The Automotive Radar Sensors Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 26.9 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Radar Sensors Market Estimated Value in (2025 E) | USD 6.9 billion |

| Automotive Radar Sensors Market Forecast Value in (2035 F) | USD 26.9 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The Automotive Radar Sensors market is experiencing strong growth, driven by the increasing adoption of advanced driver assistance systems and the global push toward vehicle automation and safety enhancement. Rising consumer demand for safer, more efficient, and technologically advanced vehicles is fueling investments in radar-based sensing solutions. Automotive radar sensors are critical for enabling applications such as adaptive cruise control, collision avoidance, blind-spot detection, and parking assistance, which require precise distance and object detection capabilities.

The integration of medium- and long-range radar systems is enhancing the accuracy and reliability of these features while supporting semi-autonomous driving technologies. Regulatory mandates for road safety and collision prevention, along with growing awareness among consumers and automakers, are further driving adoption.

Continuous innovation in sensor resolution, signal processing, and AI-based object recognition is expanding the functional capabilities of radar systems As the automotive industry moves toward connected and autonomous vehicles, radar sensors are expected to remain central to safety and operational efficiency, creating sustainable market growth over the coming decade.

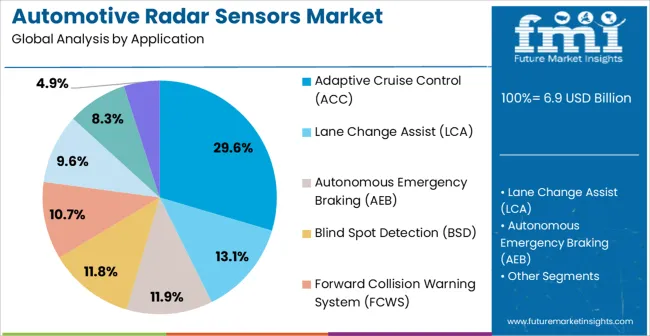

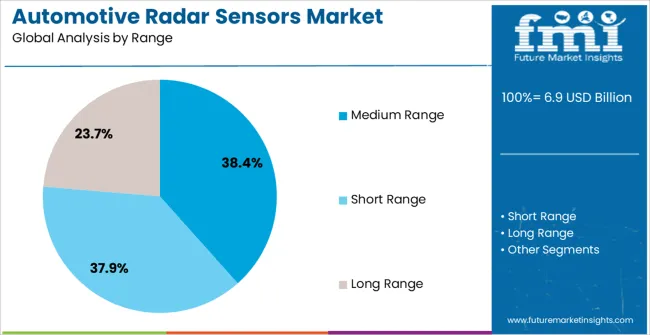

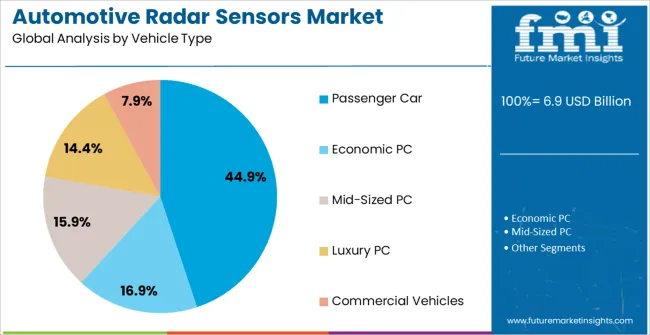

The automotive radar sensors market is segmented by application, range, vehicle type, and geographic regions. By application, automotive radar sensors market is divided into Adaptive Cruise Control (ACC), Lane Change Assist (LCA), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Rear Cross Traffic Assist (RCTA), Intelligent Parking Assistance (IPA), and Others (Exit Assist Applications, Rear Collision Warning, etc.). In terms of range, automotive radar sensors market is classified into Medium Range, Short Range, and Long Range. Based on vehicle type, automotive radar sensors market is segmented into Passenger Car, Economic PC, Mid-Sized PC, Luxury PC, and Commercial Vehicles. Regionally, the automotive radar sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adaptive cruise control (ACC) application segment is projected to hold 29.6% of the market revenue in 2025, establishing it as the leading application. Growth is being driven by the rising demand for convenience and safety features in modern vehicles, particularly in highway and urban driving scenarios. ACC systems rely heavily on radar sensors to monitor the speed and distance of surrounding vehicles, allowing automatic adjustment of vehicle speed and maintaining safe following distances.

The increasing adoption of semi-autonomous driving technologies has reinforced ACC as a critical feature, prompting automakers to integrate high-performance radar sensors into passenger vehicles. Continuous improvements in signal processing, object detection accuracy, and integration with other driver assistance systems have strengthened reliability and consumer confidence.

Growing regulatory emphasis on advanced safety systems and consumer expectations for enhanced driving convenience are further supporting the adoption of ACC As automotive technology continues to evolve, the ACC segment is expected to maintain its leading position, driven by technological innovation and increasing consumer preference for advanced safety solutions.

The medium-range radar segment is anticipated to account for 38.4% of the market revenue in 2025, making it the dominant range category. Its growth is being driven by its capability to detect vehicles, pedestrians, and obstacles at distances suitable for adaptive cruise control, lane change assist, and collision avoidance applications. Medium-range radar sensors provide an optimal balance between detection range and resolution, enabling accurate measurement of speed, distance, and relative position of surrounding objects.

The ability to integrate these sensors seamlessly into passenger cars and commercial vehicles enhances their versatility and adoption. Advancements in sensor miniaturization, signal processing algorithms, and environmental adaptability have improved performance under various driving conditions, including adverse weather and complex traffic scenarios.

Increasing consumer awareness regarding vehicle safety and regulatory mandates for advanced driver assistance systems are further accelerating adoption With growing demand for semi-autonomous and connected vehicles, medium-range radar sensors are expected to remain a critical technology, supporting both safety and convenience applications in modern vehicles.

The passenger car segment is projected to hold 44.9% of the market revenue in 2025, establishing it as the leading vehicle type for automotive radar sensor adoption. Growth is driven by rising consumer expectations for enhanced safety, convenience, and semi-autonomous features in personal vehicles. Passenger cars increasingly incorporate radar sensors to support applications such as adaptive cruise control, lane departure warning, collision avoidance, and automated parking.

The integration of radar-based sensing technologies improves both driver experience and road safety, meeting regulatory requirements and industry safety standards. Continuous advancements in sensor accuracy, miniaturization, and AI-enabled object detection have enhanced the reliability of radar systems in passenger vehicles.

OEMs are prioritizing the deployment of advanced radar solutions to differentiate product offerings and comply with evolving safety regulations As the automotive industry shifts toward connected and partially autonomous vehicles, passenger cars are expected to remain the primary segment driving the adoption of automotive radar sensors, supported by consumer demand and technological innovation.

Driver and road safety is one of the prominent challenges at present and it is estimated to be in the future as well. One of the main reasons for several road accidents is the slow reaction of the driver while responding to accidental situation. High-tech automotive wireless electronics is capable of automating many driving features which reduce significant human errors and the improve vehicle safety.

Automotive radar is one of the key development in this area and is a forward step for increasing the driving comfort, automating driving and crash prevention. Automotive radar sensors are used for enhancing various driving features which give better control to drivers in hazardous accidental situation.

Automotive radar sensors are fining various application in systems such as warning and mitigation, collision detection, collision avoidance, blind spot monitoring/blind spot detection, vulnerable road user detection, lane change assistance and lane departure warning system, and rear cross-traffic alerts. Driver assistance system which are equipped with radar sensors are already common in many passenger vehicles in the global market.

Many of the driver assistance system have sensors which help in detection for lane-change assistance, rear cross-traffic alerts, back-up parking assistance, adaptive cruise control and blind spot monitoring. Presently, the 79 GHz, 77 GHz and 27 GHz radar sensors with increased signal bandwidth have the capability to distinguish between diverse objects and also offer high resolution.

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| Brazil | 15.3% |

| USA | 13.9% |

| UK | 12.4% |

| Japan | 11.0% |

The Automotive Radar Sensors Market is expected to register a CAGR of 14.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 19.7%, followed by India at 18.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 11.0%, yet still underscores a broadly positive trajectory for the global Automotive Radar Sensors Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 16.8%. The USA Automotive Radar Sensors Market is estimated to be valued at USD 2.6 billion in 2025 and is anticipated to reach a valuation of USD 2.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 364.9 million and USD 207.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Application | Adaptive Cruise Control (ACC), Lane Change Assist (LCA), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Rear Cross Traffic Assist (RCTA), Intelligent Parking Assistance (IPA), and Others (Exit Assist Applications, Rear Collision Warning, etc.) |

| Range | Medium Range, Short Range, and Long Range |

| Vehicle Type | Passenger Car, Economic PC, Mid-Sized PC, Luxury PC, and Commercial Vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Continental, Denso, Aptiv, Infineon Technologies, NXP Semiconductors, Texas Instruments, Analog Devices, Hella, and Veoneer |

The global automotive radar sensors market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the automotive radar sensors market is projected to reach USD 26.9 billion by 2035.

The automotive radar sensors market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in automotive radar sensors market are adaptive cruise control (acc), lane change assist (lca), autonomous emergency braking (aeb), blind spot detection (bsd), forward collision warning system (fcws), rear cross traffic assist (rcta), intelligent parking assistance (ipa) and others (exit assist applications, rear collision warning, etc.).

In terms of range, medium range segment to command 38.4% share in the automotive radar sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Automotive Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive HD/Imaging Radar Market Analysis by Range, Frequency, Vehicle Type, Application, and Region Forecast Through 2035

Automotive Powertrain Sensors Market

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA