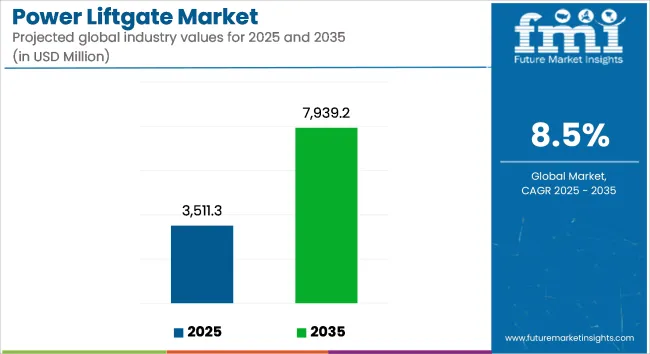

The global power liftgate market was valued at USD 3,511.3 million in 2025 and is projected to reach USD 7,939.2 million by 2035, registering a CAGR of 8.5%. This growth has been driven by increasing consumer demand for smart, hands-free vehicle access and the rising penetration of automation in both premium and mid-range vehicles.

Automakers have expanded the availability of power liftgate systems across multiple SUV and crossover platforms. In 2024, Nissan confirmed the inclusion of intelligent power liftgate features in its updated Rogue and Pathfinder models. These systems were equipped with foot-activated sensors and programmable height adjustment. As per Speedcraft Nissan, enhanced accessibility was prioritized in the 2024 lineup to support family use and aging population needs.

Hyundai, in a 2024 update, introduced smart liftgate systems with proximity key recognition and auto-open features in its Tucson and Palisade models. The liftgate was engineered to detect user presence within three feet of the rear bumper and initiate liftgate opening without foot movement. This function was designed to improve usability when carrying heavy objects or in inclement weather. According to Hyundai Central Florida, the system eliminated the need for physical interaction and improved safety during loading and unloading.

Ascencione Technologies launched a radar-based intelligent liftgate system in 2024 that included dual sensors for object detection and anti-pinch safety. The company reported increased demand from tier-1 suppliers and OEMs in Asia-Pacific and Europe. As stated on the company’s official portal, this technology was adopted to offer dynamic obstacle recognition and smooth open/close operation under low visibility conditions.

The adoption of automated rear access systems has been supported by a shift toward electrified platforms. As battery packaging and rear storage accessibility have become critical in EV architecture, OEMs have prioritized electronically controlled liftgates for optimized utility.

With rising expectations for convenience, safety, and automation, power liftgate solutions are being integrated as standard or mid-trim offerings. As urban living and last-mile delivery needs increase, this market is expected to continue evolving with radar, app-based control, and vehicle-to-user interface enhancements through 2035.

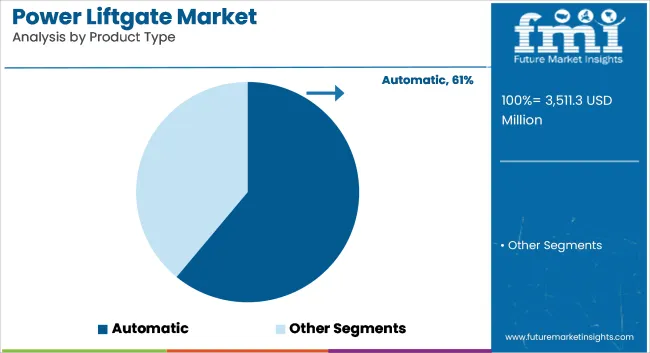

Automatic product types held 61% of the global market share in 2025 and are projected to grow at a CAGR of 9.1% through 2035. Adoption was driven by increased focus on production efficiency, operator safety, and consistency in repetitive tasks across manufacturing and processing industries.

In 2025, sectors such as automotive, food processing, and electronics shifted toward fully automated equipment to align with lean manufacturing goals and labor optimization strategies. Automatic systems were preferred for their ability to reduce human error, improve output rates, and support integration with digital control systems.

Companies in East Asia and Central Europe invested in equipment upgrades and automation retrofits, targeting process reliability and compliance with ISO quality standards. Semi-automatic systems continued to serve niche operations, especially in cost-sensitive and low-volume production environments.

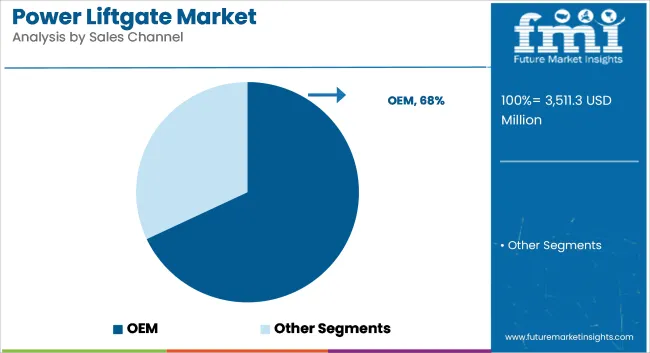

OEM sales accounted for 68% of total revenue in 2025 and are expected to grow at a CAGR of 8.9% through 2035. Growth was supported by increased incorporation of automation and control equipment into new machinery and assembly lines during the initial procurement phase.

In 2025, OEM demand was concentrated among sectors implementing greenfield and brownfield expansion projects, particularly in Asia-Pacific and North America. Equipment manufacturers bundled automation units with broader system solutions, offering performance guarantees and post-installation support.

OEM channels benefited from direct engagement with design teams and production planners, ensuring compatibility and system-level optimization. The aftermarket segment retained relevance in maintenance, repair, and retrofit applications but grew at a slower pace due to long equipment replacement cycles and limited upgrades in legacy systems.

Challenges

However, the high cost of such systems is a key challenge as they put pressure on the overall vehicle price. Consumers in price-sensitive markets might not be amenable to choosing a vehicle equipped with a power liftgate, especially in the entry-level and mid-range cheery segments. Moreover, consumers who like to watch their budget would have to consider the maintenance and repair costs associated with the electronic liftgate hardware failures in sensors or motorized actuators must be addressed by specialists in some cases.

Opportunities

The aftermarket segment presents significant growth potential, as more consumers look for retrofit solutions to enhance their vehicles. Automation and AI-driven predictive maintenance for power liftgates are expected to drive future demand. Moreover, the manufacturers will gain additional revenues through the introduction of energy-efficient liftgate systems specifically designed for electric vehicles

Additionally, increasing preference towards SUVs, rising demand for luxury cars and higher penetration rate of smart automotive solutions drive the United States power liftgate market growth. With one of the largest automotive markets in the world, the country has invested significantly in connected vehicle solutions and technologies that offer autonomous driving capabilities.

The rapid expansion of the power liftgate market is primarily driven by the SUV and crossover segment, which represents more than 50% of all vehicle sales in the USA As a result, due to consumer preference for that convenience in product usage, electric, foot-activated, and sensor-based liftgates are on the rise in new vehicle models. Ford, General Motors, Tesla, and Stellantis are among the automakers offering automated rear doors on mid- and upper-range vehicles.

Most notably, power liftgate technology is not limited to passenger and luxury vehicles alone, as it is now being introduced in commercial fleets such as delivery vans and even in various autonomous logistics vehicles, owing to the rapid growth of the e-commerce sector. Additionally, the rise of e-commerce and last-mile delivery services has led to the increased need for automated cargo access solutions, propelling the growth of the market.

In addition, features such as artificial intelligence (AI), superb sensors, remote control systems, and Internet of Things (IoT) connections have been developed to take the reliability and efficiency of the power liftgates to the next level, making it one of the key elements in modern electric and autonomous vehicles. Installed in EVs, the incentives and infrastructure investments from governments in the electric vehicle development integrator section have encouraged automakers to adopt lightweight, energy-efficient power liftgate product systems.

As consumers continue to fixate on convenience, safety, and hands-free automation, the power liftgate market for cars in the USA is sure to grow steadily over the next ten years.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

The UK colonial Power liftgate market is seeing healthy growth owing to robust demand for luxury and top range Rides, the expansion of the electric the car (EV) segment and the there is, among consumers, preference for smart automotive Technologies. There are a lot of high-end SUVs and crossovers along with executive saloons around these parts, so the UK also is a strong market for power liftgates.

As automakers step up vehicle convenience features and accessibility, so too are gesture-controlled, remote-operated, and foot-sensor-activated power liftgates. The increasing need for hands-free tailgate access is being answered by leading manufacturers, such as Jaguar Land Rover, BMW and Audi, which include automated liftgate solutions in their new vehicle models.

Another factor driving growth in the market is the UK government's strong push for electrification and smart vehicle infrastructure. Due to the rapid adoption of electric vehicles, manufacturers are increasingly integrating light-weight power liftgate systems into electric SUVs and crossovers.

Moreover, demand for automate, app-controlled liftgate solutions is being fostered by emerging technology trends including intelligent a smart key technology, voice recognition systems and IoT connectivity solutions, with sophisticated consumers increasingly looking to integrate these technologies. As a result, the continuing shift towards premium automotive experiences and expanding EV infrastructure will further bolster power liftgate market growth within the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

Growing sales of luxury vehicles, demand for smart automotive features, and adoption of electric mobility in the region are all driving robust growth of the European power liftgate market. Europe, with a mature premium car market, is embracing advanced vehicle automation solutions (such as AI-enabled, gesture-activated and voice-activated power liftgates) like no other region.

So, Germany, France and Italy lead the market, with the most prominent automakers in the above mentioned countries, including their top high-tech liftgate systems in their SUVs, crossovers and high-performance sedans; BMW, Mercedes-Benz, Volkswagen and Audi.

Europe’s electric vehicle revolution also significantly influences power liftgate adoption, with manufacturers opting for energy-efficient, lighter tailgate mechanisms for battery-powered vehicles. Moreover, the emergence of shared mobility, car subscription services, and smart fleet management has further propelled the adoption of automated liftgates in ride-sharing and commercial vehicles.

EU regulations mandating that vehicles offer higher levels of safety and convenience features is further pressuring automakers into offering more access-friendly features as standard (power liftgates are becoming standard on mid-range and above models). The European market is likely to see sustained growth in the coming years owing to the continued investments in AI-powered automotive applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.2% |

The Japanese power liftgate market is growing steadily, bolstered by the country’s technological prowess in automotive innovation, growing sales of SUV and crossovers, and growing consumer inclination towards convenience-oriented features.

Japanese manufacturers such as Toyota, Honda, Nissan, and Mazda have been some of the first in the world to implement these advanced liftgate systems in the vast majority of their new models. Japanese car makers are ramping up innovations in the vehicle access solutions market with the growing demand of smart access, AI-powered automation, and gesture-controlled tailgate systems.

Japan's production of hybrid and electric vehicles has also spurred growth in energy-efficient, lightweight power liftgates. Furthermore, the rising implementation of sensor-based tailgate systems in compact vehicles and passenger cars is increasing market opportunities outside the luxury vehicle segment.

Japan’s rapidly expanding logistics and e-commerce industry has bolstered adoption of power liftgates too, with delivery vehicles and smart logistics fleets adopting automated tailgate systems for effectively handling cargo. Given its reputation as a trailblazer in the AI-infused automotive systems space, Japan's contributions to liftgate automation are likely to spur further innovation and bolster its share of the global marketplace as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

The South Korean power liftgate market is experiencing substantial growth, driven by the country’s strong automotive industry, rapid expansion of the electric vehicle sector, and increasing demand for smart vehicle features.

South Korea is home to leading automakers like Hyundai, Kia, and Genesis, which are actively incorporating automated liftgate solutions into their latest SUV and EV models. With rising consumer expectations for luxury and convenience, manufacturers are equipping mid-range and high-end vehicles with remote-controlled, voice-activated, and foot-sensor-based power liftgates.

Additionally, the South Korean government’s EV incentives have accelerated the integration of lightweight, energy-efficient liftgate technologies in hybrid and electric cars. The increasing adoption of connected car technologies and smartphone-controlled vehicle systems has further expanded demand for AI-powered liftgate solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The power liftgate market is expected to experience substantial growth in the coming years due to factors such as the growing need for convenience among consumers, technological advancements in the automotive sector, and the increasing adoption of electric and luxury vehicles.

This implementation of technology has resulted in much more than just a simple tailgate in our vehicles today, power liftgates offer hands-free operation, increased vehicle accessibility, and improved safety, all desirable qualities in a device that continues to be a commonplace feature in our vehicles. As all car manufacturers are adopting power liftgates across vehicles from SUVs to sedans, it is expected to drive the growth of the market.

Technological progress such as smart sensors, gesture control, and integration with in-automobile automation systems is playing a major part in shaping the aggressive landscape. Business is specializing in lightweight materials, energy-efficient, and economical derivatives to accommodate a wider population. The growing safety regulations along with increasing consumer demand for a better vehicle comfort are boosting the ongoing innovations in the power liftgate mechanism.

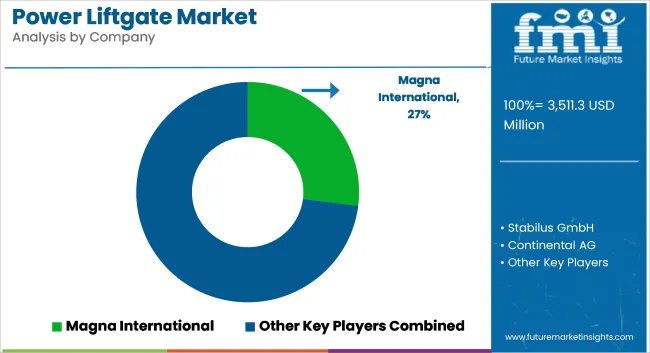

Magna International Inc.

Magna International Inc. is a leading global automotive supplier, and always at the forefront of technology to address the industry's current and future power liftgate needs. The company’s liftgates leverage lightweight materials, intelligent sensors, and automation features for greater user convenience and improved vehicle efficiency.

With the ongoing innovation of Magna's R&D team, our power liftgates are now designed as part of an ADAS environment, contributing to overall safety and user-friendliness. As a partner to the world's top automakers, the company offers customized solution with compatibility across multiple vehicle types.

Magna is also committed to sustainability with liftgates with energy-efficient features that lower emissions from the rest of the vehicle as it moves toward more sustainable automotive technologies. Magna continues to be a global leader with manufacturing plants in North America, Europe and Asia, and expanding capabilities to support growing market demands.

Brose Fahrzeugteile SE & Co. KG

Brose Fahrzeugteile is a key player in the power liftgate market, known for its expertise in intelligent mechatronics. The company focuses on designing liftgate systems that utilize gesture-based controls, automatic detection of obstacles, and improved safety features for hands-free operation.

Brose’s specialized energy-efficient actuators reduce power consumption, which makes their solutions widely adopted for e- and hybrid vehicles. Alpine also works closely with luxury automotive brands and its solutions integrate at high-performance levels with next-gen automotive architectures.

And Brose is also pouring nice sums of money into AI-powered diagnostics and predictive maintenance tech, which enables users to monitor liftgate performance in real time. Accordingly, this optimism shows the company's commitment and efforts towards its expansion strategy through continuous development and improvements in the manufacturing processes while increasing the footprint into emerging market, to keep up with its heritage of quality and innovation.

Aisin Seiki Co., Ltd.

Aisin Seiki Co., Ltd., the automotive components manufacturer, provides powerful liftgates systems which are known for their robustness and efficiency. The company’s liftgates are designed with smooth operation mechanisms that are very reliable in all sorts of weather, making them suitable for luxury as well as mass-market vehicles.

Aisin's focus here is to reduce weight and power consumption while still fulfilling liftgate strength and function. Its liftgates utilize smart safety features driven by sophisticated sensor technology, like automatic anti-pinch detection and customizable opening angles.

The business is focused on adding integrated connectivity products that will enable drivers to manage liftgates through mobile apps. Aisin continues to strengthen its market position ensures its products remain at the forefront of technological advancements.

Johnson Electric Holdings Limited

Johnson Electric is a leading provider of motion systems, offering compact and cost-effective power liftgate motors designed to deliver high torque and minimal noise. Designed for smooth and reliable operation, the company's motors deliver long-term performance. Johnson Electric delivers scalable solutions to a wide range of automakers that can be flexibly tailored to match a wide variety of vehicle types, from entry-level sedans to full-size SUVs.

Research continues, with an emphasis on brushless motor technology, the aim being to increase efficiency while at the same time decreasing energy consumption. Johnson Electric is also working towards integrating intelligent control modules for real-time monitoring and diagnostics which will increase user comfort. Johnson Electric continues its innovation and market reach globally, with strong partnerships spanning to both OEM and aftermarket segments.

Stabilus GmbH

With innovative motion control solutions for improved access to vehicles, Stabilus GmbH is a market leader in hydraulic and electromechanical liftgate systems. Features on the company’s power liftgate technology include anti-pinch protection as well as remote operation of the liftgate. It focuses on research to develop a new range of products like energy-efficient actuators and sustainable materials that offer ultimate long-lasting performance.

The company works with top vehicle producers to embed functional liftgate solutions into the vehicles, resulting in improved user accessibility and automobile security. Next-gen liftgate systems with adaptive speed control and noise reduction technology are also in the works from Stabilus. But the company also prides itself on innovation, and it plans on adding other liftgate products to its offerings as there are hundreds of automotive segments to serve in which it seeks to satisfy.

The market is segmented into OEM and Aftermarket.

The industry is categorized into Passenger Vehicles and Commercial Vehicles.

The market is classified into Automatic and Semi-Automatic.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global power liftgate market is projected to reach USD 3,511.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.5% over the forecast period.

By 2035, the power liftgate market is expected to reach USD 7,939.2 million.

The Passenger Vehicle segment is expected to hold a significant share due to increasing demand for comfort and convenience features in modern automobiles.

Key players in the power liftgate market include Stabilus GmbH, Mitsuba Corporation, STRATTEC Security Corporation, HI-LEX Corporation, and Continental AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA