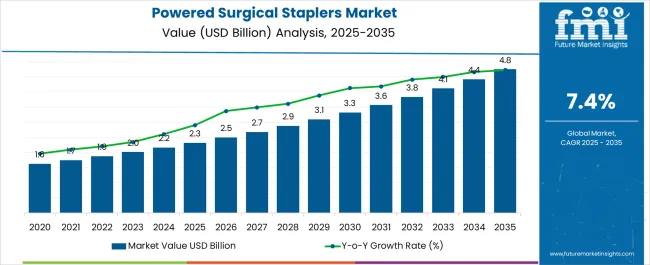

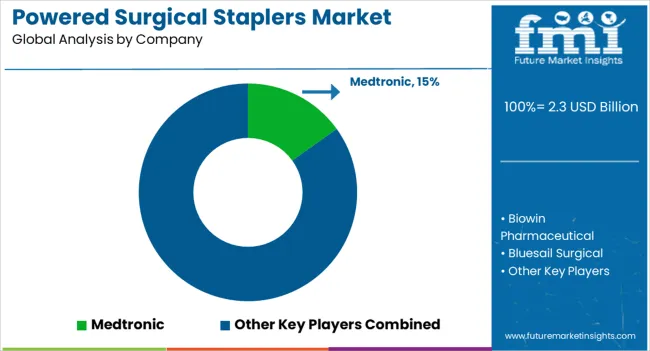

The Powered Surgical Staplers Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Powered Surgical Staplers Market Estimated Value in (2025 E) | USD 2.3 billion |

| Powered Surgical Staplers Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The powered surgical staplers market is expanding steadily, supported by the increasing adoption of minimally invasive procedures and the demand for surgical precision. Clinical journals and hospital reports have highlighted the advantages of powered staplers over manual variants, including reduced surgeon fatigue, consistent staple formation, and lower intraoperative complication risks.

Investments by medtech companies into advanced stapling technologies, such as battery-powered and electrically powered systems, have further strengthened product portfolios and improved clinical outcomes. Additionally, the growing incidence of chronic diseases requiring surgical interventions, such as gastrointestinal and thoracic disorders, has elevated procedural volumes and accelerated the adoption of powered staplers.

Hospitals and ambulatory surgical centers have also emphasized disposable, single-use devices to minimize infection risks and meet strict sterilization requirements. Looking ahead, the market is expected to be driven by continued innovation in ergonomic designs, improved staple cartridge materials, and the integration of digital feedback mechanisms, which will enhance both surgical efficiency and patient safety.

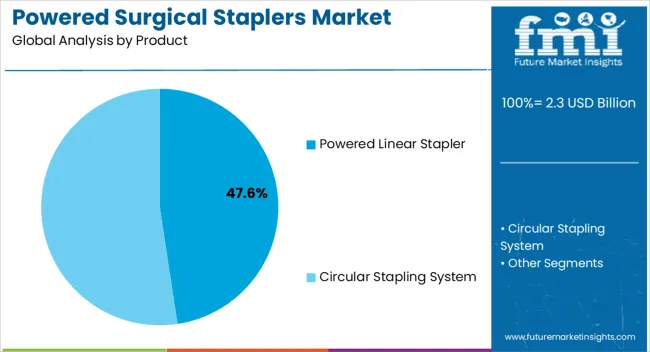

The Powered Linear Stapler segment is projected to hold 47.60% of the powered surgical staplers market revenue in 2025, maintaining its position as the leading product type. Growth in this segment has been influenced by its wide applicability in gastrointestinal, bariatric, and thoracic procedures where precise tissue approximation and hemostasis are critical.

Clinical evaluations have emphasized that powered linear staplers deliver consistent staple lines with minimal tissue trauma, improving surgical outcomes and reducing operative times. Manufacturers have invested in product innovations such as reloadable cartridges and advanced staple line reinforcement, enhancing performance and safety.

Additionally, powered linear staplers have been widely adopted in both open and laparoscopic surgeries due to their versatility and surgeon familiarity. The segment’s dominance is expected to continue, supported by a strong combination of clinical reliability, procedural efficiency, and ongoing enhancements in device design.

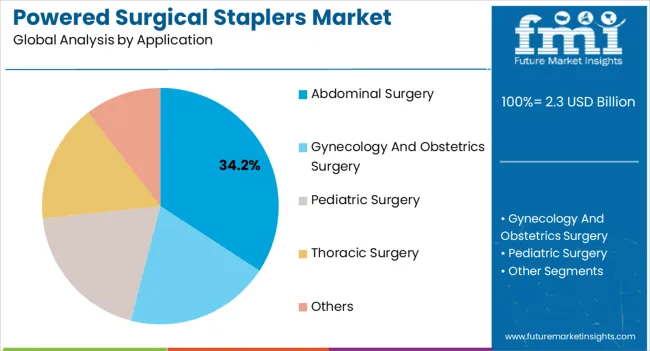

The Abdominal Surgery segment is projected to account for 34.20% of the powered surgical staplers market revenue in 2025, reflecting its role as the leading application category. This growth has been supported by the increasing global burden of abdominal disorders, including colorectal cancer, obesity, and gastrointestinal diseases, which frequently require surgical interventions.

Powered staplers have been integrated into abdominal procedures due to their ability to reduce anastomotic leakage risks and enhance operative efficiency. Clinical adoption has been driven by the preference for minimally invasive laparoscopic techniques, where powered staplers provide ergonomic advantages and improved visualization.

Healthcare providers have also recognized the value of powered staplers in reducing operating room time, which contributes to better hospital resource utilization. With rising procedural volumes and continuous technological improvements, the Abdominal Surgery segment is expected to maintain its leadership in application share.

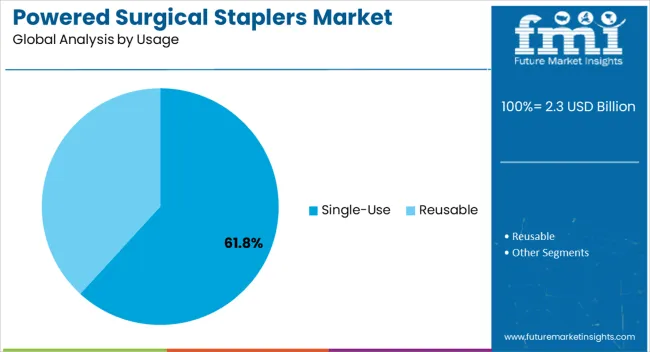

The Single-Use segment is projected to capture 61.80% of the powered surgical staplers market revenue in 2025, emerging as the dominant usage category. This growth has been propelled by the heightened emphasis on infection control and the avoidance of cross-contamination in surgical environments.

Hospitals and surgical centers have preferred disposable staplers as they eliminate the need for sterilization, reducing turnaround times between procedures. Press releases and healthcare procurement reports have indicated an increasing shift toward single-use medical devices to comply with stringent safety standards and accreditation requirements.

Furthermore, manufacturers have expanded their single-use stapler portfolios with cost-effective and ergonomic models tailored for high-volume procedures. The convenience of ready-to-use devices, combined with reduced maintenance costs, has strengthened adoption across diverse surgical specialties. As infection prevention continues to remain a top priority globally, the Single-Use segment is expected to sustain its leadership in the powered surgical staplers market.

The global powered surgical staplers market recorded a historic CAGR of 5.7% in the last 5 years from 2020 to 2025. The market value for the powered surgical staplers market was around 38.6% of the overall USD 4.8 billion of the global surgical staplers market.

Semi Annual Market Update

| Particular | Value CAGR |

|---|---|

| H1 | 6.95% (2025 to 2035) |

| H2 | 8.60% (2025 to 2035) |

| H1 | 6.98% (2025 to 2035) |

| H2 | 8.63% (2025 to 2035) |

Surgical method advancements have emerged as a prominent market growth factor for the powered surgical staplers business. These devices have evolved in concert with new surgical techniques, allowing surgeons to conduct complex surgeries with greater precision and speed.

As surgical procedures become less invasive, powered surgical staplers have gained popularity due to their ability to perform precise movements through tiny wounds. The incorporation of articulation elements in staplers improve access and movement inside small anatomical spaces, facilitating the use of minimally invasive procedures.

Also, the inclusion of real-time feedback systems and clever sensors in current stapler designs helps surgeons make informed decisions during key periods of surgery. This decreases the possibility of errors and difficulties, thus increasing demand for these modern gadgets.

The increased use of robotic-assisted surgeries and computer-assisted surgeries has increased the demand for appropriate powered staplers that can interact seamlessly with these platforms. Surgeons benefit from improved ergonomics and precision control, while patients benefit from less tissue trauma and faster recovery times.

As surgical disciplines continue to perfect their procedures and embrace technology developments, powered surgical staplers are becoming indispensable instruments that not only keep up with these advancements but also help to push the frontiers of what is possible in modern surgery. As a result, the synergy between evolving surgical techniques and powered stapler technology is projected to continue market expansion by serving the changing needs of surgeons and patients alike.

The growing number of surgical procedures like abdominal surgery and thoracic surgery worldwide is a key driver for the powered surgical staplers market. As medical interventions become more prevalent due to an increased incidence of chronic diseases like appendicitis, hernia and to treat varicose veins and evolving surgical techniques, the demand for advanced tools like powered staplers rises.

These devices offer efficiency, accuracy, and reduced operating times, making them essential in various surgical specialities. The trend toward minimally invasive procedures also fuels adoption, as powered staplers enable precise tissue closure, contributing to better patient outcomes and shorter recovery periods. This surge in surgical cases propels the market's growth trajectory, emphasizing the crucial role of powered surgical staplers in modern healthcare practices.

The occurrence of early staple-line failure while dealing with tumours in close proximity is a significant growth limitation in the powered surgical staplers industry. Securing staple lines in complex procedures involving tumours near important tissues can be difficult.

Inadequate tissue perfusion, impaired integrity, and possible leakage can all lead to postoperative problems that necessitate costly repairs. To mitigate this issue, surgeons must carefully examine tissue thickness and stapler choices, frequently choosing manual suturing in crucial cases.

This constraint emphasizes the importance of continuing innovation in stapler design and surgical techniques for efficiently addressing close proximity tumour scenarios, assuring optimal outcomes while minimizing the detrimental impact on patient recovery and healthcare expenses.

Market Growth Outlook by Key Countries

| Countries | Value CAGR |

|---|---|

| United States | 6.5% |

| Germany | 8.4% |

| United Kingdom | 6.7% |

| Japan | 7.3% |

| China | 7.5% |

| India | 7.1.6% |

The United States dominates the global market with 30.9% market share in 2025 and is projected to continue experiencing high growth throughout the forecast period. The increased number of bariatric procedures in the United States is a significant market growth factor for powered surgical staplers. As obesity rates rise, so does the need for weight loss operations.

Powered staplers are essential in these procedures for ensuring secure tissue closure, decreasing postoperative problems, and promoting speedier recovery. Their precision and efficiency are in line with the unique requirements of bariatric surgeries, which is boosting acceptance. With a rising emphasis on living a better lifestyle, the bariatric surgery trend is projected to continue, boosting demand for advanced-powered surgical staplers designed specifically for this medical field.

China held 7.6% of the global market share in 2025. In China, the increasing number of surgical procedures is a significant market growth factor for powered surgical staplers. The country's expanding healthcare infrastructure and rising prevalence of chronic diseases all contribute to an increased need for surgical procedures.

Powered staplers improve surgical efficiency, decrease operative time, and improve patient outcomes. As China's medical landscape advances, the adoption of innovative surgical equipment such as powered staplers becomes critical, fueling market growth and providing optimal healthcare delivery.

Germany holds about 7.0% share of the global market in 2025 and is projected to increase during the forecast period. Germany's emphasis on preventing contamination in surgical operations drives the growth of the powered surgical staplers market. These devices provide sterile, single-use options, lowering the danger of infection, which is a major concern in modern healthcare settings.

Powered staplers provide for precise and rapid tissue closure, reducing exposure time and potential contamination sources. As infection control remains a primary priority, powered surgical staplers meet Germany's demanding healthcare requirements, propelling their use in a variety of surgical specialties.

The desire for improved patient safety and results underpins this market development factor, underscoring the significance of sophisticated stapling technology.

Market Growth Outlook by Key Product

| Product | Value CAGR |

|---|---|

| Powered Linear Stapler | 8.1% |

| Circular Stapling System | 7.3% |

Powered linear staplers within the product segment hold a revenue share of 65.4% in 2025, and the same trend is being followed over the forecasted period. Due to their versatility and precision, powered linear staplers dominate the global market. They provide constant staple development along the whole length of the incision, which is essential for a variety of surgical operations. Since this technology provides rapid tissue closure, fewer complications, and speedier surgeries, powered linear staplers are a favorite choice for surgeons looking for dependable and effective stapling solutions.

Market Growth Outlook by Key Applications

| Application | Value CAGR |

|---|---|

| Abdominal Surgery | 7.3% |

| Gynecology and Obstetrics Surgeries | 7.7% |

| Pediatric Surgery | 8.0% |

| Thoracic Surgery. | 8.4% |

| Others | 8.8% |

Abdominal Surgery held a market share of 36.7% in 2025. Due to their incidence and complexity, abdominal procedures dominate the global market. These operations include a wide range of procedures, such as gastrointestinal and bariatric surgeries, where tight tissue closure is critical. Powered staplers improve efficiency, precision, and operative time, all of which contribute to better patient outcomes. Their versatility in a variety of abdominal procedures establishes them as a cornerstone in modern surgical treatments, fueling their supremacy.

Market Growth Outlook by Key Usage

| Usage | Value CAGR |

|---|---|

| Single-use | 8.4% |

| Reusable | 7.6% |

Reusable segment holds a market share of 73.3% in 2025. The reusable segment's dominance in the use of powered surgical staplers is attributed to cost-effectiveness and sustainability. While single-use staplers reduce infection hazards, reusable devices provide long-term cost savings. Hospitals put cost-efficiency over patient safety, resulting in a widespread preference for reused staplers. This tendency emphasizes the importance of striking a balance between high-quality patient care and sensible resource management.

Market Growth Outlook by Key End User

| End User | Value CAGR |

|---|---|

| Hospitals | 6.9% |

| Specialty Clinics | 7.8% |

| Ambulatory Surgery Centers | 8.6% |

| Others | 9.4% |

Hospitals held a market share of 43.2% in 2025. Given their role as key locations for surgical procedures, hospitals dominate the end-user segment of the global market. The regulated environment, the availability of experienced medical professionals, and the necessity for sophisticated surgical equipment drive the need for powered staplers. The fact that hospitals have a large caseload and a focus on patient outcomes solidifies their position as the major users of these novel surgical instruments.

Leading powered surgical stapler firms prioritize strategic collaborations as they attempt to develop new product lines and increase their global consumer base.

Similarly, recent developments related to companies in the powered surgical staplers market have been tracked by the team at Future Market Insights, which are available in the full report.

Related Market Growth Outlook Scenario

| Particulars | Value CAGR |

|---|---|

| Surgical Stapling Devices Market | 8.3% |

| Surgical Sutures Market | 5.3% |

| Surgical Needles Market | 5.4% |

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value, Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East and Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC Countries, South Africa, and Northern Africa |

| Key Market Segments Covered | Product, Application, Usage, End User and Region |

| Key Companies Profiled | Medtronic Plc; Biowin Pharmaceutical; Bluesail Surgical; Changzhou Ankang Medical Instruments; Golden Stapler Surgical; Jiangsu Channel Medical Device; Miconvey; Ningbo David Medical Device; Panther Healthcare; Sinolinks Medical Innovation; Waston medical; Ethicon; Surgnova; Lepu Medical Technology(Beijing)Co.,Ltd; Victor Medical Instruments Co., Ltd.; CJ Medical. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global powered surgical staplers market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the powered surgical staplers market is projected to reach USD 4.8 billion by 2035.

The powered surgical staplers market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in powered surgical staplers market are powered linear stapler and circular stapling system.

In terms of application, abdominal surgery segment to command 34.2% share in the powered surgical staplers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powered Lawn Mowers Market Analysis - Size, Share & Forecast 2025 to 2035

Powered Storage Devices Market

Powered Screed Market

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

AI-Powered CRM Platform Market Forecast Outlook 2025 to 2035

AI-powered Care Coordination Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Powered Packaging Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Stethoscope Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Storage Market Growth - Trends & Forecast 2025 to 2035

AI-powered Design Tools Market Insights - Growth & Forecast 2025 to 2035

Non-Powered Air Purifying Respirator Market Size and Share Forecast Outlook 2025 to 2035

GaN-powered Chargers Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA