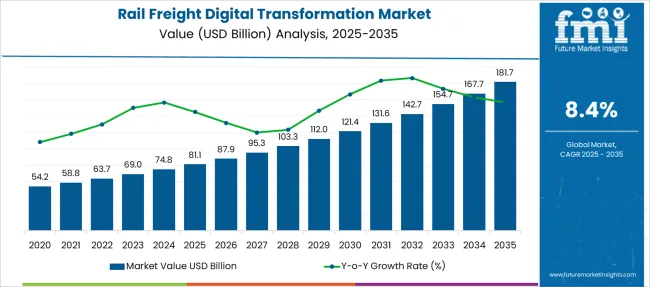

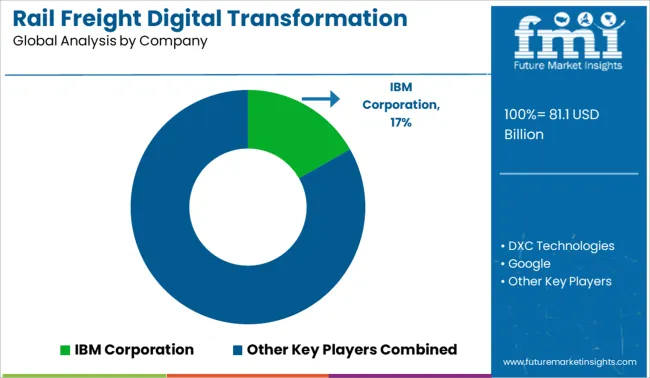

The Rail Freight Digital Transformation Market is estimated to be valued at USD 81.1 billion in 2025 and is projected to reach USD 181.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Rail Freight Digital Transformation Market Estimated Value in (2025 E) | USD 81.1 billion |

| Rail Freight Digital Transformation Market Forecast Value in (2035 F) | USD 181.7 billion |

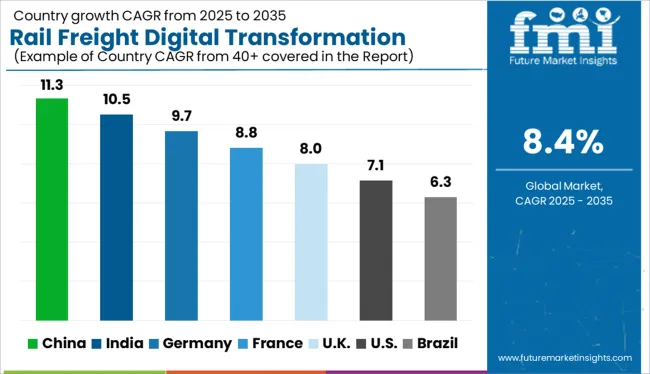

| Forecast CAGR (2025 to 2035) | 8.4% |

The rail freight digital transformation market is gaining momentum as logistics providers seek to enhance operational efficiency and improve supply chain visibility. Growing adoption of advanced information systems and digital technologies has enabled better tracking, route optimization, and asset management.

Industry reports indicate that rising demand for faster, more reliable freight services has pushed rail operators to integrate automation and data analytics. Increased investment in infrastructure modernization and government initiatives promoting sustainable freight transport have further accelerated digital adoption.

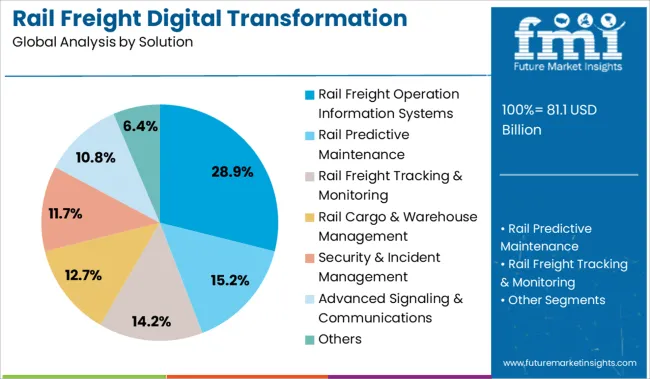

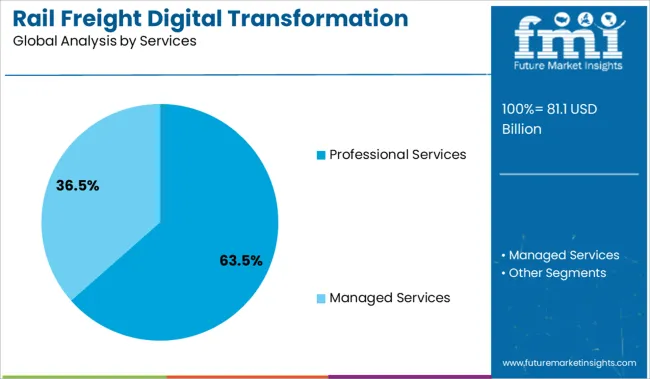

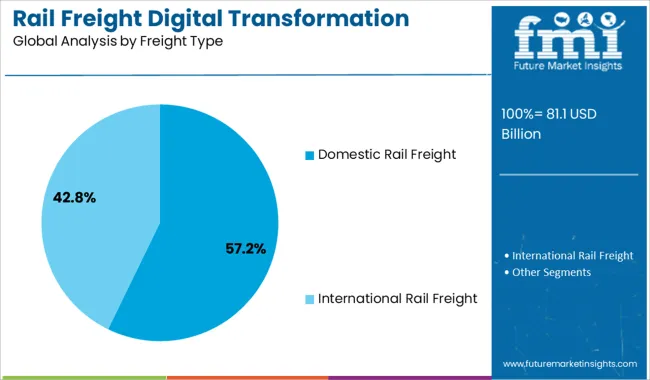

The shift towards real-time data exchange and cloud-based platforms has improved decision-making and reduced operational costs. The market is expected to continue expanding as the integration of emerging technologies such as artificial intelligence and Internet of Things evolves. Segmental growth is anticipated to be driven by Rail Freight Operation Information Systems in solutions, Professional Services in service offerings, and Domestic Rail Freight as the primary freight type.

The market is segmented by Solution, Services, and Freight Type and region. By Solution, the market is divided into Rail Freight Operation Information Systems, Rail Predictive Maintenance, Rail Freight Tracking & Monitoring, Rail Cargo & Warehouse Management, Security & Incident Management, Advanced Signaling & Communications, and Others. In terms of Services, the market is classified into Professional Services and Managed Services. Based on Freight Type, the market is segmented into Domestic Rail Freight and International Rail Freight. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Rail Freight Operation Information Systems segment is projected to contribute 28.9% of the market revenue in 2025, leading the solution category. This segment has grown due to the critical role these systems play in managing schedules, tracking freight, and optimizing resource allocation.

Rail operators have increasingly implemented these information systems to improve transparency across the supply chain and reduce delays. The systems’ ability to integrate with other digital tools has enhanced overall operational agility and efficiency.

As rail freight volumes increase, especially in domestic markets, the demand for sophisticated operation management platforms is expected to grow. Continued investments in upgrading legacy systems and adopting scalable solutions are likely to sustain the segment’s leading position.

Professional Services are expected to hold 63.5% of the rail freight digital transformation market revenue in 2025, dominating the services category. The growth of this segment is driven by the need for consulting, system integration, and ongoing support to ensure successful implementation of digital solutions.

Freight operators often rely on expert guidance to navigate complex technology landscapes and customize solutions to their unique operational requirements. Additionally, training and change management services have become essential to maximize user adoption and return on investment.

As digital transformation projects become more comprehensive, the demand for professional services that can deliver end-to-end implementation and maintenance is expected to rise. This segment’s dominance reflects the increasing complexity of digital initiatives and the value of expert involvement.

The Domestic Rail Freight segment is projected to account for 57.2% of the market revenue in 2025, holding the leading position in freight types. This growth is driven by the expansion of regional supply chains and the emphasis on efficient inland transportation.

Domestic rail freight benefits from investments in network upgrades and digital platforms that enable better cargo tracking and route management. Companies operating within national borders are adopting digital tools to improve delivery times and reduce costs in highly competitive markets.

Environmental regulations encouraging the shift from road to rail for freight have further boosted the domestic rail freight segment. As the demand for sustainable and reliable freight solutions increases, domestic rail freight is expected to remain the primary focus of digital transformation efforts in the sector.

aging traditional rail freight transportation network to boost demand for rail freight digital transformation market

Rail freight transportation is traditionally an ancient industry. The aging rail infrastructure is failing to fulfill the growing demand for rail freight digital transformation year-on-year. With the tremendous increase in the pace of technology and digital services, the rail freight transportation infrastructure is disrupting at a very high level.

The use of technologies such as 5G and LTE for high-speed connectivity, cloud infrastructure for scalability and backend rail freight operations, cyber security systems for rail safety, etc., is revolutionizing the demand for rail freight digital transformation and sales of rail freight digital transformation which in turn helps in upsurging of rail freight digital transformation market share. These technological breakthroughs would provide immense growth opportunities in the rail freight digital transformation market sales in the next 5 years.

The Asia Pacific has one of the busiest and most extensive rail networks globally and is estimated to emerge as a highly lucrative region for rail freight digital transformation market share.

As China’s One Belt, One Road (OBOR) global development strategy is gaining traction, the rail freight volumes in the Asia Pacific region tend to increase. According to China Railway, the rail freight volume for goods in China in 2020 was 754.2.8.0 billion tonnes and is estimated to reach 754.2.8.8 billion tonnes by 2024.

Moreover, Indian Railway plans to triple its rail freight volume by 2035. Such massive freight volume statistics show the growth and opportunities for rail freight digital transformation market share in Asia Pacific countries to escalate the demand for digital transformation and rail freight digital transformation sales.

Digital technologies have emerged as a critical driver for the rail freight digital transformation market in the Asia Pacific region. The use of IoT, 5G, Augmented and Virtual Reality (AR/VR) techniques, and cybersecurity for rail freight management has streamlined operations and reduced costs.

In the coming years, the governments in the Asia Pacific region are making big investments to implement the rail freight digital transformation market to surge demand for rail freight digital transformation along with sales of rail freight digital transformation.

Key players in the rail freight digital transformation market are focusing on product innovation and strategic partnerships with the technology vendors to collaborate for offering digital transformation solutions and services for sustained business growth and to escalate the demand for rail freight digital transformation as well as sales of rail freight digital transformation.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 8.4% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million, volume in kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Solutions, Services, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom., France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa |

| Key companies profiled | SAP; DXC Technologies; Ericsson; and VTG |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global rail freight digital transformation market is estimated to be valued at USD 81.1 billion in 2025.

The market size for the rail freight digital transformation market is projected to reach USD 181.7 billion by 2035.

The rail freight digital transformation market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in rail freight digital transformation market are rail freight operation information systems, rail predictive maintenance, rail freight tracking & monitoring, rail cargo & warehouse management, security & incident management, advanced signaling & communications and others.

In terms of services, professional services segment to command 63.5% share in the rail freight digital transformation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA