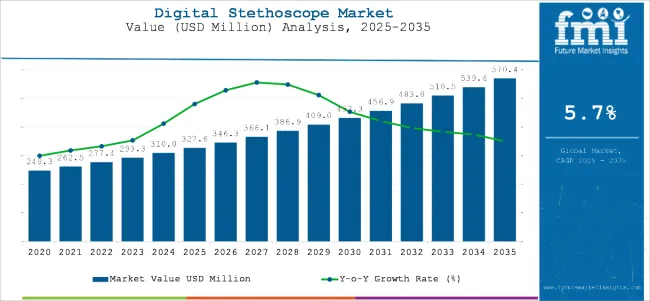

The global digital stethoscope market is worth USD 327.6 million in 2025 and is poised to reach USD 570.4 million by 2035, which shows a CAGR of 5.7% over the forecast period. The rising demand for accurate, real-time patient monitoring and telehealth solutions is a key driver behind this growth.

Digital stethoscopes, equipped with sound amplification, recording, Bluetooth connectivity, and data visualization features, are increasingly replacing traditional acoustic devices in clinical and home care settings. Their ability to support remote diagnostics, integrate with electronic health records, and enhance auscultation quality is making them essential tools in modern healthcare systems.

Technological advancements are enabling the development of digital stethoscopes with enhanced filtering algorithms, AI-powered anomaly detection, and smartphone compatibility. These features are particularly useful in cardiology, pulmonology, and primary care, where early detection of abnormalities can significantly improve outcomes. Market players are investing in portable, rechargeable, and wireless devices to cater to the growing trend of point-of-care diagnostics and mobile health applications.

In addition, the adoption of digital stethoscopes in veterinary medicine and medical training programs is further expanding the user base and application scope of these devices across both human and animal healthcare. Manufacturers are investing in research and development for the launch of new and enhanced capabilities of products.

Regulatory approvals, reimbursement support, and integration with telemedicine platforms are strengthening the digital stethoscope market landscape. The USA, FDA and CE marking frameworks have facilitated faster adoption, while national health systems are promoting the use of digital tools to reduce diagnostic errors and expand rural healthcare access.

In emerging economies, increasing healthcare digitization and investments in infrastructure are opening new opportunities for market penetration. As healthcare systems globally prioritize accuracy, portability, and connectivity, the digital stethoscope market is expected to grow steadily, supported by innovations in sound analysis, remote diagnostics, and AI-enhanced auscultation.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 327.6 million |

| Industry Value (2035F) | USD 570.4 million |

| CAGR (2025 to 2035) | 5.7% |

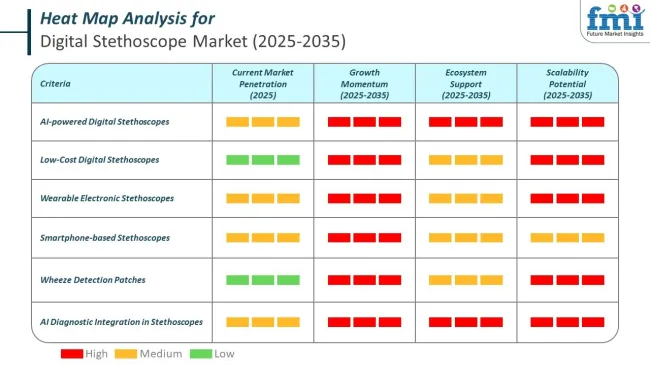

Research from 2024 to 2025 has yielded multiple AI-powered, low-cost, and wearable digital stethoscope prototypes designed for clinical, remote, and educational use. These models emphasize real-time analysis, multimodal sensing, and accessibility for both developed and resource-constrained healthcare systems.

Academic and industry venues between 2024 and 2025 have become key platforms for unveiling and validating these technologies. These conferences highlight not only new devices but also integration with AI, telemedicine, and biosensor systems.

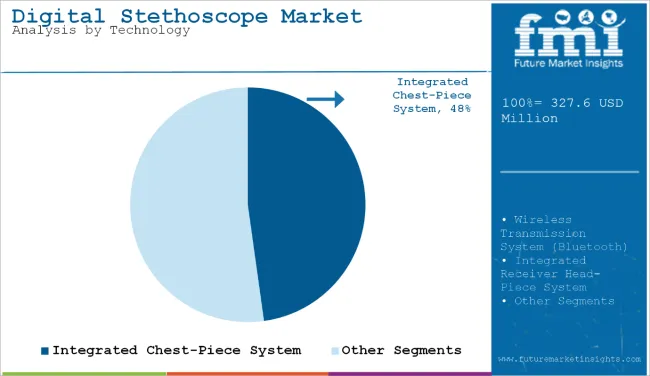

The market is segmented based on technology, end user, and region. By technology, the market is categorized into integrated chest-piece system, wireless transmission system (Bluetooth), integrated receiver head-piece system, and numerical simulation and system integration.

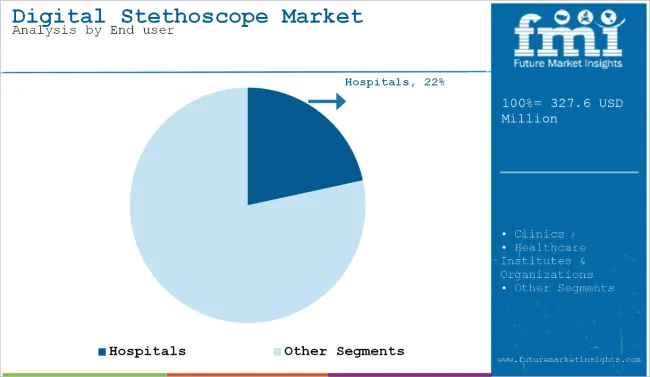

In terms of end user, the market includes hospitals, clinics, healthcare institutes & organizations, home care settings, and others (including ambulatory surgical centers, military medical units, telemedicine providers, and academic research institutions). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The integrated chest-piece system segment is projected to lead the digital stethoscope market with a 48% share in 2025. These stethoscopes are designed with built-in microphones and digital sensors embedded directly into the chest-piece, offering a seamless combination of traditional design and advanced functionality.

Medical professionals prefer this configuration for its simplicity, accuracy, and compatibility with conventional examination techniques. The integrated design eliminates the need for external receivers or additional modules, reducing the device’s complexity and increasing ease of use in high-pressure environments. These systems often feature sound amplification, background noise reduction, and data transmission capabilities for enhanced auscultation.

Major manufacturers such as 3M Littmann, Thinklabs, and Eko are continuously improving the quality of integrated chest-piece stethoscopes by adding Bluetooth connectivity, AI-based sound analysis, and mobile app integration. This segment is especially favored in hospitals and specialty clinics, where accurate and rapid cardiac and pulmonary assessments are crucial.

While wireless transmission systems and numerical simulation-based models are gaining attention, the integrated chest-piece system remains the most accessible and widely adopted technology. Its ergonomic familiarity and performance reliability ensure its continued dominance in the digital stethoscope market. The wireless transmission system (Bluetooth) segment captures 21% share.

| Technology | Share (2025) |

|---|---|

| Integrated Chest-Piece System | 48% |

| Wireless Transmission System (Bluetooth) | 21% |

Hospitals account for a 22% share of the digital stethoscope market in 2025, positioning them as the top end user. The adoption of digital stethoscopes in hospitals is rising due to increased focus on early diagnosis, infection control, and real-time patient monitoring. Digital stethoscopes are being integrated into hospital systems to improve diagnostic workflows and enable data storage in electronic health records (EHRs).

The technology’s compatibility with telemedicine tools and AI-based analysis is further enhancing its value in multi-specialty hospital settings. Use in emergency rooms, intensive care units, and cardiology departments has become routine, especially in private and teaching hospitals with larger budgets and advanced infrastructure.

Hospitals also leverage digital stethoscopes for staff training, patient follow-ups, and contactless examinations, supporting overall infection prevention goals. Leading brands offer stethoscopes with cloud storage, wireless syncing, and ambient noise cancellation, making them highly effective in busy clinical environments.

Compared to home care or small clinics, hospitals are more equipped to support implementation and training for these advanced diagnostic tools. As hospitals continue modernizing and adopting smart technologies, their role as the leading institutional buyer of digital stethoscopes is expected to remain strong. The clinics segment holds 15% share.

| End User | Share (2025) |

|---|---|

| Hospitals | 22% |

| Clinics | 15% |

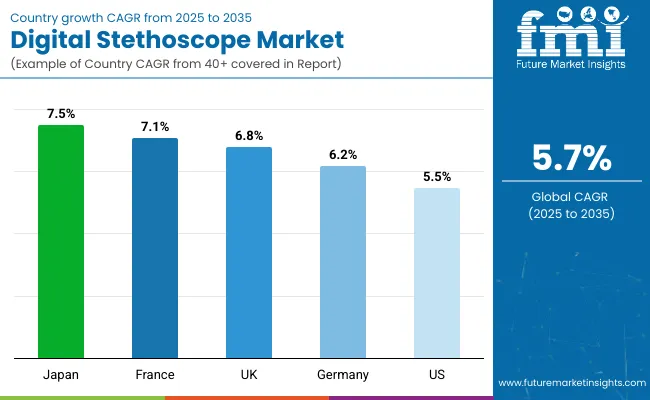

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 6.8% |

| Japan | 7.5% |

| Germany | 6.2% |

| France | 7.1% |

The USA digital stethoscope market is estimated to grow at a 5.5% CAGR during the study period. The market is experiencing growth due to advancements in medical technology and the increasing adoption of telemedicine. Digital stethoscopes offer enhanced features such as noise reduction, amplification, and wireless connectivity, which improve diagnostic accuracy and patient outcomes.

The integration of artificial intelligence (AI) in these devices further aids healthcare professionals in detecting cardiac abnormalities more efficiently. Additionally, the rising prevalence of chronic diseases and the aging population contribute to the demand for advanced diagnostic tools. Hospitals and clinics are investing in digital stethoscopes to enhance their diagnostic capabilities and streamline patient care processes.

The UK digital stethoscope market is estimated to grow at a 6.8% CAGR during the study period. The UK market is expanding due to the increasing emphasis on healthcare digitization and the adoption of advanced medical devices. Digital stethoscopes provide healthcare professionals with enhanced diagnostic capabilities, enabling more accurate detection of heart and lung conditions.

The integration of digital technology allows for better data recording, analysis, and sharing, improving patient care and clinical outcomes. Government initiatives and funding support the adoption of innovative medical technologies, further driving market growth. The growing awareness among healthcare providers about the benefits of digital stethoscopes contributes to their increasing adoption across hospitals and clinics in the UK

The Japanese digital stethoscope market is estimated to grow at a 7.5% CAGR during the study period. The market is witnessing growth driven by technological advancements and the country's aging population. Digital stethoscopes equipped with features like noise cancellation, amplification, and wireless connectivity are gaining popularity among healthcare professionals. These devices enable more accurate and efficient diagnosis of cardiac and respiratory conditions.

The Japanese government's focus on healthcare innovation and the integration of digital technologies into medical practices further support market expansion. Additionally, the increasing demand for remote patient monitoring solutions and telemedicine services in Japan is propelling the adoption of digital stethoscopes.

The German digital stethoscope market is estimated to grow at a 6.2% CAGR during the study period. The market is expanding due to the country's strong healthcare infrastructure and the rising demand for advanced diagnostic tools. Digital stethoscopes offer features such as noise filtering, sound amplification, and data recording, which enhance the accuracy of auscultation and improve patient outcomes.

The integration of digital stethoscopes with electronic health records (EHR) systems facilitates seamless data sharing and collaboration among healthcare providers. Government initiatives promoting the adoption of digital health technologies and the increasing focus on preventive healthcare contribute to the growth of the digital stethoscope market in Germany.

The French digital stethoscope market is estimated to grow at a 7.1% CAGR during the study period. The market is experiencing growth driven by the increasing adoption of digital health technologies and the demand for advanced diagnostic tools. Digital stethoscopes provide healthcare professionals with enhanced capabilities for detecting and diagnosing cardiac and respiratory conditions.

Features such as noise reduction, amplification, and wireless connectivity improve the accuracy and efficiency of auscultation. The French government's initiatives to promote digital health and the integration of digital stethoscopes into healthcare practices support market expansion. Additionally, the growing emphasis on preventive healthcare and the aging population in France contribute to the rising demand for digital stethoscopes.

A few reputable companies hold a significant share of the market. However, the market still has room enough for small and middle-sized entities to flourish. Startup culture is prevalent in the market, with these startups aiming to differentiate themselves from the competition through innovative products.

Similar to other players in the healthcare sector, participants in the digital stethoscope industry prefer collaborative strategies with fellow medical companies to expand their market scope. Acquisitions and mergers are also part of the strategy for a notable number of market players.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 327.6 million |

| Projected Market Size (2035) | USD 570.4 million |

| CAGR (2025 to 2035) | 5.70% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value |

| By Technology | Integrated Chest-Piece System, Wireless Transmission System (Bluetooth), Integrated Receiver Head-Piece System, Numerical Simulation and System Integration |

| By End User | Hospitals, Clinics, Healthcare Institutes & Organizations, Home Care Settings, Others (Ambulatory Surgical Centers, Military Medical Units, Telemedicine, Academic Research Institutions) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United Kingdom, China, India |

| Key Players | FarmaSino Pharmaceuticals, Contec Medical Systems, Hefny Pharma Group, Eko, 3M, Think Labs Medical LLC, TeleSensi, American Diagnostics, EKuore, Hill-Rom |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global digital stethoscope market is projected to reach USD 570.4 million by 2035, growing from USD 327.6 million in 2025, at a CAGR of 5.7% over the forecast period.

The integrated chest-piece system segment is expected to dominate with a 48% market share in 2025, driven by ease of use, embedded sensors, and enhanced sound quality with AI-assisted auscultation features.

Hospitals are projected to lead in end user adoption with a 22% share in 2025, due to integration with electronic health records (EHRs), telemedicine compatibility, and advanced diagnostic needs in emergency and ICU settings.

India is expected to experience the fastest growth with a CAGR of 13.7% from 2025 to 2035, fueled by innovation from local research institutions and widespread adoption in remote and underserved healthcare areas.

Prominent companies include 3M, Eko, Thinklabs Medical LLC, Contec Medical Systems, American Diagnostics, EKuore, and Hill-Rom, all focusing on AI-powered sound analysis, telehealth integration, and wireless stethoscope innovations.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Technology, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 16: Global Market Attractiveness by Technology, 2024 to 2034

Figure 17: Global Market Attractiveness by End User, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 34: North America Market Attractiveness by Technology, 2024 to 2034

Figure 35: North America Market Attractiveness by End User, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Technology, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Technology, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Technology, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Technology, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Technology, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Technology, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Technology, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Technology, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Technology, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA