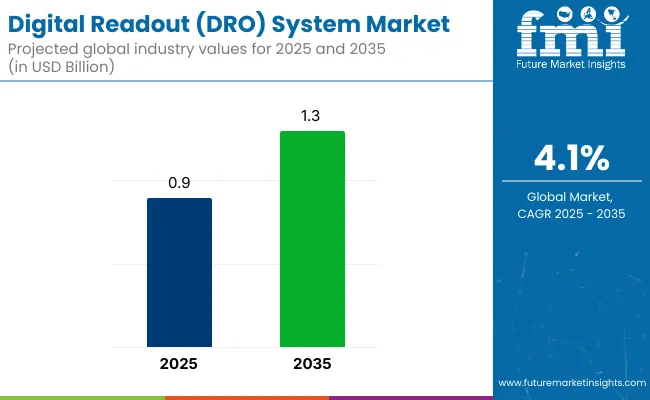

The global digital readout (DRO) system market is valued at USD 0.9 billion in 2025 and is poised to be worth USD 1.3 billion by 2035, reflecting a steady CAGR of 4.1%. This growth is expected to be driven by the increasing adoption of precision engineering and CNC machining systems across automotive, aerospace, and electronics industries.

The shift toward Industry 4.0 and smart factory environments is likely to accelerate the deployment of DRO solutions with advanced digital connectivity and IoT integration. Furthermore, favorable government policies supporting automation in developing economies are projected to contribute to industry growth.

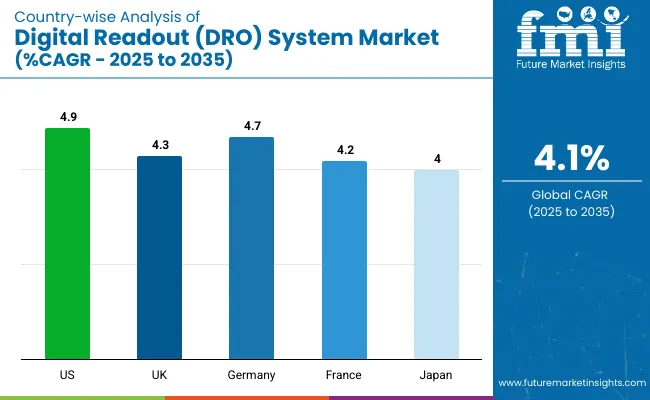

The USA is expected to emerge as the country with the highest CAGR of 4.9% during 2025 to 2035, owing to its stringent precision manufacturing standards and strong industrial base. Germany is projected to witness growth, registering a CAGR of 4.7% due to rapid industrialization and adoption of smart manufacturing.

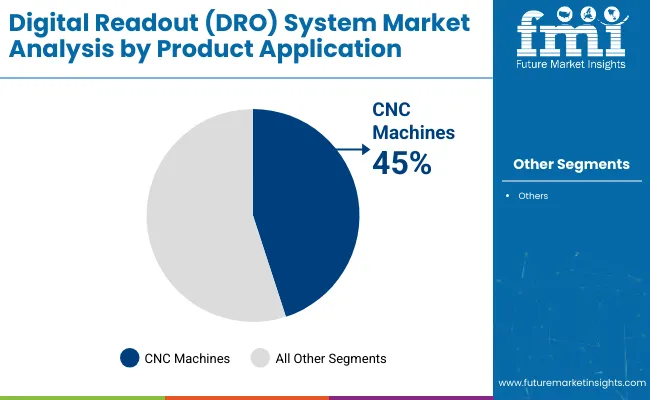

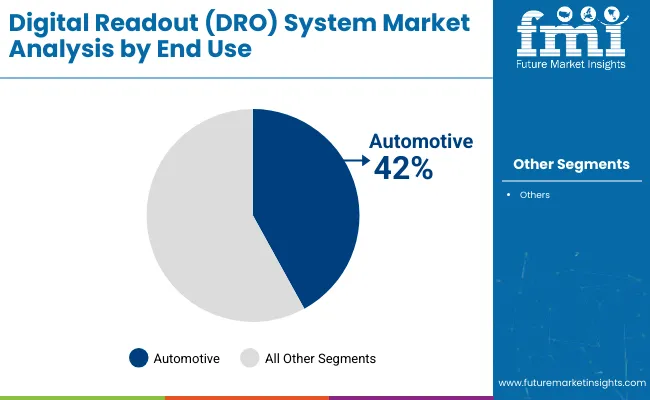

The automotive segment is projected to dominate the end-use industry category with a 42% share, driven by its widespread adoption in milling and lathe machines. The CNC machine segment is expected to lead with a 45% market share in 2025, while manual lathe machines are estimated to hold around 15% share in 2025, maintaining relevance in semi-automated workshops and developing economies.

Government regulations are expected to play a pivotal role in shaping the digital readout (DRO) system market by enforcing stringent standards for precision, safety, and electromagnetic compatibility. In the USA, compliance with NIST, OSHA, and FCC norms has been mandated, while the European Union enforces CE and RoHS directives. Countries such as China and India require CCC and BIS certifications, respectively, ensuring quality and performance of DRO units.

Recent innovations in the digital readout (DRO) system market have been centered around IoT integration, AI-driven predictive maintenance, and wireless connectivity. Heidenhain introduced AI-enabled DRO systems to optimize uptime and reduce operational disruptions, particularly for aerospace and automotive sectors. Fagor Automation launched a new series of wireless DRO systems for flexible installation in smart factories. Sino Group expanded its footprint through the acquisition of a Southeast Asian DRO manufacturer, strengthening regional supply capabilities.

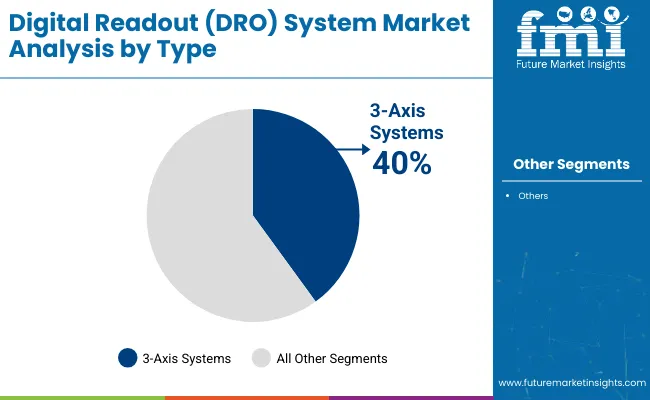

The digital readout (DRO) system market is segmented by type, product application, end-use industry, and region. By type, the market is categorized into 2-axis, 3-axis, 4-axis, and others (including 5-axis DRO systems, modular kits, and customized multi-axis DROs for defense, medical, and R&D purposes). Based on product application, the market is segmented into manual lathe, milling machine, boring, grinding machine, CNC machine, and measuring instruments.

By end-use industry, the market is classified into automotive, electronics industry, manufacturing, shipping industry, and others (including aerospace and defense, jewelry and watchmaking, medical device production, and research institutions). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East and Africa (MEA), East Asia, and South Asia and Pacific.

The 3-axis segment is anticipated to dominate the digital readout (DRO) system market, accounting for nearly 40% of the global share in 2025.

The CNC machine segment is expected to emerge as the most lucrative in the digital readout (DRO) system market, projected to capture over 45% of the total market share by 2025.

The automotive end-use segment of the digital readout (DRO) system market is projected to register over 42% of the total market share.

The global digital readout (DRO) system market is growing steadily, driven by rising adoption of precision machining, industrial automation, and CNC technologies.

Recent Trends in the Digital Readout (DRO) System Market

Key Challenges in the Digital Readout (DRO) System Market

The global digital readout (DRO) system market is experiencing steady growth, driven by increasing demand for precision machining, rising industrial automation, and the rapid adoption of CNC technologies. The shift toward smart manufacturing and Industry 4.0 frameworks is accelerating the deployment of DRO-integrated systems.

The digital readout (DRO) system revenue in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by strong demand from aerospace, automotive, and advanced manufacturing sectors.

The sales of digital readout (DRO) system in the UK is expected to expand at a CAGR of 4.3% during the forecast period, with rising automation in aerospace and defense sectors playing a key role.

Germany’s digital readout (DRO) system revenues are forecasted to register a CAGR of 4.7% from 2025 to 2035, owing to the country's legacy in precision manufacturing and industrial automation.

France’s digital readout (DRO) system market is projected to grow at a CAGR of 4.2% between 2025 and 2035, driven by industrial modernization programs and compliance with EU metrology regulations.

Digital readout (DRO) system revenue in Japan is expected to grow at a CAGR of 4.0% from 2025 to 2035, supported by its mature CNC and robotics ecosystem.

The digital readout (DRO) system market is moderately consolidated, with several global players commanding significant market shares, while regional manufacturers and niche providers continue to innovate through affordability and integration features. Competitive dynamics are being influenced by the rise of smart manufacturing, demand for IoT-enabled systems, cost-efficient retrofitting, and regional localization strategies to meet diverse industry needs.

Tier-one firms such as Heidenhain GmbH, Fagor Automation, Acu-Rite, Sino Group, and Newall Electronics are competing through advanced DRO solutions featuring real-time data analytics, predictive maintenance, and AI-driven interfaces. These companies are expanding global distribution networks and investing in robust, energy-efficient DRO systems tailored for CNC compatibility and regulatory compliance.

Recent Digital Readout (DRO) System Industry News

In March 2024, Heidenhain acquired a new 12,000 square foot manufacturing innovation hub in Fremont, California (Silicon Valley). The facility includes a 6,000 square foot demonstration lab and office space for regional sales and support staff.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 0.9 billion |

| Projected Market Size (2035) | USD 1.3 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions / Volume in units sold |

| Type Analyzed | 2-Axis, 3-Axis, 4-Axis, Others (5-Axis, Modular DROs, Training Units) |

| Product Application Analyzed | Manual Lathe, Milling Machine, Boring, Grinding Machine, CNC Machine, Measuring Instruments |

| By End-Use Industry Analyzed | Automotive, Electronics Industry, Manufacturing, Shipping Industry, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Heidenhain, Newall Measurement System, Mitutoyo, Fagor Automation, DRO PROS, and Electronica Mechatronics |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry is segmented into 2-axis, 3-axis, 4-axis and others

It is segmented into manual lathe, milling machine, boring, grinding machine, CNC machine and measuring instruments

It is fragmented into automotive, electronics industry, manufacturing, shipping industry and others

The industry is fragmented among North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific and The Middle East & Africa

The market is valued at USD 0.9 billion in 2025.

The market is projected to grow to USD 1.3 billion by 2035.

CNC machines are projected to lead, holding over 45% share by 2025.

The USA is forecasted to grow at the highest CAGR of 4.9% from 2025 to 2035.

3-axis DRO systems are expected to lead the market with a 40% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dropper System Market Size and Share Forecast Outlook 2025 to 2035

Digital Signage System Market Analysis by Technology, Software, Application, Type, and Region through 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Patient Monitoring System Market Analysis – Size, Share & Forecast 2024-2034

Digital Glass Military Aircraft Cockpit Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrostatic Fan Drive System Market Size and Share Forecast Outlook 2025 to 2035

Vaporized Hydrogen Peroxide Sterilization System Market Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA