The digital marketing analytics industry in Latin America is experiencing robust expansion. Growth is being driven by increasing digital adoption, expanding e-commerce ecosystems, and rising demand for data-driven decision-making across enterprises. Businesses are focusing on optimizing marketing spend and improving campaign performance through analytics-based insights.

The regional landscape is witnessing rapid integration of artificial intelligence, machine learning, and automation within digital marketing tools. Governments and private sectors are investing in digital infrastructure, which is strengthening connectivity and supporting analytics deployment across industries. The future outlook remains positive, supported by the growing importance of omnichannel marketing strategies and the shift toward real-time customer engagement analytics.

Market players are enhancing platform interoperability and data visualization capabilities to cater to evolving client needs The continued rise of social commerce and influencer marketing is further expected to elevate analytics adoption, positioning the region as a key growth hub for marketing intelligence solutions over the forecast period.

| Metric | Value |

|---|---|

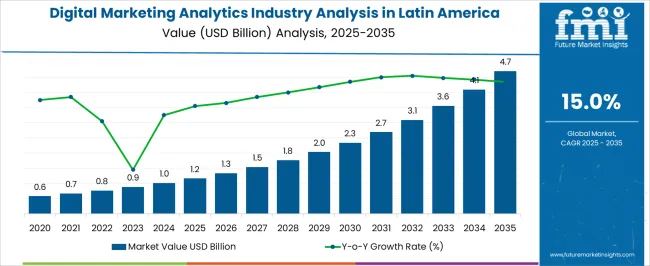

| Digital Marketing Analytics Industry Analysis in Latin America Estimated Value in (2025 E) | USD 1.2 billion |

| Digital Marketing Analytics Industry Analysis in Latin America Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The market is segmented by Solution, Enterprise Size, and Application and region. By Solution, the market is divided into Digital Marketing Analytics Software and Services. In terms of Enterprise Size, the market is classified into Large Enterprises and Small & Medium Enterprises. Based on Application, the market is segmented into Social Media Marketing, Email Marketing, Content Marketing, SEO Marketing, Pay Per Click Marketing, Video Marketing, and Display Marketing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

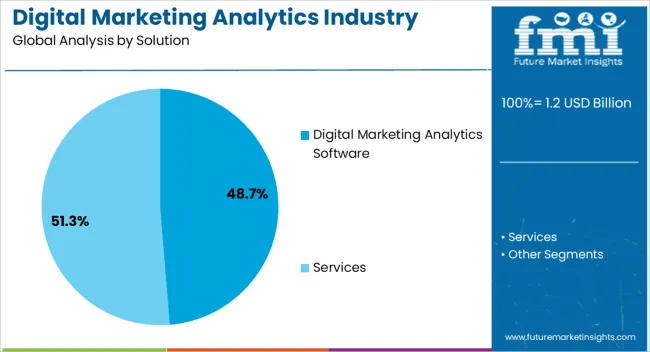

The digital marketing analytics software segment, accounting for 48.70% of the solution category, has emerged as the leading segment due to its critical role in enabling marketers to measure performance, optimize strategies, and enhance return on investment. Its dominance is being driven by widespread adoption across retail, financial services, and consumer goods industries.

Continuous improvements in software functionality, including predictive analytics, customer journey mapping, and automated reporting, are strengthening its market position. Cloud-based deployment models have expanded accessibility for both large and mid-sized enterprises, while integration with CRM and ERP systems has enhanced data utility.

The segment’s growth is expected to continue as businesses increasingly prioritize real-time insights and marketing automation to sustain competitiveness in an evolving digital environment.

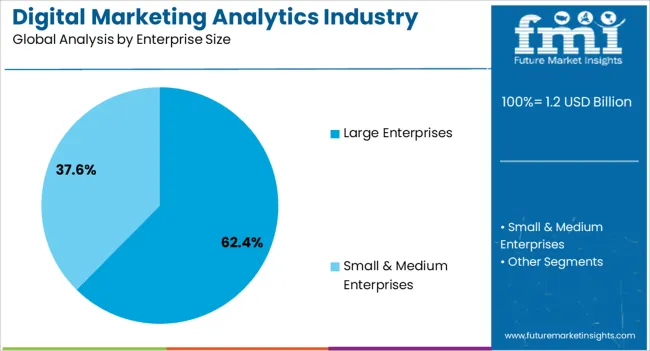

The large enterprises segment, holding 62.40% of the enterprise size category, has maintained dominance due to their extensive marketing budgets and the need for advanced analytics solutions to manage complex campaigns. Adoption has been reinforced by strong internal data management capabilities and established digital transformation initiatives.

Large organizations in Latin America are leveraging analytics platforms to improve cross-channel performance measurement and customer retention strategies. Investment in proprietary data ecosystems and partnerships with analytics vendors has further enhanced operational efficiency.

As large enterprises continue to focus on customer segmentation, personalization, and ROI optimization, the demand for sophisticated analytics tools is expected to remain high, ensuring sustained leadership within the overall market structure.

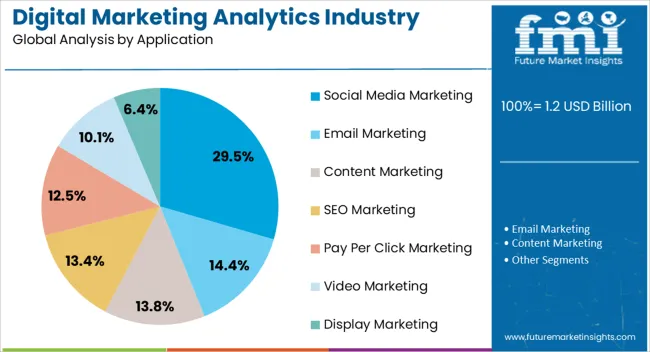

The social media marketing segment, representing 29.50% of the application category, has emerged as a major growth driver in the regional analytics landscape. Increasing social media penetration, mobile-first consumer behavior, and the popularity of short-form content have amplified the need for advanced performance tracking and engagement measurement.

Businesses are utilizing analytics platforms to assess influencer effectiveness, content reach, and conversion metrics, enabling more informed marketing decisions. Integration of real-time dashboards and AI-based recommendation engines has enhanced the ability to adapt campaigns dynamically.

As regional brands intensify their presence on platforms like Instagram, TikTok, and LinkedIn, the social media marketing analytics segment is expected to expand further, supported by the growing emphasis on data transparency, measurable ROI, and consumer insight generation.

From 2020 to 2025, the digital marketing analytics industry in Latin America grew at a CAGR of 6.7%.

The digital marketing analytics industry in Latin America is expected to rise at a CAGR of 15.0% from 2025 to 2035. The industry is expected to reach USD 2,250.8 million during the forecast period.

The table presents the expected CAGR for Latin America's digital marketing analytics industry over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the field is predicted to surge at a CAGR of 10.4%, followed by a slightly higher growth rate of 10.6% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 12.7% in the first half and remain steady at 12.9% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 10.4% (2025 to 2035) |

| H2 | 10.6% (2025 to 2035) |

| H1 | 12.7% (2025 to 2035) |

| H2 | 12.9% (2025 to 2035) |

The section below highlights the projected CAGR of key segments, including solution and enterprise size.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Digital Marketing Analytics Software (Solution) | 7.4% |

| Small & Medium Enterprises (Enterprise Size) | 10.2% |

| Social Media Marketing (Application) | 12.2% |

Key players are constantly evolving and adapting to the dynamic industry landscape by employing several growth strategies to remain competitive and meet the evolving needs of their clients.

Key Strategies Adopted by Leading Players

Product Innovation

Leading companies focus on product innovation, which includes artificial intelligence (AI). AI works behind the scenes in all customer interactions, from marketing to sales to service. The company also focuses on machine learning capabilities, which analyze the organization's marketing, sales, and service strategies to assess the current level of empathy.

Strategic Partnerships and Collaborations

Leading players are directing toward partnerships with local marketing agencies and technology providers to expand reach and better understand the local landscape.

Expansion into Emerging Markets

Key companies are focusing on launching innovative solutions and expanding their digital marketing analytics solution offerings to deliver enhanced technology as well as offer new and upgraded solutions in new markets.

Key Developments

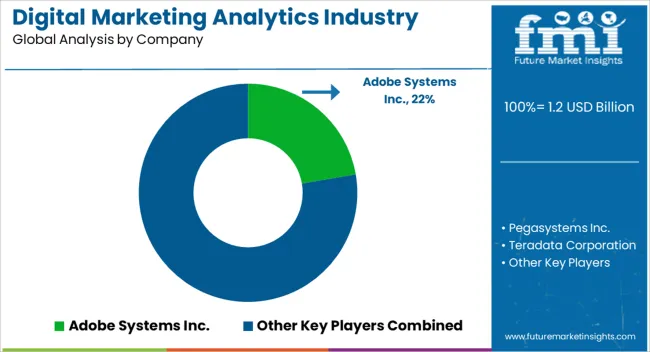

The global digital marketing analytics industry analysis in latin america is estimated to be valued at USD 1.2 billion in 2025.

The market size for the digital marketing analytics industry analysis in latin america is projected to reach USD 4.7 billion by 2035.

The digital marketing analytics industry analysis in latin america is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in digital marketing analytics industry analysis in latin america are digital marketing analytics software, services, _consulting, _design & implementation and _support & maintenance.

In terms of enterprise size, large enterprises segment to command 62.4% share in the digital marketing analytics industry analysis in latin america in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Trust Market Size and Share Forecast Outlook 2025 to 2035

Digital Psychotherapeutics Market Size and Share Forecast Outlook 2025 to 2035

Digital Glass Military Aircraft Cockpit Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport (DPP) Platforms Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA