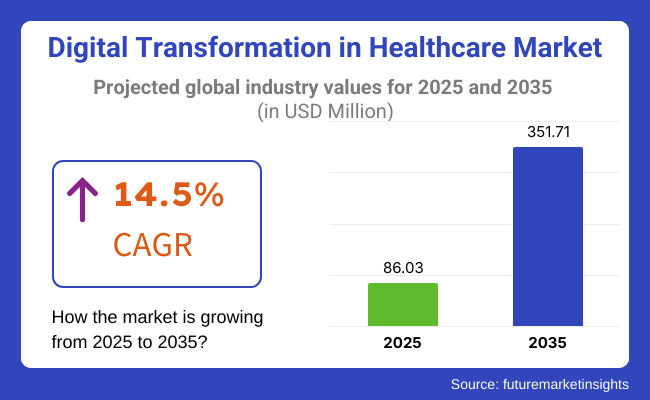

The global digital transformation in healthcare market is anticipated to witness tremendous growth between 2025 and 2035 due to increased adoption of cloud-based healthcare systems, relentless technological advancement, and support from governments. The market is anticipated to reach USD 86.03 billion in 2025 and is expected to grow at a CAGR of 14.5% to reach around USD 351.71 billion by 2035.

The growing intersectionality of artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) in the healthcare ecosystem is revolutionizing patient care, operational effectiveness, and clinical outcomes. Cloud-enabled infrastructure is providing real-time access to patient information, improving collaboration among healthcare professionals, and enabling improved decision-making. Government support for digital healthcare infrastructure and rising demand for personalized and remote healthcare services are also accelerating market growth.

The growing use of artificial intelligence-driven diagnostic solutions, telemedicine software, and health wearables is enhancing patient care and aiding disease detection at an early stage. Cloud computing is transforming the way we deal with data, with all-access patient files and real-time sharing between providers of care. Big data analytics is optimizing clinical decision-making by analyzing large amounts of patient data to identify patterns and personalize treatment strategies.

Cyberattack susceptibility and concerns over data privacy pose the biggest hindrances to the mass adoption of digital healthcare technology. Healthcare system technophobia and insufficient numbers of highly qualified IT healthcare experts also serve as industry penetration barriers.

Compliance with regulations and data protection legislation, such as HIPAA and GDPR, also keeps new entrants away from firms. Increased investment in cybersecurity and consumer-driven digital platforms is poised to overcome the hindrances and propel market adoption.

The digitization of the healthcare industry presents numerous opportunities for growth, driven by the development of AI-powered solution capabilities and cloud-based healthcare platforms. Incorporating machine learning and predictive analytics into clinical practice will enhance diagnostic accuracy and treatment workflows. The growth of telemedicine and remote patient monitoring technology is creating new business prospects for technology companies and healthcare facilities.

The software segment dominates the health industry, with a share of 74.6% of the total share in 2025. Growth is attributed to increased adoption of AI-powered healthcare solutions, cloud-based Electronic Health Records (EHRs), and predictive analytics. With hospitals and clinics focusing on immediate patient monitoring, digital diagnostics, and the growth of telehealth, software solutions are at the core of the transformation in health care.

Leading vendors like Epic Systems, Oracle Cerner, and Allscripts are using AI, machine learning, and blockchain technology to boost data security and interoperability and enhance decision-making. Software In healthcare, software adoption is becoming the center stage of points of delivery with the combined forces of virtual care platforms and remote patient monitoring (RPM) on mHealth platforms. For example, Epic’s AI-powered EHRs can now include predictive patient deterioration analysis, and Oracle Cerner’s cloud solutions facilitate communications and interoperability among providers.

The service segment is projected to capture a 25.4% share in 2025, owing to the increasing demand for healthcare IT consulting, system integration, and cybersecurity solutions. Providers have been turning to increasingly complex ecosystems of software to meet their needs, and investment to support staff training, infrastructure management, and compliance consulting is on the rise.

The leading companies in the space, like IBM Watson Health, Cognizant, and Accenture, are harnessing AI-driven automation, cloud migration services, and digital transformation strategies. As providers start to transition toward value-based care models, both software and services will continue to grow and drive greater efficiency, cost reduction, and better patient outcomes for ALL providers.

The hospitals & clinics segment is anticipated to account for 41.9% of the overall share in 2025 as a result of the growing use of Electronic Medical Records (EMRs), AI-enabled diagnostics, and connected medical devices.

We would all agree that the transition from paper-based to digitized healthcare systems is revolutionizing their efficiency, reducing medical errors, and consequently, boosting patient care. Over the past decades, digital health spending has generated huge revenue, which was valued at USD 300 billion in 2023, and is rapidly expanding as hospitals spend big bucks on smart medical solutions.

Hospitals are utilizing IoMT innovations like virtual patient monitoring, AI imaging insights, and smart wearables to make improvements in patient care. Siemens Healthineers, GE Healthcare, and Philips Healthcare have been expanding their digital health portfolios to allow hospitals to take advantage of real-time patient data and predictive analytics to make better decisions at the moment.

By 2025, the pharma companies segment is anticipated to account for the largest share of 58.1% due to the expansion of AI-based drug discovery, cloud-based analytics, and blockchain adoption. Pharma companies are increasingly adopting machine learning and real-world evidence (RWE) platforms to speed up drug development while ensuring compliance with regulatory requirements.

At the forefront are companies like Pfizer, Novartis, and Roche, which are applying AI/ML clinical trials, predictive modeling, and automated drug manufacturing to drive efficiencies and cost savings. AI-powered pharmacovigilance systems are enhancing drug safety monitoring and accelerating the development of innovative medicines.

AI, big data, and connected healthcare ecosystems will transform the way we deliver care to patients and develop new drugs, as hospitals and pharmaceutical companies continue to invest in digital transformation.

Digital transformation is happening rapidly in the healthcare sector due to the emergence of new technologies, including artificial intelligence, big data analytics, IoT, and cloud computing. Data security, system integration, and AI-based diagnostic tests have become the priorities of hospitals and clinics, which in turn enables them to provide ethical patient care and work more efficiently.

Telemedicine, which was recently introduced, has been making its way into the market with the demand for seamless video conferencing, real-time analytics, and high-level cybersecurity without breaching patient confidentiality. Connectivity, IoT integration, and AI-assisted diagnostics are the areas of medical device manufacturers' interest in the enhancement of patient monitoring and outcomes.

The use of digital tools in the drug discovery process, supply chain optimization, and regulatory compliance by the pharmaceutical sector is another example of digitalization within the healthcare sector. Dispatcher companies in the healthcare field are often put under pressure to think of processes that are simpler, more efficient, and less costly. Thus, they convey regulatory matters to their end-users.

During the fast-paced times of digitalization, the medical area has also benefited from the extension of cybersecurity, the implementation of blockchain for secure data transfer, and predictive analytics, which are all together the basis for personalized treatment and patient involvement.

Between 2020 and 2024, the digital transformation in healthcare accelerated rapidly, driven by the need for efficiency, cost reduction, and improved patient outcomes. The COVID-19 pandemic catalyzed the adoption of telemedicine, AI-driven diagnostics, and remote patient monitoring at an unprecedented scale. Telehealth became a standard care model, with AI-powered diagnostic tools reducing the time for disease detection and medical imaging analysis. The integration of electronic health records (EHRs) improved data sharing across providers, enhancing clinical decision-making.

Wearable health technology, including smartwatches and biosensors, enables the real-time tracking of vital signs such as heart rate, oxygen levels, and glucose levels, empowering patients with self-care capabilities. Healthcare providers invested in blockchain security, AI-driven threat detection, and encryption to protect patient data as they moved to cloud-based platforms.

Regulatory frameworks, including HIPAA and GDPR, evolved to strengthen data privacy and support cross-border healthcare collaboration. Despite challenges such as interoperability issues and digital literacy gaps, healthcare organizations have made significant progress in adopting AI, IoT, and big data analytics, setting the foundation for future growth.

Between 2025 and 2035, healthcare will enter an era of AI-powered diagnostics, personalized medicine, and smart hospitals. Machine learning algorithms will predict disease outbreaks, optimize treatment plans, and improve hospital resource allocation. Blockchain-based health records will ensure secure, patient-controlled data sharing, improving continuity of care. 5 G-powered remote healthcare will enable real-time surgeries, robotic procedures, and virtual patient monitoring, expanding access to medical care.

Digital twins will revolutionize treatment strategies by simulating disease progressions and optimizing surgical outcomes. AI-driven genetic profiling will advance precision medicine, allowing hyper-personalized treatments based on individual DNA. Smart hospitals with AI-driven management systems will automate patient scheduling, staff allocation, and supply chain operations. IoT-connected smart wards will monitor patients 24/7, providing real-time alerts to medical teams. Cybersecurity will remain a top priority, with quantum encryption, AI-driven fraud detection, and biometric authentication ensuring secure and compliant healthcare systems.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Virtual consultations, remote patient monitoring | AI-powered diagnostics, 5G-enabled remote surgeries |

| EHR adoption, cloud-based records | Blockchain-secured health records, AI-driven data analysis |

| Fitness trackers, glucose monitors | Smart biosensors, AI-integrated real-time health tracking |

| Image-based AI detection, machine learning triage | Digital twin-based personalized treatment simulations |

| Smart scheduling, predictive maintenance | Fully automated smart hospitals with AI-driven resource management |

| Data encryption, compliance with HIPAA, and GDPR | Quantum encryption, biometric AI fraud prevention |

| Basic genetic testing for risk assessment | AI-driven precision medicine, genomics-based therapies |

| COVID-19 acceleration, regulatory support | AI-powered efficiency, expansion of digital-first healthcare services |

In 2024 and early 2025, the industry has witnessed significant progress as healthcare providers intensify investments in innovative digital solutions. Industry leaders such as Philips Healthcare, GE Healthcare, Cerner, IBM Watson Health, and Siemens Healthineers have secured pivotal contracts and strategic partnerships aimed at integrating advanced technologies across clinical and operational settings. These developments underscore the commitment to enhancing patient care, optimizing workflows, and driving data-driven decision-making in a rapidly evolving healthcare landscape.

| Company | Contract Value (USD million) |

|---|---|

| Philips Healthcare | Approximately USD 80 - 90 |

| GE Healthcare | Approximately USD 70 - 80 |

| Cerner | Approximately USD 60 - 70 |

| IBM Watson Health | Approximately USD 90 - 100 |

| Siemens Healthineers | Approximately USD 75 - 85 |

The industry faces high regulatory threats. Manufacturers of health equipment must meet strict standards like HIPAA, GDPR, and FDA guidelines. If manufacturers fail to meet the standards, they will incur legal penalties, damage their reputation, and experience delays in product launches, which will directly impact the entry and growth of businesses.

Cybersecurity is also the second most serious issue. Digital health solutions are becoming the major holders of sensitive patient data, which makes companies susceptible to cyberattacks. Data breaches can cause monetary losses, lawsuits, and loss of consumer trust. Companies are required to invest heavily in strong cybersecurity systems in order to protect patient information and comply with regulations.

Interoperability problems are yet another source of technical risks. The majority of healthcare providers have data systems that are difficult to integrate with the new digital systems. The inability to exchange data accurately between electronic health records (EHRs), telemedicine, and artificial intelligence (AI)-based analytics hampers the adoption of technology and the effectiveness of digital healthcare initiatives.

The high costs of implementation, however, may hinder the integration of digital technologies. Small and medium healthcare facilities will probably experience the financial difficulties related to AI, IoT, and cloud-based solutions adoption. If the cost-effective alternatives are not provided, the penetration for these new technologies would be slow and certain healthcare providers may disregard the upgrading of the systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 14.2% |

| The UK | 12.8% |

| France | 11.5% |

| Germany | 13.0% |

| Italy | 10.7% |

| South Korea | 14.0% |

| Japan | 13.5% |

| China | 15.2% |

| Australia | 12.2% |

| New Zealand | 11.0% |

CAGR from 2025 to 2035 will be 14.2%. The USA is leading the healthcare digital revolution in the form of rapid developments in artificial intelligence, telemedicine, and big data analytics. GE Healthcare, IBM Watson Health, and Epic Systems are heavy investors in digital health solutions that facilitate better diagnosis and patient engagement. Remote monitoring and prediction analysis using AI continues to grow with increasing chronic diseases and a more tech-savvy population.

Government initiatives and collective venture capital investment push digital health firms to be innovative, fostering marketplace expansion. Applications of electronic health records (EHRs) and interoperability solutions optimize operational effectiveness. Greater emphasis on precision medicine and data-driven clinical decision-making also push digitalization further.

It is estimated that CAGR during 2025 to 2035 will be 12.8%. The UK will implement digital healthcare technologies for its National Health Service (NHS) with a focus on artificial intelligence, cloud computing, and telehealth. Some major players in driving AI-based diagnostics, patient management, and drug discovery include Babylon Health, BenevolentAI, and EMIS Health. Digital health records and AI-based clinical decision-making are encouraged by the government, driving growth.

The growing demand for teleconsultation and e-prescription accelerates digitalization. Data security and interoperability are key challenges, but ongoing investment in blockchain technology-based health records and cybersecurity addresses these challenges. Strong regulation enables innovation with compliance.

CAGR is projected to be 11.5% for the industry in France. France is investing in digital transformation through AI-based healthcare solutions, networked medical devices, and telemedicine platforms. Innovation leaders like Doctolib, Withings, and MedinCell power telehealth, wearable technology, and pharma digitalization. The government highly prioritizes the adoption of EHR to provide immediate access to patients' data and boost health outcomes.

Higher investments in machine learning and AI make healthcare services more efficient, while more hospital-technology firm collaborations guarantee that healthcare is made more efficient. Increased precision medicine and personalized healthcare focus in the country drive more digitalization, better patient empowerment, and preventive care methods.

CAGR for the market is likely to be 13% through 2035. Germany's strong industry has led to the adoption of digital healthcare products and a focus on AI, robotics, and IoT-based medical devices. Siemens Healthineers, BioNTech, and Ada Health are prominent digital health technology players that facilitate enhanced diagnosis and treatment planning. The Digital Healthcare Act facilitates digital script and telemedicine growth.

Increased investment in remote monitoring technologies and digital therapeutics propels expansion. Emphasis on decentralized healthcare and blockchain for secure patient information exchange enhances the transparency of business, enabling increased adoption of wider digital transformation initiatives.

10.7% CAGR is expected during 2025 to 2035. Italy embraces digital healthcare with a greater focus on telemedicine, health wearables, and AI-based diagnostics. Bracco Imaging, Sorin Group, and Dedalus are some of the players that provide imaging solutions, cardiac monitoring, and EHR software development. Government-funded digital initiatives make healthcare more accessible and interoperable.

The growing population of older adults and rising incidence of chronic disease drive demand for digital health. The adoption of big data analytics in clinical workflows enhances treatment outcomes and operational effectiveness, making South Korea a top market for digital healthcare transformation.

CAGR for the industry in South Korea is expected to be 14%. South Korea is a digital health leader in AI diagnosis, 5 G-based telemedicine, and robot-assisted surgery. Samsung Medison, Lunit, and VUNO are some of the key players that develop new imaging solutions, AI-diagnostic solutions, and smart hospital management systems. Health tech startup-friendly government policies promote innovation.

A technologically savvy population and mass-scale adoption of 5G facilitate the digital growth of healthcare. The growing demand for home healthcare products through the incorporation of AI in health research drives the development. Biotech industry dominance also facilitates digital transformation scenarios.

CAGR for the regional market is estimated to be 13.5%. Robotics, artificial intelligence, and wearables drive Japan's digital health revolution. Fujifilm, Canon Medical, and Sysmex hold sway in the medical imaging, diagnostics, and precision medicine arenas. Government spending on digital health solutions drives the adoption of telehealth and remote monitoring solutions.

The aging population and the need for effective healthcare interventions drive digitalization. AI diagnosis, smart hospitals, and AI-based care solutions revolutionize Japan's healthcare sector. Blockchain's use to protect patient data enhances trust and transparency.

The industry in China is anticipated to record a 15.2% CAGR from 2025 to 2035. China is experiencing rapid digital health development spearheaded by AI, big data, and cloud health solutions. Ping a Good Doctor, Tencent Healthcare, and Alibaba Health are just some of the leading companies driving telemedicine, wearable technology, and intelligent diagnostic solutions. Government policies are encouraging digitalization for greater healthcare reach.

The growing middle class, high health spending, and strong technology infrastructure are propelling the industry. Patient tracking via AI, e-pharmacies, and smart hospital ecosystems constitutes a highly dynamic health ecosystem alignment of tech champions with healthcare organizations, further fueling innovation.

CAGR between 2025 to 2035 is estimated at 12.2%. Australia fosters digital health innovation via the use of AI, telemedicine, and data-driven clinical decision support. Cochlear, ResMed, and Telstra Health are some of the disruptors in hearing implant, respiratory care, and telehealth platform spaces. Government-funded initiatives encourage the adoption of digital health records, with an emphasis on interoperability.

Increased telemedicine needs, especially in rural areas, drive digital investment. Artificial intelligence diagnosis and wearable health technology are preferred, boosting patient monitoring. Increased focus on cybersecurity ensures a safe and efficient digital healthcare roll-out.

The industry in New Zealand is projected to report a CAGR of 11%. Digitally accessible healthcare is the number one priority in New Zealand, with particular emphasis on telehealth, EHRs, and AI diagnosis. Orion Health and Volpara Health Technologies are two organizations engaged in digital health platforms and AI cancer diagnosis. Government patronage implements digital solutions in the public healthcare sector.

Increased use of telehealth necessitates rural healthcare development. AI-based clinical decision support systems improve diagnosis accuracy, whereas investments in big data analytics boost the effectiveness of healthcare provision. Increased collaboration among medical institutions and technology firms deepens the country's digital healthcare infrastructure.

The technology revolution, powered by advanced technology in artificial intelligence, cloud computing, and data analysis, is revolutionizing the healthcare industry. Telemonitoring, artificial intelligence-based diagnostics, and blockchain-based secure data sharing are increasingly popular among physicians.

The technologies are also becoming increasingly automated in clinical judgment, reducing inefficiencies in processes and empowering patients. Digitalization of the playbook and the necessity of personalized medicine are also forcing the uptake of digital health solutions.

Wearable health devices and telemedicine are leading the revolution, while real-time health tracking and online consultations are made possible. Predictive analytics and AI are being incorporated into their systems by Cerner Corporation, Epic Systems, and GE Healthcare at the revolution's forefront. Cybersecurity takes the top position on healthcare organizations' agendas as they struggle not to let patients' data be victims of cyberattacks and to abide by data protection regulations.

In the face of an increasingly competitive marketplace, companies are employing strategic investing, acquisitions, and R&D spending to finance their digital strategies. Siemens Healthineers and Philips Healthcare are building innovations in robotic surgery and cloud-based electronic health records.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cerner Corporation | 20-25% |

| Epic Systems Corporation | 15-20% |

| GE Healthcare | 12-16% |

| Siemens Healthineers | 10-14% |

| Philips Healthcare | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cerner Corporation | Specializes in cloud-based electronic health records (EHR) and AI-driven analytics. |

| Epic Systems Corporation | Develops sophisticated EHR platforms with integrated telemedicine and patient engagement solutions. |

| GE Healthcare | Invests in AI-enabled imaging, diagnostics, and remote patient monitoring. |

| Siemens Healthineers | Emphasizes digital twin tech, AI-based diagnostics, and smart imaging. |

| Philips Healthcare | Leads with digital therapeutics, wearable health monitoring, and connected care. |

Key Company Insights

Cerner Corporation (20-25%)

Cerner is at the forefront of healthcare digitalization with not only with its cloud-based EHR solutions, using AI but also big data analytics to revamp patient care and operating efficiency.

Epic Systems Corporation (15-20%)

Epic Systems leads healthcare digitalization through its enterprise-level EHR solutions that incorporate telehealth capabilities and predictive analytics for personalized patient care.

GE Healthcare (12-16%)

GE Healthcare is leading the pack in AI-based medical imaging and diagnostics, enabling precision medicine and remote patient monitoring for improved healthcare outcomes.

Siemens Healthineers (10-14%)

Siemens Healthineers offers smart imaging and AI-driven diagnostics, empowering healthcare centers to improve clinical workflows and patient care.

Philips Healthcare (6-10%)

Philips is transforming digital healthcare using its connected care solutions, wearable monitoring devices, and telehealth innovations.

Other Key Players (30-40% Combined)

By solution, the segmentation is into software and service.

By organization size, the segmentation is into small and medium size enterprises, and large enterprises.

By technology, the segmentation is into artificial intelligence, cloud computing, big data & analytics, internet of things, and cybersecurity.

By end user, the segmentation is into hospitals & clinics, pharma companies, life science & biotech companies, and healthcare insurance providers.

By region, the market is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa.

The overall market size for the digital transformation in healthcare market was USD 86.03 Billion in 2025.

The digital transformation in healthcare market is expected to reach USD 351.71 Billion in 2035.

The demand will grow due to the increasing adoption of telemedicine, advancements in AI-driven healthcare solutions, and the rising need for electronic health records (EHRs).

The top 5 contributors to the digital transformation in healthcare market are the USA, China, Germany, Japan, and the UK.

Telehealth, AI-powered diagnostics, and cloud-based healthcare solutions are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Technology , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Solution, 2023 to 2033

Figure 22: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 23: Global Market Attractiveness by Technology , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Technology , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Solution, 2023 to 2033

Figure 47: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 48: North America Market Attractiveness by Technology , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Technology , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Technology , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Technology , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 97: Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 98: Europe Market Attractiveness by Technology , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Technology , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Technology , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Technology , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Technology , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Technology , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Organization Size, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Technology , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Technology , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Technology , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Technology , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Technology , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 197: MEA Market Attractiveness by Organization Size, 2023 to 2033

Figure 198: MEA Market Attractiveness by Technology , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Trust Market Size and Share Forecast Outlook 2025 to 2035

Digital Psychotherapeutics Market Size and Share Forecast Outlook 2025 to 2035

Digital Glass Military Aircraft Cockpit Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport (DPP) Platforms Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digital Fault Recorders (DFR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA