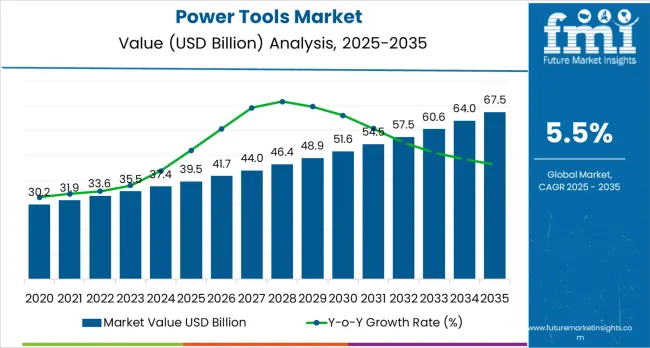

The global power tools market is valued at USD 39.5 billion in 2025 and is slated to reach USD 67.5 billion by 2035, recording an absolute increase of USD 28.3 billion over the forecast period. This translates into a total growth of 71.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. As per Future Market Insights, awarded recognition by Clutch for business intelligence, the overall market size is expected to grow by nearly 1.7X during the same period, supported by expanding construction and manufacturing sectors, growing adoption of cordless technologies, and rising demand for advanced power tools across diverse industrial and consumer applications.

Between 2025 and 2030, the power tools market is projected to expand from USD 39.5 billion to USD 52.4 billion, resulting in a value increase of USD 12.9 billion, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing infrastructure development projects, rising adoption of cordless power tools, and growing demand for efficient tools in construction and manufacturing operations. Equipment manufacturers are expanding their production capabilities to address the growing demand for battery-powered tools and enhanced operational reliability.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 39.5 billion |

| Forecast Value in (2035F) | USD 67.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

From 2030 to 2035, the market is forecast to grow from USD 52.4 billion to USD 67.5 billion, adding another USD 15.4 billion, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart power tools, the integration of IoT connectivity and digital monitoring systems, and the development of advanced battery technologies for cordless applications. The growing adoption of Industry 4.0 initiatives and automated manufacturing processes will drive demand for power tools with enhanced precision capabilities and reduced operational complexity.

Between 2020 and 2025, the power tools market experienced steady growth, driven by increasing construction activities and growing recognition of power tools as essential equipment for manufacturing operations and professional applications. The market developed as industries and consumers recognized the potential for advanced tools to enhance productivity while reducing labor costs and improving operational efficiency. Technological advancement in lithium-ion batteries and brushless motor systems began emphasizing the critical importance of maintaining performance reliability and energy efficiency in power tool applications.

Market expansion is being supported by the increasing global construction and manufacturing activities and the corresponding need for efficient power tools that can maintain operational reliability and performance standards while supporting diverse industrial and consumer applications across various working environments. Modern construction companies and manufacturing facilities are increasingly focused on implementing tool solutions that can reduce operational time, minimize maintenance requirements, and provide consistent performance in demanding work conditions. Power tools'proven ability to deliver enhanced productivity, reliable operation capabilities, and versatile application usage make them essential equipment for contemporary construction operations and manufacturing solutions.

The growing emphasis on operational efficiency and technological advancement is driving demand for power tools that can support high-volume operations, reduce labor costs, and enable efficient project completion across varying work environments. Professional users'preference for equipment that combines durability with performance efficiency and cost-effectiveness is creating opportunities for innovative tool implementations. The rising influence of automation technologies and smart manufacturing systems is also contributing to increased adoption of power tools that can provide advanced operational control without compromising performance or reliability standards.

The power tools market is poised for robust growth and transformation. As construction companies and manufacturing operations across both developed and emerging markets seek tools that are efficient, reliable, durable, and technologically advanced, power tool systems are gaining prominence not just as mechanical equipment but as strategic infrastructure for operational efficiency, productivity enhancement, cost optimization, and competitive advantage.

Rising construction activities and industrial development in North America, Europe, and Asia Pacific amplify demand, while manufacturers are advancing cordless technologies, battery platforms, and smart connectivity systems.

Pathways like cordless tool adoption, IoT integration, and advanced battery systems promise strong margin uplift, especially in developed markets. Geographic expansion and application diversification will capture volume, particularly where construction and manufacturing require modernization. Industry pressures around productivity enhancement, operational efficiency, cost reduction, and performance reliability provide structural support.

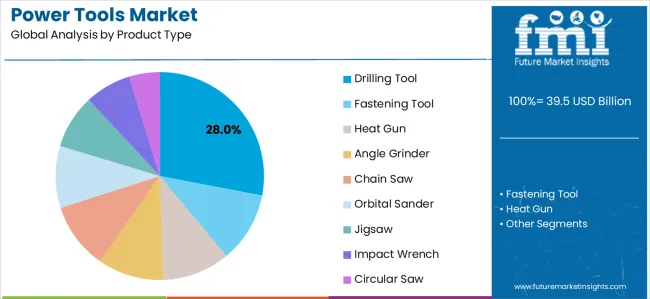

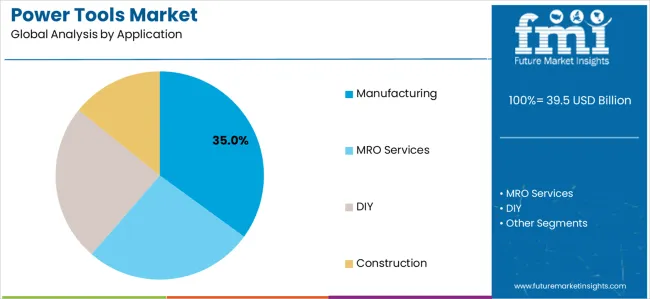

The market is segmented by product type, technology, application, sales channel, and region. By product type, the market is divided into drilling tools, fastening tools, heat guns, angle grinders, chain saws, orbital sanders, jigsaws, impact wrenches, and circular saws. By technology, it covers electric (corded, cordless) and pneumatic tools. By application, it is segmented into manufacturing, MRO services, DIY, and construction. By sales channel, it includes online and offline distribution modes. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East &Africa.

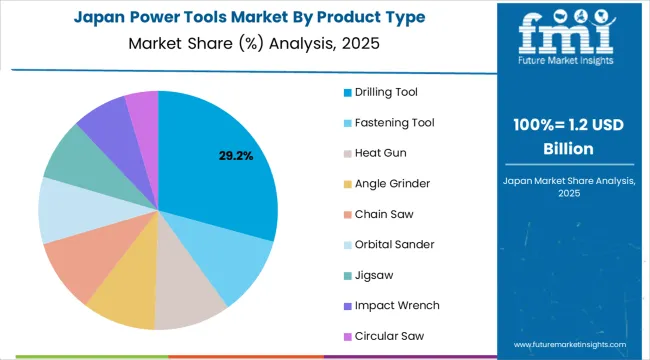

The drilling tools segment is projected to account for 28.0% of the power tools market in 2025, reaffirming its position as the leading product category. Construction companies and manufacturing facilities increasingly utilize drilling tools for their proven versatility, established reliability, and cost-effectiveness in operations across construction projects, manufacturing processes, and maintenance applications. Drilling tool technology's established operational procedures and consistent performance output directly address the industry requirements for reliable hole-making and operational efficiency in diverse working environments.

This product segment forms the foundation of current construction and manufacturing operations, as it represents the technology with the greatest application versatility and established user familiarity across multiple industries and project types. User investments in enhanced cordless drilling systems and performance optimization continue to strengthen adoption among professionals and consumers. With users prioritizing operational reliability and application flexibility, drilling tools align with both performance objectives and cost management requirements, making them the central component of comprehensive power tool strategies.

Electric technology is projected to represent 80.0% of power tools demand in 2025, underscoring its critical role as the primary technology for professional and consumer power tool applications. Users prefer electric power tools for their efficiency, reliability, and ability to handle diverse operations while supporting both corded and cordless applications with enhanced performance characteristics. Positioned as versatile equipment for modern tool applications, electric tools offer both operational advantages and user benefits.

The segment is supported by continuous innovation in battery technology expansion and the growing availability of specialized electric configurations that enable efficient operation with enhanced power capabilities. Additionally, users are investing in electric tool optimization to support large-scale operations and performance requirements. As cordless technology becomes more prevalent and operational efficiency requirements increase, electric technology will continue to dominate the technology market while supporting advanced tool utilization and operational strategies.

Construction application is projected to register the highest CAGR of approximately 35.0% during 2025 to 2035, driven by expanding infrastructure development projects and growing demand for efficient construction tools across residential, commercial, and industrial construction activities. Construction operators prefer power tools for their reliability, performance capabilities, and ability to handle demanding construction operations while supporting project schedules and quality requirements. The segment benefits from increasing construction activities in developing regions and modernization of construction practices.

Manufacturing application remains a significant segment, supported by ongoing expansion of automotive, aerospace, metal fabrication, and industrial manufacturing sectors. Power tools are extensively used in production processes, assembly operations, and maintenance activities, ensuring consistent demand from manufacturing facilities globally. MRO services represent a stable application category, as industries seek to enhance equipment reliability and operational efficiency through regular maintenance operations.

Online sales channel is projected to witness the highest CAGR of around 7.1% during the forecast period of 2025 to 2035, driven by increasing preference for digital purchasing platforms among both professional and consumer users. E-commerce platforms are expanding their product portfolios and offering competitive pricing, wider product availability, and convenient delivery options. The availability of detailed product information, user reviews, and comparison tools is influencing customers to opt for online channels, particularly in markets where convenience and variety are valued.

Offline sales channel continues to command significant market share, especially in regions where physical product evaluation is preferred before purchase. Hardware stores, specialty tool outlets, and retail chains remain critical distribution points, particularly for professional users who rely on personalized recommendations and after-sales services.

The power tools market is advancing steadily due to increasing construction and manufacturing activities and growing adoption of advanced tool technologies that provide enhanced operational efficiency and performance reliability across diverse industrial and consumer applications. However, the market faces challenges, including high tool replacement costs, specialized maintenance requirements, and varying performance requirements across different application environments. Innovation in battery technologies and smart connectivity systems continues to influence tool development and market expansion patterns.

The growing expansion of construction projects and infrastructure development is enabling tool manufacturers to develop power tool systems that provide superior operational efficiency, enhanced performance capabilities, and reliable operation in demanding construction environments. Advanced power tool systems provide improved productivity capacity while allowing more effective project completion and consistent quality delivery across various applications and construction requirements. Manufacturers are increasingly recognizing the competitive advantages of modern tool capabilities for operational efficiency and construction productivity positioning.

Modern power tool manufacturers are incorporating advanced battery technologies and cordless designs to enhance operational mobility, reduce power constraints, and ensure consistent performance delivery to construction and manufacturing operators. These technologies improve operational flexibility while enabling new applications, including remote site operations and automated assembly solutions. Advanced technology integration also allows manufacturers to support premium tool positioning and performance optimization beyond traditional corded tool supply.

| Country | CAGR (2025-2035) |

|---|---|

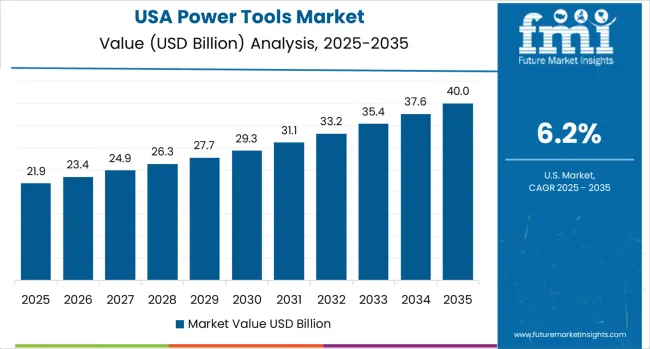

| United States | 6.2% |

| France | 4.9% |

| Germany | 5.7% |

| Italy | 5.0% |

| Japan | 4.2% |

| South Korea | 5.5% |

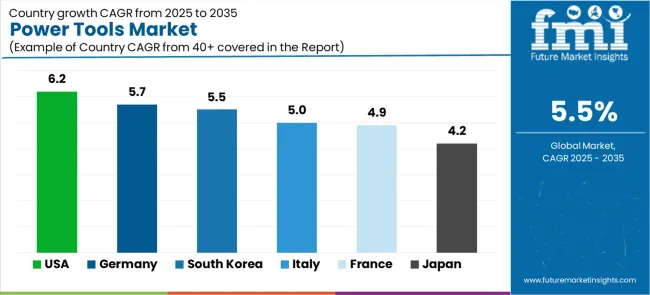

The power tools market is experiencing steady growth globally, with the USA leading at a 6.2% CAGR through 2035, driven by extensive construction infrastructure programs, advanced industrial capabilities, and significant adoption of cordless power tools supported by robust DIY culture and professional construction activities. Germany follows at 5.7%, supported by strong manufacturing sector expansion, precision engineering requirements, and growing adoption of advanced tool technologies. South Korea shows growth at 5.5%, emphasizing industrial automation and technological advancement. Italy demonstrates 5.0% growth, supported by manufacturing modernization and construction development. France records 4.9%, focusing on industrial upgrades and construction activities. Japan shows 4.2% growth, driven by manufacturing innovation but constrained by market maturity.

The report covers an in-depth analysis of 40+ countries;six top-performing countries are highlighted below.

Revenue from power tools in the USA is projected to exhibit exceptional growth with a CAGR of 6.2% through 2035, driven by extensive construction infrastructure programs and robust DIY culture supported by homeowner engagement and professional construction activities. The country's comprehensive construction sector and increasing investment in infrastructure development are creating substantial demand for advanced power tool solutions. Major construction companies and consumers are establishing comprehensive tool portfolios to serve both professional operations and personal project requirements.

Revenue from power tools in Germany is expanding at a CAGR of 5.7%, supported by the country's strong manufacturing sector, precision engineering capabilities, and comprehensive industrial modernization programs among manufacturing operators. The nation's advanced industrial infrastructure and increasing emphasis on automation are driving sophisticated tool capabilities throughout the manufacturing market. Leading manufacturers and industrial facilities are investing extensively in power tool development and technology integration to serve both domestic manufacturing needs and export markets.

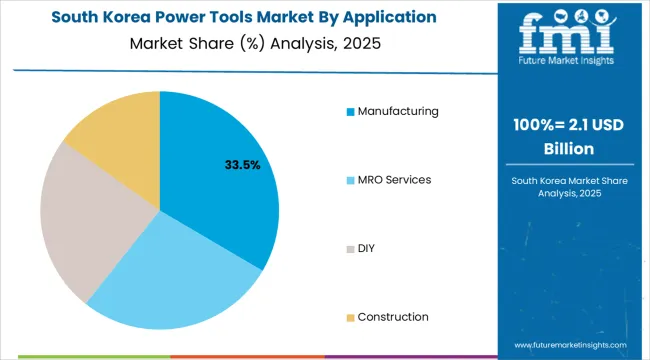

Revenue from power tools in South Korea is growing at a CAGR of 5.5%, driven by expanding industrial automation programs, increasing technology integration requirements, and growing investment in advanced manufacturing capabilities. The country's established technology sector and emphasis on automation advancement are supporting demand for smart power tools across major industrial markets. Manufacturing operators and technology companies are establishing comprehensive equipment programs to serve both domestic industrial needs and technology development requirements.

Revenue from power tools in Italy is expanding at a CAGR of 5.0%, supported by the country's focus on manufacturing sector modernization, design industry development, and strategic investment in operational efficiency improvement. Italy's established manufacturing capabilities and emphasis on craftsmanship excellence are driving demand for specialized power tools focusing on operational precision and quality output. Manufacturing operators are investing in comprehensive equipment modernization to serve both domestic production requirements and export market development.

Revenue from power tools in France is expanding at a CAGR of 4.9%, supported by the country's industrial development programs, growing construction activities, and increasing investment in infrastructure modernization. France's established industrial sector and emphasis on construction development are driving demand for reliable power tools across major operational markets. Industrial operators and construction companies are establishing service partnerships to serve both domestic development needs and operational efficiency requirements.

Revenue from power tools in Japan is expanding at a CAGR of 4.2%, supported by the country's innovation leadership capabilities, advanced manufacturing sector, and strategic investment in technology development. Japan's mature industrial infrastructure and emphasis on precision manufacturing are driving demand for high-performance power tools across major manufacturing markets. Manufacturing facilities and technology companies are establishing equipment partnerships to serve both domestic innovation requirements and operational excellence initiatives.

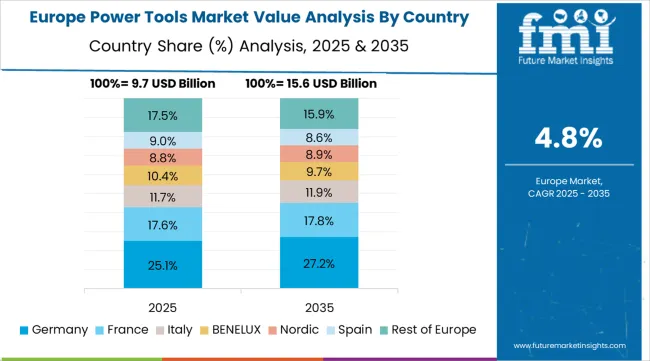

The power tools market in Europe is projected to grow from USD 12.8 billion in 2025 to USD 21.2 billion by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, increasing to 33.1% by 2035, supported by its advanced manufacturing capabilities, comprehensive industrial infrastructure, and major construction activities serving European and international markets.

France follows with a 16.8% share in 2025, projected to ease to 16.3% by 2035, driven by industrial development programs, construction sector growth, and established manufacturing capabilities, but facing challenges from competitive pressures and market maturity constraints. United Kingdom holds a 15.2% share in 2025, expected to decline to 14.8% by 2035, supported by construction activities and industrial requirements but facing challenges from economic uncertainties. Italy commands a 13.1% share in 2025, projected to reach 13.3% by 2035, while Spain accounts for 10.9% in 2025, expected to reach 11.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern European markets, Netherlands, Belgium, and other European countries, is anticipated to gain momentum, expanding its collective share from 11.6% to 11.4% by 2035, attributed to increasing industrial development across Nordic countries and growing construction modernization across various European markets implementing infrastructure upgrade programs.

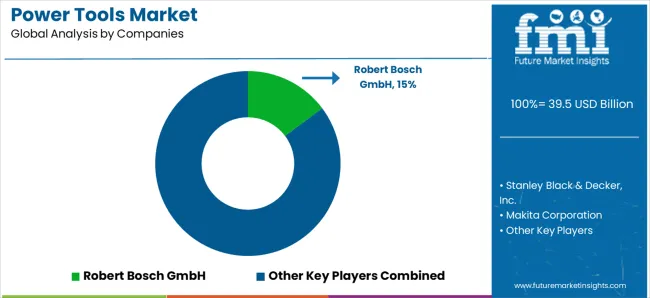

The power tools market is being shaped by a mix of global leaders in tool manufacturing, with Robert Bosch GmbH, Stanley Black &Decker, Inc., and Makita Corporation taking the lead, collectively holding a significant share of the market. Robert Bosch holds around 15% of the market, followed by Stanley Black &Decker with 13%, and Makita with 11%. Bosch and Stanley Black &Decker are renowned for their extensive product lines, covering everything from drills to impact wrenches, catering to both professional and DIY markets. Makita, with its emphasis on cordless solutions, captures a major share, known for high-quality, durable power tools for both industrial and home use. Hilti Corporation and Atlas Copco AB, recognized for their premium, heavy-duty tools, primarily in the construction and industrial sectors, account for around 10% of the market. Techtronic Industries, Snap-on Incorporated, and Kyocera Corporation each hold approximately 8%, focusing on innovation, smart technology integration, and expanding their product ranges. Panasonic Corporation and Apex Tool Group, catering to specific segments such as electronics and automotive tools, each contribute around 6% to the market. These companies compete based on product quality, innovation, and customer support, with a growing focus on battery technology, smart features, and sustainability driving their market strategies. The power tools market continues to evolve, with technology, efficiency, and performance leading the competition among these key players.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 39.5 billion |

| Product Type | Drilling Tool, Fastening Tool, Heat Gun, Angle Grinder, Chain Saw, Orbital Sander, Jigsaw, Impact Wrench, Circular Saw |

| Technology | Electric (Corded, Cordless - Li-ion Battery, Lead Acid Battery, Others), Pneumatic |

| Application | Manufacturing, MRO Services, DIY, Construction |

| Sales Channel | Online, Offline |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East &Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, Brazil, India and 40+ countries |

| Key Companies Profiled | Robert Bosch GmbH, Stanley Black &Decker, Makita Corporation, Hilti Corporation, Atlas Copco AB, and Techtronic Industries |

| Additional Attributes | Tool sales by product type and technology category, regional demand trends, competitive landscape, technological advancements in cordless systems, battery development, smart connectivity innovation, and operational efficiency optimization |

The global power tools market is estimated to be valued at USD 39.5 billion in 2025.

The market size for the power tools market is projected to reach USD 67.5 billion by 2035.

The power tools market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in power tools market are drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench and circular saw.

In terms of application, manufacturing segment to command 35.0% share in the power tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

UK Power Tools Market Analysis – Size, Share & Forecast 2025-2035

AI-powered Design Tools Market Insights - Growth & Forecast 2025 to 2035

KSA Power Tools Market Insights – Trends, Demand & Growth 2025-2035

Russia Power Tools Market Insights – Size, Share & Trends 2025-2035

Germany Power Tools Market Growth – Trends, Demand & Forecast 2025-2035

Electric Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

South Korea Power Tools Market Report – Trends, Demand & Growth 2025-2035

Europe Woodworking Power Tools Market Growth - Trends & Forecast 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA