The digital freight matching market is projected to increase from USD 39.4 billion in 2025 to USD 230.2 billion by 2035, expanding at a CAGR of 19.3%. Growth is being driven by the need for efficiency in freight logistics, where shippers and carriers benefit from automated platforms that reduce empty miles and optimize load utilization. Increased e-commerce activity and globalization of supply chains are creating a stronger need for flexible freight solutions, making digital matching platforms critical for cost and time savings.

Technology integration, such as AI, IoT, and blockchain, is enhancing visibility, predictive analytics, and trust within logistics networks. Partnerships between logistics providers, tech firms, and transport operators are accelerating adoption. Despite strong momentum, challenges such as regulatory compliance, cybersecurity, and resistance from traditional freight brokers may restrain expansion. Nonetheless, high demand for real-time tracking and dynamic pricing is expected to ensure rapid adoption across global logistics.

| Metric | Value |

|---|---|

| Digital Freight Matching Market Estimated Value in (2025 E) | USD 39.4 billion |

| Digital Freight Matching Market Forecast Value in (2035 F) | USD 230.2 billion |

| Forecast CAGR (2025 to 2035) | 19.3% |

The digital freight matching market has been increasingly recognized as a transformative segment within multiple broader industries, each reflecting measurable adoption and operational significance. Within the freight transport management market, digital freight matching accounts for approximately 7.6%, driven by its ability to connect shippers and carriers seamlessly, reducing inefficiencies and improving asset utilization. In the supply chain management market, its share is estimated at 6.4%, as digital platforms enable real-time visibility, load optimization, and improved resource allocation across transport networks.

The logistics technology market records a penetration of about 8.2%, reflecting the central role of digital freight platforms in automating workflows, reducing empty miles, and ensuring timely deliveries. Within the freight and cargo services market, digital freight matching accounts for roughly 5.7%, underscoring its importance in optimizing freight brokerage and minimizing manual intervention. In the e-commerce logistics market, the share stands at around 6.9%, with rising adoption fueled by demand for faster, more reliable, and scalable delivery solutions.

Its adoption has been driven by the pursuit of efficiency, transparency, and reliability, compelling logistics providers and carriers to adopt digital platforms as indispensable tools for competitive advantage. The market has been reshaping cost structures, reducing operational bottlenecks, and driving customer-centric approaches, positioning digital freight matching as a decisive force influencing strategic directions across its parent industries.

The digital freight matching market is expanding steadily, supported by the rapid adoption of digitalization in logistics operations and the growing emphasis on operational efficiency in freight transportation. The market is currently shaped by increasing freight volumes, the proliferation of connected devices, and the need for real-time visibility in supply chains.

Rising pressure on freight operators to reduce empty miles and improve asset utilization has driven the uptake of technology platforms that facilitate seamless matching of loads with available carriers. Furthermore, cost optimization and time savings offered by digital freight solutions have positioned them as a critical enabler in modern logistics.

The competitive landscape is increasingly influenced by the integration of artificial intelligence, predictive analytics, and automation into matching algorithms, enhancing accuracy and reliability. The market is poised for sustained growth as shippers and carriers continue to shift from manual and broker-based models toward fully digital, transparent, and data-driven freight management systems.

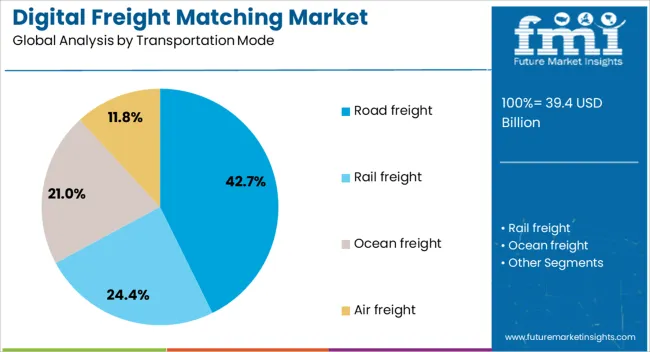

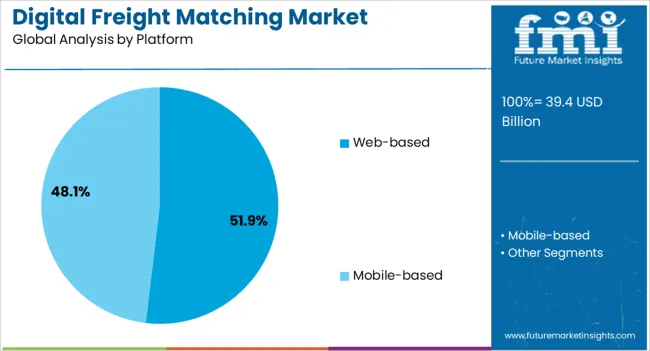

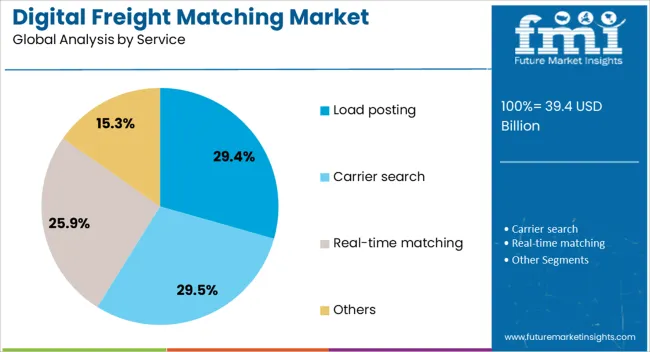

The digital freight matching market is segmented by transportation mode, platform, service, end use, industry vertical, and geographic regions. By transportation mode, digital freight matching market is divided into Road freight, Rail freight, Ocean freight, and Air freight. In terms of platform, digital freight matching market is classified into Web-based and Mobile-based. Based on service, digital freight matching market is segmented into Load posting, Carrier search, Real-time matching, and Others.

By end use, digital freight matching market is segmented into Shippers, Carriers, Freight brokers, 3PL, and Others. By industry vertical, digital freight matching market is segmented into Retail & E-commerce, Food & beverages, Manufacturing, Oil & gas, Automotive, Healthcare, and Others. Regionally, the digital freight matching industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The road freight segment accounts for approximately 42.7% of the transportation mode category in the digital freight matching market, reflecting its dominance in short-haul and long-haul logistics operations. This leadership is largely attributed to the extensive network coverage and flexibility that road freight offers compared to other transportation modes.

The segment’s growth has been driven by the increasing integration of telematics and GPS-based tracking, enabling more precise load matching and route optimization. Additionally, the high share is supported by the rising need for last-mile delivery solutions, especially in e-commerce and retail supply chains, where road freight provides faster and more adaptable services.

The scalability of digital platforms in managing diverse fleet sizes and shipment volumes has further strengthened adoption within this mode. With continued investments in connected truck technologies and regulatory support for digitalization in transport, road freight is expected to maintain its leading position in the forecast period.

The web-based segment leads the platform category, representing about 51.9% of the market share. Its dominance stems from the widespread accessibility of browser-based solutions that do not require extensive hardware investment or complex installation processes. This delivery model allows shippers and carriers to quickly adopt and scale digital freight matching tools across different geographies and fleet structures.

The segment has grown significantly due to its cost-effectiveness, ease of integration with existing enterprise systems, and compatibility with multiple devices. Moreover, web-based platforms offer real-time data sharing, contract management, and secure payment processing, which have strengthened user confidence and retention.

The flexibility to access services remotely and the constant updates enabled by cloud-hosted infrastructures have further reinforced market leadership. As enterprises continue to prioritize agility and interoperability in their digital ecosystems, the web-based segment is projected to retain its strong position over the forecast horizon.

The load posting segment holds a 29.4% share in the service category, underpinned by its role as a fundamental function in digital freight marketplaces. This service enables shippers to post available loads instantly, allowing carriers to respond quickly and secure bookings without prolonged negotiation cycles.

The growth of this segment has been reinforced by the increasing demand for time-sensitive freight solutions and the need to reduce idle truck capacity. Load posting services have evolved with enhanced search filters, automated matching algorithms, and real-time notifications, improving efficiency for both shippers and carriers.

The high level of transparency in pricing and availability has further encouraged adoption, particularly among small and medium-sized freight operators seeking to expand their customer base. As competition in freight marketplaces intensifies, the load posting segment is expected to benefit from continuous technological upgrades and its central role in the operational workflow of digital freight matching platforms.

The digital freight matching market has been influenced by the rising adoption of automated logistics platforms, growing e-commerce, and increased cross-border trade. Demand has been supported by the need for faster, more reliable, and cost-effective freight services. Opportunities are being created in expanding real-time visibility, small carrier integration, and scalable digital solutions. Trends reflect the industry’s move toward automated route planning, enhanced predictive analytics, and growing partnerships between shippers and digital platforms. However, challenges remain in driver availability, data security, and fragmented adoption across regions.

The demand for digital freight matching has been strongly driven by shippers and carriers seeking transparency, efficiency, and reduced empty miles. Industries have been observed placing greater reliance on digital platforms to locate available freight and carriers in real time, ensuring optimized resource use. In opinion, the accelerating demand for quicker delivery cycles, influenced by global e-commerce and manufacturing supply chains, has made digital freight matching indispensable. Companies are increasingly using these platforms to reduce logistics costs, improve load efficiency, and enhance service reliability. Small and mid-sized carriers are also being drawn to these platforms for improved market access and fairer pricing opportunities. Demand has therefore been reinforced by the combined need for operational efficiency, competitive pricing, and better shipment visibility, positioning digital freight matching as an essential tool for the modern freight ecosystem.

Opportunities in the digital freight matching market have been driven by the integration of small and independent carriers into digital ecosystems and the expansion of scalable freight solutions. These platforms have been seen as effective in bridging the gap between fragmented carriers and larger shippers, providing greater capacity access and flexibility. In opinion, significant opportunities lie in offering small fleets access to advanced freight networks that were previously dominated by large-scale operators. The creation of scalable, cloud-based platforms that allow businesses to expand capacity on demand is presenting further avenues for growth. Regional expansion, partnership-driven models, and innovative financing options for small carriers are also emerging as lucrative opportunities. Overall, the opportunity landscape is being shaped by the growing inclusion of smaller players and the scalability of digital freight solutions to meet dynamic logistics requirements.

The digital freight matching market has been shaped by trends in predictive analytics, automated route planning, and enhanced carrier-shipper collaborations. Platforms are being increasingly adopted to improve decision-making by forecasting demand, identifying capacity shortages, and reducing delays through predictive algorithms. In opinion, this movement reflects a practical approach to logistics management, where efficiency and reliability are prioritized over traditional freight handling practices. The trend toward automating route optimization has been seen as particularly impactful, as it reduces empty miles and improves resource allocation. Integration of telematics, digital payment solutions, and real-time freight tracking is further consolidating these platforms into mainstream logistics operations. These observed trends indicate a broader shift toward intelligent freight ecosystems where data-driven insights and automated processes play a defining role in ensuring logistics competitiveness.

The digital freight matching market has faced notable challenges, particularly in terms of data privacy, trust among users, and inconsistent adoption across regions. Carriers and shippers have expressed concerns about sharing sensitive information, leading to hesitation in adopting fully digital solutions. In opinion, this challenge has been compounded by fragmented logistics regulations and varied digital infrastructure across countries, which creates barriers to universal adoption. Shortages of qualified drivers and fluctuating freight rates have also intensified difficulties for platform operators in ensuring consistent service delivery. Data security breaches, if left unchecked, could undermine user confidence in digital freight systems, slowing adoption rates. Furthermore, regional disparities in connectivity and digital literacy have hindered uniform market penetration. These challenges highlight the need for stronger trust-building measures, robust security frameworks, and policy alignment to stabilize long-term growth in digital freight matching.

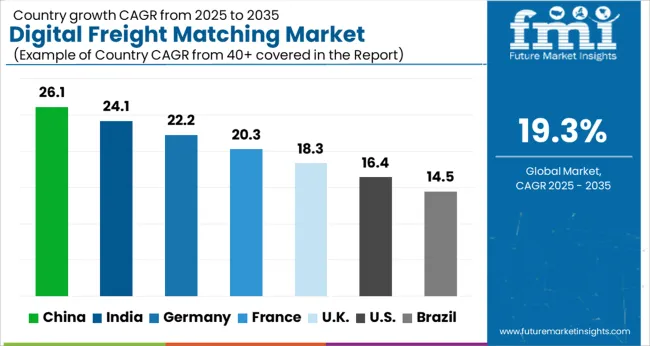

| Country | CAGR |

|---|---|

| China | 26.1% |

| India | 24.1% |

| Germany | 22.2% |

| France | 20.3% |

| UK | 18.3% |

| USA | 16.4% |

| Brazil | 14.5% |

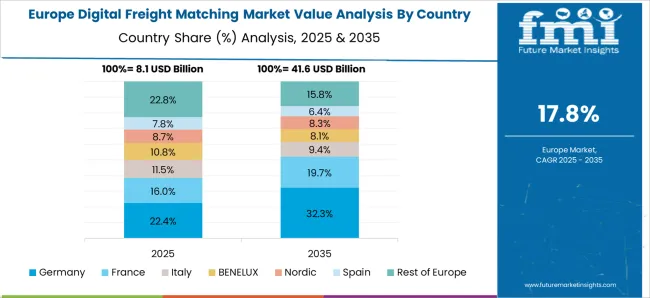

The global digital freight matching market is projected to grow at a CAGR of 19.3% between 2025 and 2035. China leads with 26.1% growth, followed by India at 24.1% and France at 20.3%. The United Kingdom records 18.3%, while the United States expands at 16.4%. Growth is being shaped by increased adoption of real-time logistics platforms, higher reliance on freight digitization, and rising e-commerce shipments. Emerging economies such as China and India benefit from the rapid expansion of logistics networks, while European markets like France and the UK focus on operational efficiency. The USA market remains steady, with strong demand for cost-effective solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The digital freight matching market in China is expanding at a CAGR of 26.1%, led by the rapid integration of online freight platforms into logistics and supply chain operations. Growth is reinforced by the country’s large e-commerce sector, expanding cross-border trade, and government-backed efforts to digitize logistics infrastructure. The Chinese market benefits from strong participation of tech-based logistics providers, which are increasingly optimizing routes, reducing empty miles, and cutting operational costs. Domestic adoption is further supported by strong demand from manufacturers and retailers who rely on timely and efficient freight solutions to sustain supply chains across diverse regions.

The digital freight matching market in India is advancing at a CAGR of 24.1%, driven by high logistics demand, growing e-commerce, and significant investments in supply chain digitization. India’s fragmented trucking sector is finding strong value in digital platforms that streamline shipper-carrier interactions and improve truck utilization rates. Growth is reinforced by government initiatives supporting digital logistics, increased funding for freight-tech startups, and expanding demand for same-day and last-mile delivery solutions. The adoption of digital freight systems is also supported by rising expectations for efficiency in industrial supply chains and continued expansion of export-oriented manufacturing hubs.

The digital freight matching market in France is projected to grow at a CAGR of 20.3%, supported by the need for improved logistics efficiency, reduced freight costs, and growing adoption of digital solutions in transportation. The French market is being shaped by strong participation of third-party logistics firms that are integrating freight-matching technologies into their operations. Growth is reinforced by the expansion of e-commerce deliveries, demand for sustainable supply chain practices, and rising pressure to optimize freight movements across the European Union. France benefits from advanced logistics infrastructure and government-backed initiatives that encourage digital freight transformation.

The digital freight matching market in the United Kingdom is recording a CAGR of 18.3%, with growth supported by strong logistics demand, digital adoption among carriers, and increased e-commerce shipments. Freight digitization is reshaping the UK logistics landscape as companies focus on reducing costs and improving transparency in supply chains. Market expansion is reinforced by investments in freight-tech platforms, government initiatives encouraging digital logistics adoption, and growing demand for cross-border shipping optimization. The market also benefits from the integration of AI-driven solutions that enable predictive freight planning and improved truck utilization rates.

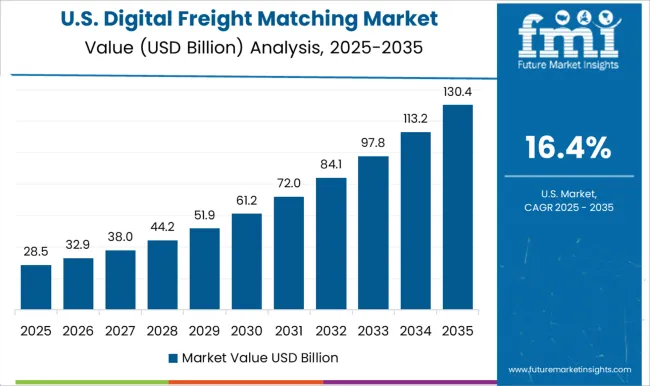

The digital freight matching market in the United States is expanding at a CAGR of 16.4%, driven by high demand for cost-efficient freight movement, increased e-commerce penetration, and greater focus on eliminating inefficiencies in trucking. The USA market benefits from a strong network of freight brokers and digital logistics providers who are reshaping the freight ecosystem. Growth is supported by rising expectations for on-demand freight solutions, widespread smartphone adoption among truck drivers, and the integration of real-time tracking and AI-based freight-matching capabilities. Market adoption is further reinforced by large-scale investments in freight digitization and logistics infrastructure modernization.

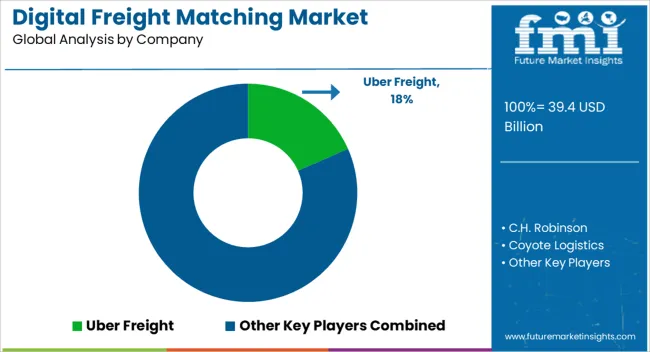

The digital freight matching market is being shaped by logistics giants, digital-first startups, and data-driven platform providers competing for efficiency and scale. Uber Freight, C.H. Robinson, and J.B. Hunt are being positioned as dominant players by leveraging their extensive carrier networks and digital ecosystems that optimize freight visibility and real-time load matching. Their strategy is being executed with AI-driven pricing engines, predictive analytics, and scalable platforms designed for shippers and carriers alike. Coyote Logistics, XPO Logistics, and Echo Global Logistics are being recognized for integrating brokerage expertise with digital matching, ensuring capacity utilization and reduced empty miles.

Loadsmart, Transfix, and DAT Freight & Analytics are being directed toward platform specialization, focusing on automation, real-time market intelligence, and smart bidding systems. Trucker Path is being noted for community-driven engagement, providing mobile-first solutions that prioritize driver usability and load accessibility. Competition is being determined by platform scalability, predictive accuracy, and integration capabilities, while market leadership is being reinforced by customer trust, data-driven decision-making, and proven cost efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.4 Billion |

| Transportation Mode | Road freight, Rail freight, Ocean freight, and Air freight |

| Platform | Web-based and Mobile-based |

| Service | Load posting, Carrier search, Real-time matching, and Others |

| End Use | Shippers, Carriers, Freight brokers, 3PL, and Others |

| Industry Vertical | Retail & E-commerce, Food & beverages, Manufacturing, Oil & gas, Automotive, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uber Freight, C.H. Robinson, Coyote Logistics, DAT Freight & Analytics, Echo Global Logistics, J.B. Hunt, Loadsmart, Transfix, Trucker Path, and XPO Logistics |

| Additional Attributes | Dollar sales by platform type (app-based, web-based) and application (full truckload, less-than-truckload, last-mile delivery) are key metrics. Trends include rising adoption of digital logistics solutions, growth in e-commerce and on-demand freight services, and increasing preference for real-time visibility. Regional adoption, carrier networks, and automation are driving market growth. |

The global digital freight matching market is estimated to be valued at USD 39.4 billion in 2025.

The market size for the digital freight matching market is projected to reach USD 230.2 billion by 2035.

The digital freight matching market is expected to grow at a 19.3% CAGR between 2025 and 2035.

The key product types in digital freight matching market are road freight, rail freight, ocean freight and air freight.

In terms of platform, web-based segment to command 51.9% share in the digital freight matching market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA