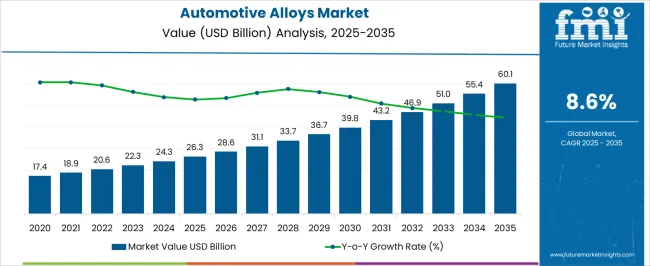

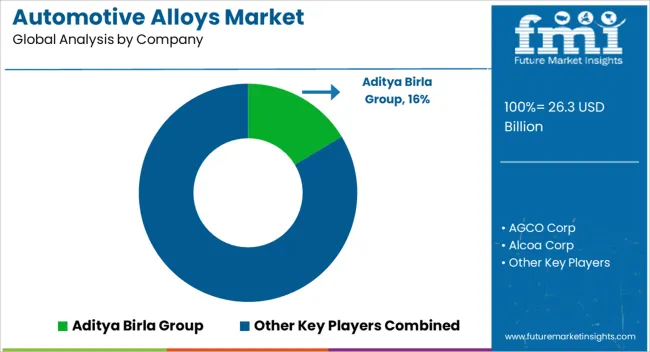

The Automotive Alloys Market is estimated to be valued at USD 26.3 billion in 2025 and is projected to reach USD 60.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Alloys Market Estimated Value in (2025 E) | USD 26.3 billion |

| Automotive Alloys Market Forecast Value in (2035 F) | USD 60.1 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The Automotive Alloys market is witnessing strong growth, driven by the increasing demand for lightweight, high-strength materials to improve fuel efficiency, vehicle performance, and safety standards. Adoption is being accelerated by the automotive industry’s focus on reducing vehicle weight while maintaining structural integrity and crashworthiness. Alloys are being used extensively in body panels, chassis components, and critical structural parts to enhance durability and reduce overall emissions.

Technological advancements in alloy composition, processing techniques, and corrosion resistance have enabled manufacturers to meet stricter regulatory standards and environmental norms. The rise of electric vehicles, hybrid powertrains, and advanced internal combustion engines has further stimulated the demand for high-performance alloys that can withstand thermal and mechanical stress.

Growing consumer preference for high-quality, long-lasting vehicles, combined with investments in research and development, is shaping the market landscape As automotive production continues to expand globally, particularly in emerging markets, the demand for specialized alloys is expected to maintain consistent growth, supported by continuous innovation in materials engineering and manufacturing processes.

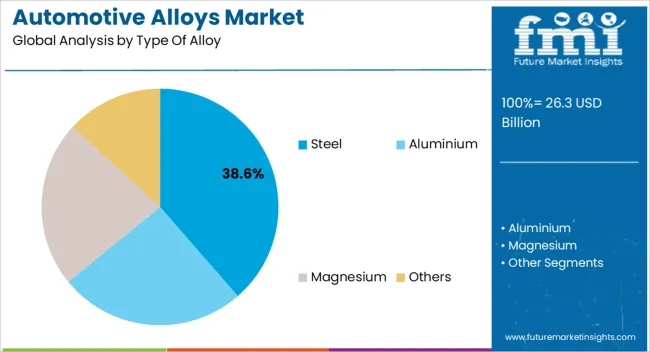

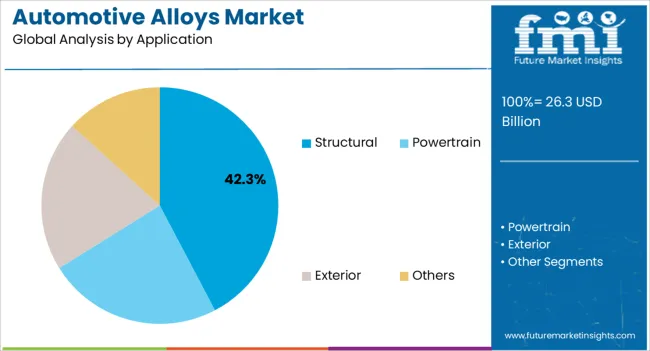

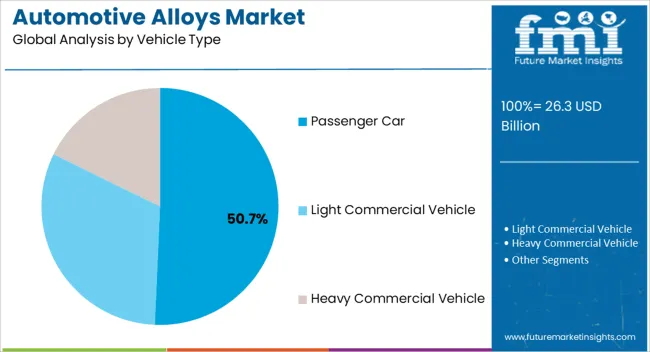

The automotive alloys market is segmented by type of alloy, application, vehicle type, and geographic regions. By type of alloy, automotive alloys market is divided into Steel, Aluminium, Magnesium, and Others. In terms of application, automotive alloys market is classified into Structural, Powertrain, Exterior, and Others. Based on vehicle type, automotive alloys market is segmented into Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle. Regionally, the automotive alloys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steel type of alloy segment is projected to hold 38.6% of the market revenue in 2025, positioning it as the leading alloy type. Growth in this segment is being driven by the widespread adoption of steel alloys in automotive structural components, chassis, and safety-critical parts due to their high tensile strength, durability, and cost-effectiveness.

Steel alloys allow for design flexibility, crash energy absorption, and improved manufacturability, making them highly suitable for large-scale vehicle production. Advances in high-strength and ultra-high-strength steel grades have enabled manufacturers to reduce component weight while maintaining structural performance, supporting fuel efficiency and emissions reduction goals.

The ability to integrate steel alloys with other lightweight materials and the ease of recycling further enhance their appeal As vehicle manufacturers focus on optimizing performance and complying with increasingly stringent safety and environmental regulations, steel alloys are expected to retain a dominant share, supported by their balance of affordability, performance, and long-term reliability.

The structural application segment is anticipated to account for 42.3% of the market revenue in 2025, making it the leading application area. Growth is being driven by the increasing need for materials that provide strength, rigidity, and durability for vehicle frames, chassis, and load-bearing components. Steel and other high-performance alloys are being used extensively to improve crashworthiness, occupant safety, and overall vehicle longevity.

Advanced alloy compositions and processing technologies enhance structural performance while reducing component weight, which supports fuel efficiency and compliance with environmental standards. Manufacturers are leveraging structural alloys to optimize vehicle design and integrate features such as impact resistance and vibration reduction.

Rising production of passenger vehicles, commercial vehicles, and electric vehicles is creating additional demand for structurally robust materials As automotive OEMs continue to focus on lightweighting, safety, and regulatory compliance, the structural application segment is expected to maintain its leading position, supported by technological innovation in alloy formulation and manufacturing.

The passenger car segment is projected to hold 50.7% of the market revenue in 2025, establishing it as the leading vehicle type. Growth is being driven by the widespread production of passenger vehicles worldwide, particularly in emerging and developed markets, where demand for lightweight, fuel-efficient, and safe vehicles is increasing. Alloy materials, especially steel alloys, are extensively used in body structures, chassis, and other critical components to enhance durability, crash performance, and overall vehicle quality.

The increasing adoption of electric and hybrid passenger cars is further supporting demand for specialized alloys that reduce weight without compromising strength. Manufacturers are focusing on integrating alloys with advanced production techniques to improve manufacturability, design flexibility, and cost efficiency.

Rising consumer preference for safer and longer-lasting vehicles, coupled with regulatory pressures for emissions reduction and crashworthiness, is reinforcing the adoption of high-performance alloys in passenger cars The segment is expected to continue leading the market, driven by ongoing innovations in materials science and automotive design.

The automotive alloy market is expected to be worth US$ 50,840.7 Million in 2035. The global demand for automotive alloys is driven primarily by fuel efficiency concerns and increased automotive vehicle production.

According to FMI, the global Market of Automotive Alloys is estimated to be valued at US$ 22,279.9 Million in 2025 and is projected to increase at a CAGR of 8.6% in the forecast period from 2025 to 2035.

| Attributes | Details |

|---|---|

| Market Size (2025) | US$ 20,572.4 Million |

| Market Size 2025 | US$ 22,279.9 Million |

| Market Size 2035 | US$ 50,840.7 Million |

| Value CAGR (2025 to 2035) | 8.6% |

The automotive industry is rapidly developing in terms of customer safety, fuel efficiency, comfort, and popular built-in advanced technologies. Nowadays, automotive vehicles are getting heavier as a result of an increase in demand for safety and comfort technologies. Vehicles with lighter weights are gradually becoming more popular in the global automobile sector due to their ability to consume less fuel and produce fewer emissions compared to other heavier vehicles. There is a clear relationship between vehicle weight and fuel efficiency, according to research and development on the fuel economy of motor vehicles. This has influenced the move toward lighter alloys and lighter body panels for cars. OEMs are hence more motivated to adopt lighter materials in their automobiles.

According to estimations, the utilization of light automotive alloys in automobiles will increase due to rising government regulations on reducing weight and rising demand for fuel-efficient vehicles. The several types of automotive alloys include aluminium, steel, magnesium, and others (composites).

Steel alloys hold the strongest market share in the global automotive alloys market as a result of an increase in demand for steel alloys in China and India for the production of automobiles. As a light metal alloy, magnesium alloy is preferred by Original Equipment Manufacturers (OEMs) in the automotive sector due to its advantages such as thermal stability, strength, stiffness, ductility, and specific strength of magnesium alloy as well as its lightweight. The automotive body and chassis structure of a vehicle (oil pumps, housings, the crankshaft, the cylinder crankcase, mounts, brackets, and radiator support) and other interior parts are the main applications of magnesium alloy.

The market for magnesium alloys is anticipated to expand steadily over the forecast period. Due to the increased demand for lightweight automobiles made of aluminum alloys the automotive alloy market is anticipated to develop at the quickest rate.

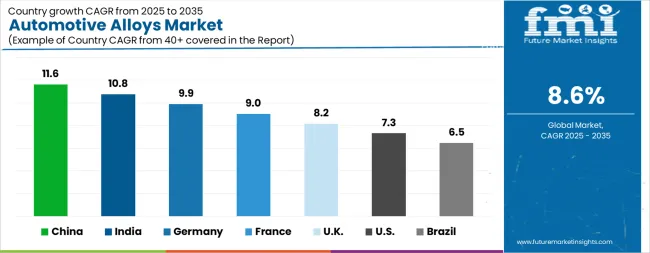

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The Automotive Alloys Market is expected to register a CAGR of 8.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.6%, followed by India at 10.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.5%, yet still underscores a broadly positive trajectory for the global Automotive Alloys Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.9%. The USA Automotive Alloys Market is estimated to be valued at USD 9.7 billion in 2025 and is anticipated to reach a valuation of USD 19.6 billion by 2035. Sales are projected to rise at a CAGR of 7.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.4 billion and USD 674.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.3 Billion |

| Type Of Alloy | Steel, Aluminium, Magnesium, and Others |

| Application | Structural, Powertrain, Exterior, and Others |

| Vehicle Type | Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aditya Birla Group, AGCO Corp, Alcoa Corp, AMG Advanced Metallurgical Group, ArcelorMittal, Bansal Wire Industries Ltd, China Metallurgical Information and Standardization Institute (CMISI), Constellium, Dynafond, Eutectix, Kobe Steel, Neonickel, and Nextgen Steel & Alloys |

The global automotive alloys market is estimated to be valued at USD 26.3 billion in 2025.

The market size for the automotive alloys market is projected to reach USD 60.1 billion by 2035.

The automotive alloys market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in automotive alloys market are steel, aluminium, magnesium and others.

In terms of application, structural segment to command 42.3% share in the automotive alloys market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA