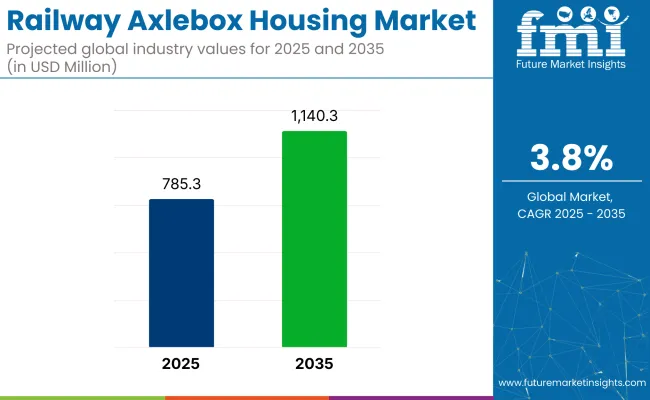

The railway axlebox housing market is estimated to grow to a valuation of USD 785.3 million in 2025. Demand is likely to grow to USD 1,140.3 million by 2035, at a CAGR of 3.8% during the forecast period.

Growth is driven by the increasing demand for reliable and efficient railway infrastructure and the rising focus on safety, reliability, and maintenance. As rail transportation continues to play an integral role in global logistics and passenger transport, the demand for advanced axlebox housing solutions, which are designed to withstand high pressures and improve operational efficiency, is expected to rise.

The railway axlebox housing industry is considered a specialized segment within its broader parent categories. In the railway wheelset components industry, a share of approximately 12-15% is held by axlebox housings, as their function of enclosing bearings and enabling axle rotation is regarded as essential. Within the bogie and suspension systems industry, a share of 8-10% is assigned to axlebox housings, given their role in supporting wheel alignment and shock absorption.

In the railway bearings industry, around 10-12% is attributed to axlebox housings, as they are used to provide the structural casing for bearing assemblies. Within the rolling stock OEM and after-industry sector, a modest share of 3-5% is associated with axlebox housings, primarily due to their linkage to replacement and maintenance cycles. In the smart railway components industry, approximately 4-6% is accounted for by axlebox housings equipped with sensors, reflecting their incremental use in condition-monitoring systems.

Schaeffler’s TAROL axlebox bearings, which were showcased at InnoTrans 2024 from September 24 to 27, 2024, have been recognized for their contribution to reliable and robust products that ensure maximum uptime and efficiency in rail transportation. These low-friction bearings are known for their long service life and extended maintenance intervals. The bearings are manufactured according to customer-specific design requirements, with adjustments made to bearing dimensions and materials to accommodate required payloads and mileage.

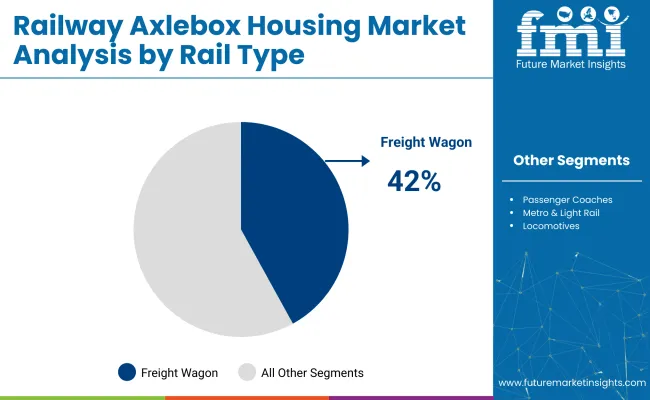

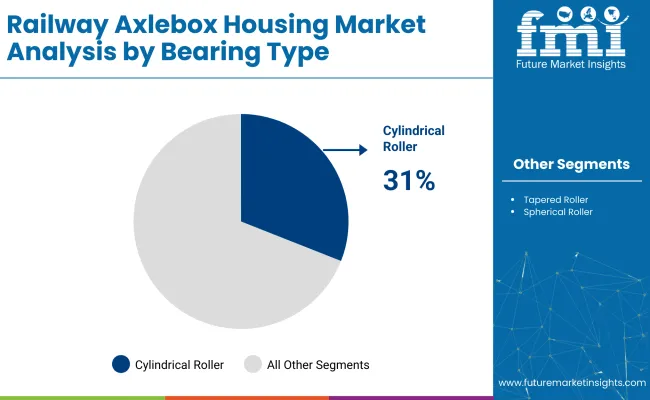

The railway axlebox housing market is being shaped by key investments in freight wagons, cylindrical roller bearings, and durable materials. In 2025, freight wagons are expected to lead with a 42% share, while cylindrical roller bearings will hold 31%, driven by their load-handling capacity and reduced maintenance requirements across rail transport applications.

The freight wagon segment is projected to contribute 42% of the share in 2025. This share is being driven by expanding global trade, particularly across Eurasian and African rail corridors. Companies such as CRRC Corporation, Greenbrier, Titagarh Wagons, and Transmash Holding are deploying freight wagons equipped with high-load axlebox housings suited for rugged terrains and intermodal operations. Wabtec Corporation and Alstom have introduced modular axlebox units with thermal dissipation layers to support high-speed freight transit.

Cylindrical roller bearings are expected to hold a 31% share in 2025. These bearings are being widely adopted due to their superior radial load handling and ability to endure long operational cycles without performance degradation. SKF, Timken, NTN Corporation, and NSK Ltd. are leading this segment with innovations such as sealed cylindrical bearings, adaptive preload technologies, and corrosion-resistant coatings. Schaeffler Group has developed compact cylindrical bearing units for electric passenger trains, while RBC Bearings is targeting freight-specific applications with extended inner ring designs to prevent misalignment.

The railway axlebox housing market is being influenced by expanding high-speed and freight rail infrastructure, innovation in component engineering, and rising emphasis on safety. However, production cost burdens and strict compliance standards continue to pose growth limitations, especially in cost-sensitive economies.

Acceleration from High-Speed and Freight Rail Expansion

Global expansion of freight corridors and high-speed passenger rail systems is being identified as a core growth catalyst. Axlebox housings capable of handling increased speeds, axle loads, and dynamic stresses are being prioritised by rail manufacturers. Government infrastructure initiatives, particularly across Asia-Pacific and the Middle East, are intensifying procurement of durable, precision-engineered axlebox solutions aligned with new rolling stock deployments.

Cost Pressures and Regulatory Complexity Constrain Uptake

Widespread adoption of advanced axlebox housing systems is being slowed by high production expenses and complex regulatory pathways. Specialized materials, precision machining, and rigorous validation procedures are contributing to elevated unit costs. Global railway safety standards, such as EN 12080 and AAR S-600, are mandating extensive lifecycle testing and documentation, creating entry barriers for smaller suppliers and limiting affordability in emerging industries.

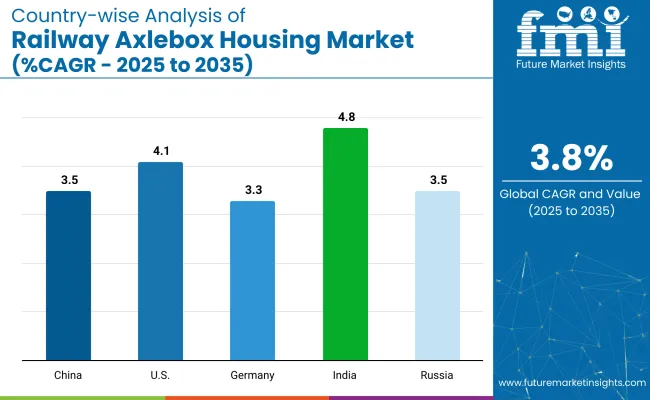

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 3.5% |

| United States | 4.1% |

| Germany | 3.3% |

| India | 4.8% |

| Russia | 3.5% |

In OECD economies, an average CAGR of 3.7% has been projected for railway axlebox housing production during 2025 to 2035. A rise of 4.1% has been forecasted in the United States, with demand being driven by freight-car renewal programmes and scheduled high-speed-train overhauls. Germany has been assigned a growth rate of 3.3%, where the mature rail network has kept expansion dependent on component-replacement cycles. Within BRICS, expansion of approximately 3.9% has been estimated, led by India at 4.8%.

Domestic output in India is being supported by extensive electrification projects and new semi-high-speed corridors. China and Russia have been projected at 3.5%, with production in China being guided by rolling-stock export orders, while in Russia, wagon-modernisation mandates are being weighed against import-substitution constraints. Volume growth is expected to be delivered by emerging economies, whereas OECD nations are relying on fleet upgrades, resulting in a global CAGR projection of 3.8%.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The United States railway axlebox housing market is expected to grow at a CAGR of 4.1% through 2035. Growth is being driven by advancements in rail infrastructure and the increasing demand for high-performance railway components. Innovation in axlebox housing solutions is being led by companies like SKF, Siemens, and Wabtec.

Regulatory policies promoting green practices and emission control are contributing to the industry's expansion. Adoption of electric and autonomous trains, combined with innovations in telematics and automation, is being prioritized. The USA continues to lead in innovation and the development of advanced railway components, ensuring steady industry growth.

The German railway axlebox housing market is projected to grow at a CAGR of 3.3% through 2035. Growth is being supported by the country’s focus on innovation in railway infrastructure. Companies like SKF, Siemens, and Schaeffler are investing in the development of high-performance axlebox housing solutions. Regulatory frameworks supporting environmentally friendly technologies are fueling industry demand.

The need for durable and efficient components is being driven by Germany’s well-established rail infrastructure and strong emphasis on reducing the environmental impact of transportation. Germany’s expertise in precision engineering and high-quality manufacturing further contributes to industry growth.

The Railway Axlebox Housing Market in China is expected to grow at a CAGR of 3.5% through 2035. The industry is being driven by China’s rapid industrialization, growing demand for railway infrastructure, and the increasing need for durable and efficient railway components. Leading companies such as CRRC Corporation and ZF Friedrichshafen are expanding production capacities to meet rising demand.

Government initiatives promoting green practices and clean energy solutions are contributing to the industry's growth. Investment in high-speed rail and freight transportation, coupled with technological innovations in axlebox housing, is accelerating the industry expansion in China.

Demand for railway axlebox housing in India is expected to grow at a CAGR of 4.8% through 2035. Growth is being driven by expanding rail networks, increasing demand for efficient rail transportation, and government initiatives supporting infrastructure development. Companies such as SKF and Schaeffler are expanding their presence in India, focusing on manufacturing and supplying durable axlebox housings.

The rise in high-speed trains and freight transport has fueled demand for high-performance components. The adoption of smart and energy-efficient solutions, combined with the increasing need for modernization in railway systems, is driving growth in the industry.

Sales of railway axlebox housing in Russia is estimated to grow at a CAGR of 3.5% through 2035. Growth is being supported by the increasing demand for durable and efficient railway components driven by the expansion of Russia’s rail network. Companies like TMH Group and SKF are investing in the development of advanced axlebox housing solutions.

The Russian government’s focus on modernizing railway infrastructure and improving operational efficiency is contributing to industry growth. Emphasis on technological innovation and high-quality manufacturing is supporting the demand for advanced axlebox housing systems in Russia.

The railway axlebox housing market features a moderately consolidated competitive landscape, with dominant players, key players, and emerging firms. SKF holds a leading position, supported by continuous investment in R&D, technological innovation, and eco-friendly axlebox housing designs.

Schaffner Holding AG, NTN Corporation, and FAG Bearings are key players in the industry, focusing on providing high-performance axlebox housing solutions known for their durability and quality. Emerging players such as Silbitz Group GmbH and Jiangsu Tedrail Industrial Co., Ltd. are expanding their presence through strategic partnerships, localized manufacturing, and cost-effective solutions tailored to regional needs, driving innovation in the industry.

Recent Railway Axlebox Housing Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 785.3 million |

| Projected Industry Size (2035) | USD 1,140.3 million |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and units for volume |

| Material Types Analyzed (Segment 1) | Cast Iron, Cast Steel, Ductile Iron, Other Alloys |

| Rail Types Analyzed (Segment 2) | Freight Wagon, Passenger Coaches, Metro & Light Rail, Locomotives, High Speed Rail |

| Bearing Types Analyzed (Segment 3) | Tapered Roller Bearing, Cylindrical Roller Bearing, Spherical Roller Bearing |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | SKF, Silbitz Group GmbH, Jiangsu Tedrail Industrial Co., Ltd., NBC Bearings, Kovis Group, Sudisa Pvt. Ltd. |

| Additional Attributes | Dollar sales, share by material and bearing type, rising demand in high-speed rail, growth in freight wagon segment, regional manufacturing dynamics |

The industry is segmented into cast iron, cast steel, ductile iron, and other alloys.

The industry covers freight wagons, passenger coaches, metro & light rail, locomotives, and high-speed rail.

The industry includes tapered roller bearings, cylindrical roller bearings, and spherical roller bearings.

The industry spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The Industry value in 2025 is USD 785.3 million.

The industry forecast value by 2035 is USD 1,140.3 million.

The forecast CAGR from 2025 to 2035 is 3.8%.

The leading segment in the industry is Freight Wagon, with a 42% share.

Asia Pacific, particularly India, is the key growth region in industry with a 4.8% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA