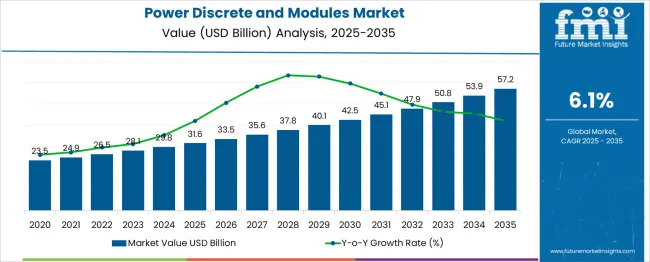

The Power Discrete and Modules Market is estimated to be valued at USD 31.6 billion in 2025 and is projected to reach USD 57.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The power discrete and modules market expansion represents a growth multiplier of 1.81x, supported by a CAGR of 6.1%, driven by rising electrification across automotive, industrial automation, renewable energy systems, and consumer electronics.

Phase-wise evaluation shows that during the first five years (2025–2030), the market is expected to rise from USD 31.6 billion to approximately USD 42.4 billion, adding USD 10.8 billion, which accounts for 42% of the total incremental gain. Growth in this phase is fueled by high-volume demand for silicon-based IGBTs, MOSFETs, and power diodes in EV inverters, charging infrastructure, and industrial drives.

The second phase, spanning 2030–2035, contributes USD 14.8 billion, or 58% of the incremental opportunity, as wide-bandgap semiconductors (SiC and GaN) achieve deeper penetration in high-voltage EV platforms, renewable energy inverters, and fast-charging ecosystems. This back-loaded growth highlights increasing adoption of energy-efficient power electronics in smart grids and data centers. Companies that invest in next-generation semiconductor technologies, packaging innovations, and localized manufacturing will capture the largest share of this USD 25.6 billion growth opportunity.

| Metric | Value |

|---|---|

| Power Discrete and Modules Market Estimated Value in (2025 E) | USD 31.6 billion |

| Power Discrete and Modules Market Forecast Value in (2035 F) | USD 57.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The power discrete and modules market holds a significant share across multiple electronics and semiconductor-related sectors. In the power electronics market, it accounts for approximately 35–40%, as power semiconductors form the core of devices used for energy conversion and control. Within the semiconductor devices market, its share is around 8–10%, as integrated circuits and memory dominate overall demand.

In the electronic components market, the share stands at about 6–7%, since this category includes a wide range of passive and active components beyond power devices. For the industrial power conversion equipment market, the contribution is approximately 12–14%, driven by the widespread use of power modules in inverters, converters, and motor drives.

In the automotive and energy systems electronics market, power discretes and modules represent nearly 10–12%, as they enable efficient energy management in electric vehicles and renewable power systems. Growth in this segment is propelled by increasing electrification in transportation, rising deployment of renewable energy systems, and the demand for high-efficiency power conversion solutions. Technological innovations such as wide bandgap materials like SiC (silicon carbide) and GaN (gallium nitride) are further accelerating adoption. As energy efficiency and high-power density requirements increase, the market is expected to strengthen its position across these parent categories.

The power discrete and modules market is experiencing significant growth as energy efficiency demands, electrification trends, and advancements in semiconductor technologies converge. Increased deployment of renewable energy systems, electric vehicles, and industrial automation solutions is driving robust adoption of power components to manage high voltages and improve system reliability.

The current landscape reflects growing integration of modular and compact power solutions that optimize performance while minimizing heat loss and footprint. Future growth is anticipated to be supported by continued innovations in semiconductor materials, rising investment in grid infrastructure modernization, and the scaling of sustainable transportation.

Efficiency mandates, cost reduction imperatives, and a focus on longevity and durability are expected to open further opportunities across diverse end-use industries. Strategic collaborations between semiconductor manufacturers and end-users are paving the way for tailored solutions that meet both operational and regulatory requirements.

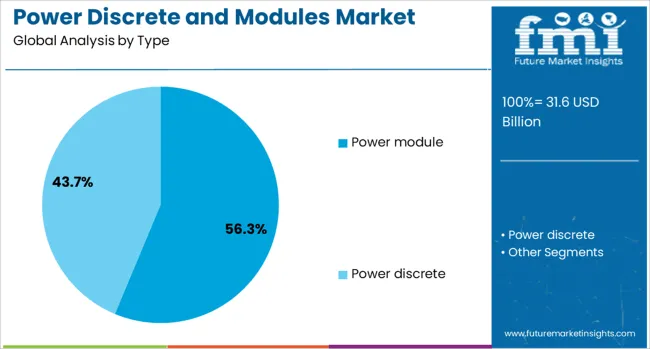

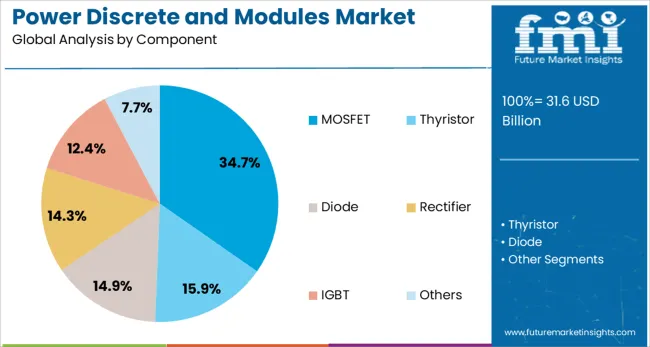

The power discrete and modules market is segmented by type, component, material, application, and geographic regions. By type of power, the market is divided into Power modules and Power discrete. In terms of components of the power discrete and modules market, it is classified into MOSFET, Thyristor, Diode, Rectifier, IGBT, and Others.

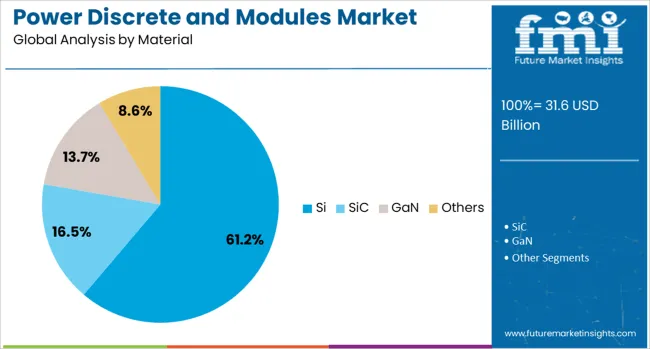

Based on the material of the power discrete and modules market, it is segmented into Si, SiC, GaN, and Others. By application of the power, the market is segmented into Automotive, Telecom & data centers, Industrial, Renewable energy, Consumer electronics, Others, Military & defense, and Medical. Regionally, the power discrete and modules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the power module segment is projected to hold 56.30% of the total market revenue in 2025, establishing itself as the leading type segment. This dominance has been supported by the ability of power modules to deliver compact, highly efficient solutions that integrate multiple discrete components into a single package.

Their inherent design enables reduced parasitic losses, improved thermal management, and simplified assembly processes, which have been widely adopted in automotive, industrial, and renewable energy applications. Furthermore, increased demand for modular designs that facilitate ease of maintenance and scalability has reinforced the appeal of power modules over individual discretes.

The ability to offer higher power density while maintaining reliability and reducing system complexity has further solidified their leadership in the market.

In terms of components, the MOSFET segment is expected to account for 34.7% of the market revenue share in 2025, making it the top component segment. This prominence has been driven by the superior switching speed, low on-resistance, and high efficiency of MOSFETs, which make them well suited for high-frequency and low-voltage applications.

Continuous improvements in design and manufacturing processes have facilitated their widespread deployment in automotive powertrains consumer electronics and renewable energy systems. The versatility of MOSFETs in delivering precise power control and their ability to operate efficiently under varying load conditions have contributed to their sustained adoption.

Their compact form factor, coupled with cost-effectiveness and compatibility with modern circuit designs, has further anchored their position as the preferred component in diverse applications.

Segmented by material, silicon (Si) is forecast to capture 61.2% of the market revenue in 2025, maintaining its leadership position. This dominance has been reinforced by the established supply chain, maturity, cost efficiency, and proven performance characteristics of silicon in power electronic applications.

The material’s ability to balance electrical conductivity, thermal stability, and manufacturability has supported its widespread usage in both discrete and modular components. Technological refinements in silicon processing and packaging have extended its applicability even as alternative materials emerge.

The combination of high availability, robust infrastructure, and compatibility with existing manufacturing ecosystems has ensured silicon’s continued preference. Its proven reliability across high-volume and mission-critical applications has further solidified its standing as the leading material in the power discrete and modules market.

The power discrete and modules market is influenced by accelerating demand for energy-efficient solutions, rising EV production, and renewable power integration. Opportunities are expected in wide bandgap semiconductor adoption and advanced module packaging for high-voltage applications.

Key trends include the shift to silicon carbide and gallium nitride components for enhanced thermal performance and reduced energy losses. However, high material costs, manufacturing complexity, and supply chain constraints act as major restraints. Companies emphasizing localized manufacturing and vertically integrated supply strategies are believed to achieve a competitive advantage in this rapidly evolving semiconductor-based power electronics market.

Growth in the power discrete and modules market has been fueled by strong adoption in automotive electrification, industrial automation, and renewable power applications. In 2024, electric vehicle sales surpassed expectations across Europe and Asia, significantly boosting demand for insulated gate bipolar transistors (IGBTs) and MOSFET modules. Utility-scale solar and wind projects have also increased the requirement for high-efficiency power modules for inverters and grid interfaces. It is widely believed that OEMs and tier-one suppliers are accelerating partnerships with semiconductor firms to secure critical components for high-performance power conversion and energy management systems.

Opportunities are expected from the growing shift toward wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) for power modules. In 2025, SiC-based modules were integrated into electric drivetrain inverters and fast-charging stations in North America and Europe to reduce energy losses and enhance thermal stability. Industrial equipment manufacturers have shown strong interest in GaN-based discrete devices for high-frequency converters and data center power supplies. It is believed that suppliers investing in next-generation packaging technologies, along with robust wafer production capabilities, will capture long-term value in automotive, industrial, and renewable energy sectors.

A notable trend is the increasing use of compact, high-power-density modules featuring advanced packaging and thermal management systems. In 2024, leading semiconductor manufacturers introduced double-sided cooled SiC modules for traction inverters to enhance system reliability and extend operational lifespans. Demand for press-fit and solderless interconnections is rising in industrial drives to improve assembly efficiency. It is strongly viewed that the combination of power density optimization and superior heat dissipation technologies will define future procurement decisions across transportation electrification and high-load industrial infrastructure, positioning suppliers with packaging expertise as strategic market leaders.

One of the primary restraints in the power discrete and modules market is the elevated cost of SiC wafers and GaN substrates, which significantly impacts overall module pricing. In 2024, semiconductor companies faced prolonged lead times and logistic disruptions in the Asia-Pacific region, affecting delivery schedules for OEMs. Capital-intensive manufacturing processes and the limited availability of a skilled workforce in wafer fabrication plants further exacerbate production challenges. It is believed that without strategic investment in localized fabs and wafer recycling initiatives, smaller suppliers may struggle to remain competitive in meeting the growing demand for high-efficiency power electronics components.

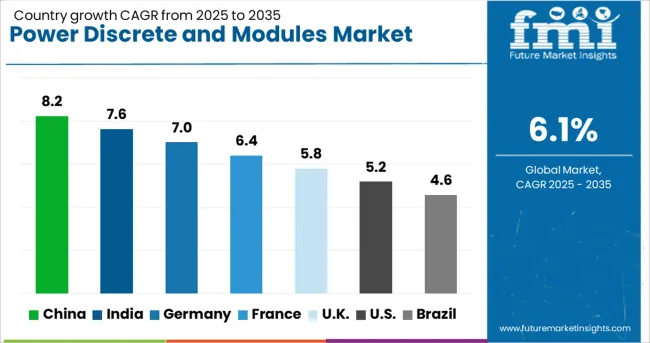

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global power discrete and modules market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads with 8.2%, followed by India at 7.6% and Germany at 7.0%. France records 6.4%, while the United Kingdom posts 5.8%. Growth is fueled by rising demand for power electronics in electric vehicles, renewable energy systems, and industrial automation. China and India dominate adoption due to large-scale EV production and energy infrastructure projects. Germany emphasizes advanced SiC and GaN modules for high-efficiency applications, while France and the UK prioritize compact, thermally efficient power components.

The power discrete and modules market in China is projected to grow at 8.2%, driven by strong demand from EV manufacturers and solar energy projects. IGBT modules dominate adoption for high-voltage applications in transportation and grid systems. Manufacturers focus on wide-bandgap technologies to boost efficiency. Government policies promoting domestic semiconductor production strengthen China's leadership in this segment.

The power discrete and modules market in India is forecast to grow at 7.6%, supported by rapid electrification and renewable energy initiatives. MOSFET-based modules dominate for industrial automation and consumer electronics. Manufacturers develop cost-effective, high-performance power solutions to meet local manufacturing needs. Expansion of EV charging networks further boosts demand for robust power modules.

The power discrete and modules market in Germany is expected to grow at 7.0%, driven by the adoption of SiC and GaN power devices in automotive and energy sectors. High-voltage power modules dominate electric mobility and renewable energy systems. Manufacturers emphasize reliability and thermal management for long-life performance. EU energy efficiency targets encourage rapid integration of advanced power technologies.

The power discrete and modules market in France is forecast to grow at 6.4%, driven by energy grid modernization and smart manufacturing initiatives. Hybrid modules dominate demand for industrial automation and renewable energy projects. Manufacturers integrate digital monitoring features for predictive maintenance. Rising investment in EV assembly lines strengthens demand for next-generation power electronics.

The power discrete and modules market in the UK is projected to grow at 5.8%, supported by strong interest in energy-efficient technologies and EV ecosystem development. Compact power modules dominate adoption in data centers and grid applications. Manufacturers prioritize miniaturized designs to save space while improving thermal performance. Growth of offshore wind projects further enhances the need for high-reliability modules.

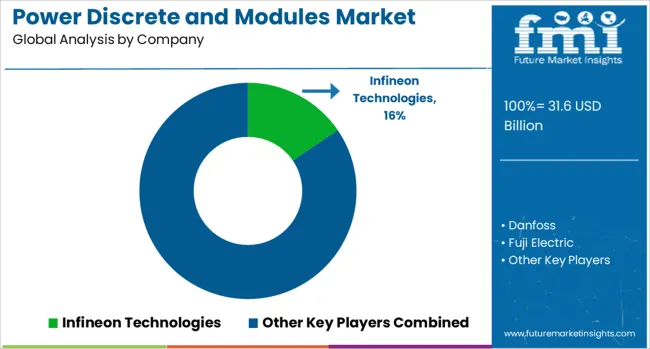

The power discrete and modules market is moderately consolidated, with Infineon Technologies recognized as a leading player due to its strong portfolio of power semiconductors, including IGBTs, MOSFETs, and power modules optimized for automotive, industrial, and renewable energy applications. Infineon’s expertise in wide-bandgap technologies and system solutions reinforces its market leadership globally.

Key players include Danfoss, Fuji Electric, Littelfuse, Microchip Technology, Mitsubishi Electric, ON Semiconductor, Powerex, Renesas Electronics, ROHM Semiconductor, Sanken Electric, Semikron, STMicroelectronics, Texas Instruments, Toshiba, Vishay Intertechnology, and Wolfspeed. These companies provide high-performance power electronics components that enable efficient energy conversion, thermal management, and reliability for applications in electric vehicles (EVs), industrial drives, solar inverters, and consumer electronics.

Market growth is driven by accelerating electrification trends, increased adoption of renewable energy, and the rising penetration of EVs, which require advanced power management solutions. Companies are focusing on innovations such as silicon carbide (SiC) and gallium nitride (GaN) technologies for higher efficiency and compact designs. Additionally, strategic collaborations with automotive OEMs and renewable energy developers, along with investments in capacity expansion, are shaping competitive dynamics. Asia-Pacific dominates production and consumption due to strong semiconductor manufacturing ecosystems, while North America and Europe continue to invest in advanced power electronics for EV and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.6 Billion |

| Type | Power module and Power discrete |

| Component | MOSFET, Thyristor, Diode, Rectifier, IGBT, and Others |

| Material | Si, SiC, GaN, and Others |

| Application | Automotive, Telecom & data centers, Industrial, Renewable energy, Consumer electronics, Others, Military & defense, and Medical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies, Danfoss, Fuji Electric, Littelfuse, Microchip Technology, Mitsubishi Electric, ON Semiconductor, Powerex, Renesas Electronics, ROHM Semiconductor, Sanken Electric, Semikron, STMicroelectronics, Texas Instruments, Toshiba, Vishay Intertechnology, and Wolfspeed |

| Additional Attributes | Dollar sales split across discrete components and power modules, using silicon, SiC, and GaN technologies for automotive, telecom, industrial, and renewable applications. Asia-Pacific leads adoption, while North America and Europe see steady growth. Buyers demand efficiency, thermal stability, and compactness. Integration spans EVs, smart grids, and automation, with innovations in wide-bandgap semiconductors and AI-driven thermal management. |

The global power discrete and modules market is estimated to be valued at USD 31.6 billion in 2025.

The market size for the power discrete and modules market is projected to reach USD 57.2 billion by 2035.

The power discrete and modules market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in power discrete and modules market are power module and power discrete.

In terms of component, mosfet segment to command 34.7% share in the power discrete and modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA