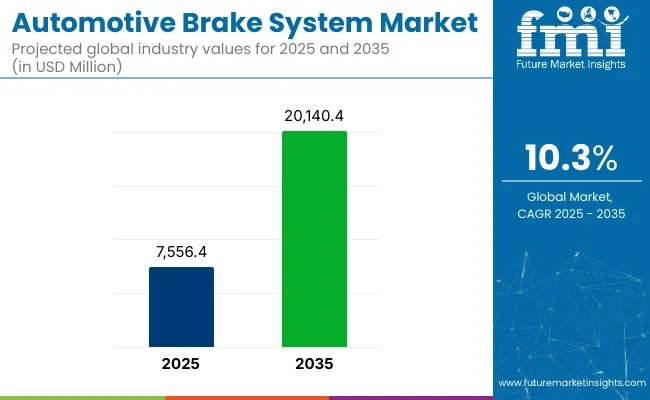

The global automotive brake system market is projected to expand from USD 7,556.4 million in 2025 to USD 20,140.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 10.3% during the forecast period. Growth is being supported by the increased adoption of electronic braking technologies and regulatory requirements related to vehicle safety and emission standards.

In 2024, ZF announced the development of a brake-by-wire system for use in battery electric and automated vehicles. According to the company’s official release, the system has been designed to operate without hydraulic components and to function entirely through electronic signals.

Applications have been targeted for EV platforms where compatibility with regenerative braking and minimal maintenance are required. ZF stated that the system was developed to meet efficiency and system redundancy targets in line with automation levels up to Level 4.

Bosch reported updates to its brake control platform in 2024, focusing on integration with vehicle software and control systems. The technology has been designed to enable over-the-air updates and configurable braking profiles. According to Bosch engineers cited by The BRAKE Report, the system was created to align with the requirements of advanced driver assistance systems (ADAS) and partially automated vehicles. The architecture allows manufacturers to modify vehicle brake performance parameters based on market-specific regulations and vehicle use cases.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7,556.4 million |

| Industry Value (2035F) | USD 20,140.4 million |

| CAGR (2025 to 2035) | 10.3% |

In the commercial segment, Accelera, a Cummins brand, introduced an Endurance Braking System in 2024. The product has been designed for electric trucks and buses operating under high load and variable terrain conditions. As noted in the official company release, the system integrates regenerative braking with thermal control to support braking consistency and system durability. It has been positioned for use in long-haul applications where extended duty cycles are present.

The demand for electronic and regenerative braking systems is projected to rise in response to the increasing share of electric vehicles and automated driving features. Development is expected to continue around non-hydraulic systems and brake control units that support modular software integration and compliance with regional safety standards through 2035.

Disc brake systems accounted for 71% of the global market share by system type in 2025 and are projected to grow at a CAGR of 10.6% through 2035. Their increasing adoption was driven by enhanced heat dissipation, consistent braking performance, and compatibility with advanced driver assistance systems (ADAS).

In 2025, disc brakes were widely integrated into mid-sized, compact, and premium passenger vehicles, as well as select light commercial vehicles. Automakers in Europe, Japan, and North America transitioned to four-wheel disc configurations to meet evolving safety regulations and consumer expectations for responsive braking.

Disc brake systems were also preferred in electric vehicles due to regenerative braking integration and the need for reduced drag. Manufacturers focused on lightweight caliper designs, corrosion-resistant coatings, and noise-dampening technologies to support product differentiation across market segments.

Mid-sized passenger cars represented 36% of the total market by vehicle type in 2025 and are forecast to grow at a CAGR of 10.4% through 2035. This segment continued to serve as a key volume contributor, particularly in Asia-Pacific and Europe, where it balanced fuel efficiency, cabin space, and affordability. In 2025, disc brake systems were standard in front axle applications, with growing rear axle adoption supported by safety feature integration such as ABS and electronic stability control (ESC).

Automakers targeted mid-sized models for ADAS feature rollouts, requiring more responsive and electronically compatible braking systems. Vehicle platforms in this category offered flexibility for both ICE and hybrid powertrains, supporting sustained demand for reliable, performance-oriented brake components. Suppliers optimized rotor and pad formulations to meet diverse driving profiles and regulatory friction material standards.

High Cost of Advanced Braking Systems

The high cost associated with advanced braking technologies is one of the key challenges of automotive brake system market. Like AEB, ESC, and brake-by-wire, Advanced Brake Assist (ABA) systems, which help in collision avoidance, also require complex systems consisting of sensors, actuators, and electronic control units, all of which results in vehicular manufacturing costs. said the data left them with no useful information with which to price something well-suited for this price-sensitive market, especially in developing economies where everyone searches for budget-friendly solutions.

Moreover, the high cost of maintenance and replacement of electronic braking components may hinder the adoption of these systems among consumers. This cost optimization and economies of scale will be a necessary focus for the automakers and suppliers to ultimately make these platforms affordable and achieve greater market penetration and adoption.

Complex Integration and Compatibility Issues

Advanced brake systems can be found in every modern vehicle, but they come with a compatibility nightmare удар. The electronic braking systems have to enable seamless interaction with other vehicle systems such as ADAS, powertrains, and chassis control units.

It adds considerable development time and costs because it needs software algorithms for reliable communication between all those components, and it has to be calibrated as well. Old vehicles lack modern architecture and therefore retrofitting electronic braking solutions into them is complicated.

Car companies need to focus on R&D to make systems safer and more reliable, while taking into account the compatibility of systems. The integration issues facing the industry showcase the necessity of standardization efforts to overcome these hurdles and encourage the implementation of the technology on a wider scale.

Growth in Electric and Autonomous Vehicles

The rising adoption of electric and autonomous vehicles presents a significant opportunity for the automotive brake system market. Electric vehicles (EVs) involves the braking process, electric vehicles (EVs) have become increasingly reliant on regenerative braking systems designed to improve energy efficiency while extending battery life resulting in greater demand for advanced braking solutions.

Moreover, self-driving vehicles demand extremely responsive and fail-safe braking systems, resulting in advances like brake-by-wire and systems that integrate sensors directly into the braking process.

To address the twists and turns of self-driving and electric cars, automakers and suppliers are pouring money into next-gen braking technologies. Braking systems that are smarter and more efficient will have a competitive advantage and gain traction as global EV adoption speeds up.

Advancements in Smart and Lightweight Braking Systems

The demand for lightweight and intelligent braking systems is growing as automakers seek to enhance fuel efficiency and vehicle performance. These advancements including carbon-ceramic brake systems and certain aluminium-based components contribute to reducing the overall weight of the vehicle while preserving braking efficiency. Moreover, the cross-pollination of AI and IoT with braking systems is providing real-time feedback, predictive diagnostics, and improved safety measures.

Adaptive braking and remote diagnostics are some of the smart braking solutions witnessing high adoption in connected vehicles. With the evolving automotive technology, there are numerous opportunities for growth in the market landscape for manufacturers that can come up with lightweight, smart, and energy-efficient braking systems.

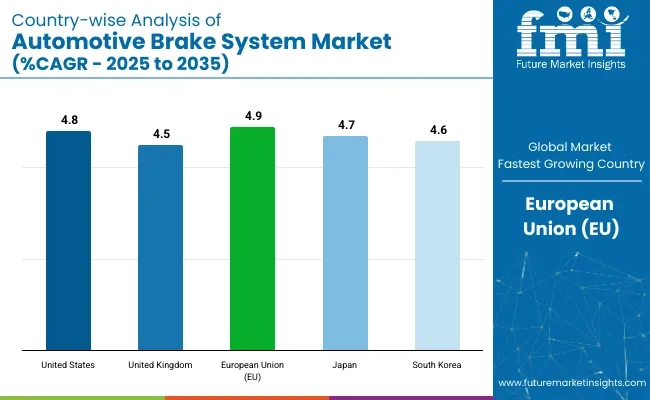

The demand for automotive brake systems in the USA market is primarily driven by the increasing production of vehicles, the implementation of stringent safety regulations, and the growing adoption of advanced braking technologies such as electronic stability control (ESC) and automatic emergency braking (AEB). A transition to EVs (electric vehicles) and regenerative brakes also contributes to growth in the market.

These main players are placing great emphasis on the use of lightweight materials and digital integration to improve performance. The industry's enlargement is bolstered by the presence of major automakers and suppliers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

In the UK market, strict safety regulations and fast growing van EV adoption are propelling the evolution. Government policies encouraging the use of green transport and low emission vehicles are gradually adopting regenerative braking systems.

The demand for disc brakes and electronic braking systems is on the rise as they are lightweight, cater to the demand of automakers for less weight and integrating electronic solutions. Hybrid vehicle popularity also helps the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

Stringent safety and environmental regulations along with the rising adoption of ADAS (Advanced Driver Assistance Systems) significantly influence the EU automotive brake system market. High-growth demand is integrated from regions, and countries such as Germany and France drive high technological innovations in the countries.

The shift toward electrification and autonomous vehicles is generating demand for the next generation of braking systems, including electro-hydraulic braking (EHB) systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

Japan's automotive market is well-driven by the high-demand vehicles in Japan, and automotive safety and vehicle quality are rigidly implemented in Japan. Shift towards brake-by-wire technology and integration of AI driven braking assist systems are on the rise.

Demand for regenerative braking solutions is being driven by a strong electric vehicle (EV) market in the country, supported by major manufacturers such as Toyota and Honda. The growth of the market is also backed by government policies in favour of green mobility.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korean market is growing with an increased output of electric and autonomous vehicles. South Korea has also been made a top player in smart car technology, with major national manufacturers like Hyundai and Kia pouring money into smart brake methods, including AI-driven brake systems and preventative maintenance systems.

The drive toward sustainable practices and stringent emissions legislation are speeding up implementation of regenerative braking systems. Moreover, partnerships with international tech companies further strengthen market positioning.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The Automotive Brake System Market is essential for ensuring vehicle safety, performance, and compliance with regulations. The growth of the market will be propelled by technological advancements, growing electric vehicles (EVs) adoption, and strict safety rules & regulations. Advanced Driver Assistance Systems (ADAS) along with electronic braking systems (EBS) minimize stopping distances and improve handling.

Sustainability trends have led to the creation of low-emission, eco-friendly brake materials. The world market has some key players investing in smart braking technology, regenerative braking, and AI-based safety systems.

Moreover, mergers and acquisitions (M&A) and strategic alliances are a part of the market evolution. With a determined focus on autonomous driving and electric mobility, intelligent, lightweight, high-performance braking solutions have greater demand.

In terms of System Type, the industry is divided into Disc Brake, Drum Brake.

In terms of Vehicle Type, the industry is divided into Mid-Sized Passenger Cars, Compact Passenger Cars, Luxury Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Premium Passenger Cars.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Automotive Brake System market is projected to reach USD 7,556.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 10.3% over the forecast period.

By 2035, the Automotive Brake System market is expected to reach USD 20,140.4 million.

The Disc Brake segment is expected to dominate the market, due to superior heat dissipation, consistent performance, lower fade risk, better stopping power, reduced maintenance, and increasing adoption in passenger and commercial vehicles for safety.

Key players in the Automotive Brake System market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Brembo S.p.A.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 20: Latin America Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 25: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 27: Western Europe Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 28: Western Europe Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 29: Western Europe Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 31: Western Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 32: Western Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 33: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 35: Eastern Europe Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 36: Eastern Europe Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 37: Eastern Europe Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 39: Eastern Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 40: Eastern Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 41: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: South Asia and Pacific Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 44: South Asia and Pacific Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 45: South Asia and Pacific Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 47: South Asia and Pacific Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 49: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 50: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

Table 51: East Asia Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 52: East Asia Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 53: East Asia Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 54: East Asia Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 55: East Asia Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 56: East Asia Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 57: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2020 to 2035

Table 59: Middle East and Africa Market Value (USD Million) Forecast by System Type, 2020 to 2035

Table 60: Middle East and Africa Market Volume (Units) Forecast by System Type, 2020 to 2035

Table 61: Middle East and Africa Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 63: Middle East and Africa Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 64: Middle East and Africa Market Volume (Units) Forecast by Technology, 2020 to 2035

Figure 1: Global Market Value (USD Million) by System Type, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Technology, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Volume (Units) Analysis by Region, 2020 to 2035

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 9: Global Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 10: Global Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 17: Global Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 18: Global Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 19: Global Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 20: Global Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 21: Global Market Attractiveness by System Type, 2025 to 2035

Figure 22: Global Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 23: Global Market Attractiveness by Technology, 2025 to 2035

Figure 24: Global Market Attractiveness by Region, 2025 to 2035

Figure 25: North America Market Value (USD Million) by System Type, 2025 to 2035

Figure 26: North America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 27: North America Market Value (USD Million) by Technology, 2025 to 2035

Figure 28: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 29: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 30: North America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 33: North America Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 34: North America Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 41: North America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 42: North America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 43: North America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 44: North America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 45: North America Market Attractiveness by System Type, 2025 to 2035

Figure 46: North America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 47: North America Market Attractiveness by Technology, 2025 to 2035

Figure 48: North America Market Attractiveness by Country, 2025 to 2035

Figure 49: Latin America Market Value (USD Million) by System Type, 2025 to 2035

Figure 50: Latin America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) by Technology, 2025 to 2035

Figure 52: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 53: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 57: Latin America Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 58: Latin America Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 59: Latin America Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 66: Latin America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 69: Latin America Market Attractiveness by System Type, 2025 to 2035

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 71: Latin America Market Attractiveness by Technology, 2025 to 2035

Figure 72: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 73: Western Europe Market Value (USD Million) by System Type, 2025 to 2035

Figure 74: Western Europe Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 75: Western Europe Market Value (USD Million) by Technology, 2025 to 2035

Figure 76: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 77: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 81: Western Europe Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 82: Western Europe Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 85: Western Europe Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 89: Western Europe Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 90: Western Europe Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 93: Western Europe Market Attractiveness by System Type, 2025 to 2035

Figure 94: Western Europe Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 95: Western Europe Market Attractiveness by Technology, 2025 to 2035

Figure 96: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 97: Eastern Europe Market Value (USD Million) by System Type, 2025 to 2035

Figure 98: Eastern Europe Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 99: Eastern Europe Market Value (USD Million) by Technology, 2025 to 2035

Figure 100: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 101: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 105: Eastern Europe Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 106: Eastern Europe Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 109: Eastern Europe Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 113: Eastern Europe Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 114: Eastern Europe Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 117: Eastern Europe Market Attractiveness by System Type, 2025 to 2035

Figure 118: Eastern Europe Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 119: Eastern Europe Market Attractiveness by Technology, 2025 to 2035

Figure 120: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 121: South Asia and Pacific Market Value (USD Million) by System Type, 2025 to 2035

Figure 122: South Asia and Pacific Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 123: South Asia and Pacific Market Value (USD Million) by Technology, 2025 to 2035

Figure 124: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 125: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 129: South Asia and Pacific Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 133: South Asia and Pacific Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 137: South Asia and Pacific Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 141: South Asia and Pacific Market Attractiveness by System Type, 2025 to 2035

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 143: South Asia and Pacific Market Attractiveness by Technology, 2025 to 2035

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 145: East Asia Market Value (USD Million) by System Type, 2025 to 2035

Figure 146: East Asia Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 147: East Asia Market Value (USD Million) by Technology, 2025 to 2035

Figure 148: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 149: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 153: East Asia Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 154: East Asia Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 155: East Asia Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 157: East Asia Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 161: East Asia Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 162: East Asia Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 165: East Asia Market Attractiveness by System Type, 2025 to 2035

Figure 166: East Asia Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 167: East Asia Market Attractiveness by Technology, 2025 to 2035

Figure 168: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 169: Middle East and Africa Market Value (USD Million) by System Type, 2025 to 2035

Figure 170: Middle East and Africa Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 171: Middle East and Africa Market Value (USD Million) by Technology, 2025 to 2035

Figure 172: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 173: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 177: Middle East and Africa Market Value (USD Million) Analysis by System Type, 2020 to 2035

Figure 178: Middle East and Africa Market Volume (Units) Analysis by System Type, 2020 to 2035

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by System Type, 2025 to 2035

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by System Type, 2025 to 2035

Figure 181: Middle East and Africa Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 185: Middle East and Africa Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 189: Middle East and Africa Market Attractiveness by System Type, 2025 to 2035

Figure 190: Middle East and Africa Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 191: Middle East and Africa Market Attractiveness by Technology, 2025 to 2035

Figure 192: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Shims Market Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Brake Pad Market - Growth & Demand 2025 to 2035

Automotive Brake Tube Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Brake Override System Market

Automotive Handbrake And Clutch Cables Market

Automotive Park Brake Lever Market Growth – Trends & Forecast 2024-2034

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Automotive Carbon Brake Rotors Market Growth - Trends & Forecast 2025 to 2035

Automotive Washer System Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA