The Railway Braking System Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Railway Braking System Market Estimated Value in (2025 E) | USD 2.9 billion |

| Railway Braking System Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Railway Braking System market is experiencing consistent growth, driven by rising investments in rail infrastructure, modernization projects, and the increasing demand for safer and more efficient transport solutions. Governments and private operators are focusing on enhancing passenger safety and freight reliability, which has accelerated the adoption of advanced braking systems. Technology innovations such as electronic brake control, regenerative braking, and predictive maintenance are reshaping the market by reducing operational costs and improving performance.

The global shift toward sustainable transportation and the expansion of high-speed rail networks are also contributing to the demand for modernized braking technologies. Furthermore, stringent safety regulations and compliance requirements are compelling rail operators to upgrade conventional braking systems with advanced solutions that deliver higher reliability and precision.

The growing use of automation and IoT-based monitoring in railway systems is expected to provide new opportunities for braking system manufacturers With railways continuing to serve as a backbone of passenger and cargo transport worldwide, the market is positioned for long-term growth, supported by continuous infrastructure upgrades and demand for efficiency.

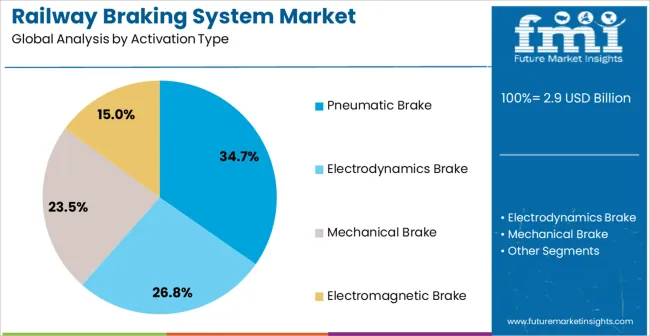

The railway braking system market is segmented by activation type, and geographic regions. By activation type, railway braking system market is divided into Pneumatic Brake, Electrodynamics Brake, Mechanical Brake, and Electromagnetic Brake. Regionally, the railway braking system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pneumatic brake segment is projected to account for 34.7% of the Railway Braking System market revenue in 2025, making it the leading activation type. Its dominance is being driven by widespread adoption in both passenger and freight trains due to proven reliability, cost-effectiveness, and compatibility with existing railway infrastructure. Pneumatic braking systems provide stable and uniform braking force across long trains, ensuring safety and operational consistency.

Their simple design, ease of maintenance, and ability to withstand harsh operating conditions further support their market position. While advanced electronic and hydraulic braking technologies are gaining traction, pneumatic systems remain the standard choice in many regions, particularly in developing markets where affordability and durability are prioritized.

The segment’s growth is also supported by continuous design improvements that enhance efficiency and reduce response time As global railway networks expand and freight movement increases, the use of pneumatic brakes is expected to remain strong, reinforced by their long-established presence and adaptability within both conventional and modern rail systems.

Braking is a mechanical operation used to retard a vehicle’s speed when in locomotion. Braking system in railways not only reduces the train’s ongoing speed but also controls the speed at optimal levels of its run. Railway baking system is quite complex as compare to other vehicle braking systems.

There are three primary functions of braking systems used in railways, one is to stop the train at a fixed point, second is used to maintain a low speed and the third is used for emergency braking. The railway braking system works on compressed air locking. Rail vehicles need essential braking systems to ensure utmost safety and braking systems in trains are slightly complex.

The latter can be attributed to the fact that while braking numerous phenomena of different kinds take place, such as thermal, electrical, and pneumatic. The design of railway braking system is complex and large rails require intelligent braking systems. Another factor adding to this complexity is the fact that the capacity of locomotive transportation is increasing due to increasing tonnages.

Westinghouse Air Brake Company launched the Westinghouse Air Braking System, which is now adopted universally. The basic principle is the same as that in cars, but the braking systems are a bit more complex in trains. To decrease the acceleration, it is important that all the coaches careering tons of load are controlled and stopped at the same time by the mechanical operation of brakes.

While using the braking system, significant issues govern the operation, including surface area contact, pressure, amount of heat generation and braking materials. Railways have been the strength of many economies for many countries. Growing population and urbanization have led to new railway lines.

Most of the economies benefit from the revenue generated by the railway systems. Intensifying demand from consumers and increasing penetration of new models are driving the growth of the market.

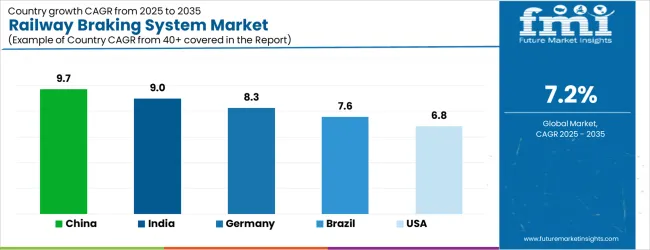

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| Brazil | 7.6% |

| USA | 6.8% |

| UK | 6.1% |

| Japan | 5.4% |

The Railway Braking System Market is expected to register a CAGR of 7.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.7%, followed by India at 9.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.4%, yet still underscores a broadly positive trajectory for the global Railway Braking System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.3%. The USA Railway Braking System Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 131.8 million and USD 93.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Activation Type | Pneumatic Brake, Electrodynamics Brake, Mechanical Brake, and Electromagnetic Brake |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

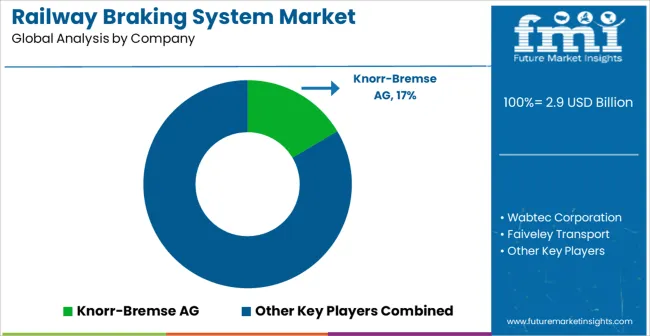

| Key Companies Profiled | Knorr-Bremse AG, Wabtec Corporation, Faiveley Transport, Dako-CZ, a.s., Mitsubishi Electric Corporation, Hitachi Ltd., Alstom SA, Siemens Mobility, Bombardier Inc., CAF Power & Automation, and Nabtesco Corporation |

The global railway braking system market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the railway braking system market is projected to reach USD 5.8 billion by 2035.

The railway braking system market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in railway braking system market are pneumatic brake, electrodynamics brake, mechanical brake and electromagnetic brake.

In terms of , segment to command 0.0% share in the railway braking system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railways Management System Market Report – Trends & Forecast 2017-2022

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Braking System Market

Regenerative Braking System Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emergency Braking System Market - Size, Share, and Forecast 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Braking Resistor Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA