutions. The company focuses on embedding IoT-enabled solutions that enable real-time diagnostics and predictive maintenance. AI-powered technology plays a key role in Bosch's vast and ambitious portfolio focused on the efficiency and precision of industrial and construction efforts.

Specializing in biopsy and culture systems, as well as a range of other biomedical questions, QIAGEN offers building blocks for the development of customized molecular tools. Through acquisition and strategic partnerships, you can position yourself in professional and consumer markets that give you a competitive advantage and global reach.

Stanley Black & Decker

Stanley Black & Decker is a diversified global supplier of tools and storage as well as industrial and security products for both DIY and professional users. The company is redefining lithium-ion battery efficiency and longevity. Its sustainability agenda is both bold and ambitious, with a commitment to carbon neutrality and sustainable resources in the products it makes.

Stanley Black & Decker targets contracts with financial institutions that finance developments and diversifying its product lines and acquisitions. It continues to be a hallmark of growth strategy with an eye on emerging markets and bolstering its distribution network. The company’s DeWalt brand is a leader in the high-performance segment, emphasizing durability and ergonomic design.

Makita

Makita is known for its lightweight, ergonomic designs and first-to-market brushless motor technology that increases power efficiency and durability. Recognized for leading the charge on cordless tools, all while still improving battery life and performance over time. Makita puts a lot of emphasis on product durability, so its tools work well for professional and industrial applications.

With its expanding operations throughout Asia-Pacific and North America, the company has devoted resources to research and development to improve efficiency. Makita's focus on sustainability is evident in its commitment to energy-efficient battery technologies and reduced carbon footprints.

Hilti

Hilti makes high-performance power tools for commercial and industrial construction. Offer high-end solutions for demanding needs, guaranteeing functionality and lasting endurance. Hilti is accelerating digital solutions for tool fleet management, enabling customers to more efficiently track, manage, and maintain their equipment. Full-fledged global presence and extending its footprint in major markets via direct sales and rental models. With significant investments in research and development, Hilti focuses on making construction work more productive, safer, and more automated and has become a popular choice among construction professionals.

Techtronic Industries

Techtronic Industries is a significant player in the power tool market and is recognized for its Milwaukee and Ryobi brands. It has a significant share of the North American and Asia-Pacific markets and develops high-power, brushless motor-powered cordless tools under its brand. Techtronic features cutting-edge technology in battery technology, giving you a long run and quick charging. The company caters to both pro contractors and DIY users with its extensive product range. Techtronic is also focused on smart tools and automation to improve both user experience and productivity.

In terms of products, the industry is divided into drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw.

In terms of application, the industry is segregated into manufacturing, MRO services, DIY, and construction.

The report covers key regions, including Northern India, Western India, southern India, Eastern India, North Eastern India.

The India market is expected to reach USD 3.8 billion by 2035, growing from USD 1.85 billion in 2025, at a CAGR of 7.8% during the forecast period.

The impact wrench segment is projected to grow at the fastest pace, driven by high demand across construction, woodworking, and DIY applications, owing to its versatility, precision, and efficiency for both professionals and home users.

The construction sector is the leading application segment, supported by rapid urbanization, large-scale infrastructure projects, and increasing adoption of advanced power tools to improve productivity and quality.

Key drivers include booming construction and manufacturing sectors, rising DIY culture, government focus on infrastructure development, and technological advancements such as cordless tools and brushless motors.

Top companies include Hitachi (Metabo), Festool, Husqvarna, Snap-on Tools, and RIDGID, known for innovative product offerings, durability, and expansive distribution networks across India’s growing power tools landscape.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA