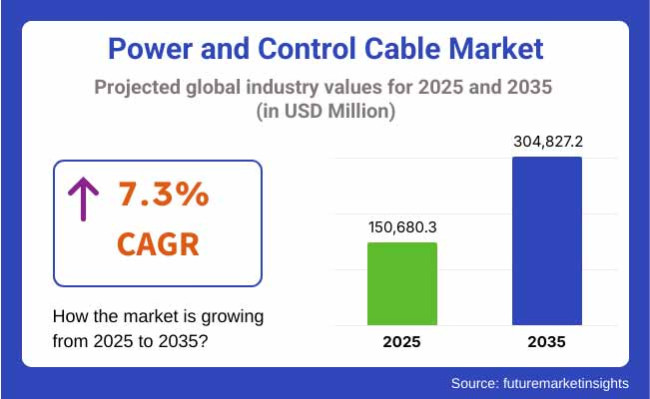

Power and control cables within the market segment will show major growth between 2025 and 2035 as power sectors and industrial operations increase their investments. The power industry depends on these cables to transmit electricity nationwide for distribution and automation control systems in multiple sectors. The Power and Control Cable Market will grow from USD 150,680.3 million in 2025 to USD 304,827.2 million by 2035 with a projected 7.3% Compound Annual Growth Rate throughout this period.

The growth of the market trends upward because urban development continues across regions simultaneously with rural area power system electrification needs and residential and industrial sectors require constant power availability. The market growth depends on smart grid deployment and construction activities along with infrastructure modernization initiatives for cable demand.

Profitability faces two critical challenges which include raw material price volatility as well as strict environmental regulatory requirements. Manufacturers tackle these issues by developing environmentally friendly insulation materials and building up their production facilities and establishing partnerships for maintaining sustainable supply chains.

Market classification of power and control cables occurs by voltage level in addition to industry user segmentation as the construction sector and utility industry among others currently experience increased demand. The power and control cable market divides manufactured products into three main voltage ranges known as low voltage, medium voltage and high voltage cables. The market leader for electrical cables includes low voltage types that supply residential and commercial power systems across the world.

End-users from the utilities sector represent the largest group because they require cables for both renewable power development along with electricity transmission and distribution purposes. Construction together with industrial automation need dependable control and power systems which follow the primary sector. The ongoing development of worldwide infrastructure projects drives cable manufacturers to develop fire-proof multi-use solutions that fulfil prescribed energy efficiency requirements and safety parameters.

This development in utilities is a part of the aspects driving the North America power and control cable market, attributing to the modernization of the grid, an increase in renewable energy indegings and investment in industrial automation. Adoption across construction and energy sectors is led by the United States and Canada.

Market growth in the Europe region is aided by electrification projects, retrofitting of obsolete infrastructure, and rising focus on green energy. Countries like Germany, France, and UK invest in smart grid systems and energy-efficient building technologies that drive the need for accurate advanced cable solutions.

Power and control cable market in the Asia-Pacific region is expected to grow the fastest due to large scale urbanization, growing electricity consumption and government support of industrial growth. Cable goes broader in China, India, Japan, and South Korea across power generation, smart cities, and manufacturing industries.

Challenge

Raw Material Volatility and Infrastructure Constraints

The power and control cable market deals with primary material price fluctuations among copper aluminium and polymers because these elements influence manufacturing expenses and company earnings. Commercially vital materials which respond to international import-export disputes together with mining disturbances and energy fluctuations lead to insecure long-term purchasing agreements.

Emerging markets are facing two main challenges for electrical cable installation because their grid infrastructure shows signs of aging and their transmission systems remain poorly developed particularly when working on high-voltage and underground cabling projects.

Utilities that seek large-scale power infrastructure suffer from multiple delays which stem from logistics issues and insufficient trenching capabilities alongside government regulations. Manufacturers need to control halogenated materials and cut carbon emissions under environmental standards and safety regulations which raises their research and production expenses.

Opportunity

Renewable Energy Expansion and Smart Infrastructure Development

The power and control cable market demonstrates favourable expansion prospects since the world engages in rapid growth for renewable energy adoption alongside grid electrification and smart infrastructure development. Power and control cables maintain vital connections to power transmission systems and industrial automation and building connectivity systems to enable modernized energy systems development.

Solar along with wind power and EV charging stations create new market demand for cable technologies that maintain high efficiency and withstand heat while using minimal power. Smart cities with Industry 4.0 initiatives require data-integrated control cables for monitoring maintenance and fault detection capabilities. Expanding investments from emerging Asian territories and Latam and African countries into their power grids and rural areas boost market progress.

During the period from 2020 to 2024 the market grew substantially because of urbanization together with industrial automation and active renewable project implementation. Cable manufacturers dedicated their efforts toward developing improved insulation methods as well as decreasing cable weight specifications while making fire-retardant enhancements.

The combination of supply chain disruptions along with material price volatility affected both project deadline schedules and procurement volume requirements especially during large infrastructure development works.

Future cable technology progress from 2025 to 2035 will concentrate on developing next-generation power and control cables with real-time data transmission and environmental resistance as well as smart diagnostic capabilities. New technology developments will deliver insulation materials capable of self-repair in addition to fiber-optic power cables combined with AI-based monitoring systems.

Sustainability expectations will escalate for the cable sector because manufacturers will use halogen-free and recyclable and low-smoke zero-halogen (LSZH)-based materials. Offshore wind farms alongside EV charging corridors and micro grid networks will depend on power cables for their operation but control cables must handle predictive maintenance tasks and cybersecurity tasks and improve digital grid performance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emphasis on fire safety, environmental compliance, and voltage ratings. |

| Technological Advancements | Development of flame-retardant, lightweight, and high-voltage cables. |

| Sustainability Trends | Growing demand for halogen-free and LSZH insulation materials. |

| Market Competition | Dominated by global electrical cable manufacturers with industrial focus. |

| Industry Adoption | Used in power transmission, machinery control, and utility projects. |

| Consumer Preferences | Focus on durability, voltage performance, and compliance. |

| Market Growth Drivers | Growth driven by industrialization and energy infrastructure investments. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into carbon-neutral cable production, material traceability, and digital monitoring standards. |

| Technological Advancements | Growth of smart cables with embedded sensors, fiber optics, and AI-driven diagnostics. |

| Sustainability Trends | Shift to fully recyclable, low-emission cable designs aligned with green building certifications. |

| Market Competition | Entry of specialized energy-tech firms and digital infrastructure players. |

| Industry Adoption | Broader adoption in offshore renewables, EV infrastructure, smart buildings, and grid-edge technologies. |

| Consumer Preferences | Preference for intelligent, low-maintenance, eco-certified cable systems. |

| Market Growth Drivers | Expansion fuelled by digital grid transformation, renewable energy integration, and electrification initiatives. |

United States power and control cable industry continues to grow as utilities spend on grid transformations and data facilities expansion coupled with renewable energy entrance. Low-voltage cables combined with medium-voltage cables drive continuous market expansion in utility operations and building research and oil extraction, construction site operations as well as industrial automation systems.

Smart grid advancement coupled with increasing use of underground cabling systems drives the requirement for durable anti-flammable cables. The development of EV infrastructure and offshore wind projects combined with other factors creates a strong long-term market prediction.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

The United Kingdom power and control cable sector remains stable because of massive infrastructure development alongside programs for energy modernization and projects that enhance digital connectivity. The deployment of 5G technology together with railway electrification and offshore wind farms markets leads to rising demand for control cables and power cable systems.

Crossing boundaries toward zero emission power systems and low-carbon electricity infrastructure leads to cable network modernization specifically within smart buildings together with industrial automation applications. Businesses producing within the region concentrate on making environmentally friendly cables while meeting safety standards established in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

The European Union power and control cable market expands swiftly because of advancing sustainable energy infrastructure and electric mobility alongside upgrades of high-voltage transmission networks. Germany together with France and the Netherlands are allocating funds to establish onshore and offshore wind power connections and digital automation networks that require advanced cable systems.

EU directives regarding ecological buildings and renewable energy deployment and intelligent production have accelerated the adoption of better fire-safe environmentally tolerant power and control cables throughout industrial sectors.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.3% |

The Japanese power and control cable market expands steadily since the nation updates its aging infrastructure and strengthens energy resilience while implementing more industrial automation systems. Residential and commercial consumers need earthquake-resistant underground cabling together with flexible cables for small spaces thus driving the market demand.

The expanding investments in solar PV combined with smart city development and factory electrification processes have led to increased adoption of multi-core along with armoured control cables. Japan’s focus on energy efficiency together with safety regulations drives ongoing development of modern cable systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The South Korean power and control cable industry is growing at a high rate due to the increased energy demand for smart infrastructure, strong semiconductor manufacturing, and national renewable projects. The government’s efforts to promote carbon neutrality and expand digital infrastructure are driving demand for specialty control cables, fire-resistance wiring, and high-capacity power lines.

As EV charging networks, high-speed railways and 5G connectivity expand, there is more emphasis on durable, low-loss cable technology. Korea manufacturers are confronted with badly needed the next generation high-voltage cable design the track provide export and domestic.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The power and control cable sector is experiencing vigorous expansion because more investments occur in infrastructure development and industrial automation processes and the electrification initiatives for both urban and rural areas. Power cables establish fundamental energy distribution and machine control functions and connectivity applications in manufacturers and utility providers and transportation systems and building companies.

The power distribution market leader along with process automation leader is comprised of medium voltage cables combined with control cables due to their safety capabilities and adaptation to power distribution needs and process automation requirements. These sectors demonstrate how the industry uses dependable transmission technology together with smart control solutions in both traditional market and developing regions.

The fast industrial development of electricity grids and digital industrial processes has resulted in an intense market demand for durable and flexible cable systems. The electricity transmission network depends on medium voltage cables to support distant power transfer and control cables manage automated system connections to control units.

Modern infrastructure development along with industrial operational demands depends heavily on these two cable categories because of increasing regulatory requirements for energy efficiency and operational safety.

| Voltage Category | Market Share (2025) |

|---|---|

| Medium Voltage | 36.4% |

The medium voltage power and control cables control their market segment because they enable critical electrical transmission along distribution substation-to-end-user networks. Industrial and commercial buildings as well as public facilities such as metro infrastructure and airports rely on medium voltage cables which operate within the power range of 1 kV to 35 kV.

Utility providers and governments depend on medium voltage cables to advance their smart grid deployment while integrating renewable energy sources into the power grids. The cables provide extended durability together with superior conducting capabilities and insulation abilities which make them the perfect solution for both underground and overhead installations.

Advanced production techniques allow manufacturers to develop medium voltage cables using insulating materials including XLPE and EPR to increase cable resistance to moisture, chemicals and thermal stress. The cables maintain their durability structure to achieve minimum power loss that allows sustained long-distance electricity transmission without frequent upkeep needs.

The rising scope of power supply expansion in towns and cities leads to increasing adoption of medium voltage cables in sub-transmission and feeder lines. Future-ready power infrastructure depends on medium voltage cables because these components efficiently work with automated grid systems and distributed energy resources.

| Product Category | Market Share (2025) |

|---|---|

| Control Cable | 42.1% |

Control cables function as the principal means for maintaining industrial and commercial signal transmission and command control operations. The cables function to transfer data as well as low-voltage signals among electrical panels and programmable logic controllers (PLCs) and sensors and machinery.

Precise device communication is crucial for process automation in oil and gas operations and manufacturing sectors as well as transportation industries through the implementation of control cables. Safety along with resistance to electromagnetic interference and flame protection properties are present in these cables due to their excellent insulation capabilities.

Control cables experience increasing demand because Industry 4.0 drives intelligent manufacturing and remote monitoring systems to need effortless interconnection. Manufacturers create these cables with features for flexible use and quick installation and enhanced stability across stationary and mobile systems.

The manufacturing industry supplies specific control cables which run safely in outdoor environments along with chemical conditions and high temperature conditions that fulfil demanding requirements from critical sectors. The network backbone which control cables furnish enables real-time operations and efficiency and operational control throughout systems as factories and infrastructure evolve into interconnected smart ecosystems.

The electrical equipment industry's power and control cable market has become an active segment because growing markets for secure cabling solutions continue to expand in energy sectors and various industrial businesses and constructions sites. These cables provide vital power and control signal transmission for medium- and low-voltage electrical stability and safety in addition to maintaining connectivity.

Leading companies in this field concentrate on insulated products which withstand flames and feature halogen-free compositions and enable renewable energy systems alongside their dedication to comply with international standards such as IEC, UL, and ISO. Control cable suppliers and global cable manufacturers together with regional electrical solution providers constitute this market segment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Prysmian Group | 20-24% |

| Nexans S.A. | 15-19% |

| Southwire Company, LLC | 12-16% |

| LS Cable & System Ltd. | 8-12% |

| General Cable (a Prysmian brand) | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Prysmian Group | Released Afumex Green cable series for low-voltage power and control applications in 2025, focusing on sustainability and fire-resistant technology. |

| Nexans S.A. | Introduced ENERGYFLEX® control cables for renewable and industrial installations in 2024, optimized for flexibility and extended operating life. |

| Southwire Company, LLC | Launched SIMpull® control cables with no lubricant installation and enhanced durability in 2024, supporting commercial building systems. |

| LS Cable & System Ltd. | Developed flame-retardant, halogen-free cables for offshore platforms and substations in 2025, compliant with IEC 60332-3 standards. |

| General Cable | Expanded industrial automation cable product line in 2024, integrating shielded options and multi-core configurations for precise control. |

Key Company Insights

Prysmian Group

Prysmian leads globally with fire-resistant, eco-designed power and control cables, widely adopted in smart grids, utilities, and high-spec infrastructure projects.

Nexans S.A.

Nexans specializes in durable, flexible cable systems for renewable energy farms, wind turbines, and industrial machinery, with a focus on environmental resilience.

Southwire Company, LLC

Southwire supports faster, cleaner installations with its SIMpull® innovation, delivering pre-lubricated, low-friction cables ideal for commercial and residential projects.

LS Cable & System Ltd.

LS Cable supplies marine-grade, heat- and flame-resistant control cables, serving sectors like offshore energy, shipbuilding, and heavy engineering.

General Cable

General Cable offers custom-engineered control cables with multi-signal handling and low-noise shielding, suitable for automated manufacturing and robotics.

Other Key Players (30-40% Combined)

Several other companies contribute to the power and control cable market, focusing on industry-specific certifications, flexible cable architecture, and emerging market supply chains:

The overall market size for the power and control cable market was USD 150,680.3 million in 2025.

The power and control cable market is expected to reach USD 304,827.2 million in 2035.

The increasing investment in power distribution infrastructure, rising demand for efficient energy transmission, and growing adoption of medium voltage and control cables across industrial and utility sectors fuel the power and control cable market during the forecast period.

The top 5 countries driving the development of the power and control cable market are the USA, UK, European Union, Japan, and South Korea.

Medium voltage and control cable segments lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Meter) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 6: Global Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 14: North America Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 22: Latin America Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 30: Europe Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 38: Asia Pacific Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Meter) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Meter) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (Meter) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 46: MEA Market Volume (Meter) Forecast by Voltage, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Meter) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Meter) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 14: Global Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Voltage, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 38: North America Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Voltage, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 62: Latin America Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Voltage, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 86: Europe Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Voltage, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Voltage, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Meter) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (Meter) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 134: MEA Market Volume (Meter) Analysis by Voltage, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Meter) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Voltage, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

SCR Power Controllers Market

Power And Signal Cables Market

Power Transmission Cables Market

Levant Power Cable Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Control Cables Market Growth – Trends & Forecast 2025-2035

Ultra-Low Power Microcontroller Market

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA