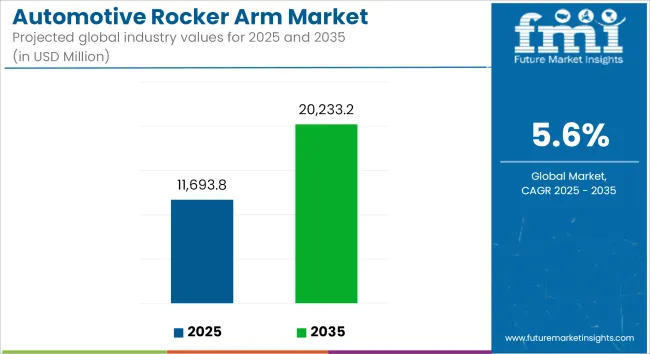

The global automotive rocker arm market is estimated at USD 11,693.8 million in 2025 and projected to reach USD 20,233.2 million by 2035, reflecting a CAGR of 5.6% during the forecast period. Demand is being supported by rising vehicle production volumes and the requirement for fuel-efficient valvetrain systems.

In January 2024, Rheinmetall confirmed the receipt of a low double-digit million-euro order for rocker arm bushings from a globally active automaker. According to Automotive World, the components were specified for heavy-duty engine variants and designed to reduce friction losses. The improvements were intended to raise cylinder fill levels and enhance thermal efficiency in high-RPM operation.

Throughout 2024, advancements in materials and geometry have continued. Roller rocker arms were introduced with hardened contact areas and integrated bearings, allowing for reduced wear and sustained operation under high valve speed conditions. Patent CN201802814U described a roller-follower rocker arm with lower mass and enhanced load-bearing properties, expected to see deployment in racing and high-output vehicles.

Growth has also been driven by hybrid internal combustion systems and turbocharged engine platforms. In start-stop enabled hybrids, steel alloy rocker arms have been reinforced to tolerate frequent ignition cycling. Diesel and gas engines in commercial fleets have used these components to address elevated valvetrain pressures.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11,693.8 million |

| Industry Value (2035F) | USD 20,233.2 million |

| CAGR (2025 to 2035) | 5.6% |

Rocker arm assemblies have been modularized to support adjustable pivot settings, preload tuning, and compatibility with aftermarket camshaft profiles. Service kits have been packaged with retainers and lash shims to reduce downtime during maintenance without requiring full cylinder head replacement.

Asia-Pacific has remained a key demand region, with continued motorcycle production in India, China, and Southeast Asia requiring both OEM and aftermarket rocker arms. In North America, performance upgrades for muscle cars have encouraged the use of high-ratio roller rockers for precision camshaft operation.

Recent supply-side innovations have included the development of lightweight aluminum rocker arms for adventure and motorsport applications, along with anti-corrosion finishes and sealed bearings to extend service life in humid and salt-prone environments.

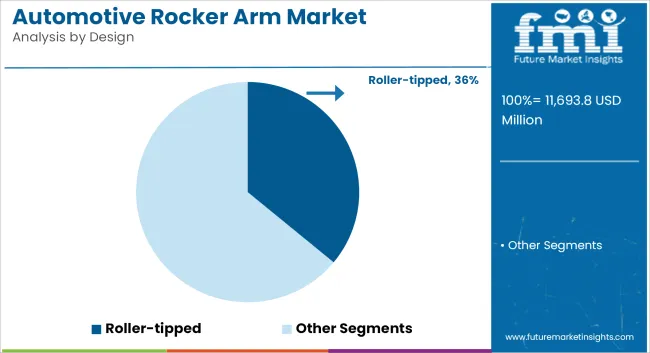

Full roller rocker arms are estimated to account for approximately 36% of the global automotive rocker arm market in 2025 and are projected to grow at a CAGR of 6.3% through 2035. Their design minimizes friction between the valve tip and camshaft lobe, enabling better valve actuation and reduced wear, which supports improved engine efficiency and durability.

Automakers favor full roller designs in high-performance and turbocharged powertrains, where precise valve timing and reduced parasitic losses are critical. In 2025, demand remains strong across both gasoline and diesel engines in light-duty vehicles, especially in North America and Europe, where fuel economy standards continue to tighten. Suppliers are developing lightweight roller designs using high-strength alloys and advanced heat-treatment techniques to improve stiffness, temperature resistance, and fatigue life.

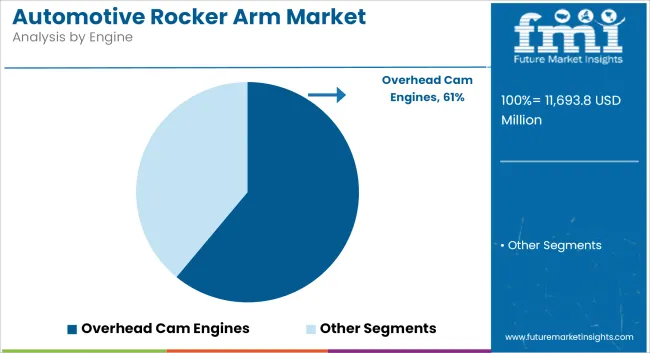

Overhead cam (OHC) engines are projected to account for nearly 61% of the global rocker arm market by engine type in 2025 and are expected to grow at a CAGR of 6.2% through 2035. OHC configurations are commonly used in passenger vehicles and light commercial vehicles due to their ability to support higher engine speeds, better airflow, and more compact design. In 2025, rocker arms integrated into OHC engines are increasingly designed for precision motion control and reduced mass to improve engine responsiveness.

Automakers continue to favor OHC systems for their compatibility with variable valve timing (VVT) and hybrid powertrain layouts. As emission norms become more stringent and engine downsizing trends persist, OHC-based architectures remain central to rocker arm demand globally.

Increasing Adoption of Electric Vehicles (EVs)

One of the primary challenges is the transition from traditional vehicles to electric cars (EVs) which do not need conventional valve train parts such as rocker arms. The shift to the prioritization of EV production by car manufacturers and state bodies and the consequent reduction of reliance on ICE will conjoin in the long run to the decreased demand for standard rocker arms.

In order to tackle this issue, component manufacturers are more focused on hybrids and internal combustion engine reducer technologies, which offer, in contrast, advanced, lightweight rocker arms to operate at maximum performance and efficiency, and they are the ones who benefits directly.

Material and Manufacturing Cost Volatility

The volatility in the costs of raw materials, such as aluminium, steel, and composites, used in manufacturing rocker arms at affordable prices, has emerged as a significant challenge for producers. Also, the high rate of precision manufacturing, automation, and quality control acts as the solid overall contributor to high renewable investment costs.

In this regard, reluctant investors are being convinced to change their resorting to adept material technologies such as molecular composites that have been granted high strength and resistance to corrosion plus the advanced coatings that have been utilized in them.

Street-and-Track Automotive Enhancements Lightweight and Strong

The manufacture of lightweight and high-strength rocker arms (made from aluminium, titanium, and carbon-fibre-reinforced composites), which in turn, will create new market opportunities is definitely one of the best particular advantages. The use of these materials will, in fact, lead to improved fuel economy, lower engine weight and extended service life, making them an optimal choice for high-performance applications and hybrid vehicles.

Infinite advancements like roller-bearing rocker arms, and self-adjusting hydraulic lifters turn into major tasks for the manufacturers focusing on enhancing engine efficiency and lowering friction losses that, in turn, lead to increased implementation of rocker arm technologies.

Surge of Aftermarket Performance Upgrades

Automotive enthusiasts and professionals push the performance and originality frontiers, creating an aftermarket to develop diversified products for the market. Among the components, roller rocker arms, precision engineered lifters, and variable valve timing upgrades are the most popular among aftermarket enthusiasts.

With the ongoing growth of motorsport events, the interest of customers in the tuning of engines, and the availability of aftermarket customization options, the automotive rocker arm market is likely to get an extra boost from the aftermarket.

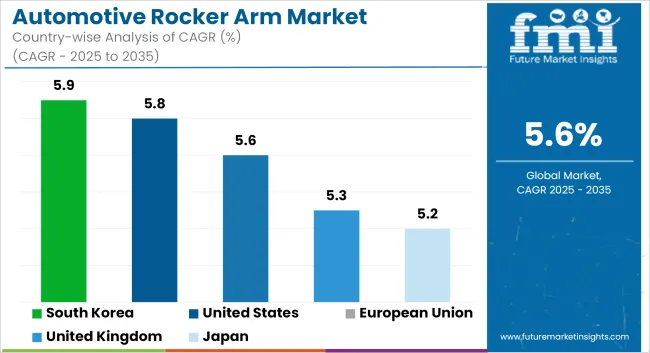

The USA automotive rocker arm industry is on an upward trajectory, owing to factors like the appreciation of vehicle production, the rise in the quest for fuel-efficient engines as well as the chip in high-performance automotive components. The increase of hybrid and turbocharged gasoline engines is driving the demand for lightweight and high-strength rocker arms applied for the more efficient engine and emission reduction features.

On the other hand, the Environmental Protection Agency (EPA) mandates that cut down of vehicle emissions which in turn are consequences of automakers using state-of-the-art rocking arm materials (aluminium and composite alloys) to account for engine rarely efficiency. The emergence of the performance auto parts aftermarket sector is also a reason for the rise in the sale of performance rocker arms for vehicle tuning and improvements.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The UK automobile rocker arm industry is experiencing a steady development backed by the rigid rules for emissions, the growing rate of the hybrid cars, and the demands for the lightweight car engine components. By being the UK the forerunner on the road to carbon reduction and the shift to hybrid and alternative fuel vehicles is prompting the auto makers into the implementation of rocker arm design efficiency that aids in better performance of the engine.

Furthermore, the upsurge of the motorsport and performance vehicle sector in Britain is boosting the need for precision-engineered, high-strength rocker arms. Besides this, the use of electric-assisted hybrid engine technologies has spurred the research into rocker arm weight reduction and advanced friction-reducing coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The above paragraph discusses the increasing sales of European Union automotive rocker arm driven by the need for CO₂ emission reduction, the trend of lightweight engine components, and the move towards hybrid and turbocharged gasoline engines, etc. In line with this, the EU’s Euro 7 emission standards are in a way proving to be the catalyst for the introduction of low-friction and high-efficiency engine parts, which are likely to include advanced rocker arms.

Moreover, the countries such as Germany, France, and Italy that have substantial automotive manufacturing sectors are at the forefront of the introduction of next-generation rocker arm materials and production techniques to boost fuel efficiency and engine life. The small-size turbocharged engines boom in the European passenger cars market is also a factor that increases the demand for tailored rocker arm models.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

The Japan automotive rocker arm market is going through an era of mid-growth, backed by the development of hybrid and fuel-efficient engine technologies, progression in precision engineering, and the emergence of the trend for high-performance attachments to cars. As the world leader in hybrid vehicle production, Toyota, and Honda companies are boosting the demand for low-friction, and high-efficiency rocker arms.

Another element is that the idea of lightweight design and lower emissions are persuading car firms to use materials such as titanium and aluminium in rocker arms. The R&D in the automotive sector of Japan is heavily devoted to optimizing next-generation engines, which in turn is causing the development of digital control of valve-train systems with the incorporation of state-of-the-art rocker arm technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The South Korea automotive rocker arm market is witnessing an upward trend due to factors such as the rise of hybrid and electric-assisted combustion engines, the increase in investments for automotive lightweight materials, and the state’s assertive position in the automotive manufacturing industry. With leading brands such as Hyundai and Kia, who are pioneers in hybrid cars technology, the demand for high-strength, low-weight rocker arms are on the rise. Apart from this, the South Korean automotive component manufacturing sector development is resulting in the precision rocker arm production for both local and international car brands.

The proliferation of electric-assist combustion engines are propelling the demand for the roller rocker arm which is a device to be added that will handle accordingly improve the fuel consumption to the engine while keeping it still safe and durable. The implementation of robotic automation in automotive parts production also brings about improvements in quality and performance consistency in contemporary rocker arm production.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The global automotive rocker arm market is beleaguered by the advent of rising vehicle production, demand for high-performance engines, and the focus on fuel efficiency technologies, thus steady growth could be seen. Rocker arms are the key components in the engine that control the opening and closing of the valves, which leads to the optimization of combustion, the reduction of friction, and the increase in overall engine efficiency.

The market trend is dictated by new lightweight material technologies (such as aluminium, titanium, and composites), the growing utilization of roller rocker arms, and the increasing consumer preference for energy-efficient, high-performance vehicles. Top companies concentrate on such areas as precision engineering, product durability, and reduced weight in order to boost power output and lower fuel consumption.

The global automotive rocker arm market is projected to reach USD 11,693.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.6% over the forecast period.

By 2035, the automotive rocker arm market is expected to reach USD 20,233.2 million.

The roller-tipped rocker arm segment is expected to dominate due to its improved efficiency in reducing friction, enhancing valve lift performance, and increasing fuel efficiency in modern internal combustion engine (ICE) vehicles.

Key players in the market include INA (Schaeffler Group), Crower Cams & Equipment Co., COMP Cams, Yuhuan Huiyu, and Riken Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA