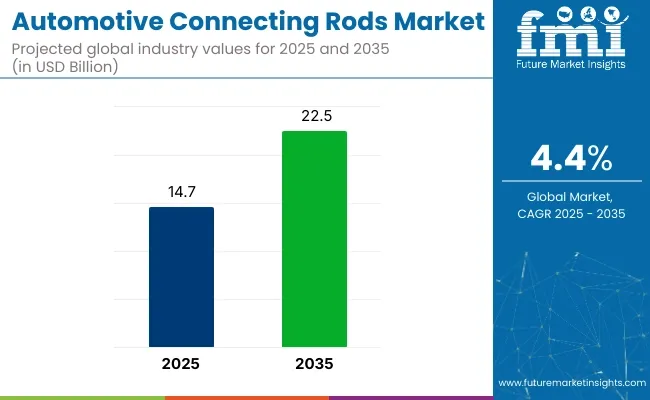

The global automotive connecting rods market is projected to reach USD 14.7 billion by 2025 and expand to USD 22.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% during the forecast period. In 2024, market revenues were recorded at approximately USD 14.1 billion, reflecting sustained demand from internal combustion engine (ICE) and hybrid vehicle applications. This growth has been attributed to advances in lightweight material technologies, increasing engine durability requirements, and evolving needs in motorsport and aftermarket segments.

Notable product introductions were observed in 2024, when CP-Carrillo unveiled a new range of connecting rods made from titanium and aluminum alloys during the PRI Show. These rods were engineered to reduce reciprocating mass while offering a superior strength-to-weight ratio, particularly for high-performance and racing vehicles. According to technical coverage by EngineLabs, titanium variants have demonstrated improved fatigue resistance, whereas aluminum rods have shown value in short-distance racing due to their reduced inertia. CP-Carrillo confirmed that these innovations are being applied in drag racing and endurance competitions where thermal and dynamic stresses are critically managed.

| Attributes | Key Insights |

|---|---|

| Estimated Market Value, 2025 | USD 14.7 billion |

| Projected Market Value, 2035 | USD 22.5 billion |

| Market Value CAGR (2025 to 2035) | 4.4% |

European OEM supply chains have continued to be supported by AC Floby, which has remained a key supplier of forged steel connecting rods. These components were developed using simulation-led optimization and fracture-split technology to enhance structural integrity while aligning with stringent Euro 7 emission regulations. Their application has been confirmed in turbocharged and downsized engines, which prioritize fuel efficiency and emission control.

Material innovation has further extended into experimental territories. As reported by EngineLabs in 2024, carbon fiber connecting rods are under development, offering considerable weight savings while retaining tensile strength. Although still in the prototype stage, such rods are being tested in collaboration with motorsport teams and specialized engine manufacturers.

Despite the shift toward electrified powertrains, hybrid vehicles continue to depend on efficient ICE components. As a result, connecting rods are expected to remain a critical component, supported by OEM integration, material innovation, and niche high-performance applications through 2035.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Automotive Connecting Rod market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.5% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.5% (2024 to 2034) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.1% in the first half and remain relatively moderate at 4.7% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Forged connecting rods accounted for 52% of the global market share in 2025 and are projected to grow at a CAGR of 4.7% through 2035. Their continued use was driven by high strength-to-weight ratio and durability under high-load engine operations. In 2025, forged rods were standard across internal combustion engines in passenger vehicles, light commercial vehicles, and performance-oriented powertrains.

OEMs preferred forged designs for their resistance to cyclic stress and reliability under prolonged usage, particularly in diesel and turbocharged engines. Manufacturers invested in advanced forging techniques to reduce weight while retaining mechanical integrity, aligning with engine downsizing and efficiency goals. Applications in high-revving engines, hybrid propulsion units, and motorsports segments further reinforced demand for forged connecting rods.

Steel held 63% of the global connecting rod market by material type in 2025 and is forecast to grow at a CAGR of 4.5% through 2035. Its widespread adoption was supported by cost efficiency, material availability, and mechanical strength suitable for various engine configurations. In 2025, both forged and cast steel rods were utilized across gasoline and diesel engine platforms in passenger cars, commercial vehicles, and industrial equipment.

Steel provided the desired balance of fatigue strength, machinability, and heat resistance, especially under continuous high-pressure combustion cycles. Automotive manufacturers across India, China, and Brazil favored steel connecting rods in budget and utility vehicle models due to proven performance and ease of integration. Suppliers also introduced high-strength alloyed steel grades to reduce rod mass while meeting stringent endurance criteria.

Manufacturers are focusing on increasing their production capacity

The scenario is impressive with increasing production capacity becoming a notable trend in the global market for expanding automotive connecting rods. The need is to scale operations as the global automotive output rises particularly in the case of developing economies.

In this regard regions like the Asia Pacific are very dynamic as a result of developing economies supplanting urbanization and increasing demand for vehicles of all market segments She noted growth in production capacity as venturing into new technological areas is required to produce new types of connecting rods on large scale.

This trend is likely to become prominent in the Asian region where urbanization is at a fast pace enabling mass and premium vehicle production. Today's hybrid vehicles have small torque-efficient and turbocharged engines which means the need arises for specially designed connecting rods. Therefore, manufacturers have to ramp up capacity to shift this niche market.

Bharat Forge: Indian facilities were recently expanded to meet the upcoming need for connecting rods related to commercial vehicles and passenger vehicles.

Mahle GmbH: Emphasis was laid on lightweight aluminum connecting rods while investing in capacity augmentation across Europe and North America.

Shift towards Lightweight Materials and Advanced Alloys

The use of lightweight materials in automotive engines has massively improved for the simple fact that the details feature materials such as forged steel, titanium, and aluminum alloys which are firm yet light. Such upgrades to connecting rods - parts of an engine is a reciprocating mechanism - allow for fuel economy and better vehicle efficiency overall.

Thin connecting rods are in demand due to EVs becoming more popular over diesel engines as the weight of each component and boosting efficiency is essential, and so are environmental standards, and strict regulations. Substituting in lighter alloys has enabled the automotive industry to tackle fuel consumption and emission standards achieved through the decrease in engine weight improving the vehicle's overall dynamic. Furthermore, to expand on lighter alloys, materials such as titanium are good at enhancing the vehicle's performance and durability.

A significant innovator and investor in lightweight materials including aluminum and forged steel is Mahle, and this is essential for improving fuel economy for both hybrid and conventional engines, as well as automotive construction as a whole.

Consumer Preference for Sustainability and Environmental Regulations

Due to growing concerns about the environment, there is an increasing emphasis on reducing emissions and enhancing fuel efficiency by both consumers and governments around the world. The change comes with an increase in the trend of utilizing green manufacturing processes and materials.

This shift is even more crucial when it comes to connecting rods as they are especially vulnerable - they are the parts of an internal combustion engine that determine the dynamics of fuel consumption, emission levels, and the performance of a vehicle.

Producers are increasingly implementing "green" practices into their manufacturing facilities Advanced "Green" captures sustainable manufacturing NC parameters such as energy used, waste, and the recycling practices utilized. In the case of connecting rods, recyclable aluminum can be used which reduces the cost of production as well as the cost to the environment.

Schaeffler Group: Schaeffler places great emphasis on the machining of connecting rods supplements Schaeffler's expertise in manufacturing processes, Schaeffler's attention is focused on connecting rods for hybrid and electric vehicles that are designed to comply with green manufacturing concepts. Using ecologically sound processes, the company aims to lower the carbon footprint of its products.

Technological Advancements and Automation in Automotive Connecting Rods

The expansion of technology in the form of fully automotive connecting rods is changing the landscape for the industry. The conventional method which involves the manual approach, although effective, is very tedious and prone to errors such as inaccuracy, and takes a lot of time. The automated systems do indeed eliminate these disadvantages by enabling quicker, more accurate, and high-volume testing.

Today's automotive connecting rods make use of closed tube systems, which greatly mitigate risks associated with biohazards, and digital reporting systems, which enhance workflow processes in the busy laboratory setting. Some of them are interfaced with Laboratory Information Management Systems (LIMS), and this helps improve information handling and the management of compliance issues.

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 25% to 30% globally. These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Linamar Corporation, Mahle GmbH, Bharat Forge Limited, Yasunaga Corporation, Metalart Corporation, Sanjo Machine Works Ltd., Albon Engineering & Manufacturing Plc and others.

Tier 2 includes most of the small-scale companies operating at the local level serving niche Automotive Connecting Rod vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach.

Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

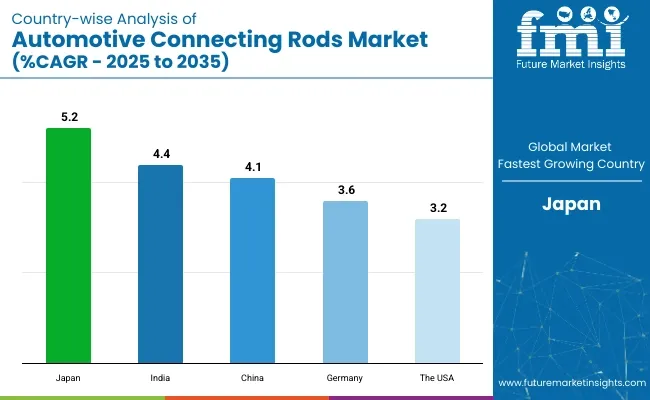

The section below covers the analysis of the automotive connecting rod industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. China is anticipated to remain at the forefront in East Asia, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 4.4% through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| Japan | 5.2% |

| India | 4.4% |

| China | 4.1% |

| Germany | 3.6% |

| The USA | 3.2% |

The automotive market seems to have great potential, particularly driven by China's automotive connecting rods market. In the year 2023, the industry showed impressive growth as passenger car manufacturing reached over 30.16 million units while total sales exceeded 30.09 million, thus growing every year by 11.6% and 12% respectively, as noted by the Chinese Automobile Manufacturing Association (CAAM).

Moreover, it is important to point out that concerning exports, China became the largest exporter of vehicles worldwide replacing Japan after exporting 4.41 million vehicles within the 11 first months of 2023, which corresponds to a 58% increase compared to the previous year.

China's competencies in the manufacturing of automotive connecting rods at lower costs and high precision increase its market share across the globe. However, as technology improves and progresses in China the demand for automotive connecting rods is bound to increase whereby more inventions, dominance in the market, and improvements in how far the engines can go would be experienced.

The expansion of the market for connecting rods in the USA is due to the increasing demand for upper-class engine technologies among consumers. As one of the three global leaders in the automotive industry, USA is at the forefront of the production of high-strength connecting rods. American car manufacturers have been seeking new and better materials and ways of manufacturing in order to boost the power, the life span, and the efficiency of their products.

For instance, in its high-performance engines General Motors has introduced lightweight forged aluminum connecting rods to improve fuel efficiency and lessen engine vibration. This focus on all aspects of development caters to the wider market that seeks powerful, less polluting, and long-lasting engines thus consolidating the position of the USA market for high-end connecting rods.

World's third-largest economy in nominal terms and fourth-largest economy in terms of purchasing power parity, Japan remains a giant in global automotive connectors. It has an automotive industry that is sophisticated and places great emphasis on efficiency, quality, and innovation.

Manufacturers such as Toyota, Honda, and Nissan make it a requirement for Japan to build better and more efficient engines continuously. These engines are progressively changing as the design concept evolves, and higher strength-to-weight ratio connecting rods are required to be able to withstand harsh operating conditions and increasing loads.

In the case of Toyota for instance, the promotion of HICE (Hybrid Internal Combustion Engine) and Hydrogen fuel cell engine designs means that there is an increasing need for connecting rods that are made using high-strength materials such as titanium and aluminum alloys due to requisite performance requirements and other targeted efficiency levels.

Given that the future of cars can only get better and drive us to efficiently powered automobiles, geographical barriers whenever broken lead to success for connecting rod manufacturers in Japan to venture more.

Some of the renowned companies present in the global Automotive Connecting Rod market include Linamar Corporation, Mahle GmbH, Bharat Forge Limited, Yasunaga Corporation, Metalart Corporation, Sanjo Machine Works Ltd., Albon Engineering & Manufacturing Plc, and others.

Competition is also intensified by the shift towards hybrid and electric vehicles, requiring manufacturers to adapt their offerings to new powertrains. As the market continues to grow, leading companies are investing in research and development to create cost-effective, high-strength connecting rods that meet stringent environmental and performance standards.

Industry Updates

In terms of Material type, the industry is segmented into Steel, Aluminum, Titanium, and Composites

In terms of vehicle type, the industry is segmented into Passenger Cars, Commercial Vehicles, Two Wheelers, Three Wheelers, and Off-highway Vehicles.

By design type, the industry is segmented into Hollow Connecting Rods, Forged Connecting Rods, and Cast Connecting Rods.

By Sales Channel, the industry is segmented into OEM and Aftermarket

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 14.1 Billion in 2024.

The industry is set to reach USD 14.7 billion in 2025.

The industry value is anticipated to rise at 4.4% CAGR through 2035.

The industry is anticipated to reach USD 22.5 billion by 2035.

China accounts for 17.2% of the global Automotive Connecting Rod market revenue share alone.

Japan is predicted to witness the highest CAGR of 5.2% in the Automotive Connecting Rod market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Automotive Engine Connecting Rods Market

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA