The Railway Rolling Stock market is experiencing sustained growth, driven by increasing investments in railway infrastructure modernization, electrification projects, and sustainable transportation solutions. Rising demand for efficient passenger and freight transport systems is encouraging adoption of advanced rolling stock equipped with modern safety systems, energy-efficient traction technologies, and digital monitoring tools. Urbanization and growing trade volumes are further fueling the need for reliable rail transport solutions that support heavy loads and long-distance operations.

Governments across regions are promoting the shift toward rail to reduce carbon emissions, optimize logistics, and enhance mobility networks. Integration of predictive maintenance, telematics, and automation technologies is enabling operators to improve fleet performance and reduce downtime.

Additionally, the expansion of high-speed rail projects and dedicated freight corridors is contributing to market growth As the industry transitions toward digitalized and eco-friendly systems, the Railway Rolling Stock market is expected to achieve consistent expansion, supported by technological innovation, regulatory initiatives, and rising demand for sustainable and cost-effective rail transport solutions.

| Metric | Value |

|---|---|

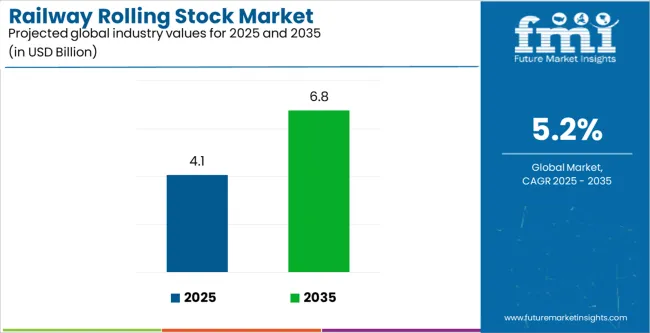

| Railway Rolling Stock Market Estimated Value in (2025 E) | USD 4.1 billion |

| Railway Rolling Stock Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

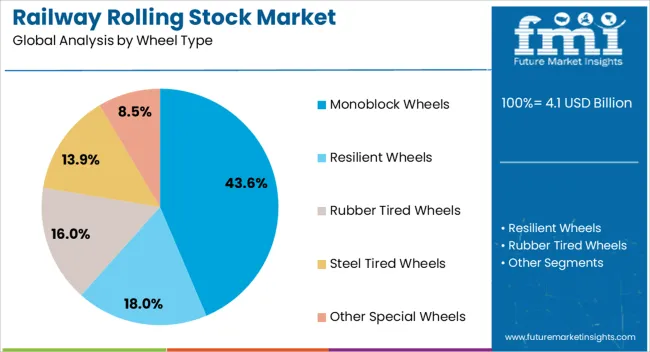

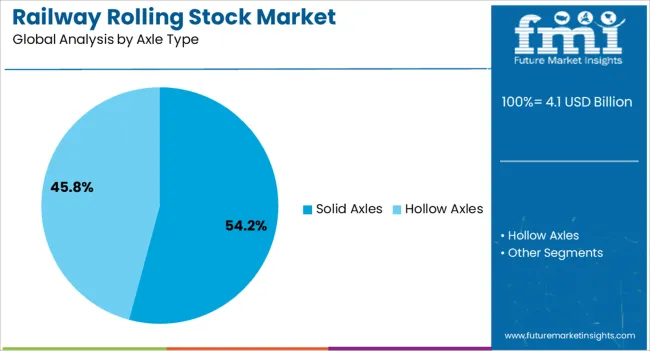

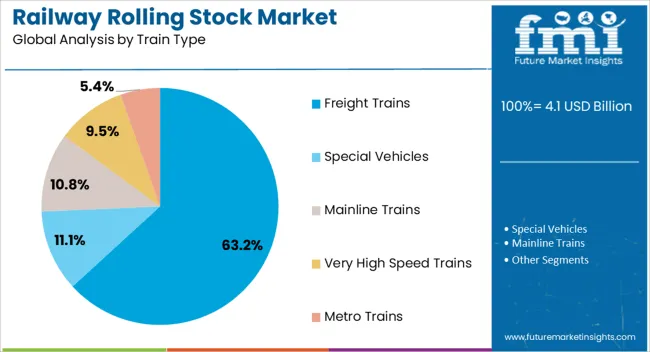

The market is segmented by Wheel Type, Axle Type, Train Type, and Sales Channel and region. By Wheel Type, the market is divided into Monoblock Wheels, Resilient Wheels, Rubber Tired Wheels, Steel Tired Wheels, and Other Special Wheels. In terms of Axle Type, the market is classified into Solid Axles and Hollow Axles. Based on Train Type, the market is segmented into Freight Trains, Special Vehicles, Mainline Trains, Very High Speed Trains, and Metro Trains. By Sales Channel, the market is divided into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

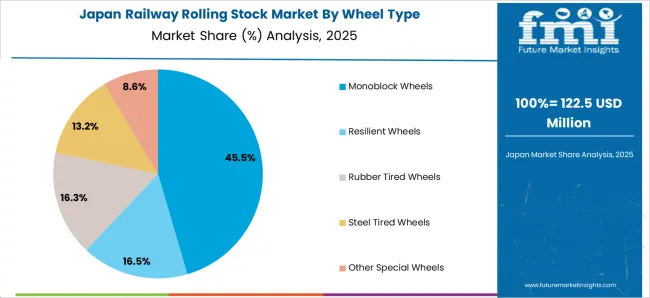

The monoblock wheels segment is projected to hold 43.6% of the market revenue share in 2025, making it the leading wheel type in the Railway Rolling Stock market. Its dominance is attributed to superior strength, durability, and resistance to stress under heavy-load operations. Monoblock wheels, manufactured from a single piece of forged steel, offer enhanced safety and reduced maintenance requirements, making them ideal for both passenger and freight applications.

Their ability to withstand high rotational speeds and variable climatic conditions has increased adoption globally. Furthermore, the reduced probability of mechanical failures and better balance characteristics contribute to smoother ride quality and operational stability.

As rail operators seek solutions that combine safety, longevity, and cost efficiency, the demand for monoblock wheels continues to rise Ongoing innovations in metallurgy, coupled with automated inspection systems, are enhancing performance standards, further consolidating the segment’s position as the preferred choice across modern railway networks.

The solid axles segment is expected to account for 54.2% of the Railway Rolling Stock market revenue share in 2025, establishing it as the dominant axle type. The segment’s leadership is driven by the reliability, structural integrity, and long operational life of solid axles, which make them suitable for heavy-duty applications such as freight and passenger trains. Solid axles ensure optimal weight distribution and high load-bearing capacity, contributing to the smooth performance of rolling stock.

Their cost-effectiveness and ease of maintenance compared to more complex axle configurations have further encouraged widespread adoption. Additionally, continuous improvements in steel composition and heat-treatment processes are enhancing axle strength and fatigue resistance.

As railway operators prioritize durability and performance consistency, solid axles remain the preferred standard for modern rail systems With increasing infrastructure development and fleet modernization, the segment’s market share is expected to remain strong, driven by advancements in axle technology and the growing emphasis on operational safety and efficiency.

The freight trains segment is projected to hold 63.2% of the market revenue share in 2025, marking it as the leading train type in the Railway Rolling Stock market. Growth in this segment is being fueled by the rising demand for efficient logistics and bulk goods transportation driven by industrial expansion and international trade. Freight trains offer superior load capacity and cost-effectiveness over long distances, making them integral to global supply chains.

The adoption of advanced rolling stock with improved braking systems, lightweight materials, and telematics-based tracking is optimizing operational performance and fuel efficiency. Governments are increasingly investing in dedicated freight corridors and electrification projects to enhance cargo movement speed and reliability.

As e-commerce and manufacturing activities continue to expand, the demand for robust freight transport networks is strengthening The ongoing transition toward greener rail solutions, including hybrid and electric freight locomotives, is further supporting the segment’s dominance and ensuring sustained growth over the forecast period.

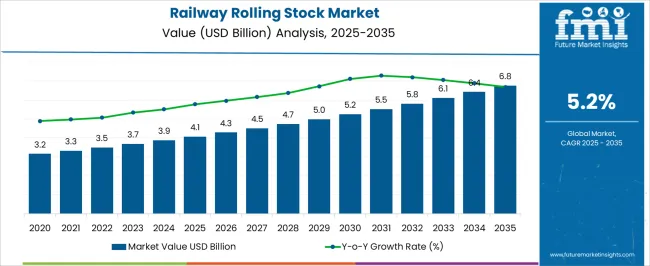

A historical CAGR of 1.9% was recorded for the market and a 5.2% CAGR is calculated up to 2035. Upon closer examination of the data related to the historical growth and future growth of the railway rolling stock market, it can be stated that a boom in the sales of railway rolling stocks is awaiting in the future.

| Attributes | Details |

|---|---|

| Railway Rolling Stock Market Historical CAGR for 2020 to 2025 | 1.90% |

High capital investments, increased costs, competition, stringent regulations, and decarbonization trends may hinder market growth in railway rolling stock manufacturing and railway infrastructure development, requiring additional capital for cost optimization.

Critical aspects that are anticipated to influence the demand for railway rolling stock through 2035.

Market players are going to desire to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decades.

Adoption of Metro and Subway Trains Propels the Demand for Railway Rolling Stocks

Autonomous Trains Shoot Up the Trends in the Railway Rolling Stock Market

Tours and Travel Industry Develops Demand for Railway Rolling Stocks

An in-depth segmental analysis of the railway rolling stock market indicates that according to the wheel type, monoblock wheels are in significant demand. Similarly, based on the train type, freight trains are in demand.

| Attributes | Details |

|---|---|

| Top Wheel Type | Monoblock Wheels |

| Market share in 2025 | 43.6% |

The railway rolling stock market runs significant demand for monoblock wheels, registering a market share of around 43.60% in 2025. The following aspects display the development of monoblock wheels in the industry:

| Attributes | Details |

|---|---|

| Top Train Type | Freight Trains |

| Market share in 2025 | 63.2% |

The freight trains are significant in railway transport, which acquires almost 63.2% market share in 2025. The development of freight trains from the following aspects:

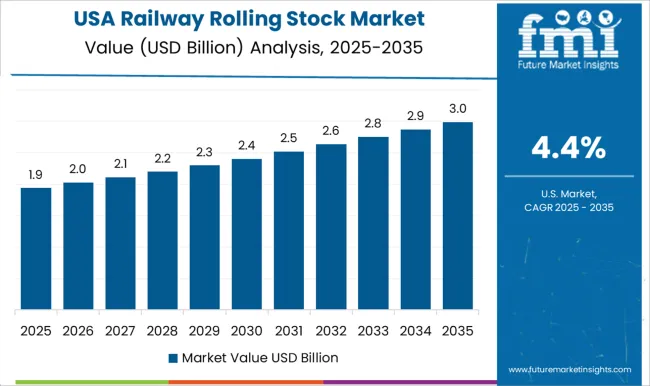

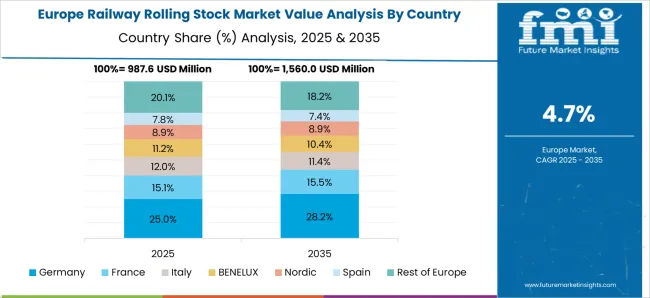

Based on the statistical data, it can be inferred that the industry in the United States and India is developing at a moderate pace in the upcoming decade. Simultaneously, the railway rolling stock industry in Germany and Japan is hitting the roof due to several factors. The railway rolling stock industry in China registers a lower CAGR than the other countries.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 5.1% |

| Germany | 6.7% |

| China | 4.8% |

| Japan | 6.7% |

| India | 5.7% |

The demand for railway rolling stock in the United States registers a CAGR of 5.1% from 2025 to 2035. Here are a few of the major trends:

Demand for railway rolling stock in Germany is set to develop at a CAGR of 6.7%. The following factors are propelling the demand for railway rolling stock in Germany:

The demand for railway rolling stock in China is en route to extend at a CAGR of 4.8% between 2025 and 2035. Some of the primary trends in the industry are:

The demand for railway rolling stock in Japan is on its way to report a CAGR of 6.7% from 2025 to 2035. Some of the primary trends are:

The railway rolling stock industry in India is fixed to register a CAGR of 5.7% by 2035. Among the primary catalysts of the market are:

The railway rolling stock industry is saturated with several market players. To thrive in the railway rolling stock market company is anticipated to develop high capital money and a well-established trade network.

In the forthcoming decade, railway companies are expected to use several strategies to develop their network and operations and increase their market share, such as forming partnerships with prominent railway entities. This allows railway companies to combine resources, knowledge, and expertise to succeed in the market.

Another strategy is to introduce pristine and better products and services. Market players plan to get a competitive edge through product launches.

Railway manufacturers strive to improve their rolling stock's safety, efficiency, and comfort through the development and implementation of new technologies as well as innovations. This vaguely includes leveraging advanced technologies such as AI and IoT to reduce expenses and enhance their customers' travel experience.

These strategies above could be proven fruitful in propelling the demand for railway rolling stock in the upcoming decade.

Recent Developments in the Railway Rolling Stock Market

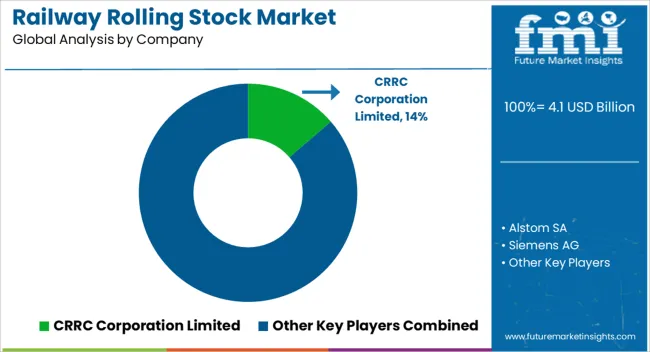

The global railway rolling stock market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the railway rolling stock market is projected to reach USD 6.8 billion by 2035.

The railway rolling stock market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in railway rolling stock market are monoblock wheels, resilient wheels, rubber tired wheels, steel tired wheels and other special wheels.

In terms of axle type, solid axles segment to command 54.2% share in the railway rolling stock market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA