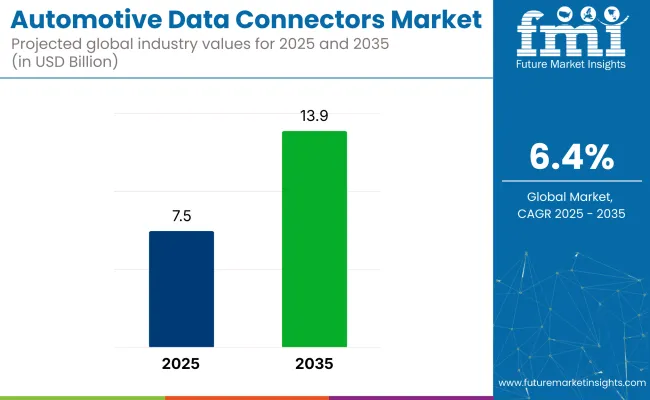

The automotive data connectors market is expected to rise from USD 7.5 billion in 2025 to USD 13.9 billion by 2035. This significant increase reflects a CAGR of 6.4% during the forecast period. The growth highlights the critical role of connectors in the current automotive industry.

As vehicles become increasingly sophisticated, integrating advanced electronics and communication systems, the need for efficient, reliable data connectors has never been greater. These connectors facilitate seamless data transfer between various electronic components within vehicles, making them indispensable in modern automotive design.

The industry’s growth is closely linked to the rapid development and adoption of connected and autonomous vehicles, which demand robust data communication networks. Automotive data connectors are essential for transmitting sensor data, control signals, and infotainment information across the vehicle’s internal systems.

This enables features such as advanced driver assistance systems (ADAS), real-time navigation, and vehicle-to-everything (V2X) communication. As governments and manufacturers push for safer, smarter, and more environmentally friendly vehicles, the integration of high-speed, durable connectors becomes a key technological enabler. Furthermore, increasing consumer demand for enhanced in-car connectivity and infotainment options also propels the industry forward.

Driving this industry’s expansion are several factors, including the ongoing electrification of vehicles, which introduces new wiring harnesses and data pathways that must be connected efficiently. The growing complexity of automotive electronics, including sensors, cameras, and control units, requires connectors capable of withstanding harsh environmental conditions while maintaining signal integrity.

Moreover, the rising sales of electric vehicles (EVs) are driving demand for automotive data connectors due to the increased need for high-speed, reliable communication between electronic control units, battery management systems, and advanced driver assistance systems (ADAS). EVs rely heavily on data transmission for safety, efficiency, and real-time vehicle diagnostics. As per the IEA, electric car sales neared 14 million in 2023, 95% of which were in China, Europe, and the United States.

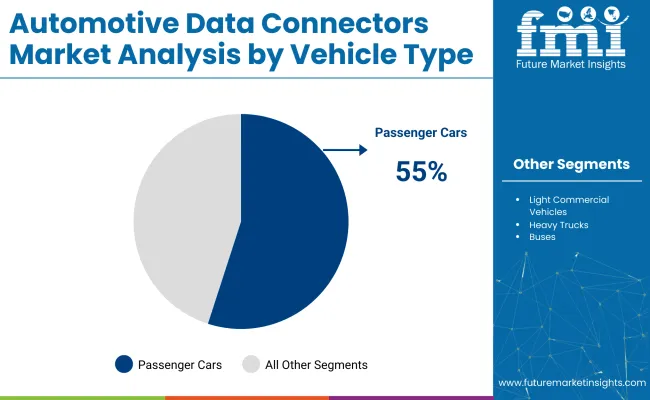

Infotainment and passenger cars dominate the industry due to rising demand for advanced connectivity and high vehicle production. First Fit (OEM) leads sales channels with strong investment in new technologies, while USB connectors prevail for their speed, design, and power capabilities.

Infotainment is projected to dominate the application segment with a 24% industry share in 2025, because it requires extensive data transmission capabilities to support a wide range of multimedia and connectivity features that modern consumers expect.

The passenger car segment is projected to dominate the industry, accounting for approximately 55% industry share in 2025.

The first fit (OEM) segment is expected to dominate the industry in 2025, capturing around 70% of the industry share.

USB connectors, particularly USB Type-C, are projected to dominate the industry in 2025, capturing over 26% of the total industry share.

The industry is driven by the rising integration of advanced electronic systems like infotainment and ADAS, boosting demand for reliable, high-speed connectors. However, the complexity of modern electronics and proprietary designs pose challenges, while electrification and data-heavy applications offer new growth opportunities.

Rising Installation of Advanced Electronic Systems in Vehicles

The industry is primarily driven by the increasing integration of advanced electronic systems in vehicles, such as infotainment, advanced driver-assistance systems (ADAS), and electric powertrains. These systems require high-speed, reliable data transmission, fueling demand for sophisticated connectors.

Additionally, the rapid adoption of connected and autonomous vehicles, along with rising consumer expectations for enhanced in-car experiences, further accelerates industry growth. Continuous innovation in connector technology, including miniaturization and improved durability, also supports this expanding demand.

Complexity of Modern Electronics May Hamper Sales

Despite strong growth, the industry faces challenges such as the complexity of modern automotive electronics and the need for connectors that can withstand harsh environmental conditions. Proprietary connector designs by OEMs may limit aftermarket expansion, creating barriers for third-party suppliers.

However, the shift towards electrification and increasing use of data-heavy applications like infotainment and V2X communication present significant opportunities for manufacturers to innovate and capture industry share. Investments in R&D and collaborations between automotive and technology firms are expected to drive future advancements.

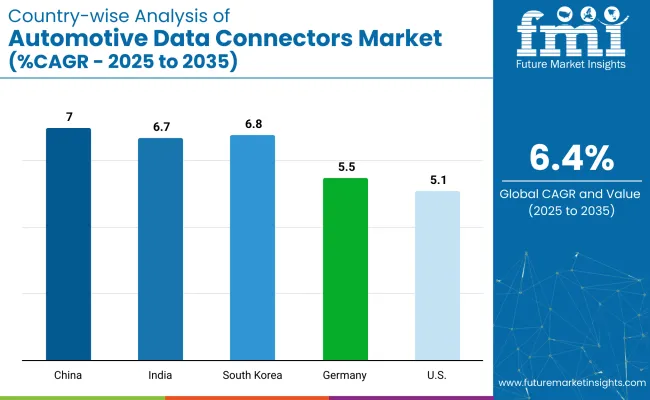

The industry study identifies leading trends across top countries, including the United States, Germany, China, South Korea, and India. Manufacturers in these regions can design focused strategies by considering factors such as increasing vehicle electrification, adoption of ADAS and infotainment systems, evolving connector technologies, and rising consumer demand for connected, high-performance automotive systems.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7% |

| India | 6.7% |

| South Korea | 6.8% |

| Germany | 5.5% |

| United States | 5.1% |

The United States industry is estimated to grow at a 5.1% CAGR during the study period. This growth is driven by the increasing adoption of electric vehicles and advanced driver-assistance systems (ADAS) across the country.

The China industry is estimated to grow at a 7% CAGR during the study period.

The India industry is estimated to grow at a 6.7% CAGR during the study period.

The South Korea industry is estimated to grow at a 6.8% CAGR during the study period.

The German industry is estimated to grow at a 5.5% CAGR during the study period.

Leading Company - TE Connectivity Market Share -22%

Key players like TE Connectivity dominate the industry due to their extensive portfolios of high-performance connectors, strong partnerships with OEMs, and leadership in innovative design and manufacturing capabilities.

Other significant players, including Rosenberger, Molex, Amphenol RF, Hirose Electric, and Aptiv, offer specialized connector solutions, hold important industry certifications, and maintain robust supply chains to support the automotive sector. Complementing these leaders, various companies focus on niche applications or regional industries, providing agility, customization, and competitive pricing to support the broader automotive data connector ecosystem.

Recent Automotive Data Connectors Market Development

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 7.5 billion |

| Projected Industry Size (2035) | USD 13.9 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units |

| Application Analyzed (Segment 1) | Infotainment, Dashboard/Touch Screens, HD Screens, Bluetooth, USB Connections, Dual-Band Wi-Fi, And Surround Cameras |

| Vehicle Type Analyzed (Segment 2) | Passenger Cars, Light Commercial Vehicles, And Heavy Trucks & Buses |

| Sales Channel Analyzed (Segment 3) | First Fit and Aftermarket |

| Connector Type Analyzed (Segment 4) | RF Coaxial Connectors, High-Speed Data Connectors, Ethernet Connectors, USB Connectors, HDMI Connectors, and OBD Data Ports |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | TE Connectivity, Rosenberger, Molex, Amphenol RF, Hirose Electric Co., and Aptiv. |

| Additional Attributes | Dollar sales, share, competitive landscape, growth drivers, regional trends, OEM vs. aftermarket demand, connector types, key applications, regulatory impact, and emerging tech trends |

In terms of application, the industry is classified into infotainment, dashboard/touch screens, HD screens, Bluetooth, USB connections, dual-band Wi-Fi, and surround cameras.

With respect to vehicle type, the industry is divided into passenger cars, light commercial vehicles, and heavy trucks & buses.

In terms of sales channel, the industry is divided into first fit and aftermarket.

In terms of connector type, the industry is divided into RF coaxial connectors, high-speed data connectors, Ethernet connectors, USB connectors, HDMI connectors, and OBD data ports.

From a regional standpoint, the industry is segmented into Latin America, Asia Pacific, the Middle East and Africa, North America, and Europe.

The industry is valued at USD 7.5 billion in 2025.

The industry is forecast to reach USD 13.9 billion by 2035.

The first fit holds 70% industry share in 2025.

TE Connectivity is the leading company in the industry with 22% market share.

The industry is projected to grow at a CAGR of 6.4%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA