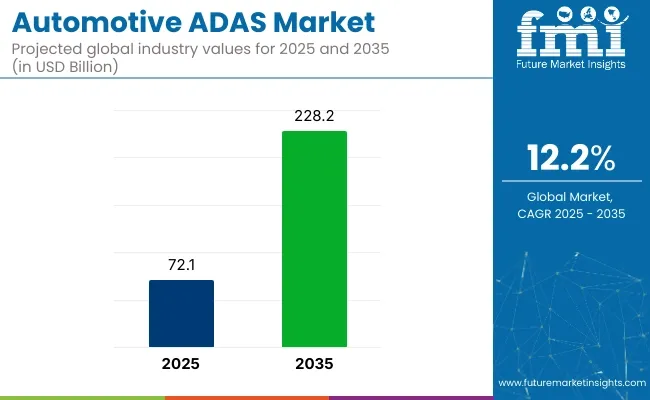

The global automotive advanced driver assistance systems (ADAS) market is estimated at USD 72.1 billion in 2025 and is projected to reach USD 228.2 billion by 2035, registering a robust CAGR of 12.2% throughout the forecast period. This surge is being driven by the expansion of safety mandates, advancements in sensor fusion, and growing consumer demand for driver-assist features in both premium and mass-market segments.

In March 2025, Mobileye launched its Surround ADAS platform, designed specifically for broad adoption in non-luxury vehicles. The system was built with 11 surround-view cameras, scalable compute platforms, and redundancy mechanisms for real-time perception and decision-making. According to Forbes, Mobileye confirmed that OEM partnerships had already been secured for high-volume rollouts beginning in late 2025. The company stated that "with Surround ADAS, we aim to bring L2+ safety features to every consumer segment".

Nissan, in a 2024 announcement, confirmed the planned rollout of its ProPILOT AD system by 2027. This ADAS suite will combine 3D mapping, high-resolution radar, and AI-based predictive algorithms to offer semi-autonomous capabilities in urban and highway settings. As noted by Autonomous Vehicle International, development has been structured around scalable architecture to ensure compliance with varying international safety regulations.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 72.1 Billion |

| Market Value (2035F) | USD 228.2 Billion |

| CAGR (2025 to 2035) | 12.2% |

According to a 2024 market penetration study by MITRE’s PARTS initiative, L1 and L2 ADAS features had reached 69% and 36% of new vehicle production respectively, in North America. The report highlighted that collision warning, blind-spot monitoring, and automatic emergency braking systems were among the most widely adopted safety features, while adaptive cruise control and lane centering systems continued to gain share.

The International Association of Chiefs of Police (IACP), in its 2024 regulatory guidance, emphasized the importance of standardizing ADAS terminology and ensuring driver engagement in semi-autonomous scenarios. The guidelines were issued to assist jurisdictions in harmonizing testing and deployment procedures.

With increasing regulatory clarity, maturing sensor technologies, and strong OEM investment, the ADAS market is poised for accelerated adoption through 2035, serving as a foundational pillar for future autonomous mobility systems.

Adaptive Cruise Control (ACC) accounted for 7.5% of the global driver assistance systems market in 2025 and is projected to grow at a CAGR of 12.6% through 2035. Its implementation expanded across both entry-level and mid-range passenger vehicles as OEMs aimed to meet evolving safety norms and enhance long-distance driving convenience.

In 2025, ACC systems were commonly combined with forward collision warning (FCW) and automatic emergency braking (AEB) to enable partial automation under highway conditions. Automakers in Europe, Japan, and South Korea integrated radar and camera-based ACC modules calibrated for variable traffic densities.

Regulatory incentives and voluntary safety rating programs such as Euro NCAP accelerated ACC integration beyond luxury vehicles. Suppliers introduced cost-optimized versions with enhanced traffic jam assist and stop-and-go functionality, enabling broader adoption across global markets.

SUVs represented 32% of total system installations in 2025 and are expected to grow at a CAGR of 12.4% through 2035. This trend was driven by high global demand for SUVs and their suitability for ADAS integration due to available space, electrical architecture, and ride height advantages. In 2025, compact and mid-size SUVs adopted multiple driver assistance features including lane departure warning, blind spot detection, parking assist, and surround view systems.

Automakers positioned these features as value additions across mid-tier variants in Asia-Pacific, North America, and parts of the Middle East. As SUVs were increasingly used for both urban commuting and intercity travel, real-time safety systems were integrated to address changing traffic dynamics. OEMs aligned ADAS rollouts with consumer expectations of connected and intelligent driving experiences, strengthening sensor penetration and system bundling across SUV platforms.

High Costs and Technical Limitations

LiDAR, radar, and high-resolution cameras are critical components of ADAS, and the cost of these features can surpass the price range allocated for low and mid-range vehicles, preventing low and mid-range vehicles from having fully-feature ADAS.

In addition, technical issues such as false positives in object recognition, poor performance of ADAS in extreme weather conditions, and difficulties in sensor alignment can impact the accuracy and reliability of combined ADAS technologies. These mixed safety standards in widely separated jurisdictions create novel challenges for manufacturers developing ADAS technologies conformant across the globe.

AI-Driven Sensor Fusion and Autonomous Driving Advancements

Despite the basic challenges the Automotive ADAS Market remains an ocean of opportunity massive opportunities. Also, the detection of objects, pedestrian safety, and adaptive driving assistance are being improved through the integration of AI-enabled sensor fusion, machine learning algorithms, and deep neural networks in real time.

Demand for AI-enhanced advanced driver assistance systems (ADAS) solutions such as real-time traffic prediction, AI-driven driver monitoring, and cloud-connected ADAS analytics are being propelled by advancements in autonomous vehicle technology, including Level 2 and Level 3 automation.

The growth of smart mobility infrastructure and AI-based traffic management, in addition to vehicle-to-everything (V2X) communications, is envisioned to open up new market opportunities for ADAS suppliers, sensor producers and automotive OEMs. Moreover, government-backed incentives for intelligent transport systems and vehicle safety campaigns drive the commercialization of next-gen ADAS technologies across commercial and passenger vehicles.

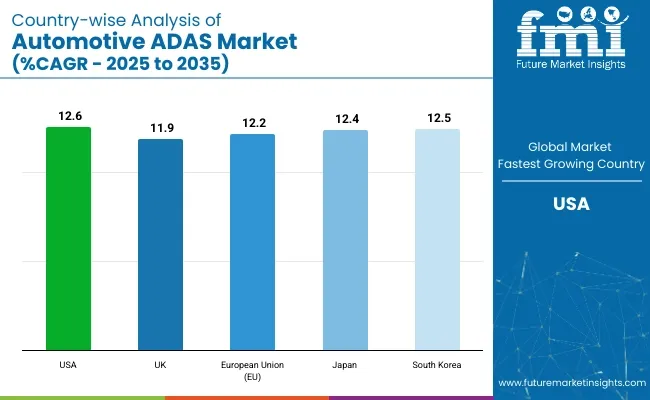

Automotive ADAS Market in the United States is witnessing considerable expansion due to stringent car safety regulations, later the increased use of automation technologies, and an increase in consumer demand for ADAS features. ADAS features, including automatic emergency braking (AEB), and lane departure warning (LDW), have been the subject of regulations from NHTSA, which has been causing accelerated market expansion.

Various manufacturers, including Tesla, Ford and General Motors are implementing AI-based ADAS solutions, like adaptive cruise control (ACC), blind-spot monitoring (BSM) and self-parking assist. The market is further driving owing to the investments in V2X (vehicle-to-everything) communication and AI-powered perception systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.6% |

The key factors driving the growth of the Automotive ADAS Market in the United Kingdom are the government-backed initiatives for vehicle safety, rise of electric vehicles (EVs) adoption, and innovations in AI-integrated driving assistance systems. To help prevent road injuries and improve driver efficiency, the UK Department for Transport is currently advocating for the incorporation of the ADAS in all new commercial and passenger vehicles.

In response, luxury and premium vehicle manufacturers are also investing heavily in LiDAR-based ADAS, AI-enabled driver monitoring systems, and high-resolution sensor fusion technologies to increase safety and automate functions at an exponential rate; in 2028, they will reach their highest levels of vehicle adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.9% |

The European Union is expected to be the fastest region in the Automotive ADAS Market because of strict Euro NCAP safety regulations, rapidly increasing EVs, and increased investment in autonomous driving technologies. The European Commission’s Vision Zero employs a similar approach, and its goal is to reach zero road fatalities by 2050 and motivate automobile manufacturers to implement high level optimal ADAS solutions, nursery for autonomous vehicles.

Automotive titans like BMW, Mercedes-Benz, and Volkswagen are among the leaders of this sector in Germany, France, and Italy, pouring investment into AI-based perception systems, LiDAR-augmented autonomous guidance, and next-gen sensor fusion systems. The need for a connected and smart transportation system in 5G logics is boosting ADAS penetration as well.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.2% |

Japan is the leader in vehicle automation, which positively impacts the growth of the Automotive ADAS Market by increasing consumer safety and government regulations in favor of intelligent transportation, as well as strong investment in AI-based driving assistance technologies. The Japanese Ministry of Land, Infrastructure, Transport and Tourism (MLIT) already has safety mandates that will force all new vehicles to have ADAS functionality by 2027.

Companies like Toyota, Honda, and Nissan are leading the charge on LiDAR, radar, and AI-based ADAS solutions to deliver level 3 and level 4 autonomous driving. Moreover, V2X-based ADAS improvements are being spurred by strong 5G and smart city infrastructure in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.4% |

In South Korea, the automotive ADAS market is rapidly growing due to government efforts to promote autonomous driving; increased investment in AI-based vehicle safety systems; and rising adoption of electric and hydrogen-fueled vehicles. The adoption of ADAS features is only going up, as the South Korean Ministry of Land, Infrastructure, and Transport (MOLIT) has required all new vehicles to be equipped with ADAS features by 2025, stimulating the need for advanced driver assistance technology.

To enhance vehicular safety and semi-autonomous driving systems, major South Korean vehicle enterprises such as Hyundai and Kia are pouring resources into additional high-precision radar, LiDAR, and camera systems powered by AI. Moreover, the penetration of 5G-enabled ADAS and real-time traffic witnessing solution is also accelerating market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.5% |

There are several reasons behind the growth of Automotive ADAS Market, including safety devices to improve driver assistance, government regulations promoting ADAS technologies, and the latest innovations in AI-enabled assistance functions. Key factors driving the market include increasing adoption of Level 2 and Level 3 automation, advancements in sensor fusion, and the growing penetration of electric and autonomous vehicles.

High resolution imaging, LiDAR, radar, and AI-driven perception systems dominate partnerships and mergers. Comprised of automotive suppliers, semiconductor manufacturers, and AI companies, the market drives new innovations in advanced perception, autonomous navigation, and driver monitoring systems.

The overall market size for the Automotive ADAS Market was USD 72.1 Billion in 2025.

The Automotive ADAS Market is expected to reach USD 228.2 Billion in 2035.

Stringent vehicle safety regulations, increasing demand for autonomous driving features, and advancements in AI-driven sensor technology will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Standard ADAS Systems is expected to dominate due to its role in enhancing driver safety and reducing road accidents.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by System, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by System, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by System, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by System, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by System, 2020 to 2035

Table 20: Latin America Market Volume (Units) Forecast by System, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 25: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 27: Western Europe Market Value (USD Million) Forecast by System, 2020 to 2035

Table 28: Western Europe Market Volume (Units) Forecast by System, 2020 to 2035

Table 29: Western Europe Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 30: Western Europe Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 31: Western Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 32: Western Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 33: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 35: Eastern Europe Market Value (USD Million) Forecast by System, 2020 to 2035

Table 36: Eastern Europe Market Volume (Units) Forecast by System, 2020 to 2035

Table 37: Eastern Europe Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 38: Eastern Europe Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 39: Eastern Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 40: Eastern Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 41: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: South Asia and Pacific Market Value (USD Million) Forecast by System, 2020 to 2035

Table 44: South Asia and Pacific Market Volume (Units) Forecast by System, 2020 to 2035

Table 45: South Asia and Pacific Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 47: South Asia and Pacific Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 49: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 50: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

Table 51: East Asia Market Value (USD Million) Forecast by System, 2020 to 2035

Table 52: East Asia Market Volume (Units) Forecast by System, 2020 to 2035

Table 53: East Asia Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 54: East Asia Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 55: East Asia Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 56: East Asia Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 57: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2020 to 2035

Table 59: Middle East and Africa Market Value (USD Million) Forecast by System, 2020 to 2035

Table 60: Middle East and Africa Market Volume (Units) Forecast by System, 2020 to 2035

Table 61: Middle East and Africa Market Value (USD Million) Forecast by Battery Type, 2020 to 2035

Table 62: Middle East and Africa Market Volume (Units) Forecast by Battery Type, 2020 to 2035

Table 63: Middle East and Africa Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 64: Middle East and Africa Market Volume (Units) Forecast by Technology, 2020 to 2035

Figure 1: Global Market Value (US$ Million) by System, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by System, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 21: Global Market Attractiveness by System, 2023 to 2033

Figure 22: Global Market Attractiveness by Battery Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Technology, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by System, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by System, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 45: North America Market Attractiveness by System, 2023 to 2033

Figure 46: North America Market Attractiveness by Battery Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Technology, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by System, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by System, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 69: Latin America Market Attractiveness by System, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Battery Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by System, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by System, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by System, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by System, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by System, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by System, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by System, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by System, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by System, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Battery Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by System, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by System, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 165: East Asia Market Attractiveness by System, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Battery Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by System, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by System, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by System, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Battery Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Advanced Automotive Materials Market Growth - Trends & Forecast 2025 to 2035

Advanced Infusion Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Personal Assistance System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Turbo Compounding Systems Market Growth – Trends & Forecast 2025 to 2035

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced (3D/4D) Visualization Systems Market Analysis by Platform, End User, Application, and Region through 2035

Automotive Gesture Recognition Systems Market

Automotive Touch Screen Control Systems Market Growth - Trends & Forecast 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA