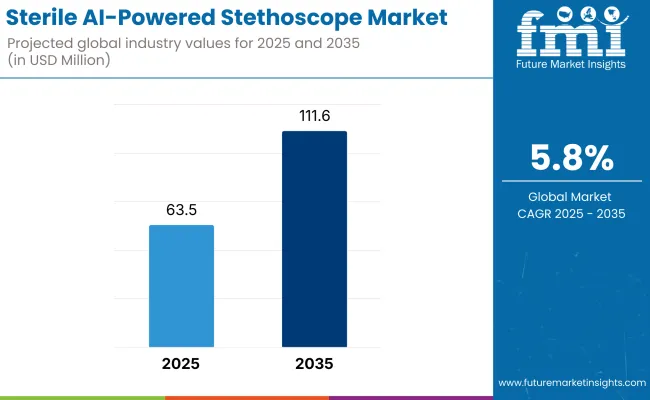

The global AI-Powered Stethoscope Market is projected to reach a valuation of USD 63.5 million by 2025 and USD 111.6 million by 2035. This indicates a decade-long increase of USD 48.1 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 5.8%, representing a 1.76X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 63.5 million |

| Industry Value (2035F) | USD 111.6 million |

| CAGR (2025 to 2035) | 5.8% |

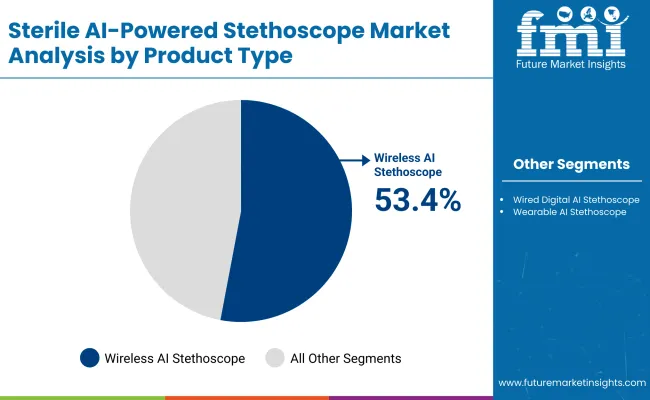

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 63.5 million in 2025 to USD 84.2 million in 2030, adding USD 20.7 million which contributes to 57.0% of the total decade growth. Wireless AI Stethoscopessegment will remain dominantholding around 53.4% share of the product type segment by 2030 due to Hospitals are prioritizing non-contact diagnostic tools to reduce cross-contamination risks. Wireless stethoscopes eliminate the need for physical cable connections.

The second half of the forecast period, from 2030 to 2035, contributes approximately USD 27.4 million, accounting for 57.0% of the total market growth, as the global AI-powered stethoscope market expands from USD 84.2 million in 2030 to reach USD 111.6 million by 2035. This surge is driven by accelerated integration of AI diagnostic tools across primary care, cardiology, and telehealth platforms, particularly in emerging markets.Wireless AI Stethoscopes and Wired Digital AI Stethoscopes together capture a large share of above 88.8% by the end of the decade. Wearable AI Stethoscopes is likely to hold around 11.2%.

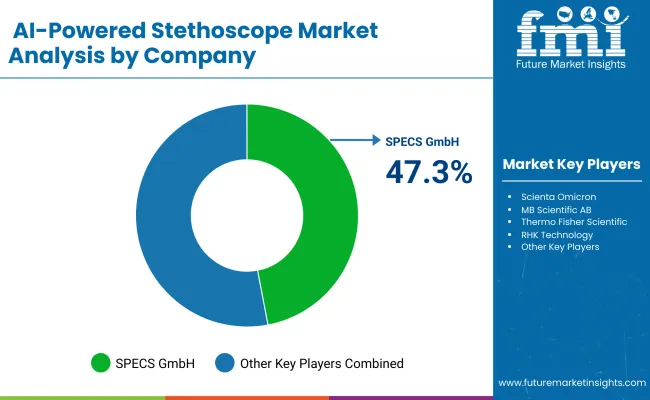

From 2020 to 2024, the overall AI-powered stethoscope market grew from USD 47.9 million to USD 60.6 million. Leading manufacturers such as Lapsi Health, Eko Health, Inc., Ai Health Highway India Pvt Ltd., together account for nearly 44.5% of global revenue.These players gained early traction through the sale of AI-integrated stethoscope kits, bundled with mobile diagnostic platforms, and targeted deployments in academic medical centers and urban hospitals.

In 2025, the global AI-powered stethoscope market is projected to reach a value of approximately USD 63.5 million, driven by a paradigm shift from traditional auscultation tools to AI-enhanced diagnostic platforms. This transition reflects growing demand for clinical decision support, remote patient monitoring, and integration with digital health ecosystems.

Growth will be accelerated by increased investment from health systems and telemedicine providers in smart diagnostic infrastructure, particularly as health services seek to reduce diagnostic errors and enhance frontline care delivery. Hospitals and primary care centers are increasingly deploying AI-powered stethoscopes to support early detection of cardiac and pulmonary anomalies, especially in high-risk and underserved populations.

AI-powered stethoscopes are experiencing rapid growth as healthcare systems worldwide face increasing pressure to improve diagnostic accuracy, support remote patient assessment, and reduce the burden on overstretched clinical staff. Major drivers include the global push for early detection of cardiovascular and respiratory diseases, expansion of telehealth infrastructure, and the integration of AI into routine clinical workflows.

Stricter guidelines around clinical decision support, growing emphasis on data-driven care, and the shortage of skilled diagnostic personnel are prompting healthcare providers to adopt intelligent auscultation tools. Recent innovations such as real-time murmur detection, noise-cancellation in busy environments, and automated documentation into EHRs are helping reduce diagnostic variability, minimize human error, and enhance clinical throughput. These capabilities are particularly valuable in primary care, emergency departments, and rural health clinics, where access to specialists may be limited.

As healthcare budgets increasingly prioritize early intervention, remote monitoring, and AI-enabled tools, manufacturers offering clinically validated algorithms, cloud integration, and secure data sharing features are achieving strong sales traction.

The market is segmented by product type, application, end-user, and region. Product type include Wireless AI Stethoscopes, Wired Digital AI Stethoscopes, and Wearable AI Stethoscopes. Application classification covers Cardiology, Pulmonology / Respiratory Diagnostics, Pediatrics, Emergency Medicine, and Telemedicine & Remote Monitoring.

Based on End User, the segmentation includes Hospitals, Clinics, Home Healthcare Settings, Ambulatory Surgical Centers (ASCs), Emergency Medical Services (EMS), Academic & Research Institutions, and others.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product Type | Market Share (%) |

|---|---|

| Wireless AI Stethoscopes | 53.4% |

| Wired Digital AI Stethoscopes | 30.0% |

| Wearable AI Stethoscopes | 16.6% |

Wireless AI Stethoscopes are projected to hold a dominant share of 53.4% in the global AI-powered stethoscope market in 2025, driven by their portability, seamless data integration, and compatibility with telehealth platforms. Their widespread adoption is underpinned by the growing demand for real-time, remote diagnostic tools particularly in primary care, home health, and telemedicine ecosystems. These devices offer Bluetooth and cloud-enabled transmission, allowing clinicians to instantly share auscultation data with specialists or integrate it into electronic health records (EHRs), streamlining clinical workflows.

Additionally, wireless models eliminate physical constraints associated with wired devices, offering greater mobility and user comfort during examinations. Favorable reimbursement policies and digital health initiatives in key markets like North America and East Asia have reinforced this trend, securing the segment’s leadership in both developed and emerging economies.

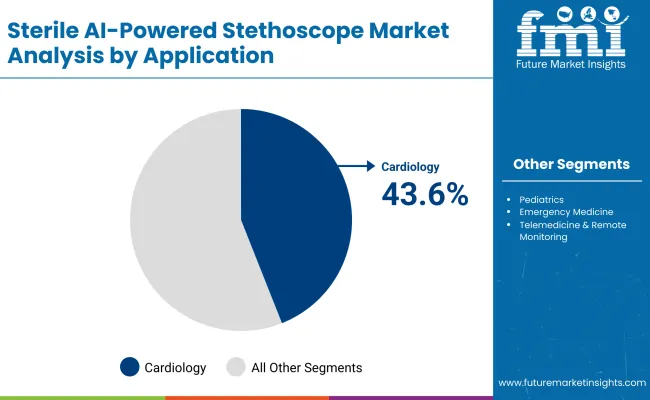

| Application | Market Share (%) |

|---|---|

| Cardiology | 43.6% |

| Pulmonology/Respiratory Diagnostics | 27.9% |

| Pediatrics | 15.0% |

| Emergency Medicine | 3.2% |

| Telemedicine & Remote Monitoring | 10.3% |

Cardiology has emerged as the leading application segment and is projected to hold approximately 43.6% of the global AI-powered stethoscope market in 2025, driven by the rising prevalence of cardiovascular diseases and the increasing demand for early and accurate diagnosis. AI-powered stethoscopes equipped with advanced algorithms can detect heart murmurs, arrhythmias, and other cardiac abnormalities with higher precision than traditional methods.

Regulatory encouragement for preventive care and remote patient monitoring has further accelerated adoption in cardiology departments across hospitals and clinics. The growing focus on personalized medicine and continuous cardiac monitoring has also spurred the use of AI stethoscopes for managing chronic heart conditions. Furthermore, integration with telecardiology platforms enables remote specialist consultations, expanding access to quality cardiac care in underserved regions. These factors collectively contribute to cardiology’s dominant position within the AI-powered stethoscope application landscape.

| End User | Market Share (%) |

|---|---|

| Hospitals | 56.8% |

| Clinics | 23.0% |

| Home Healthcare Settings | 6.7% |

| Ambulatory Surgical Centers (ASCs) | 3.0% |

| Emergency Medical Services (EMS) | 2.7% |

| Academic & Research Institutions | 5.2% |

| Others | 2.6% |

Hospitals are expected to remain the largest end user segment, contributing approximately 79.6% to the global AI-powered stethoscope market in 2025, owing to their critical need for accurate, efficient, and scalable diagnostic solutions across a wide range of clinical departments. As frontline hubs for cardiac, respiratory, pediatric, and emergency care, hospitals are prioritizing AI-integrated auscultation tools to support early diagnosis, reduce diagnostic variability, and enhance clinical decision-making.

The adoption of wireless AI stethoscopes has been especially pronounced in high-acuity units such as cardiology, emergency medicine, and intensive care, where real-time data and remote consult capabilities are increasingly essential. Additionally, investments in digital health infrastructure and the push toward AI-enabled workflows have led to the integration of smart stethoscopes within hospital EHR systems. Health policy incentives and institutional focus on reducing diagnostic errors and improving patient monitoring have further solidified hospitals’ role as the dominant end users in this rapidly evolving market.

Dominance of Wireless AI Stethoscopes for Telehealth & Clinical Efficiency

The dominance of wireless AI stethoscopes is emerging as a significant driver in the growth of the global AI-powered stethoscope market, primarily due to their seamless compatibility with telehealth and digital care ecosystems. Wireless stethoscopes enable real-time auscultation and Bluetooth-based data transmission, making them highly suitable for remote consultations, home healthcare, and mobile medical units.

Companies such as Eko Health and 3M Littmann have launched FDA-cleared wireless AI stethoscopes that integrate with electronic health record (EHR) systems and provide automated heart and lung sound analysis. Eko Health, in particular, reported that its wireless stethoscope usage surged significantly during the COVID-19 pandemic as physicians sought non-contact auscultation methods to reduce infection risk.

Furthermore, Regulatory encouragement for remote monitoring such as through the USA Centers for Medicare & Medicaid Services (CMS) reimbursement expansions for telehealth has further accelerated market penetration of wireless AI stethoscopes, particularly in North America and parts of East Asia. As health systems globally prioritize mobility, interoperability, and diagnostic speed, wireless models continue to drive a major shift in auscultation practices, directly fueling overall market growth.

High Cost and Affordability Constraints

The Global AI-Powered Stethoscope Market is facing a notable barrier that of high device cost and affordability constraints which limits its broader adoption across both developed and developing healthcare settings. This issue manifests through multiple dimensions: elevated upfront investment, limited reimbursement, and perceived lack of cost-benefit alignment. The retail prices of leading AI-enabled stethoscopes underscore just how expensive these devices can be. For instance, Eko Health lists its CORE Digital Attachment used to convert traditional stethoscopes into AI-enabled ones at USD 259, while the Littmann CORE Digital Stethoscope is priced at USD 379. Meanwhile, the more advanced Eko CORE 500 Digital Stethoscope, which includes 3‑lead ECG and AI-based murmur and AFib detection, retails at USD 399 on the USA store.

While these devices offer high-tech diagnostic value, the price points are steep when compared against traditional acoustic stethoscopes, which generally cost between USD 50-200. Even clinicians considering the lowest-cost AI attachmentface a solid upfront investment often many times the price of their existing stethoscope.

Strong Adoption and Growth Trajectory in Home Healthcare & Telemedicine

The global healthcare ecosystem has witnessed a monumental shift in care delivery over the last decade, with home healthcare and telemedicine emerging as dominant models in response to patient preferences, systemic inefficiencies, and technological breakthroughs. One of the most transformative medical technologies contributing to this evolution is the AI-powered stethoscope, whose adoption has accelerated significantly due to its compatibility with remote diagnostics and decentralized care.

This trend is not merely a reflection of technological innovation but a fundamental reimagining of healthcare access, propelled by patient-centric care models, value-based reimbursements, and the global emphasis on managing chronic conditions outside hospital walls.

The growth of home healthcare and telemedicine is evident in both utilization data and policy shifts. According to the World Health Organization (WHO), global demand for remote care solutions surged during the COVID-19 pandemic and has remained high since, particularly for chronic disease monitoring, pediatric care, and geriatrics. The Centers for Medicare & Medicaid Services (CMS) in the United States reported that over 28 million beneficiaries accessed telehealth services in 2022, a dramatic rise compared to just over 840,000 pre-pandemic. The FDA and National Institutes of Health (NIH) have also accelerated regulatory pathways and funded pilot programs for remote patient monitoring tools, including AI-assisted diagnostic devices like digital stethoscopes.

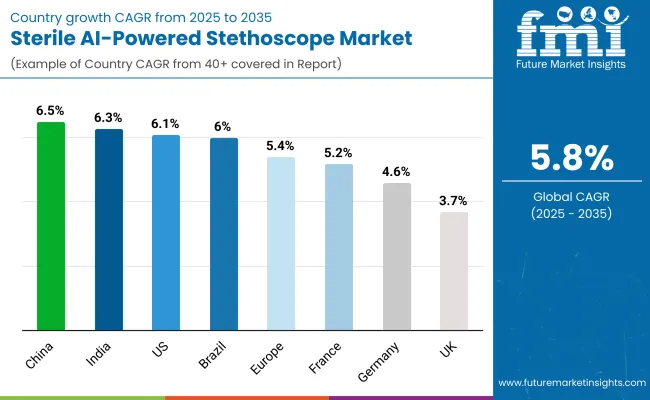

| Countries | CAGR |

|---|---|

| USA | 6.1% |

| Brazil | 6.0% |

| China | 6.5% |

| India | 6.3% |

| Europe | 5.4% |

| Germany | 4.6% |

| France | 5.2% |

| UK | 3.7% |

Asia Pacific is emerging as the fastest-growing region in the global AI-powered stethoscope market, projected to register a robust CAGR of approximately 6.0% between 2025 and 2030. Among the key markets within the region, India is anticipated to grow at a CAGR of 6.3%, fueled by rapid expansion of telemedicine services, increased digital health adoption, and rising prevalence of cardiovascular and respiratory diseases.

Concurrently, China is expected to witness a CAGR of 6.5%, driven by large-scale investments in smart healthcare infrastructure, government initiatives to enhance remote patient monitoring capabilities, and a growing emphasis on AI integration within clinical diagnostics.

Europe is expected to grow steadily at a CAGR of 5.4% through 2035 in the global AI-powered stethoscope market. Germany is projected to expand at a CAGR of 4.6%, supported by increasing adoption of digital health technologies and government-backed initiatives promoting AI integration in clinical diagnostics.

France is estimated to grow at a CAGR of 5.2%, fueled by substantial investments in telemedicine infrastructure and digital health reforms aimed at enhancing remote patient care. The UK market is anticipated to grow at a CAGR of 3.7%, largely driven by NHS modernization programs focused on improving diagnostic accuracy and reducing hospital readmissions through advanced remote monitoring tools.

North America remains a mature yet innovation-driven market in the global AI-powered stethoscope space, with the USA projected to grow at a CAGR of 6.1% between 2025 and 2035. Growth in the USA is primarily fueled by the ongoing replacement of traditional acoustic stethoscopes with advanced AI-enabled digital devices that enhance diagnostic accuracy and support remote patient monitoring. The increasing integration of AI-powered stethoscopes within telehealth platforms, especially in response to rising chronic disease burdens such as cardiovascular and respiratory conditions, is a key growth driver.

Federal initiatives and funding programs, such as those led by the Centers for Medicare & Medicaid Services (CMS), which reimburse Remote Patient Monitoring (RPM) services, are further incentivizing healthcare providers to adopt AI-powered auscultation tools. Moreover, rising surgical volumes across outpatient and ambulatory surgical centers (ASCs), coupled with a growing emphasis on reducing diagnostic errors and improving clinical workflow efficiency, are accelerating demand.

| Year | USA AI-Powered Stethoscope Market (USD Million) |

|---|---|

| 2025 | 19.8 |

| 2026 | 20.9 |

| 2027 | 22.2 |

| 2028 | 23.5 |

| 2029 | 25.0 |

| 2030 | 26.5 |

| 2031 | 28.1 |

| 2032 | 29.8 |

| 2033 | 31.7 |

| 2034 | 33.7 |

| 2035 | 35.8 |

The AI-powered stethoscope market in the United States is forecasted to grow at a CAGR of approximately 6.1%, driven primarily by increasing adoption of digital health technologies and expanded use of telemedicine services, especially in response to regulatory support and reimbursement policies for remote patient monitoring. Healthcare providers across hospitals, outpatient clinics, and home healthcare settings are replacing traditional acoustic stethoscopes with AI-enabled digital devices that offer enhanced diagnostic accuracy and remote connectivity, enabling more effective management of cardiovascular and respiratory conditions.

The AI-powered stethoscope market in the United Kingdom is projected to grow at a CAGR of approximately 3.7% through 2035, supported by the NHS England’s continued investment in digital health technologies and telemedicine infrastructure.

Initiatives such as the NHS Long Term Plan and the “Digital First” approach are accelerating the integration of AI-assisted diagnostic tools into primary care and community health services. The rising demand for remote patient monitoring, particularly in managing chronic cardiovascular and respiratory diseases, is driving widespread adoption of AI-powered stethoscopes across healthcare settings.

The AI-powered stethoscope market in Germany is forecast to grow at a CAGR of approximately 4.6%, driven by increasing investments in digital health infrastructure and a strong focus on integrating AI technologies within clinical diagnostics.

Germany’s Hospital Future Act has allocated substantial federal funding to modernize hospital equipment and promote telemedicine solutions, creating favorable conditions for the adoption of AI-enabled diagnostic devices, including stethoscopes. German healthcare providers, known for their emphasis on precision and quality, are transitioning from traditional acoustic stethoscopes to advanced AI-powered models that offer enhanced auscultation accuracy, data analytics, and interoperability with hospital information systems.

| Europe Countries | 2025 |

|---|---|

| Germany | 23.5% |

| UK | 18.9% |

| France | 14.2% |

| Italy | 13.5% |

| Spain | 15.0% |

| Benelux | 6.9% |

| Nordics | 5.9% |

| Rest of Europe | 2.1% |

| Europe Countries | 2035 |

|---|---|

| Germany | 24.2% |

| UK | 19.5% |

| France | 14.6% |

| Italy | 13.9% |

| Spain | 15.5% |

| Benelux | 5.7% |

| Nordics | 4.9% |

| Rest of Europe | 1.5% |

The AI-powered stethoscope market in India is expected to grow at a robust CAGR of approximately 6.3%, positioning it as one of the fastest-growing regional markets globally. This growth is driven by rapid expansion of healthcare infrastructure, including tertiary hospitals, diagnostic centers, and telemedicine providers across Tier 1 and Tier 2 cities. Increasing prevalence of cardiovascular and respiratory diseases, coupled with rising awareness around early diagnosis and remote patient monitoring, is fueling demand for AI-enabled diagnostic tools.

Additionally, government initiatives such as the National Digital Health Mission (NDHM) and growing penetration of affordable smartphones and internet connectivity are accelerating the adoption of AI-powered stethoscopes in both urban and rural healthcare settings.

The AI-powered stethoscope market in China is projected to grow at a strong CAGR of approximately 6.5% through 2035, underpinned by sweeping investments in digital healthcare and smart hospital infrastructure aligned with the Healthy China 2030 initiative.

As the country rapidly modernizes its medical system, there is rising demand for AI-integrated diagnostic tools that support remote consultations, chronic disease management, and point-of-care decision-making. The National Health Commission (NHC) has prioritized development of intelligent clinical tools, and AI-powered stethoscopes are increasingly being adopted across urban hospitals, telemedicine platforms, and community health networks.

The AI-powered stethoscope market in Japan is projected to reach USD 2.5 million in 2025, with Wireless AI Stethoscopes accounting for 55.1% of product type, driven by the country’s focus on medical precision, elderly care, and technological integration in clinical workflows. The adoption of AI-enabled diagnostic tools is gaining momentum across both hospital and homecare segments, largely supported by national policy frameworks promoting digital healthcare innovation, including the Society 5.0 initiative and the Medical Device Industry Vision 2025.

AI-powered stethoscopes are increasingly being deployed across hospitals, geriatric care centers, and telemedicine platforms, with wireless and wearable models gaining popularity due to their ergonomics and ability to streamline workflow for overburdened medical staff. This trend aligns with Japan’s healthcare system strategy to manage its super-aged population, where more than 28% of citizens are over 65 years of age.

The AI-powered stethoscope market in South Korea is projected to reach approximately USD 1.5 million by 2025, with Cardiology accounting for the largest application share at 44.9%, driven by the country’s rising chronic disease burden and aging population. The strong national emphasis on early-stage detection, preventive healthcare, and digitized diagnostics under the Ministry of Health and Welfare (MOHW) has been instrumental in accelerating the adoption of AI-enabled stethoscopes across both public hospitals and private clinics.

Hospitals and specialty care centers are actively integrating wireless AI-powered stethoscopes into cardiopulmonary care pathways, supported by national initiatives such as Korea’s Digital Health Innovation Strategy. These devices are being used not only for enhanced acoustic performance but also for algorithm-driven detection of murmurs, arrhythmias, and lung abnormalities, improving diagnostic confidence and reducing physician subjectivity.

The AI-powered stethoscope market is moderately fragmented, with global leaders, mid-sized innovators, and emerging regional players competing across clinical diagnostics, remote monitoring, and telemedicine applications. The market is characterized by a strong push toward AI integration, real-time waveform visualization, and interoperability with telehealth platforms and electronic health records (EHR).

Industry leaders such as Eko Health, Inc. and Rudolf Riester GmbH hold substantial market share, driven by their clinically validated AI capabilities, integration with digital health platforms, and regulatory-compliant designs. These companies are expanding through partnerships with health systems, continuous algorithm refinement, and bundled solutions that include stethoscopes with ECG, cloud connectivity, and mobile apps for live streaming and automated diagnostics. Eko Health, for instance, has secured FDA clearance for its murmur detection algorithm and is widely adopted in USA cardiology and internal medicine settings, while Rudolf Riester continues to leverage its established European hospital network to launch hybrid acoustic-digital stethoscope models.

Mid-sized manufacturers such as M3DICINE Pty Ltd., AMD Global Telemedicine, and Steth IO serve both developed and emerging markets through innovative, compact, and smartphone-enabled auscultation systems. M3DICINE’s Stethee Pro has gained traction for its AI-supported cardiac assessment features, used in both human and veterinary care. AMD Global Telemedicine integrates AI-powered stethoscopes into turnkey telehealth solutions for clinics, military care, and rural health programs. Steth IO's mobile-based solution turns a physician’s smartphone into a smart stethoscope, offering a cost-effective entry into digital auscultation for small clinics and telehealth providers.

Emerging players such as Lapsi Health, Ayu Devices Pvt Ltd., Ai Health Highway India Pvt Ltd., StethoMe sp. z o.o., Minttihealth, and NabzHooshmand Co. are gaining ground in regionally fragmented markets, offering cost-effective, customizable, and regulatory-ready solutions for primary care, pediatrics, and home-based monitoring. These players are targeting healthcare providers in price-sensitive markets and rural regions by combining affordability with core AI features such as abnormal sound detection, real-time waveform display, and app-based auscultation sharing.

As the market evolves, competitive differentiation is shifting from basic audio amplification to clinical-grade AI algorithms, cloud-enabled diagnostic workflows, and integration with broader digital health ecosystems. Players are increasingly investing in user experience design, mobile interface innovation, and government-aligned healthcare programs to enhance adoption.

Key Developments

| Item | Value |

|---|---|

| Market Value 2025 | USD 63.5 million |

| Product type | Wireless AI Stethoscopes, Wired Digital AI Stethoscopes, and Wearable AI Stethoscopes |

| Application | Cardiology, Pulmonology/Respiratory Diagnostics, Pediatrics, Emergency Medicine, and Telemedicine & Remote Monitoring |

| End User | Hospitals, Clinics, Home Healthcare Settings, Amb ulatory Surgical Centers (ASCs), E mergency Medical Services (EMS), A cademic & Research Institutions, and Others |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Lapsi Health., Eko Health, Inc., Ai Health Highway India Pvt Ltd., Ayu Devices Pvt Ltd., Steth IO, M3DICINE Pty Ltd., AMD Global Telemedicine, Rudolf Riester GmbH, Minttihealth, Nabz Hooshmand Co., StethoMe sp. z o.o., and LaennecAI. |

| Additional Attributes | Dollar sales by application and region s, adoption trends of Home Healthcare & Telemedicine, Dominance of Wireless AI Stethoscopes for Telehealth & Clinical Efficiency |

The global AI-powered stethoscope market is estimated to be valued at USD 63.5 million in 2025.

The market size for Sterile Pre-Pack Workstation is projected to reach USD 111.6 million by 2035.

The AI-powered stethoscope market is expected to grow at a CAGR of 5.8% during this period.

Key product types include Wireless AI Stethoscopes, Wired Digital AI Stethoscopes, and Wearable AI Stethoscopes.

The Cardiology segment is projected to command 43.6% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Market – Growth, Demand & Forecast 2025 to 2035

Digital Stethoscope Market Report - Trends, Innovations & Forecast 2025 to 2035

Electronic Stethoscope Market Growth – Industry Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA