The global railway after-cooler market is projected to grow from USD 1,146.68 million in 2025 to approximately USD 1,903.71 million by 2035, reflecting a CAGR of 5.2% over the forecast period. Growth is being driven by rising rail freight volumes, increased locomotive efficiency requirements, and the deployment of hybrid and dual-mode locomotives that demand precise thermal regulation.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,146.68 Million |

| Projected Market Size in 2035 | USD 1,903.71 Million |

| CAGR (2025 to 2035) | 5.2% |

After-coolers have been incorporated as essential components in diesel and hybrid engines to reduce inlet-air temperatures following turbocharging. Air-to-air and water-to-air designs continue to dominate the market. While air-to-air variants are preferred for their simpler layout and low maintenance, water-cooled systems have been increasingly adopted in regions with high ambient temperatures. Hybrid after-coolers, combining both principles, are being implemented to optimize cooling under variable load conditions, particularly in locomotives operating across mixed diesel-electric cycles.

In 2024, Union Pacific initiated field deployments of battery-electric hybrid switchers under Class I classification, with integrated after-coolers designed to manage variable engine temperatures during mode transitions. Similarly, in the Asia-Pacific region, particularly India and Southeast Asia, water-cooled copper-aluminum finned-tube after-coolers have been adopted to prevent engine derating under tropical climates. These assemblies have been designed to extend operational endurance and improve thermal reliability in long-haul freight applications.

Materials such as aluminum and copper are favored due to their corrosion resistance and high thermal conductivity. Manufacturers including MAHLE, Modine, Dana, and Denso have introduced plate-fin and bar-fin core designs that support low pressure drops while ensuring compact packaging. Their offerings include direct-fit OEM replacements and certified remanufactured units that comply with thermal performance documentation and maintenance schedules.

After-coolers have been integrated into service platforms covering heavy-haul, intercity, and passenger locomotives. Documented improvements in thermal system stability, lower pre-combustion cylinder temperatures, and increased compressor efficiency have been observed. OEM support networks have expanded to include both retrofit and certified maintenance options, enabling longer service intervals and reducing lifecycle costs.

Ongoing infrastructure investments and growing demand for energy-efficient rail transport have sustained market growth. Thermal control modules, including after-coolers, are being prioritized in locomotive renewal programs and emissions-compliant engine upgrades, ensuring consistent adoption across key markets such as North America, Germany, and India.

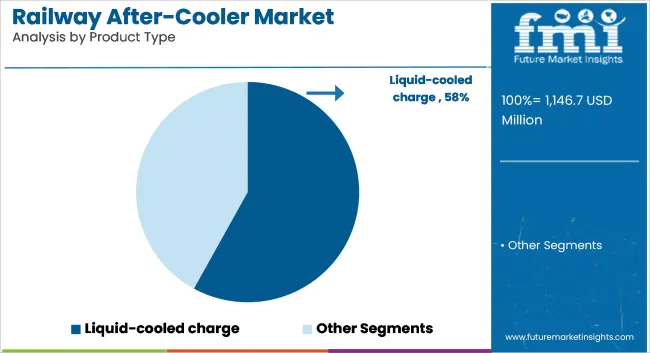

Liquid-cooled charge air coolers are estimated to hold approximately 58% of the global railway aftercooler market share in 2025 and are projected to grow at a CAGR of 5.4% through 2035. Their adoption is supported by superior heat transfer capabilities, reduced intake air temperatures, and compatibility with high-power diesel and hybrid-electric locomotive platforms.

These systems offer better packaging flexibility and thermal control in confined engine compartments, particularly in modern rail vehicles operating under variable duty cycles. Manufacturers continue to innovate in water-to-air core designs, integrated coolant routing, and corrosion-resistant coatings to extend service life and reduce maintenance requirements in harsh rail environments.

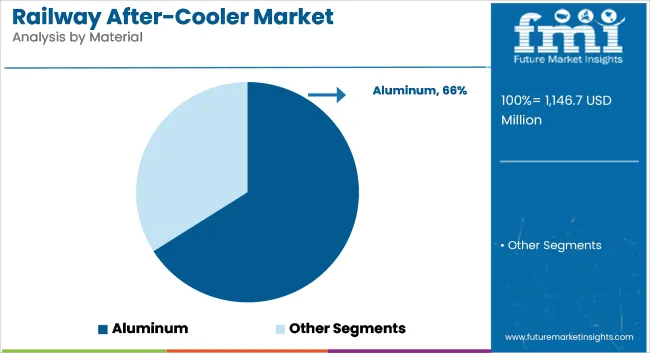

Aluminum is projected to account for approximately 66% of the railway aftercooler market share in 2025 and is expected to grow at a CAGR of 5.3% through 2035. Its favorable strength-to-weight ratio, ease of fabrication, and high thermal conductivity make it ideal for use in both air- and liquid-cooled aftercooler systems.

Rail OEMs and system integrators continue to specify aluminum cores and housings to reduce component mass, improve fuel efficiency, and comply with railway safety standards. As global rail operators modernize their fleets and emissions regulations tighten, aluminum-based aftercoolers remain central to achieving optimized engine air management and performance reliability across both freight and passenger locomotive segments.

High Maintenance and Durability Requirements

Railway after-coolers are subjected to high pressure and changeable temperatures and thus must be durable and reliable. But sensitive cooling technologies come at frequent maintenance, part replacements, and costly repairs that can discourage adoption by railway operators. Furthermore, due to the direct relationship between after-cooler performance and engine performance schedule reliability, the market is sensitive to product quality and lifecycle performance.

Integration with Evolving Locomotive Technologies

The growing trend towards electric and hybrid locomotives presents a challenge for the traditional railway after-cooler manufacturers. As newer propulsion systems need different cooling specs, after-cooler designs will often need modification to work or may even need to be fully redesigned. As technology evolves rapidly, companies need to invest heavily in R&D to remain competitive, adding immense financial and operational pressure.

Increasing Demand for High-Efficiency Rail Systems

As regions such as Asia-Pacific and Europe endorse high-speed rail and energy-efficient train operations, global demand is increasing for these services. Superior engine performance and fuel economy, increasingly supported by advanced after-cooling systems, are also emerging as important differentiators. Manufacturers of high-efficiency after-coolers that increase fuel economy and reduce emissions will be in a strong position to respond to this demand.

Government Investments in Rail Infrastructure Modernization

After cooler market growth in railways is expected to witness an improvised atmosphere due to wealth of government initiative to update rail infrastructure across the developing economies. With the significant capital investment being made to make rails more reliable and efficient, there is also an incentive to adopt welfare and advanced cooling solutions to extend locomotive life and optimize performance. Private-public partnerships further drive technological advancements in the sector.

Demand for railway after-coolers in the United States continues to increase due to investments in rail infrastructure, modernization and efficiency. As freight and passenger railway activities increase, efficient cooling systems are in high demand. Growth in the materials technology space, for example, is helping to make after-coolers more thermally efficient and longer-lasting as well.

In addition to strategic partnerships between railway companies and equipment manufacturers to improve operational reliability, the growing focus on energy-efficient rail transportation systems is further accelerating the market.

| Country | CAGR (2025 to 2035) |

|---|---|

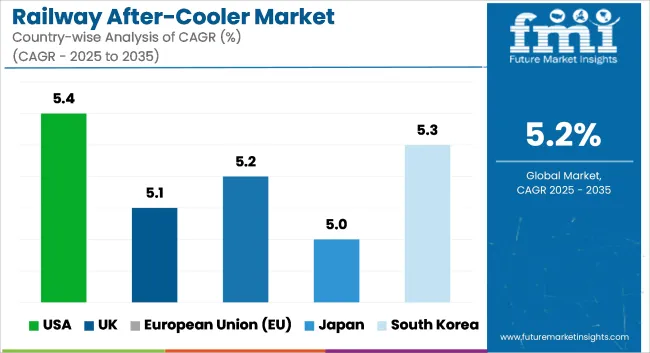

| USA | 5.4% |

The UK railway after-cooler market is witnessing growth with the government initiative to upgrade the railway systems and promote sustainable transport. The adoption of advanced after-coolers is being driven by the emphasis on emission reduction and energy efficiency of locomotives.

By acquiring the latest technologies in compact and lightweight cooling systems designed for high speed trains, therefore, new growth opportunities are opened. Moreover, public-private partnerships are investing in technological developments that will allow them to improve overall railway performance and reduce the downtime needed for maintenance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

The railway after-cooler market across the European Union is expanding, with a special focus on railway electrification and network modernization in countries i.e. Germany, France, and Italy. Strict environmental regulations are encouraging the adoption of more efficient cooling systems that reduce carbon emissions.

Innovation of products is boosting with the technological advancements such as appliance using eco-friendly refrigeration or intelligent monitoring systems. In addition, cross-border executions of railway projects are creating a need for robust and durable after-cooling solutions across the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

The market for railway after-coolers in Japan is active due to a well-developed railway network and a strong emphasis on technological innovation. The increasing deployment of high-speed trains and magnetic levitation (maglev) technologies is expected to drive demand for efficient after-cooler systems.

One of the benefits of local manufacturing is innovation in next-generation cooling technology with high reliability, low maintenance, and superior thermal management. Moreover, the initiatives announced by the governments for the development of low-emission transport solutions are further favorable for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The after-coolers market for South Korean railways is growing, underpinned by the nation’s strong emphasis on high-speed rail expansion and the development of smart railways. Innovations in compact and energy-efficient after-coolers targeted toward advanced train models are being developed by domestic manufacturers.

Predictive maintenance supported by IoT-driven monitoring systems is improving operational efficiency. Furthermore, partnerships with foreign railway operators and technological companies are expediting the implementation of advanced after-cooling systems across the expanding Korean railway market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

This growth is attributed to rising demand for improved engine efficiency and reduced emissions from locomotives, which spurs growth in the railway after-cooler market. Developers concentrated on new after-coolers that fit under high temperatures and enhanced the general performance of the engine.

Lightweight composites and corrosion-resistant alloys are just two examples of advancements in material science that are changing product designs. Some emerging trends are, smart sensors that monitor real-time cooling performance and predictive maintenance solutions.

Further availability of growth momentum is through the electrification of railways and strict emission regulations implemented globally. The railway after-cooler market is expected to grow steadily with a CAGR of 5.2% from 2025 to 2035, owing to favorable changes in regional landscape facilitating modernization of rolling stock through robust investments in railway infrastructure.

The overall market size for railway after-cooler market was USD 1,146.68 million in 2025.

The railway after-cooler market expected to reach USD 1,903.71 million in 2035.

Key drivers for railway after-cooler market demand include rising rail freight activities, engine efficiency needs, emission control norms, and rail network expansion.

The top 5 countries which drives the development of cargo bike tire market are USA, UK, Europe Union, Japan and South Korea.

Air-cooled charge air cooler segment driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA