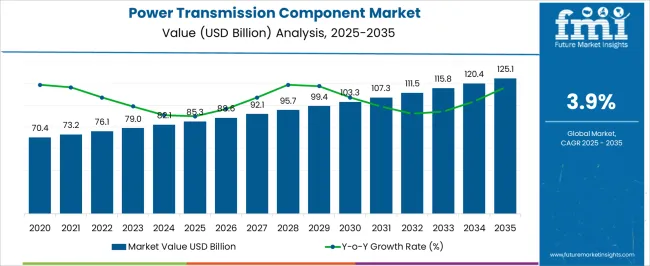

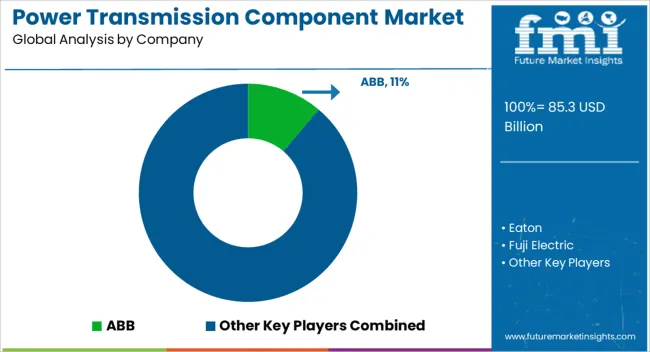

The power transmission component market is estimated to be valued at USD 85.3 billion in 2025 and is projected to reach USD 125.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

Market growth is driven by increasing demand for energy-efficient and reliable power transmission systems across industrial, automotive, renewable energy, and infrastructure sectors. Industrial modernization, expansion of manufacturing plants, and adoption of advanced machinery are creating strong demand for gears, couplings, bearings, belts, and shafts. In the automotive sector, electric and hybrid vehicle production is driving the need for high-performance power transmission components. Renewable energy installations, particularly wind and solar power, require specialized transmission systems for grid integration.

Emerging economies are investing heavily in infrastructure development, while mature markets focus on component upgrades, retrofitting, and predictive maintenance to improve operational efficiency. Dollar sales, share, and technological compatibility are critical decision factors for manufacturers, along with raw material costs, regulatory compliance, and supply chain optimization. Regional disparities, industry-specific requirements, and growing aftermarket demand for replacements and high-precision components also contribute to market dynamics. Collectively, industrial, automotive, and energy segments account for the majority of growth, while maintenance, retrofitting, and infrastructure projects provide supplementary market opportunities worldwide.

The power transmission component market is strongly influenced by several parent markets, each contributing uniquely to overall demand and growth. The industrial machinery and manufacturing market holds the largest share at 35%, as heavy machinery, automation systems, and assembly lines rely on gears, couplings, bearings, and shafts for efficient torque transmission, load management, and operational continuity. The automotive and electric vehicle market contributes 25%, with vehicles demanding high-performance transmission components to ensure reliability, smooth power transfer, and energy efficiency, particularly in electric and hybrid drivetrains.

The energy and utilities market accounts for 20%, as renewable power installations, conventional power plants, and grid infrastructure require specialized transmission components to integrate, transmit, and distribute electrical and mechanical power effectively. The construction and infrastructure market holds 10% of the share, driven by equipment such as cranes, excavators, and conveyors that use robust transmission systems for heavy-duty applications. Finally, the aftermarket and maintenance segment represents 10%, supporting replacement, retrofitting, and predictive maintenance needs across industries, ensuring prolonged operational efficiency. Collectively, industrial machinery, automotive, and energy sectors account for 80% of overall demand, highlighting that production efficiency, vehicle performance, and energy transmission remain the primary growth drivers, while construction and aftermarket activities provide supplementary opportunities for market expansion globally.

| Metric | Value |

|---|---|

| Power Transmission Component Market Estimated Value in (2025 E) | USD 85.3 billion |

| Power Transmission Component Market Forecast Value in (2035 F) | USD 125.1 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The power transmission component market is expanding steadily, driven by growing electricity demand, modernization of aging grid infrastructure, and increasing integration of renewable energy sources. Industry reports and utility company announcements have emphasized the need for efficient, high-capacity transmission networks to handle fluctuating power loads and ensure grid stability.

Investments in cross-border interconnections, urban grid upgrades, and rural electrification projects have further stimulated demand for advanced transmission components. Technological improvements in transformers, switchgear, and conductors have enhanced operational reliability, reduced transmission losses, and extended asset life cycles.

Policy frameworks supporting energy efficiency and the shift toward cleaner energy sources are also influencing procurement patterns in the sector. In emerging markets, rapid industrialization and urban expansion are accelerating grid expansion projects, while in developed regions, refurbishment programs and digital grid integration are key growth drivers. Segmental momentum is expected to be led by transformers, the >132 kV to ≤220 kV voltage level, and HVAC current systems, reflecting their widespread application and adaptability in diverse transmission environments.

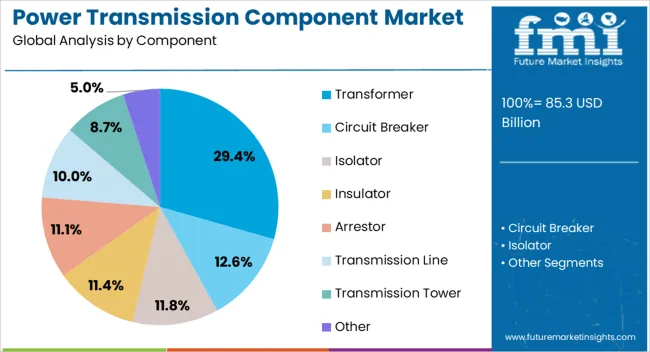

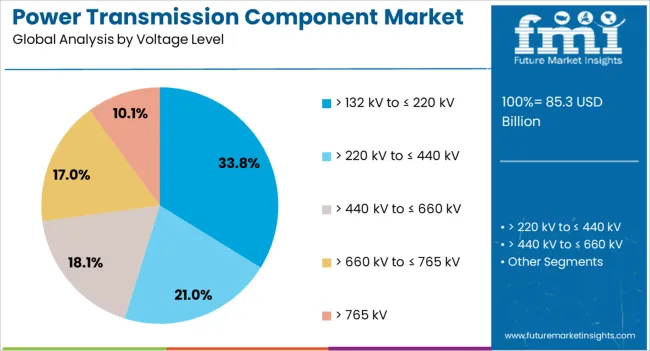

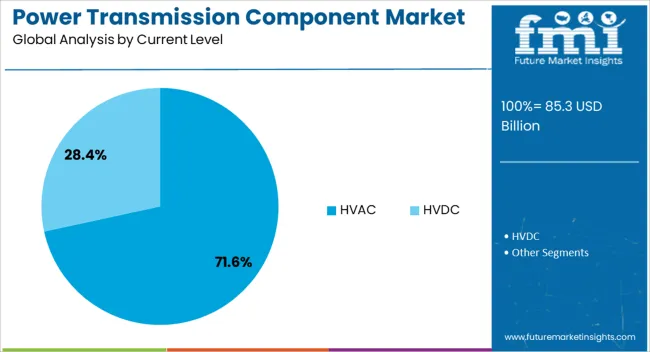

The power transmission component market is segmented by component, voltage level, current level, and geographic regions. By component, power transmission component market is divided into transformer, circuit breaker, isolator, insulator, arrestor, transmission line, transmission tower, and other. In terms of voltage level, power transmission component market is classified into > 132 kV to ≤ 220 kV, > 220 kV to ≤ 440 kV, > 440 kV to ≤ 660 kV, > 660 kV to ≤ 765 kV, and > 765 kV. Based on current level, power transmission component market is segmented into HVAC and HVDC. Regionally, the power transmission component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transformer segment is projected to account for 29.4% of the power transmission component market revenue in 2025, maintaining its leading role in enabling efficient voltage conversion and distribution. Growth in this segment has been supported by the continuous expansion of transmission networks and the replacement of outdated units to improve energy efficiency.

Transformers are essential for stepping up voltages for long-distance transmission and stepping down voltages for safe distribution, making them integral to every stage of the power supply chain. Industry updates have noted rising investments in smart transformers with remote monitoring capabilities, which improve fault detection and reduce downtime.

Furthermore, the increasing share of renewable energy in the grid has driven demand for transformers capable of handling variable loads and bidirectional power flows. With sustained grid expansion projects and the need for high-reliability equipment, the transformer segment is expected to remain a central component in power transmission infrastructure.

The >132 kV to ≤220 kV voltage level segment is projected to contribute 33.8% of the power transmission component market revenue in 2025, reflecting its critical role in regional transmission networks. This voltage range is widely used in interconnecting substations, industrial zones, and urban load centers, offering a balance between transmission efficiency and infrastructure cost.

Utility sector reports have indicated that this voltage class is optimal for medium to long-distance transmission in densely populated regions where power demand is high. Ongoing industrialization and urbanization in emerging economies have spurred investments in 132–220 kV substations to strengthen grid reliability and reduce power outages.

Additionally, this voltage range supports integration of renewable generation sources into the grid without requiring ultra-high-voltage systems, making it a cost-effective solution for many markets. With continuous demand from both grid expansion and upgrade projects, the >132 kV to ≤220 kV segment is expected to sustain its strong market presence.

The HVAC segment is projected to hold 71.6% of the power transmission component market revenue in 2025, retaining its dominant position in current transmission methods. High-voltage alternating current has remained the preferred technology for most grid systems due to its cost-effectiveness, ease of voltage transformation, and compatibility with existing infrastructure.

Industry analyses have highlighted HVAC’s flexibility in connecting various generation sources, including thermal, hydro, and renewable plants, to load centers across varying distances. Additionally, HVAC systems benefit from well-established standards, proven operational reliability, and a global base of skilled maintenance personnel.

While HVDC adoption is growing in certain long-distance and offshore applications, HVAC continues to dominate in terrestrial grids, particularly where existing infrastructure upgrades are prioritized over new installations. As utilities focus on integrating more distributed energy resources and maintaining grid stability, the HVAC segment is expected to uphold its leadership through its versatility and economic advantages.

Industrial manufacturing, automotive, and energy sectors drive the majority of market growth. Aftermarket and maintenance activities provide steady incremental opportunities worldwide.

The industrial machinery and manufacturing sector is a primary driver of the Power Transmission Component market, accounting for substantial dollar sales and share. Gears, couplings, bearings, and shafts are critical for production efficiency, torque management, and operational reliability in heavy machinery, automated production lines, and robotics. Industries such as metalworking, automotive component manufacturing, and packaging plants increasingly invest in high-precision transmission systems to reduce downtime, minimize energy loss, and extend equipment lifespan. Demand for aftermarket replacements and retrofitting further supports growth. Manufacturing hubs in Asia and Europe are driving adoption, while OEM partnerships and supply chain optimization ensure consistent availability. Components designed for durability, load tolerance, and high-speed operation are prioritized across industrial applications.

The automotive sector, including electric and hybrid vehicles, is significantly influencing market share and dollar sales for power transmission components. Vehicles require efficient, high-performance transmission systems to deliver smooth power transfer, reduce energy losses, and enhance overall vehicle performance. Gearboxes, shafts, and couplings are being optimized for compact electric drivetrains and high-torque applications, while lightweight materials reduce weight and increase efficiency. OEMs and tier-1 suppliers focus on reliability, long service life, and compatibility with emerging vehicle architectures. Aftermarket demand for replacement parts and performance upgrades continues to grow. Expansion in electric vehicle production in Asia, Europe, and North America drives adoption of specialized transmission components for both mass-market and premium vehicles.

Power generation, renewable energy, and utility sectors contribute significantly to market growth and share. Wind turbines, hydroelectric plants, and conventional power generation require reliable transmission systems to convert mechanical energy to electrical output efficiently. Specialized components such as high-capacity shafts, couplings, and gears are critical for grid integration, load management, and continuous operation. Power transmission projects, both onshore and offshore, increase demand for durable, corrosion-resistant components. Maintenance and retrofitting of existing infrastructure also create recurring market opportunities. Growth in renewable energy installations and modernization of grids in emerging economies further drive component adoption, ensuring stable power delivery and improved operational efficiency across the energy sector.

The aftermarket, retrofitting, and infrastructure maintenance sector supports incremental dollar sales and market share in power transmission components. Replacement of worn-out gears, shafts, bearings, and couplings is essential to maintain operational efficiency and reduce unexpected downtime. Industrial plants, automotive service centers, and utility operators increasingly invest in predictive maintenance, spare parts, and high-performance replacements. Infrastructure development in emerging economies creates demand for heavy-duty equipment, cranes, and conveyor systems equipped with reliable transmission components. OEM-backed service programs, component upgrades, and modular solutions allow seamless integration with existing machinery. The aftermarket segment ensures continuous revenue streams while enabling industries to enhance performance, reliability, and longevity of critical equipment globally.

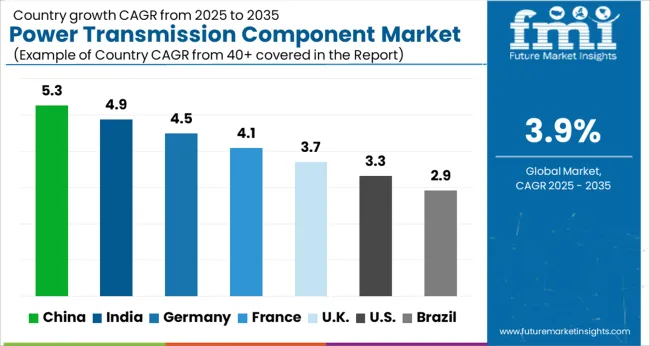

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global power transmission component market is projected to grow at a CAGR of 3.9% from 2025 to 2035. China leads with 5.3%, followed by India at 4.9%, Germany at 4.5%, the UK at 3.7%, and the USA at 3.3%. Growth is driven by expanding industrial machinery, automotive, and energy sectors that require high-performance gears, couplings, shafts, and bearings for efficient torque transfer, operational reliability, and extended equipment lifespan. BRICS countries, particularly China and India, are witnessing rapid adoption due to industrial expansion, rising manufacturing capacities, and infrastructure development. OECD nations, including Germany, the UK, and the USA, focus on precision, durability, and integration of components in high-value machinery and advanced drivetrain systems. The analysis covers over 40+ countries, with the top-performing markets detailed below.

The power transmission component market in China is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by rapid industrialization, growth in automotive manufacturing, and energy infrastructure projects. Increasing adoption of high-performance gears, bearings, shafts, and couplings is fueling demand across heavy machinery, construction equipment, and renewable energy systems. Domestic manufacturers are investing in precision engineering, heat treatment processes, and materials optimization to enhance durability and efficiency. Industrial automation and smart factory initiatives are further boosting the need for reliable drivetrain and transmission solutions. Partnerships with international suppliers allow technology transfer and improved product quality, while government infrastructure programs support large-scale deployment in industrial clusters and transport networks.

The power transmission component market in India is expected to expand at a CAGR of 4.9% from 2025 to 2035, supported by industrial expansion, automotive production, and growing renewable energy projects. Manufacturers are increasingly adopting high-efficiency gears, shafts, and couplings to enhance performance in construction, mining, and industrial machinery. Domestic players focus on precision machining, cost-effective production, and durability enhancement, while collaborations with global technology providers improve product standards and quality certifications. The increasing deployment of wind and solar energy projects is creating demand for specialized transmission components capable of handling high torque and variable loads. Expansion of organized manufacturing hubs, industrial parks, and logistics infrastructure also supports market growth.

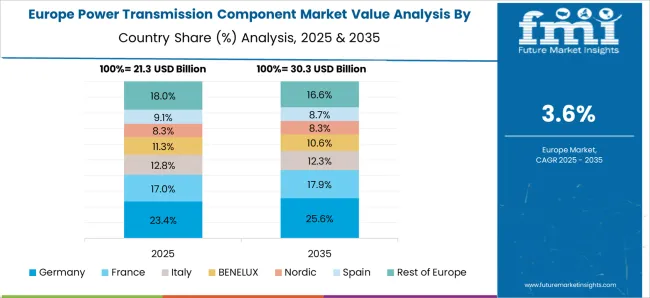

Germany’s power transmission component market is projected to grow at a CAGR of 4.5% between 2025 and 2035, led by precision engineering, automotive manufacturing, and industrial machinery sectors. High-performance gears, couplings, and shafts are increasingly adopted for electric vehicles, automation equipment, and energy systems. German manufacturers focus on precision, reliability, and lightweight materials, leveraging CNC machining, heat treatment, and surface finishing to enhance product lifespan and efficiency. Export-oriented production supports the automotive and machinery industries worldwide. Industrial modernization and the push for energy-efficient manufacturing increase demand for advanced transmission systems. Collaboration with European and global suppliers enables technology sharing and integration of innovative designs.

The UK power transmission component market is expected to grow at a CAGR of 3.7% from 2025 to 2035, supported by industrial machinery, automotive, and energy generation sectors. High-performance shafts, couplings, and gears are deployed in manufacturing plants, wind turbines, and transportation equipment. Manufacturers emphasize quality, reliability, and compliance with European standards. Adoption of hybrid and electric vehicles is creating demand for specialized lightweight and high-strength transmission components. Industrial equipment upgrades in factories and logistics hubs also contribute to market growth. Collaborations with international technology providers enable advanced design and material solutions, while local production ensures timely supply for domestic and export markets.

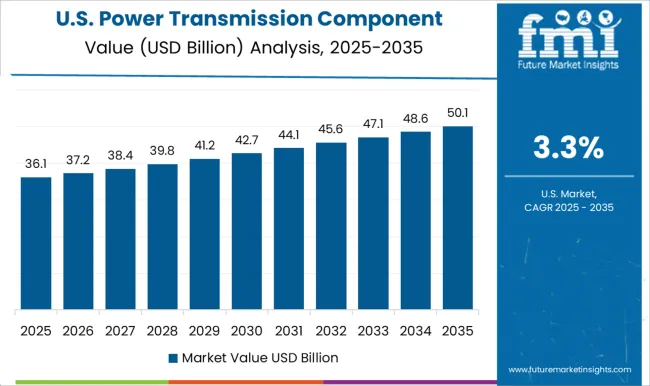

The USA market for power transmission components is projected to expand at a CAGR of 3.3% from 2025 to 2035, fueled by industrial machinery modernization, renewable energy projects, and automotive manufacturing. High-performance couplings, gears, and shafts are in demand for heavy machinery, construction equipment, and EV drivetrain systems. Domestic manufacturers prioritize precision, durability, and compliance with stringent safety and efficiency standards. Industrial automation, factory upgrades, and the deployment of wind and solar energy infrastructure increase the requirement for advanced transmission solutions. Collaborations with international suppliers enable technology transfer and adoption of innovative materials, while OEM partnerships ensure integration into high-value machinery across multiple sectors.

Competition in the power transmission component market is defined by precision engineering, durability, and reliability under high-load conditions. ABB leads with integrated solutions spanning motors, drives, couplings, and gears for industrial, automotive, and energy sectors, emphasizing high efficiency and modular design. Eaton and Fuji Electric focus on electrical and mechanical transmission systems for industrial machinery and renewable energy, highlighting energy efficiency and safety compliance. General Electric and Hitachi Energy differentiate through high-capacity gearboxes, transformers, and advanced drivetrain components suitable for heavy industrial applications. Hubbell, Hyosung Heavy Industries, and Hyundai Electric compete with specialized components for automotive, construction, and utility equipment, emphasizing quality, material optimization, and performance under variable loads.

Regional and mid-sized players such as L&T Electrical, Lucy Group, Mitsubishi Electric, Norelco, Powell Industries, Rittal, Schneider Electric, Siemens, and START Electrical leverage niche solutions, modular designs, and strong after-sales support to capture domestic and regional markets. Strategies emphasize precision manufacturing, component standardization, and integration with broader industrial systems. Warranty programs, testing certifications, and compliance with international standards are highlighted as differentiators. Collaborations with OEMs, energy providers, and industrial machinery manufacturers facilitate adoption and support large-scale deployments. Product specifications are detailed in brochures, including torque capacity, gear ratios, load rating, material composition, and operating temperature ranges.

Components such as couplings, shafts, bearings, gears, and housings are described with maintenance intervals, installation guidelines, and compatibility with industrial equipment. Solutions for renewable energy, automation, and electric vehicles are emphasized to showcase versatility. Packaging, logistics, and after-sales service offerings, including spare parts and maintenance contracts, are also highlighted, reflecting a market focused on performance, reliability, and industrial scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 85.3 billion |

| Component | Transformer, Circuit Breaker, Isolator, Insulator, Arrestor, Transmission Line, Transmission Tower, and Other |

| Voltage Level | > 132 kV to ≤ 220 kV, > 220 kV to ≤ 440 kV, > 440 kV to ≤ 660 kV, > 660 kV to ≤ 765 kV, and > 765 kV |

| Current Level | HVAC and HVDC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton, Fuji Electric, General Electric, Hitachi Energy, Hubbell, Hyosung Heavy Industries, Hyundai Electric, L&T Electrical, Lucy Group, Mitsubishi Electric, Norelco, Powell Industries, Rittal, Schneider Electric, Siemens, and START Electrical |

| Additional Attributes | Dollar sales, share, CAGR by component (gears, couplings, shafts, bearings), segment demand by automotive, industrial, and energy, regional growth, competitive landscape, supply chain trends, pricing benchmarks, and emerging application opportunities. |

The global power transmission component market is estimated to be valued at USD 85.3 billion in 2025.

The market size for the power transmission component market is projected to reach USD 125.1 billion by 2035.

The power transmission component market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in power transmission component market are transformer, circuit breaker, isolator, insulator, arrestor, transmission line, transmission tower and other.

In terms of voltage level, > 132 kv to ≤ 220 kv segment to command 33.8% share in the power transmission component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA