The digital transformation industry in MENA is evolving rapidly, driven by economic diversification initiatives, smart city developments, and accelerated enterprise digitalization. Governments across the region are prioritizing digital infrastructure investment to enhance competitiveness and service delivery.

The rise of cloud computing, data analytics, and automation technologies is reshaping business operations across public and private sectors. Organizations are increasingly adopting digital solutions to improve efficiency, cybersecurity, and customer engagement.

The market outlook is reinforced by regional initiatives such as Vision 2035 and growing partnerships between global tech providers and local enterprises. As digital maturity advances, the MENA region is expected to witness sustained growth, supported by strong demand for analytics-driven decision-making and scalable cloud-based ecosystems.

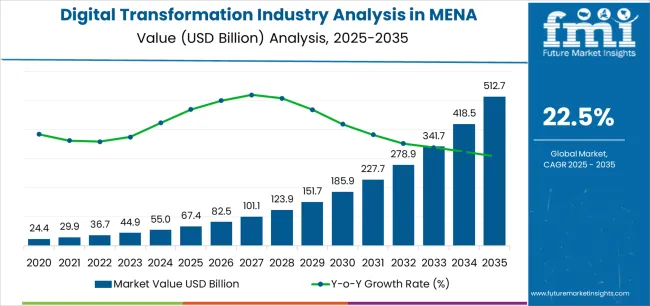

| Metric | Value |

|---|---|

| Digital Transformation Industry Analysis in MENA Estimated Value in (2025 E) | USD 67.4 billion |

| Digital Transformation Industry Analysis in MENA Forecast Value in (2035 F) | USD 512.7 billion |

| Forecast CAGR (2025 to 2035) | 22.5% |

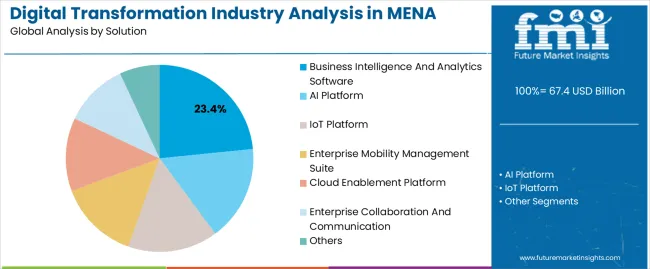

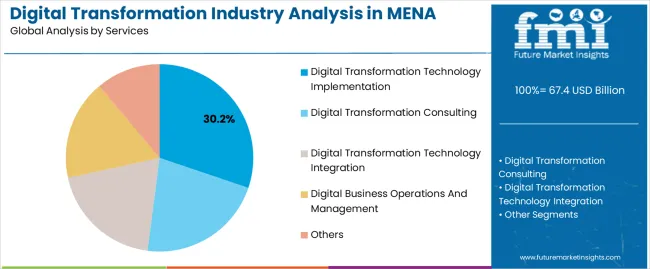

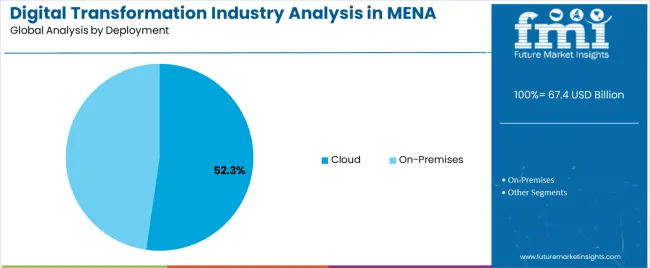

The market is segmented by Solution, Services, Deployment, Enterprise Size, and Industry and region. By Solution, the market is divided into Business Intelligence And Analytics Software, AI Platform, IoT Platform, Enterprise Mobility Management Suite, Cloud Enablement Platform, Enterprise Collaboration And Communication, and Others. In terms of Services, the market is classified into Digital Transformation Technology Implementation, Digital Transformation Consulting, Digital Transformation Technology Integration, Digital Business Operations And Management, and Others. Based on Deployment, the market is segmented into Cloud and On-Premises.

By Enterprise Size, the market is divided into Large Enterprises and Small And Medium-Sized Enterprises (SMEs). By Industry, the market is segmented into BFSI, Healthcare And Life Sciences, IT And Telecom, Retail And E-Commerce, Travel And Hospitality, Media And Entertainment, Automotive, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The business intelligence and analytics software segment holds approximately 23.4% share in the solution category, driven by the rising need for data-driven decision-making across enterprises. Organizations are leveraging analytics to gain real-time operational insights, improve efficiency, and identify new revenue opportunities.

The segment benefits from increasing cloud-based deployments and integration with AI and machine learning tools, enabling predictive and prescriptive analytics capabilities.

As regional businesses embrace digital transformation to enhance competitiveness, demand for analytics platforms is expected to strengthen, maintaining this segment’s growth momentum across industries.

The digital transformation technology implementation segment leads the services category, accounting for approximately 30.2% share. This dominance is supported by the strong demand for end-to-end digital enablement services, including infrastructure setup, software integration, and process automation.

Enterprises are investing in technology modernization to align with evolving regulatory and customer requirements. Regional governments’ emphasis on digital governance and e-service expansion further supports this segment.

With continued enterprise cloud adoption and AI integration, technology implementation services are expected to remain central to the MENA region’s digital transformation journey.

The cloud segment dominates the deployment category with approximately 52.3% share, driven by the scalability, cost-efficiency, and security advantages of cloud-based systems. Cloud infrastructure is enabling businesses to accelerate transformation, reduce IT costs, and improve operational agility.

The segment’s growth is further supported by investments from global hyperscale providers expanding data center capacity in the region. Organizations across sectors such as government, banking, and manufacturing are prioritizing hybrid and multi-cloud models for flexibility.

With continued focus on digital infrastructure and regional data sovereignty, the cloud segment is expected to sustain its leadership over the forecast period.

| Leading Product Type | Cloud-based |

|---|---|

| Industry Share (2025) | 52.30% |

The cloud-based deployment is projected to acquire a massive industry share in 2025. The following factors contribute to this industry expansion:

| Leading Industry | BFSI |

|---|---|

| Value Share (2025) | 20.60% |

The BFSI segment is projected to acquire an industry share of 20.60% in 2025. Over the forecast period, the industry is propelled by:

| Leading Solution | Business Intelligence and Analytics Software |

|---|---|

| Value Share (2025) | 23.40% |

The business intelligence and analytics software is estimated to acquire an industry share of 23.40% in 2025. The segment is anticipated to be augmented by:

The digital transformation industry in the UAE is backed by the following factors:

The digital transformation industry in Qatar is forecast to witness substantial growth opportunities over the forecast period. The industry is driven by:

The Egypt digital transformation industry is projected to assume a rapid growth rate over the forecast period. Top factors that are contributing to industry growth are:

The primary factors that are driving the growth in the MENA digital transformation industry are government initiatives and numerous large firms that are enhancing their technological capabilities in the region. Industry participants are collaborating and partnering with end-use industries to offer different digital transformation services and solutions.

Industry players are also acquiring smaller and innovative firms to access new talents and technologies to expand their service offerings. The companies are building their regional talent pool by investing in hiring and training local talent to ensure industry knowledge and increase customer trust.

Established leaders are investing in research and development to offer cutting-edge solutions to future-proof their offerings. Additionally, players are seen sponsoring thought leadership initiatives, performing in industry events, and establishing themselves as the driving force for digital transformation.

By implementing these tactics, industry players are raising their industry share and driving regional industry growth. The combination of technological innovation, local knowledge, and strategic partnerships is expected to be critical for constant success in this dynamic region.

Latest Developments in the MENA Digital Transformation Industry

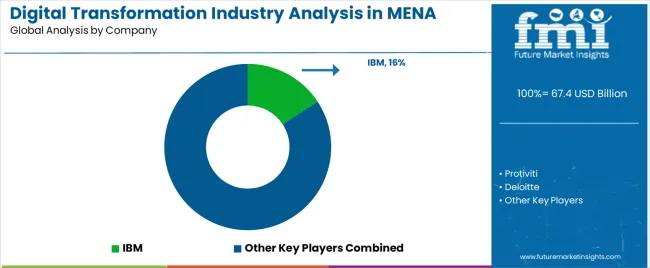

The global digital transformation industry analysis in MENA is estimated to be valued at USD 67.4 billion in 2025.

The market size for the digital transformation industry analysis in MENA is projected to reach USD 512.7 billion by 2035.

The digital transformation industry analysis in MENA is expected to grow at a 22.5% CAGR between 2025 and 2035.

The key product types in digital transformation industry analysis in MENA are business intelligence and analytics software, AI platform, iot platform, enterprise mobility management suite, cloud enablement platform, enterprise collaboration and communication and others.

In terms of services, digital transformation technology implementation segment to command 30.2% share in the digital transformation industry analysis in MENA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Transformation in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation in Healthcare Market Analysis – Size, Share & Forecast 2025 to 2035

Digital Transformation in Supply Chain Market

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA