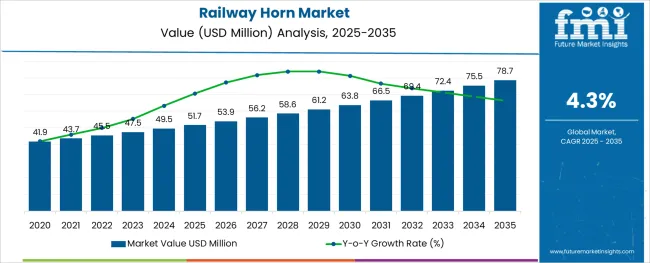

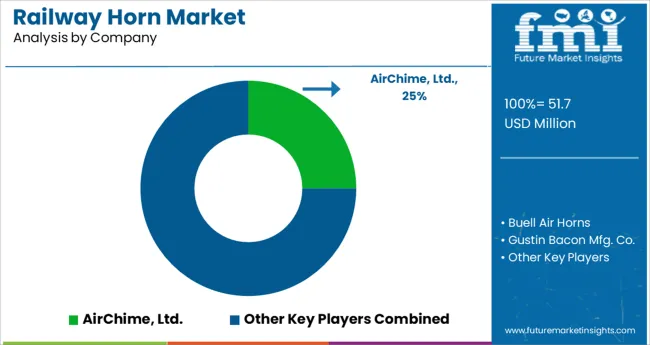

The Railway Horn Market is estimated to be valued at USD 51.7 million in 2025 and is projected to reach USD 78.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Train Type and Horn System Type and region. By Train Type, the market is divided into Passenger Trains, Within City Trains, and Freight Trains. In terms of Horn System Type, the market is classified into Five Chime Horn Systems and Three Chime Horn Systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

Global governing bodies have imposed several strict standards on manufacturing firms regarding the volume of railway horns. Globally increasing vehicle sales and production are anticipated to fuel the railway horn market.

Another factor that is anticipated to drive the market is the low cost and simplicity of horn production. OEMs are putting a lot of effort into creating horns that can be heard from a distance. OEMs produce horns with certain intensity so that they don't abruptly distract the driver of another vehicle. Railway horns can be modified to suit the needs of the user.

High-intensity horns lead to noise pollution, which is expected to impede the expansion of the railway horn market.

The market for railway horns has seen a restriction on production options and offerings for some manufacturers as a result of growing health concerns and targeted regulation intended to cut certain frequencies.

Demand for railway horns is being driven by need. Although the type of usage affects the life cycle of a railway horn, it is generally believed that a horn system has a minimum life cycle of two to four years. Therefore, the growing replacement of railway horns offers a stable market opportunity for railway horns.

The market is divided into electric and air horns based on horn type. Over the course of the forecast period, the electric horn segment is anticipated to rule the market.

Electric horns are typically found in passenger and commercial vehicles because of how loud they are and how easily they can be adjusted to suit the needs of the user. Electric horns' low price and simplicity of installation are predicted to keep them in the lead throughout the forecast period.

The three main types of railway horns are flat, spiral, and trumpet.

The flat horn market segment currently has the largest market share and is anticipated to keep leading during the forecast period. In comparison to spiral and trumpet-shaped horns, flat horns are smaller in size and have a longer lifespan.

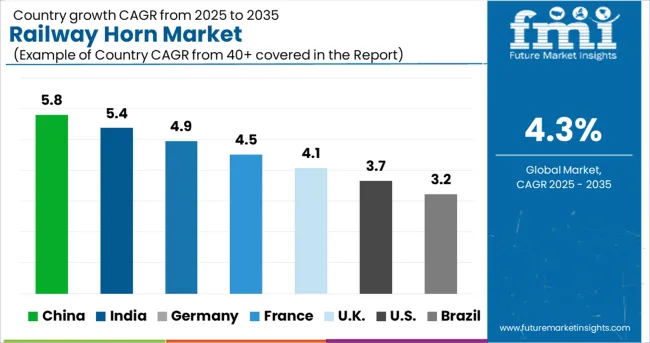

Due to rising vehicle production and sales in this region, it is anticipated that the Asia Pacific may hold the largest market share for railway horns and may continue to dominate the market for the assessment period. China has a CAGR of 4.9% in the railway horn market during the forecast period.

How may the Growth of the Railway Horn Market Escalate across India?

India may dominate the railway horn market with a CAGR of 5.9%. These areas have the highest potential for the railway horn market because of the developing automotive industry and steady aftermarket prospects.

Given the massive production of railway horns in the rising countries, the Asia Pacific i.e. Japan might expect a rise in the industry in the next years with a market share of 5%. In addition, the rapid expansion is a reaction to the OEMs' high production in quickly developing nations. Numerous laws and regulations require safety measures in cars, including horn systems.

The railway horn market is predicted to place Europe in second place overall. The railway horn market in Germany is to have a market share of 4.5% from 2025 to 2035.

Germany and Italy are the two countries that contribute most to the market for railway horns in Western Europe due to the region's robust export market.

What Accounts for United Kingdom’s Railway Horn Sales?

The market for railway horns in the United Kingdom is to grow at a CAGR of 3.4% from 2025 to 2035. The recovering sales of the light commercial vehicle segment are also anticipated to increase the market for railway horn revenue contribution.

The factors driving this region's market are the rising demand for railway horns and the increasingly stringent regulations for both driver and pedestrian safety.

Over the forecast period, the North American railway horn system market is anticipated to grow at the fastest CAGR. In North America, it is anticipated that as sales of vehicles with electric horns increase, the railway horn market may expand.

How may the USA Perform in the Global Railway Horn Market Landscape?

Demand for railway horns is likely to rise as a result of increased production and an uptick in vehicle sales in the area. As sales of hybrid and electric vehicles increase, the market for railway horns is anticipated to expand in the USA. The USA railway horn system market is anticipated to have a market share of 19% for the assessment period.

The railway horn market is expected to contribute even more to revenue as light commercial vehicle sales begin to recover.

How is the Market Progressing in Canada?

Due to the growing use of horns, which reduce noise pollution, Canada is predicted to experience strong market growth. It is anticipated that the sales of passenger and light commercial railways may increase demand for railway horns in the area. The rapidly altering dynamics of the automotive industries are predicted to drive the market.

The market for railway horns in Latin America is anticipated to grow at a relatively moderate rate through 2020 before returning to steady growth over the course of the forecast period.

By involving start-ups and other organizations, Indian Railways has undertaken a significant innovation initiative. Startups for Railways, a policy aimed at bringing scale and efficiency in the field of operation, maintenance, and infrastructure creation through the participation of a very large and untapped startup ecosystem, was introduced on Monday by Ashwini Vaishnaw, Minister of Railways, Communications, Electronics & Information Technology.

Amount up to 1.5 crores may be given to the innovator on an equal sharing basis with the option of milestone payments.

Many domestic players participate in the domestic supply dynamics of the market for railway horns. The market for railway horns is regionally fragmented.

Recent Development:

Loan:

DENSO and Sumitomo Mitsui Banking Corporation, or SMBC, have agreed to terms for INR. 400 crore Sustainability loan. In accordance with our voluntary and predetermined sustainability performance objectives, DENSO and SMBC have entered into an agreement for a sustainability-linked loan for the working capital needs of three Indian DENSO Corporation subsidiaries.

Expansion:

Leading technology and service provider Bosch is expanding its AIoT operations in India by converting its headquarters in Adugodi, Bengaluru, into a new smart campus called Spark.NXT.

Bosch has spent INR 800 crores over the past five years building the campus, which has the ability to house 10,000 associates. The 76-acre location is Bosch's first smart campus in India and offers a variety of smart solutions based on security, sustainability, and user experience for staff members, guests, and facility management.

Introduction:

The founding of AirChime, Ltd. can be traced back to Robert Swanson's work in 1949. Swanson aimed to create an air horn that would sound like a traditional steam whistle. Swanson created the six-note model H6 based on prehistoric Chinese musical theory.

Through the removal of pointless moving components, AirChime considerably enhanced the earlier horns with the introduction of the M series in 1950. The Southern Railway, which needed new horns for its motive power, was one of AirChime M's first clients.

The AirChime model K3L has been sold to Nathan Manufacturing, Inc., a part of Micro Precision Group, Inc. in Windham, Connecticut. It is displayed here in a livery that is modeled after Auburn University.

Acquisition:

Armstrong International, a leader in the world of effective thermal energy solutions, recently announced the strategic acquisition of Leslie Controls, a producer of commercial pumps, water heaters, control systems, and steam regulators.

A large selection of control valves from Leslie may be included in the acquisition, with the exception of steam water heaters for the USA Marine Corps market. Armstrong's customer base and water heater product line may be expanded as a result of this strategic acquisition, which may also promote market expansion in the power and process sectors globally. In Q3 of 2024, the acquisition was finished.

Partnership:

The new WorldSBK 2025 Championship is to begin soon, and FIAMM Energy Technology S.p.A. reaffirms its commitment to Aruba. it Racing - Ducati Team as its primary sponsor.

The two companies have been working together as a team for the past five years. In fact, Aruba has decided to rely on FIAMM Reserve Solutions' expertise for the Data Center power continuity requirements.

The global railway horn market is estimated to be valued at USD 51.7 million in 2025.

It is projected to reach USD 78.7 million by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are passenger trains, _long-distance trains, _high-speed rail, _inter-city trains, _regional trains, _short-distance trains, _commuter trains, within city trains, _rapid transit trains, _tram, _light rail, _monorail, _maglev, _railcar, _named trains, _automated people mover (apm) trains and freight trains.

five chime horn systems segment is expected to dominate with a 53.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA