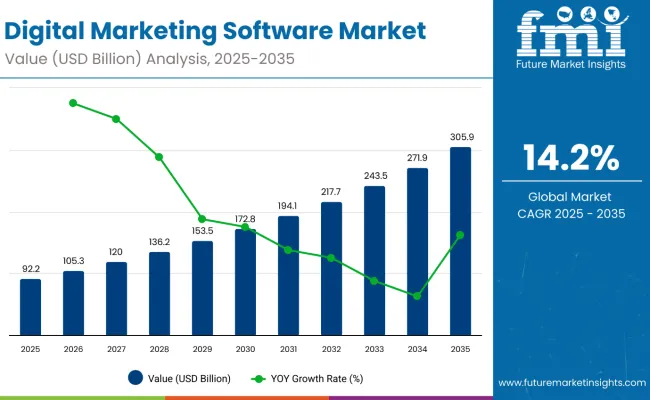

The global Digital Marketing Software market is expected to experience significant expansion, with its value projected to increase from USD 92.2 billion in 2025 to USD 305.9 billion by 2035, reflecting a CAGR of 14.2%. This rapid market growth is being driven by the rising demand for efficient and scalable marketing solutions across diverse industry verticals.

Increasing investments in AI-enabled automation and advanced data intelligence have been integrated into digital marketing platforms to enhance customer engagement and personalize customer journeys at scale. The demand for data-driven decision-making and targeted consumer interaction has been identified as a key factor fuelling the adoption of both software and marketing services in various sectors such as retail, BFSI, healthcare, and e-commerce.

The importance of collaboration with third-party software providers has been increasingly recognized by organizations seeking to strengthen their marketing technology stacks. By leveraging external vendors’ capabilities, advanced analytics, customer segmentation, and personalized content delivery have been enhanced, thereby optimizing marketing strategies and boosting brand presence.

Adoption of digital marketing solutions has been accelerated in sectors requiring strong customer relationships and real-time engagement. Compliance with evolving data privacy regulations, including GDPR and CCPA, has been ensured through the development of secure, transparent, and privacy-compliant marketing tools. This has helped businesses maintain customer trust while meeting regulatory requirements in the digital ecosystem.

North America has been observed to dominate the digital marketing software market due to the high concentration of software vendors and increasing demand for innovative marketing technologies. Growth in this region is further supported by a heightened focus on cybersecurity and compliance management.

Additionally, the adoption of digital marketing tools has been steadily increasing in emerging markets such as India and Australia, providing further momentum to the global market. As confirmed by Lisa Stevens, Chief Marketing Officer at Salesforce, “The digital marketing software landscape is evolving rapidly, driven by AI-enabled automation and data intelligence.

Marketers now have unprecedented tools to personalize customer journeys at scale, enhancing engagement and delivering measurable business value”. This statement underscores the critical role that artificial intelligence and automation are expected to play in sustaining robust growth in the digital marketing software market through 2035.

| Attributes | Details |

|---|---|

| Market Value (2025) | USD 92.2 Billion |

| Market Value (2035) | USD 305.9 Billion |

| CAGR (2025 to 2035) | 14.2% |

Leading digital marketing software companies are integrating smart technologies such as artificial intelligence, machine learning, predictive analytics, natural language processing, and automation to enhance targeting, personalization, and campaign efficiency. These tools are transforming how businesses engage with customers across channels like email, social media, search, and e-commerce.

The below table presents the expected CAGR for the global Digital Marketing Software market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Digital Marketing Software industry and identifies revenue trends, offering key decision-makers an understanding of market performance throughout the year.

H1 represents the first half of the year, from January to June, and H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the Digital Marketing Software market is predicted to surge at a CAGR of 13.0%, followed by a slightly higher growth rate of 15.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 13.0% (2024 to 2034) |

| H2 2024 | 15.0% (2024 to 2034) |

| H1 2025 | 13.7% (2025 to 2035) |

| H2 2025 | 15.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to slightly increase to 13.7% in the first half and 15.4% in the second half. In the first half (H1), the market witnessed an increase of 70 BPS; in the second half (H2), the market witnessed a rise of 40 BPS.

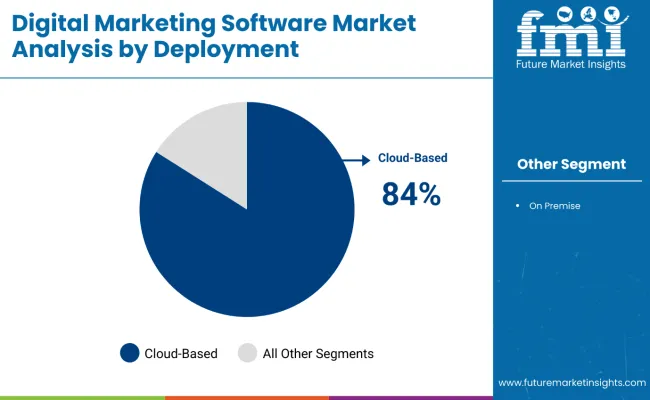

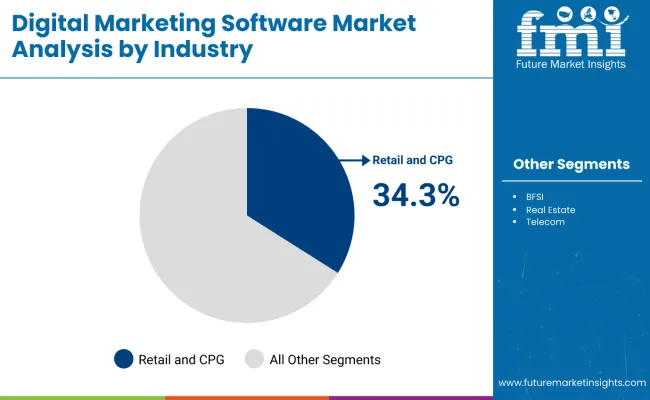

Strong growth is being driven by cloud-based deployment and retail & consumer packaged goods (CPG) industries in the digital marketing software (DMS) market. These segments are attracting significant investments due to their scalability, cost-effectiveness, and ability to deliver personalized marketing solutions.

The digital marketing software market has been significantly influenced by the rapid adoption of cloud-based deployment solutions, which are expected to grow at a CAGR of 15.9% from 2025 to 2035. Cloud-based platforms provide scalable, flexible, and cost-effective tools that facilitate campaign automation, customer data management, and Omni channel engagement.

Their affordability and real-time collaboration features have led to widespread adoption, especially among SMEs and start-ups seeking effective marketing solutions with low entry costs. Global government initiatives, such as the USA government’s Cloud Smart Strategy, have further accelerated the migration toward cloud-hosted marketing platforms.

Major technology providers such as Salesforce, Adobe, and HubSpot are investing heavily in cloud innovations to offer AI-powered marketing automation and analytics. The ability to consolidate marketing operations and enhance agility is driving cloud deployment to become a key growth segment within the digital marketing software industry.

Retail and consumer packaged goods (CPG) industries are leading the adoption of digital marketing software, capturing an estimated 34.3% market share in 2025. This sector leverages AI-driven personalization, real-time data analytics, and Omni channel engagement to optimize customer experiences and drive e-commerce growth.

Retailers and FMCG companies increasingly use marketing automation tools to create hyper-personalized promotions, loyalty programs, and AI-based product recommendations. Key players such as Amazon, Procter & Gamble, and Walmart utilize digital marketing software extensively to boost brand visibility and track consumer behavior efficiently.

Regulatory frameworks, including the USA Federal Trade Commission’s stricter rules on targeted advertising, have pushed retailers to adopt compliance-focused marketing solutions. This regulatory environment, combined with the evolving consumer digital journey, is ensuring that the retail and CPG sector remains a dominant force in the digital marketing software market.

Increasing demand for data-driven insights to improve marketing strategies

Digital Marketing Software Market expands as data-driven insights gain traction. At a time when businesses are looking for paths to optimize their campaign mechanics, data from different sources become a need from which the direction of decisions will be derived. With the ability to analyze massive amounts of consumer data, marketers can gather insights about customer behavior, preferences, and trends.

Data analytics and marketing platforms are powerful tools that give marketers the ability to develop microtargeted campaigns, optimize content, and monitor the results of their efforts in real time.

Digital marketing software can monitor and collect a massive amount of data that it can use with AI (artificial intelligence) and machine learning algorithms to deliver predictive analytics to the user to influence decision making, so that marketers can anticipate customer needs and optimize their strategies accordingly. The growing demand for data-driven marketing solutions promises to improve customer interactions and boost return on investment (ROI) as personalization progresses.

Growth of social media and mobile marketing fueling software adoption

The explosion of social media and mobile marketing has been a significant driver of the growth of digital marketing software. From Facebook and Instagram to Twitter and TikTok, with billions of active users globally, businesses have a unique opportunity to reach their target audiences. Social media platforms generate enormous amounts of data, which, combined with digital marketing software, enables brands to create hyper-relevant content for their audience.

Mobile marketing has also emerged as a powerhouse with the proliferation of smartphones and applications. Enterprises are increasingly concentrating on providing fluid mobile experiences via responsive websites, mobile applications, and location-based marketing.

These needs are being met by evolving digital marketing software solutions that include tools for social media management, performance analysis, and mobile ad tracking as features. Social media has made such software sentient, as they are capable of running targeted ads and measuring campaigns based on success.

Rising use of chatbots and conversational marketing solutions

Chatbots and conversational marketing solutions are revolutionizing how businesses communicate with their customers. Integrating Artificial Intelligence (AI) and natural language processing (NLP) into digital marketing software, chatbots are now being widely used to provide personalized and real-time customer service. Such AI-powered tools allow companies to connect with customers at scale, respond to questions in real time, and carry out transactions.

Besides customer service, chatbots are also increasingly being used for generating leads and sales and lead follow-ups, as they pre-qualify prospects and lead them through the sales funnel. As a result, companies have increasingly turned to conversational marketing, which aims to foster a more humanistic experience in the connections between brands and customers over messaging applications, websites, and voice assistants.

Business operations can be enhanced by the value of AI and chatbots recognized by Governments. For instance, the government has shown support for AI research and development in the United States, such as the National AI Initiative Act of 2020, which aims to promote the development and application of AI technologies, including conversational tools in marketing and customer support.

High integration costs with existing enterprise systems hinder adoption

The high cost of integrating digital marketing software into existing enterprise systems is one of the biggest barriers to adopting digital marketing software. Many businesses rely on legacy IT infrastructure and struggle to integrate new marketing software into the existing environment, often requiring expensive upgrades or extensive modifications.

It is a time-consuming and expensive affair when customizing digital marketing software with customer relationship management (CRM), enterprise resource planning (ERP) software, and data analytics platforms.

Other industries have had to reinvest in extensive middleware, APIs, logic, and engineers for integration. As for data exchange, even complex workflows do what they are told, and data can be put in moves (the separate rows).

In contrast, smaller businesses often find it difficult to cover the integration expenses, hampering their efforts to use sophisticated marketing software. In addition, inconsistent data formats and siloed information across various departments can delay the integration process and create inefficiencies.

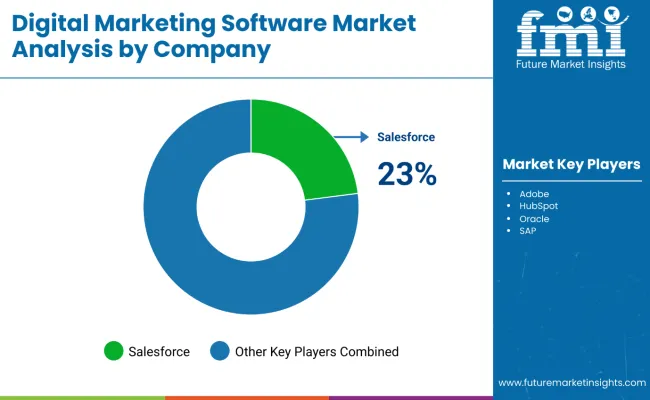

Tier 1 vendors have a significant presence in the global digital marketing software market due to their wide range of product offerings and global footprint across five continents. Some companies at the forefront, such as Adobe, Salesforce, Oracle, HubSpot, and SAP, offer expansive digital marketing suites that boast powerful functionality such as predictive analytics, personalized customer engagement, and omnichannel integration.

And that they have established solid relationships with enterprises in similar or related areas, securing multi-million and multi-year contracts with high customer retention levels.

Examples: Tier 2 vendors list of mid-sized companies with niche solutions for specific marketing requirements like social media management, email automation, and content marketing. Within this segment, players such as ActiveCampaign, Zoho, Marketo, and Mailchimp differentiate themselves by providing price-competitive and scalable solutions to small and medium enterprises (SMEs). These vendors are also geared towards innovations and integrations into third-party applications to increase adoption.

Tier 3 vendors consist of new entrants and niche vendors with specialized or industry-specific digital marketing software. These are mostly startups or regional firms specialized in point solutions for marketing automation, AI-driven chatbots, or influencer marketing. Although their market share is modest, their nimbleness and creative strategies put them in a position to grow in niche segments in the future.

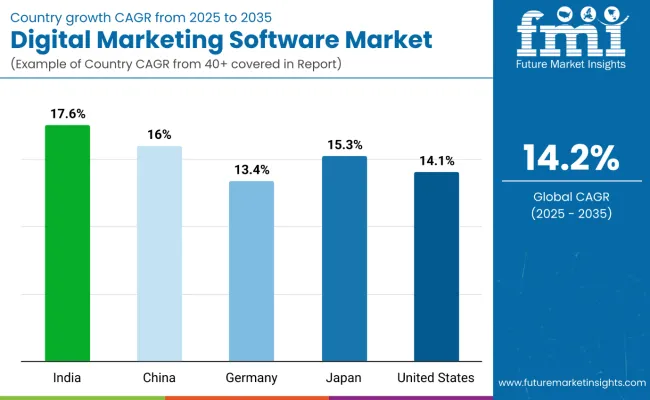

The section highlights the CAGRs of countries experiencing growth in the Digital Marketing Software market and the latest advancements contributing to overall market development. Based on current estimates, China, India, and the USA are expected to grow steadily during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 17.6% |

| China | 16.0% |

| Germany | 13.4% |

| Japan | 15.3% |

| United States | 14.1% |

There has been rapid digitization across India over the last few years owing to high internet penetration, growing smartphone, and government-led initiatives to push for digital adoption in the country. Cloud-based digital marketing software is being implemented in various businesses that handle daily operations, improve overall customer engagement, and optimize campaign management.

Companies are looking for cost-effective, scalable, and flexible marketing tools to cater to the country’s varied consumer base, which has resulted in increasing demand for cloud solutions. The deployment of cloud-based platforms is a key factor in the growth of adoption of cloud accounting software, especially among small and medium enterprises (SMEs) with affordable and easy-to-deploy solutions.

Digital transformation has been brought about with significant contributions from the Indian government's Digital India initiative. The program has connected 500,000+ villages to the internet making digital engagements between businesses and consumers possible. The Digital Marketing Software market in India is projected to grow at a robust growth rate of 17.1% from 2025 to 2035.

In fact, in recent years the American market saw a major shift to the side of AI app predictive analytics in digital marketing, enabling businesses to target customers better, personalize content, and optimize ad spend. In a highly competitive online world, companies are using predictive analytics to predict customer behavior, optimize lead generation, and improve (sales) campaign effectiveness.

These AI-powered solutions leverage data and algorithms to provide market research and analysis that help businesses decide on targeting, budgeting, and messaging for high return on investment (ROI).

American large enterprises, E-commerce companies, and media companies are at the forefront of this trend, integrating AI models to process customer interactions in gaming apps and automated recommendations of other users for 2nd tools and 3rd tools with walking by news or underscores, in a game-changing into a new, including with a certain type of 'freemium' models in their web-based content.

Increased investment in AI development, including a USD 1.5 billion AI research fund from the US government, has factored into adopting AI-powered marketing solutions. Federal agencies are also increasingly leveraging AI-based analytics to improve public engagement campaigns. The USA Digital Marketing Software market is expected to reach around USD 89 Billion with a CAGR of 14.1% throughout the forecast period.

With intelligent automation being increasingly adopted by businesses to improve customer engagement and optimize workflows, China is becoming a powerhouse in AI-influenced marketing. AI-driven chatbots, personalized recommendations, and automated content creation tools have transformed digital marketing approaches in the country.

Businesses utilize artificial intelligence to sift through huge amounts of data, foresee customer tastes, and generate hyper-targeted advertising efforts. Big e-commerce players, such as Alibaba and JD. Com is leading the way, using AI-powered insights to improve user experiences and achieve higher conversion rates.

The Chinese government’s top-down push for AI development has been another big adoption accelerator. The New Generation AI Development Plan has allocated USD 150 billion in AI investments by 2030, enhancing innovation in multiple industries, including digital marketing.

Moreover, the government's focus on smart city initiatives has propelled enterprises to implement AI-based automation in their marketing strategy to expand their digital reach. China is expected to make a profound impact on the Digital Marketing Software market, significantly holding a dominant share of 59.2% in 2025.

With the growing adoption of AI-driven tools for automation, analytics, and personalization, the competition in the digital marketing software market is becoming more intense. Companies are distinguishing themselves by providing features, including data insights in real-time, omnichannel marketing, and improved target audience segmentation.

This is why it is very important to be flexible and scalable simultaneously to keep up with the competition in this time of a great shift to cloud-based solutions. Moreover, vendors continue to invest in their AI, machine learning and predictive analytics integrations to enable better-performing marketing campaigns.

Industry Update

| Report Attributes | Details |

|---|---|

| Market Value (2025) | USD 92.2 Billion |

| Market Value (2035) | USD 305.9 Billion |

| CAGR (2025 to 2035) | 14.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Component Segments Analyzed (Segment 1) | Software, Services |

| Deployment Segments Analyzed (Segment 2) | Cloud Based, On Premise |

| Industry Segments Analyzed (Segment 3) | BFSI, Retail and CPG, Healthcare, Real Estate, Travel and Hospitality, Media and Entertainment, Telecom, Others |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East and Africa (MEA); Europe |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Digital Marketing Software Market | Adobe, Salesforce, HubSpot, Oracle, Microsoft, SAP, Marketo, Pega Systems, ActiveCampaign, Mailchimp |

| Additional Attributes | Dollar sales by component (software vs services), Dollar sales by deployment (cloud vs on premise), Industry-wise adoption trends, Impact of AI and automation in digital marketing, Growth of personalized marketing solutions, Regional technology adoption patterns, Competitive strategies and partnerships |

In terms of component, the segment is divided into software and services.

In terms of deployment, the segment is segregated into Cloud Based and On Premise.

In terms of industry, the segment is segregated into BFSI, Retail and CPG, Healthcare, Real Estate, Travel and Hospitality, Media and Entertainment, Telecom and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Digital Marketing Software industry is projected to witness CAGR of 14.2% between 2025 and 2035.

The Global Digital Marketing Software industry stood at USD 92.2 Billion in 2025.

The Global Digital Marketing Software industry is anticipated to reach USD 305.9 Billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.5% in the assessment period.

The key players operating in the Global Digital Marketing Software Industry Adobe, Salesforce, HubSpot, Oracle, Microsoft, SAP, Marketo, Pega Systems, ActiveCampaign, Mailchimp.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Deployment , 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033bb

Figure 1: Global Market Value (US$ Million) by Service, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Software, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Service, 2023 to 2033

Figure 22: Global Market Attractiveness by Software, 2023 to 2033

Figure 23: Global Market Attractiveness by Deployment , 2023 to 2033

Figure 24: Global Market Attractiveness by Application, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Service, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Software, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Attractiveness by Service, 2023 to 2033

Figure 47: North America Market Attractiveness by Software, 2023 to 2033

Figure 48: North America Market Attractiveness by Deployment , 2023 to 2033

Figure 49: North America Market Attractiveness by Application, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Service, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Software, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Service, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Software, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Deployment , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Software, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Service, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Software, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Deployment , 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Software, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Service, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Software, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Deployment , 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Service, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Software, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Service, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Software, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Deployment , 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Service, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Software, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Service, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Software, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Deployment , 2023 to 2033

Figure 174: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Service, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Software, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Deployment , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Deployment , 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment , 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment , 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Service, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Software, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Deployment , 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Pen Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA