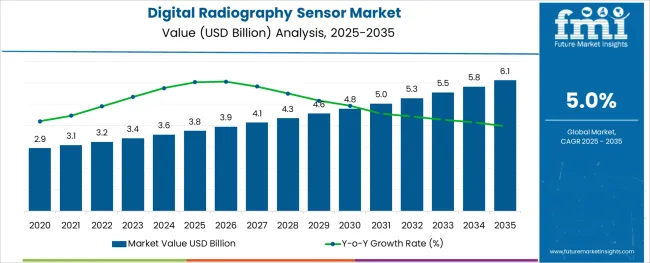

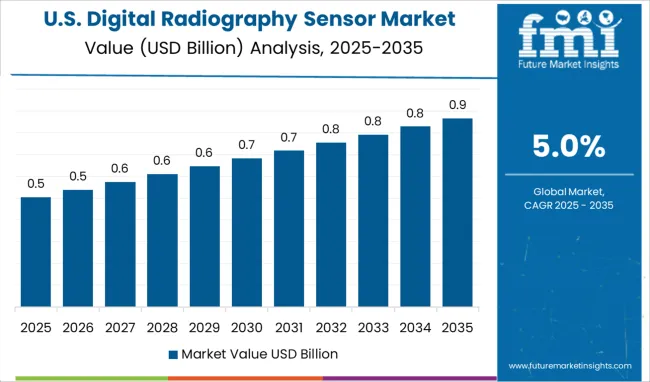

The Digital Radiography Sensor Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The digital radiography sensor market is progressing steadily as healthcare providers prioritize improved imaging efficiency, reduced radiation exposure, and enhanced diagnostic accuracy. The shift from conventional film-based radiography to digital systems has been supported by advancements in detector technologies, demand for faster workflows, and growing emphasis on patient-centric care.

Rising investments in healthcare infrastructure and technological modernization of radiology departments are also contributing to market expansion. Future growth is anticipated as miniaturization of components, integration of artificial intelligence, and adoption of portable systems continue to improve accessibility and affordability.

These factors, coupled with regulatory encouragement for dose reduction and image quality standards, are paving the way for wider adoption and deeper market penetration across diverse clinical settings.

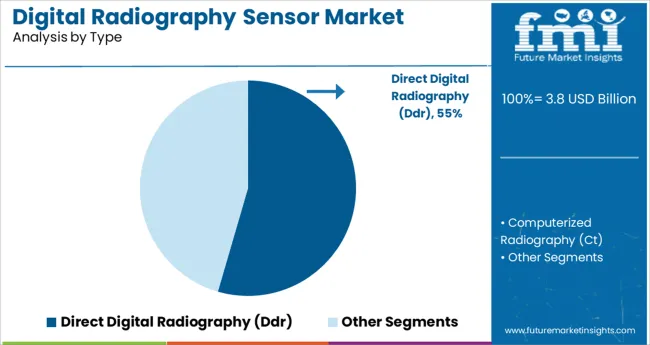

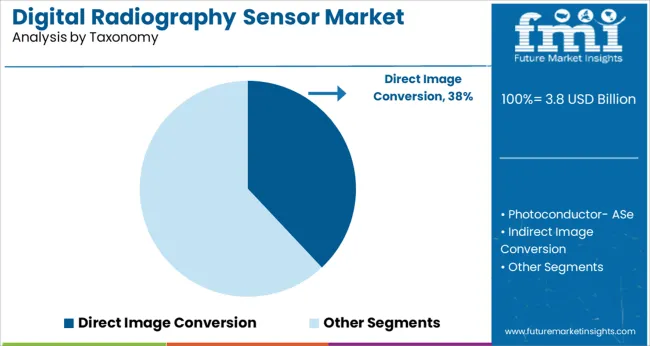

The market is segmented by Type, Taxonomy, Technology, End User, and Modality and region. By Type, the market is divided into Direct Digital Radiography (Ddr) and Computerized Radiography (Ct). In terms of Taxonomy, the market is classified into Direct Image Conversion, Photoconductor- ASe, Indirect Image Conversion, Scintillator- Csl, and Storage Phosphor- BafbrEu2+.

Based on Technology, the market is segmented into Flat-Panel Amorphous Silicon & Cesium Iodide Scintillator Detector - 1995, Phosphors Based Image Plates - 1980, Amorphous-Selenium Based Image Plates - 1987, Slot-Scan Direct Radiography (Dr) Using CCD - 1990, Selenium Drum Dr - 1994, Flat Panel Selenium-Based Detector - 1995, Gadolinium-Based Scintillator Detector - 1997, Flat-Panel Gadolinium-Based Scintillator, Portable Detector - 2001, Flat-Panel Dynamic Detector Fluoroscopy in Digital Subtraction Angiography - 2001, Digital Tomosynthesis - 2006, and Flat-Panel Wireless Dr Detector.

By End User, the market is divided into Specialized Dental Clinics, Diagnostic Imaging Centre, Research And Development Centres And Companies, and Medical Centres And Universities.

By Modality, the market is segmented into Portable and Non-Portable. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the direct digital radiography segment is projected to capture 54.5% of the market revenue in 2025, establishing itself as the leading type. This leadership has been reinforced by the ability of direct systems to deliver superior image resolution, reduced processing times, and lower operational costs compared to indirect or computed radiography systems.

The elimination of intermediate steps and enhanced detector sensitivity have enabled quicker diagnoses and streamlined clinical workflows. The reliability of direct digital radiography in high-throughput environments and its compatibility with modern picture archiving and communication systems have further strengthened its position.

Additionally, the growing awareness among healthcare facilities about long-term cost benefits and improved patient throughput has supported its continued dominance.

By taxonomy, the direct image conversion segment is expected to hold 38.0% of the market revenue in 2025, making it the foremost taxonomy. This prominence has been driven by its ability to convert X-ray photons directly into electrical signals without intermediate steps, thereby achieving superior spatial resolution and minimizing image noise.

The simplification of the conversion process and reduction of signal loss have enhanced image clarity, which is particularly valuable in complex diagnostic scenarios. Direct image conversion has also been observed to improve detector longevity and consistency, supporting its adoption in demanding clinical settings.

The segment’s leadership has been reinforced by its alignment with the healthcare sector’s push for precise, efficient, and reliable diagnostic tools.

Segmenting by technology reveals that flat panel amorphous silicon and cesium iodide scintillator detector technology is projected to secure 42.5% of the market revenue in 2025, making it the dominant technology segment. This dominance has been attributed to its optimal balance of image quality, durability, and cost-effectiveness.

The ability of cesium iodide to provide high light output with reduced radiation dose has improved both patient safety and diagnostic confidence. Furthermore, the integration of amorphous silicon has facilitated large-area imaging with consistent performance, making it suitable for diverse applications including general radiography, orthopedics, and trauma care.

Its widespread acceptance has also been strengthened by its ease of integration into existing digital systems and its proven reliability in high-volume clinical environments.

Recently, the digital radiography sensor is gaining popularity among radiologists due to its convenient work, thus driving the market size. The rising investment companies, R&D activities in the healthcare sector, and government initiative plans are flourishing the market.

The growing digital imaging technology with advanced features is increasing thedemand for digital radiography sensorfor excess use in recent times. Several studies by many radiologists and published by researchers in scientific papers show tremendous market potential.

Initially, the sensors seem too expensive to replace, but technological research has been a helping hand forthe market.Portable digital radiographycan completely replace CR systems in the market during the forecast period.

The players are focusing to build better sensor devices in developed countries such as the UK, the US, Germany and Canada by adopting new waves of technology. The healthcare manufacturers, with government initiatives, bring new products on a large scale in the market for the patient and are growing market expansion.

Digital radiography in literature and in practice are subcategorized on type of sensors into Computerized Radiography and Digital radiography. Digital radiography based on image conversion are two different types namely- Direct digital radiograph and Indirect digital radiograph.

Out of many traditional systems available for projecting radiographs, digital radiograph sensors are being used globally. Thus, digital radiography sensor market has taken over other traditional radiograph market since 1990s and the trend is still being followed.

In USA out of all radiological examinations carried out, radiographical examination accounts 70% in both children and adults, thus digital radiograph sensors market holds a large market size and share.

Exposure to harmful radiations in patients and radiologists is a major concern in imaging systems. It has been found that use of digital radiography sensors have reduced radiation exposure to about 20 to 80%. This has found to be a major driver in growth of the digital radiography sensor market.

More factors influencing digital radiography sensors market such as real time results in case of emergencies, user friendly, low cost of test, less exposure time to radiation, shorter scanning time and readily available portable systems. digital radiography sensor market is governed by high productivity, elimination of costly films, examination of more patients in less time and superior image quality with less background noise helps provide more accurate results.

Digital radiography sensors are popular amongst radiologists and thus indeed driving digital radiography sensor market.

The only restraint in digital radiography sensor market is high cost of digital radiography sensors hindering digital radiography sensor market growth in lower income or developing countries. Hence an affordable and readily available sensors are expected to completely out rule traditional radiography market by digital radiography sensor market.

Present and future of radiography is digital radiography sensor market. Benefits of digital radiography sensor over other imaging systems available have been studied by many radiologists and published by researchers in scientific papers showing tremendous potential for digital radiography sensor market.

Since 3 decades traditional computerized radiography market has been extensively replaced with digital radiography sensor market all over the world. This was due to invention of direct digital radiography using charged-couple device in 1990s and many technological advances over the time, hence leading to alarming growth rate of digital radiography sensor market.

Initially the sensors were found to be too expensive to be completely replaced but research in technology has been helping hand for digital radiography sensor market. While portable digital radiography has thought to completely replace the CR systems in near future and make immense impact on digital radiography sensor market.

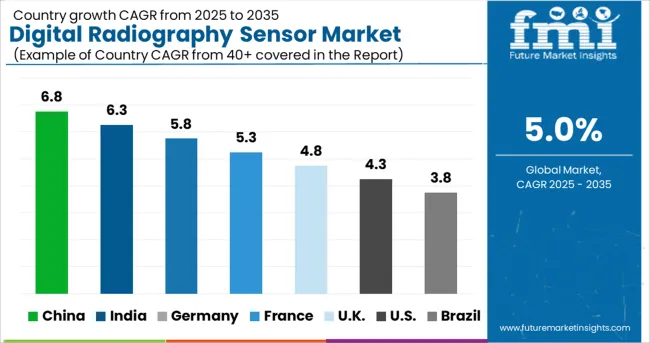

Region wise, the digital radiography sensor market is classified into regions namely, North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific, Japan, Middle East and Africa. North America dominates digital radiography sensor market globally followed by Europe.

Digital radiography sensor market in both America and Europe is driven by the fact of being developed countries, having strong infrastructure for healthcare facilities, awareness and initiative taken by government in use of imaging systems with minimum exposure to harmful radiations and tremendous growth in medical industries, hospitals and research institutes.

In last decade there has been fastest growth of digital radiography sensor market in India, China and rest of the world due to various advancement in technology owing to fast growth in digital radiography sensor market, increase in medical tourism, improvement in healthcare facilities and medical research provided by government.

Dental intraoral sensors in digital radiography is expected to be leading hand in digital radiography sensor market growth worldwide, near future.

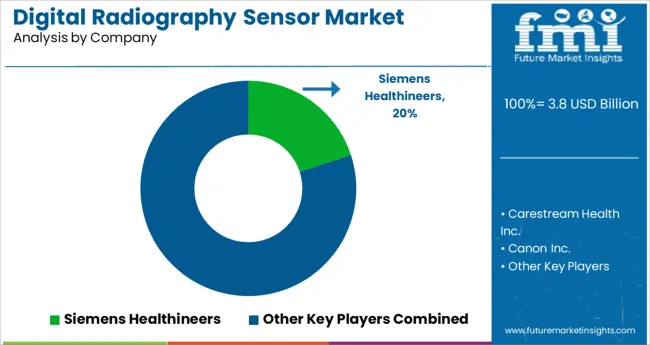

Some of the key players in digital radiography sensor market are Hologic, Inc., Carestream Health Inc., Canon Inc., Siemens Healthcare, Philips Healthcare, GE Healthcare, Hitachi Medical Corporation, Fujifilm Medical Systems. Shimadzu Corporation and Toshiba Medical Systems Corporation.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The digital radiography sensor market is classified on the basis of product type, taxonomy, technology, end user, modality and geography.

The global digital radiography sensor market is estimated to be valued at USD 3.8 USD billion in 2025.

It is projected to reach USD 6.1 USD billion by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are direct digital radiography (ddr) and computerized radiography (ct).

direct image conversion segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA