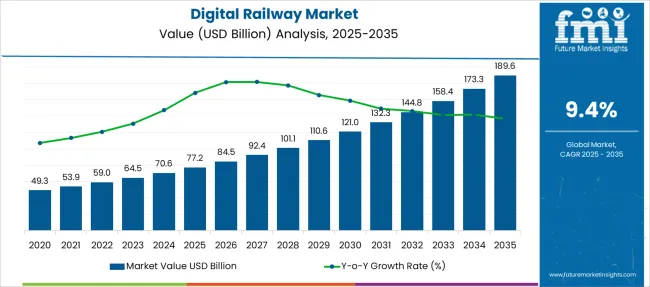

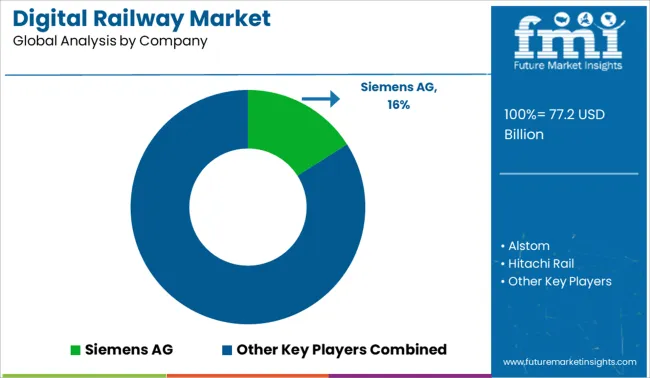

The Digital Railway Market is estimated to be valued at USD 77.2 billion in 2025 and is projected to reach USD 189.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| Digital Railway Market Estimated Value in (2025 E) | USD 77.2 billion |

| Digital Railway Market Forecast Value in (2035 F) | USD 189.6 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The digital railway market is experiencing accelerated growth as rail operators increasingly prioritize automation, real-time monitoring, and passenger-centric services. Rising urbanization and the global push for sustainable transportation have encouraged the modernization of railway infrastructure through advanced digital systems. The integration of intelligent technologies has enhanced operational efficiency, reduced downtime, and improved safety standards across rail networks.

Increasing investments by governments and private entities in smart mobility initiatives are also contributing to this upward trend. The ability to enable predictive maintenance, real-time asset tracking, and dynamic route optimization is being viewed as critical for meeting rising passenger expectations and optimizing freight operations.

Additionally, digital platforms that integrate ticketing, scheduling, and communication systems are transforming the railway ecosystem into a more agile and resilient transport solution. As the demand for energy-efficient and connected transportation continues to rise, the digital railway market is expected to maintain strong momentum through sustained technological advancements and strategic public-private partnerships..

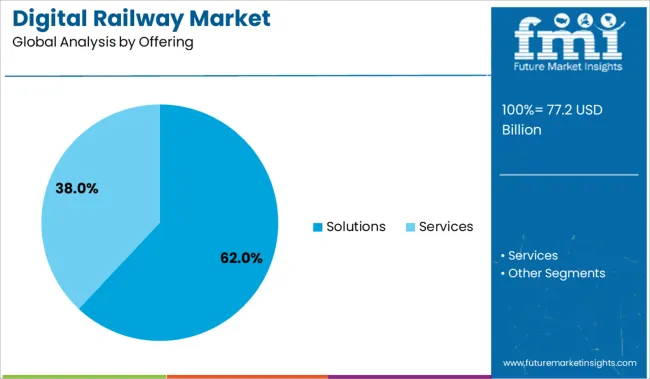

The market is segmented by Offering, Deployment, Technology, and Application and region. By Offering, the market is divided into Solutions, Remote monitoring and control systems, Advanced passenger information systems (APIS), Freight management solutions, Signaling and communication systems, Cybersecurity solutions, Others, Services, Consulting, System integration, and Support & maintenance.

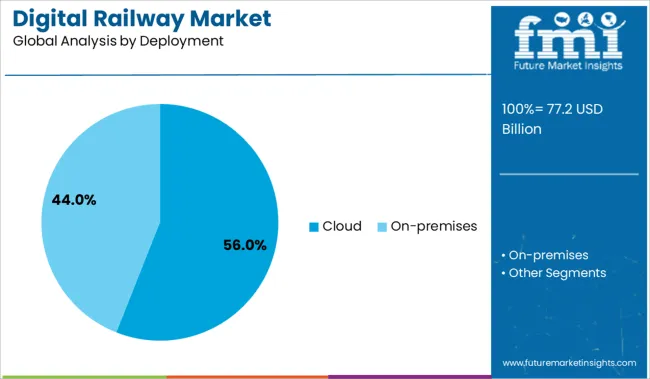

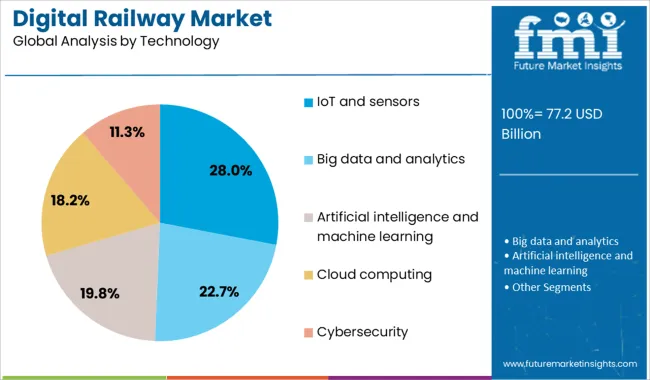

In terms of Deployment, the market is classified into Cloud and On-premises. Based on Technology, the market is segmented into IoT and sensors, Big data and analytics, Artificial intelligence and machine learning, Cloud computing, and Cybersecurity.

By Application, the market is divided into Rail operations management, Asset management, Predictive maintenance, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solutions subsegment within the offering segment is projected to hold 62% of the digital railway market revenue share in 2025, establishing it as the leading contributor. This dominance has been driven by the growing demand for integrated software platforms that manage operations, traffic control, and data analytics across complex railway networks. Rail operators have increasingly relied on software-defined systems to improve real-time decision-making and operational responsiveness.

The adoption of solutions has been further supported by the need for automation tools that enhance safety, ensure schedule reliability, and reduce human error. Customizable software frameworks have been favored for their scalability and ability to integrate seamlessly with legacy and modern infrastructure.

Additionally, the shift toward passenger-centric services has encouraged investment in mobility-as-a-service platforms, dynamic ticketing, and intelligent information systems. The emphasis on digital twins and remote monitoring has also contributed to the increased reliance on software solutions, consolidating their leadership within the overall offering segment..

The cloud subsegment within the deployment segment is expected to account for 56% of the digital railway market revenue share in 2025, emerging as the most prominent deployment model. This trend has been fueled by the growing requirement for scalable, secure, and remotely accessible infrastructure.

Cloud-based deployment has been increasingly favored by railway authorities and technology vendors due to its ability to facilitate real-time data analytics, centralized monitoring, and seamless software updates. The shift toward cloud has been accelerated by the rising volume of data generated across railway assets and stations, necessitating elastic computing resources that on-premise solutions often cannot support efficiently.

Cloud infrastructure has also reduced capital expenditures while enabling faster rollouts of digital applications, which is critical in high-demand urban transit environments. Moreover, regulatory focus on resilience and cyber protection has promoted the use of secured cloud environments, making them an integral part of digital railway transformation strategies..

The IoT and sensors subsegment within the technology segment is projected to capture 28% of the digital railway market revenue share in 2025, making it the leading technology driver. Growth in this area has been underpinned by the demand for real-time visibility into rail assets, environmental conditions, and passenger behavior. Sensor-embedded systems and IoT devices have enabled predictive maintenance by identifying component wear, temperature changes, and vibration anomalies before failure occurs.

The capability to capture granular data and transmit it instantly has strengthened operational reliability and reduced service disruptions. Rail operators have adopted this technology to optimize asset utilization, monitor energy consumption, and enhance track and rolling stock diagnostics.

Furthermore, IoT and sensors have improved situational awareness, allowing for smarter scheduling and reduced congestion. The alignment of these technologies with safety regulations and performance KPIs has positioned them as essential enablers of the broader digital railway vision, contributing significantly to this segment's leadership..

The digital railway market has revealed strong opportunities in both passenger and freight applications from 2023 to 2025. Event-linked deployments, multilingual support, and mobile-based services have expanded digital platforms beyond daily commuting. Meanwhile, freight corridors have adopted predictive analytics, automated interfaces, and signaling upgrades to improve cargo flow and dispatch accuracy. These shifts suggest that providers offering adaptive solutions tailored to both logistics and large-scale passenger mobility are well positioned for long-term value capture.

The surge in rail travel has been identified as a key trigger for digital railway adoption. In 2023, increasing ridership levels were found to have compelled railway operators to invest in real-time monitoring and automated scheduling systems to manage peak loads. By 2024, passenger information displays and cashless ticketing kiosks were being integrated with back-end analytics to reduce dwell times and crowding at stations. In 2025, advanced train control systems like ETCS were trialed on heritage and mainline routes to enhance operational flow and train throughput. These developments suggest that ridership-driven operational efficiency continues to shape investment and deployment in digital rail technology.

Integrated ticketing and journey planning features were adopted in 2023 for major events like music festivals and sporting tournaments, wherein mobile entry and station wayfinding were managed by digital platforms. By 2024, demand surged for pop-up kiosks and analytics systems at event venues to support seamless crowd throughput and minimize delays. In 2025, remote passenger experience enhancements-such as onboard route information and multilingual support-were embedded to serve international visitors and non-native speakers. These applications suggest that digital railway systems can extend from core transit operations into adaptive event-based mobility solutions, offering providers opportunities to support mass transit surges through dynamic, user-centric deployment.

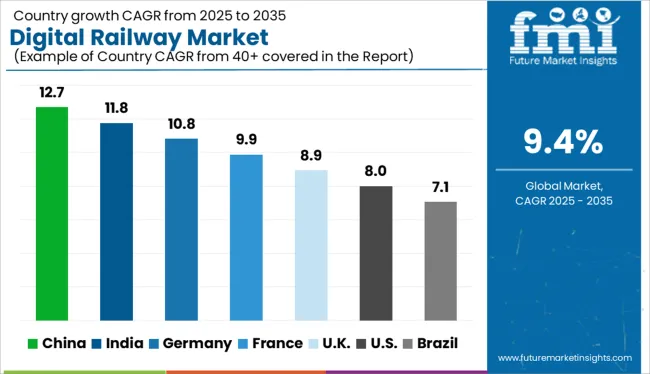

| Country | CAGR |

|---|---|

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| U.K. | 8.9% |

| U.S. | 8.0% |

| Brazil | 7.1% |

The global digital railway market is projected to grow at a CAGR of 9% from 2025 to 2035. China leads with a 12.7% CAGR, followed by India at 11.8% and Germany at 10.8%. France aligns just above the global average at 9.9%, while the United Kingdom trails slightly at 8.9%. China and India are scaling investments in 5G rail communications, predictive maintenance, and automated signaling. Germany benefits from high-speed rail modernization and ERTMS integration. France focuses on safety-centric systems and interoperable signaling upgrades. The UK remains cautious, with slower adoption due to legacy system complexities and funding prioritization gaps.

China is projected to lead the digital railway market with a 12.7% CAGR, driven by aggressive state investment in intelligent transport infrastructure and 5G-enabled smart rail corridors. CRRC and China Railway Signal & Communication Corporation are deploying AI-based signaling, real-time diagnostics, and autonomous train operations across major freight and passenger lines. Integrated command centers now manage predictive maintenance and scheduling across high-speed networks.

India is forecast to expand its digital railway market at an 11.8% CAGR, fueled by digital signaling upgrades, electrification projects, and the National Rail Plan. Indian Railways is rolling out centralized traffic control systems and real-time asset monitoring solutions across Golden Quadrilateral routes. Indigenous startups are collaborating with OEMs to develop fault prediction and energy optimization modules.

Germany is expected to grow its digital railway market at a 10.8% CAGR, shaped by federal funding for ERTMS deployment, smart rail hubs, and cybersecurity upgrades. Deutsche Bahn’s digital strategy includes AI-based energy management, infrastructure digital twins, and predictive analytics in maintenance. Regional rail networks are being outfitted with autonomous dispatch, delay prediction, and IoT-based condition monitoring systems.

France is forecast to grow its digital railway market at 9.9% CAGR, with adoption focused on safety-centric signaling systems and passenger traffic optimization. SNCF’s digital investments target onboard diagnostics, AI-based route planning, and real-time ticketing synchronization. EU-aligned standards promote cross-border interoperability, especially for high-speed international lines. Pilot testing of cloud-based operations and predictive delay modeling is underway in Paris and Lyon corridors.

The United Kingdom is forecast to grow its digital railway market at an 8.9% CAGR, reflecting steady adoption through Network Rail’s Digital Railway Programme. Upgrades include deployment of ERTMS, intelligent trackside sensors, and AI-powered scheduling software. However, the pace is moderated by budget constraints and legacy system compatibility issues. Early-stage rollouts focus on the East Coast Main Line and selected intercity routes.

The digital railway market is moderately consolidated, led by Siemens AG with a significant market share. The company holds a dominant position through its fully integrated digital rail solutions, including advanced signaling systems, real-time traffic management, and predictive maintenance platforms. Dominant player status is held exclusively by Siemens AG. Key players include Alstom, Hitachi Rail, Thales Group, and Wabtec Corporation - each offering digital rail infrastructure technologies such as ERTMS, CBTC, onboard diagnostics, and asset performance tools across freight and passenger networks. Emerging players are currently limited in this market due to high capital entry barriers and strong incumbency by global rail system integrators. Market demand is driven by the global push for automated rail operations, reduced congestion, and improved safety across aging and new railway corridors.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.2 Billion |

| Offering | Solutions, Remote monitoring and control systems, Advanced passenger information systems (APIS), Freight management solutions, Signaling and communication systems, Cybersecurity solutions, Others, Services, Consulting, System integration, and Support & maintenance |

| Deployment | Cloud and On-premises |

| Technology | IoT and sensors, Big data and analytics, Artificial intelligence and machine learning, Cloud computing, and Cybersecurity |

| Application | Rail operations management, Asset management, Predictive maintenance, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens AG, Alstom, Hitachi Rail, Thales Group, and Wabtec Corporation |

| Additional Attributes | Dollar sales by component, regional demand trends, competitive landscape, buyer preferences for cloud-based systems, integration with smart cities/e-mobility, innovations in AI-powered diagnostics and 5G-enabled signaling. |

The global digital railway market is estimated to be valued at USD 77.2 billion in 2025.

The market size for the digital railway market is projected to reach USD 189.6 billion by 2035.

The digital railway market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in digital railway market are solutions, remote monitoring and control systems, advanced passenger information systems (apis), freight management solutions, signaling and communication systems, cybersecurity solutions, others, services, consulting, system integration and support & maintenance.

In terms of deployment, cloud segment to command 56.0% share in the digital railway market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA