The digital X-ray equipment market is expanding steadily due to the growing need for advanced imaging solutions that provide faster diagnostics, reduced radiation exposure, and improved image quality. Rising healthcare investments, increasing patient volumes, and the adoption of digital healthcare infrastructure are accelerating market penetration across developed and emerging regions.

The integration of artificial intelligence and cloud-based imaging platforms is improving diagnostic accuracy and workflow efficiency, supporting the shift from conventional radiography to digital systems. Hospitals and diagnostic centers are prioritizing system upgrades to enhance patient throughput and streamline reporting processes.

The future outlook remains positive as governments and healthcare providers continue investing in modernization initiatives, and vendors focus on developing cost-effective, portable, and high-resolution imaging systems Growth rationale is built upon the rising burden of chronic diseases, demand for real-time imaging, and continuous technological advancement, collectively ensuring consistent expansion of the digital X-ray equipment market across clinical and operational settings.

| Metric | Value |

|---|---|

| Digital X-Ray Equipment Market Estimated Value in (2025 E) | USD 7.8 billion |

| Digital X-Ray Equipment Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

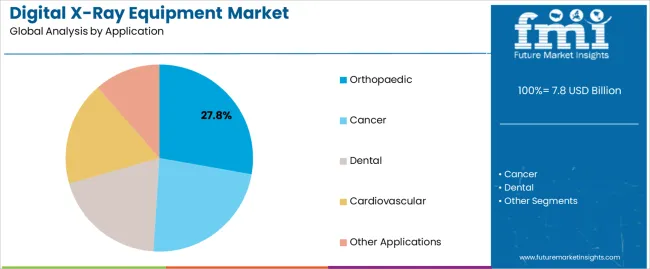

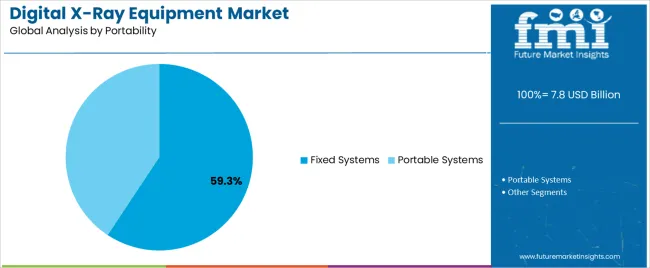

The market is segmented by Application, Product, Portability, and End User and region. By Application, the market is divided into Orthopaedic, Cancer, Dental, Cardiovascular, and Other Applications. In terms of Product, the market is classified into Direct Radiography and Computed Radiography. Based on Portability, the market is segmented into Fixed Systems and Portable Systems. By End User, the market is divided into Hospitals, Diagnostic Centres, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The orthopaedic segment, accounting for 27.80% of the application category, has been leading due to the high volume of musculoskeletal examinations and increasing incidence of fractures, arthritis, and bone disorders. Demand has been strengthened by the ability of digital X-rays to deliver detailed skeletal imaging with minimal exposure and faster turnaround time.

Healthcare providers are increasingly utilizing these systems for preoperative planning, post-surgical assessment, and injury monitoring. The segment’s performance is being enhanced by advancements in image processing algorithms and the availability of integrated diagnostic software that aids orthopedic evaluation.

As hospitals and specialty clinics continue to adopt digital radiography for improved accuracy and workflow efficiency, the orthopaedic application is expected to maintain its strong contribution to market growth over the forecast period.

The direct radiography segment, holding 54.60% of the product category, dominates due to its ability to provide superior image quality, immediate visualization, and reduced operational downtime compared to computed radiography systems. The segment’s leadership is being driven by increased installation across hospitals and diagnostic centers aiming to enhance throughput and diagnostic precision.

Direct radiography systems also support efficient data management and integration with PACS, facilitating seamless access for clinicians. Lower maintenance requirements and long-term cost efficiency further strengthen their market position.

With continuous improvements in detector sensitivity, wireless connectivity, and image storage solutions, this segment is expected to retain its prominence as the preferred technology in digital imaging environments globally.

The fixed systems segment, representing 59.30% of the portability category, has been maintaining dominance owing to its extensive utilization in hospitals and large diagnostic centers requiring high-volume, high-precision imaging. These systems provide superior image consistency, operational stability, and integration capabilities within radiology departments.

Their performance advantage in handling complex diagnostic needs across multiple specialties has reinforced preference among healthcare institutions. The adoption of advanced stationary systems with automated positioning and digital workflow optimization has further improved efficiency and patient comfort.

Continued investment in hospital-based imaging infrastructure and ongoing replacement of analog systems are expected to sustain the leadership of fixed systems, ensuring their continued contribution to the overall growth of the digital X-ray equipment market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 6590.2 million |

| Market Value for 2025 | USD 7638.6 million |

| Market CAGR from 2020 to 2025 | 3.0% |

The subsequent tables analyze the digital radiography industry. They focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for digital X-ray equipment.

| Segment | Computed Radiography |

|---|---|

| Share (2025) | 55% |

| Segment | Hospitals |

|---|---|

| Share (2025) | 34% |

The digital radiography industry analysis is observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for digital X-ray equipment.

Trends in the Digital X-Ray Equipment Market in Asia Pacific

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

| Malaysia | 4.0% |

| Thailand | 3.8% |

| Indonesia | 3.3% |

Opportunities for Digital X-Ray Equipment in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 2.3% |

| France | 1.8% |

| Germany | 1.4% |

| United Kingdom | 1.2% |

| Italy | 1.1% |

Sales Analysis of Digital Radiographic Systems in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 1.8% |

| Canada | 1.6% |

Prominent manufacturers are crucial in determining the direction of the digital radiography market competitive landscape. Leading digital X-ray equipment vendors controlling the market include Agfa-Gevaert N.V. Healthcare, Siemens AG, Philips Healthcare, Canon USA Inc., Shimadzu Corporation, GE Healthcare, and Varian Medical Systems.

Siemens AG and Philips Healthcare are major digital X-ray equipment providers, standing out for their dedication to innovation and dependability. Shimadzu Corporation and Canon USA Inc. add special advantages to the competitive mix, broadening the range of digital X-ray systems available. Agfa-Gevaert N.V. Healthcare, Varian Medical Systems, and GE Healthcare all contribute depth and experience, strengthening the competitive dynamics.

This scene reveals a mix of well-known titans and up-and-coming talents who work together to promote the advancement of digital X-ray equipment. Beyond specific product offerings, the influence of these digital X-ray equipment producers shapes ongoing innovations and market growth as they maneuver through the competitive landscape.

Latest Developments

| Company | Details |

|---|---|

| Fujifilm | The FDR Cross is a state-of-the-art hybrid C-arm and portable X-ray system intended for use in hospitals and ambulatory surgery centers (ASCs). Fujifilm announced its availability in the US in July 2025. The dual-function C-arm is the first portable fluoroscopic and radiographic imaging device that is used to perform image-guided treatments without the need to carry additional imaging equipment. |

| Konica Minolta, Inc. | Konica Minolta, Inc. debuted the AeroDR TX m01, a transportable X-ray system featuring a wireless dynamic digital radiography capability, in Japan in March 2025. |

| GE Healthcare | The Definium Tempo is a fixed overhead tube suspension (OTS) digital X-ray system introduced by GE Healthcare in September 2024. This technology is meant to serve as a personal helper for technicians and radiologists. It uses automation to reduce workloads and help radiology departments give their patients the best care possible. |

The global digital x-ray equipment market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the digital x-ray equipment market is projected to reach USD 10.3 billion by 2035.

The digital x-ray equipment market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in digital x-ray equipment market are orthopaedic, cancer, dental, cardiovascular and other applications.

In terms of product, direct radiography segment to command 54.6% share in the digital x-ray equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Breast Tomosynthesis (DBT) Equipment Market is segmented by product, and end user from 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA