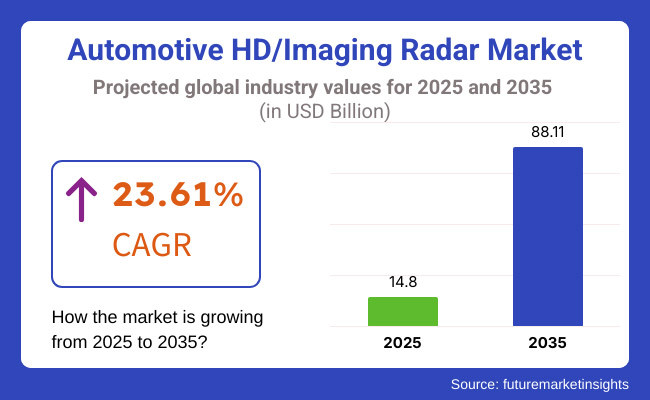

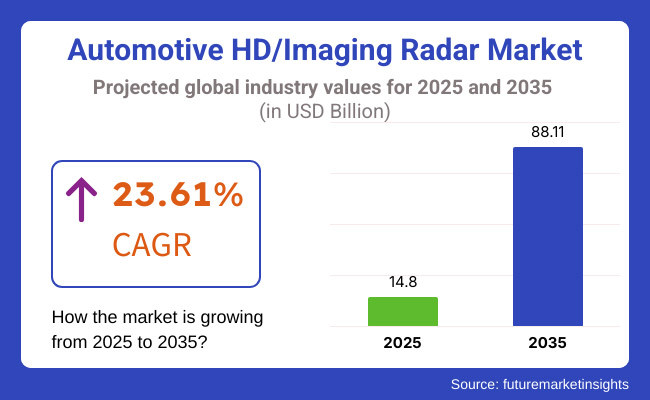

The automotive HD/imaging radar market is forecast to expand to USD 14.8 billion in 2025 after a hike from the present USD 10.1 billion in 2023. The market will experience a tremendous rise to USD 88.11 billion in 2035 at a CAGR of 23.61% driven by the constant influx of technological improvements, the increased autonomy of cars, and the global effort to ensure safer roads.

The automotive high-definition radar market is progressing at an unprecedented laughter rate due to the ever-increasing acceptance of the advanced driver-assistance systems (ADAS) and degree of autonomy in vehicles. HD radar has been instrumental in increasing vehicle safety and dependability through real-time input of environmental data aiding collision avoidance, adaptive cruise control, parking automation, and other significant functions.

Increased adoption of ADAS and autonomous vehicle technologies by more OEMs will not merely spike the demand for high-performance imaging radar systems but also radar technology will become the core of the auto industry shift to safer and efficient mobility alternatives.

The HD radar market has a prosperous growth route but has certain concerns such as the high cost of radar systems which remains the first obstacle in the course of mass-market vehicle adoption. Manufacturers are bound to learn how to keep costs down while their products maintain the expected performance and reliability levels.

Furthermore, the incorporation of radar technology into various vehicle systems, such as cameras, LiDAR, and AI-driven software, brings out the technical issues that require the seamless interoperability that should be developed for accurate and reliable real-time data deliveries for autonomous driving. The big data issue is another concern faced with the processing of massive data sets by HD radar systems.

The processing of real-time data requires the so-called computational strength which often needs the co-optimizing algorithms so that they can both reduce latency in deciding and ensure quick and effective responses to traffic and obstacles. Also, the automation of vehicles transition is the significant extension, which directly affects the HD radar devices producers, as trustworthy radars will be a must for self-driving cars to navigate safely through several weather conditions and road challenges.

The surplus of continuous ADAS features in mass-market cars also fuels the need for distributed and vehicle-coupled radar systems that make automatic emergency braking, lane-keeping assistance, and adaptive cruise control possible, among many others. Additionally, tougher government vehicle safety regulations, particularly in North America and Europe, force the automakers to install more advanced radar-based safety systems, so they accelerate the use of HD radar.

The progress of the automotive HD radar industry, which is one of the most critical components of the future smart mobility, is being driven by the staggering investments of car manufacturers and technology providers in the autonomous and semi-autonomous driving abilities.

Between 2020 and 2024, the automotive HD/imaging radar industry increased at a high rate, driven by the use of ADAS and autonomous driving technology. High-resolution radars were given priority by automakers to improve vehicle perception, reducing accidents. Mandates by regulators globally, calling for safety features such as automatic emergency braking and lane-keeping assistance, further boosted adoption.

There was a notable shift with the move from 23 GHz to 77/79 GHz frequency bands, with substantially enhanced radar resolution, range, and object detection. Progress was slowed down as it was costly to conduct R and D, semiconductors were not enough available, and sensor integration was not accurate. Developments in silicon-based radar chips and AI-based signal processing made HD radar more cost-friendly and available in all types of vehicles by 2024.

During 2025 to 2035, the industry will change a lot because of AI-based 4D imaging radar, delivering real-time target tracking, velocity sensing, and greater situational awareness. Prices will be reduced with radar-on-chip (RoC) tech. Traffic can be predicted by some technologies such as V2X connectivity, 5G, and edge computing.

Environmental initiatives will encourage the deployment of green semiconductor materials. By 2035, AI-based radar systems will be instrumental in achieving end-to-end autonomous mobility, making transportation safer and smarter.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter safety mandates for ADAS integration | Mandatory inclusion of HD radar in all vehicles, AI-driven safety compliance |

| Transition from 24 GHz to 77/79 GHz radar | 4D imaging radar, AI-driven signal processing, quantum-enhanced perception |

| Growth in ADAS and semi-autonomous driving | Full autonomy adoption, expansion into V2X and smart city networks |

| AI-powered radar classification, sensor fusion trials | Real-time AI fusion with LiDAR and camera vision systems |

| High production costs, semiconductor shortages | Solid-state RoC solutions, low-power consumption radar systems |

| Limited AI processing, traditional radar signal interpretation | AI-driven real-time predictive analytics, edge computing integration |

| Limited scalability, supply chain disruptions | Scalable radar manufacturing, AI-optimized semiconductor production |

| Increasing demand for ADAS, safety regulations | Rise of full autonomy, connected vehicle expansion, V2X communication |

Particularly with the shift to 4D imaging radar, automotive HD imaging radar is essential for ADAS and autonomous vehicles but also poses significant risks. Conventional 3D radar units are priced roughly between USD 50-USD 100 per unit, while 4D radars fetch between USD 150-USD 200, which creates a significant price differential that acts as a barrier against cost-effectiveness. This more expensive cost structure pushes OEMs to move budget around and prioritize features integrations very carefully.

In addition, the 4D radar must be integrated with LiDAR and camera systems, which adds to the complexity of sensor fusion challenges, including accurate calibration and robust data processing. Supply-chain weaknesses-most recently with semiconductor shortages seen during 2021 to 2022 threatened timely production and market penetration, too.

Changing regulatory standards and interoperability challenges introduce more uncertainty. This demands careful strategic planning and constant innovation - manufacturers must both integrate the latest and greatest performance with cost control while reviewing even stricter guidelines regarding safety and reliability in this competitive automotive market.

Value-based pricing is gaining traction among manufacturers in the automotive HD imaging radar market as it captures the safety and performance benefits of the more advanced 4D imaging radars. Tesla, Waymo and Mercedes-Benz all devote great attention to providing these sensors in high-end truck and car configurations, with companies leveraging customer interests in being able to pay more for autonomous driving. Budget manufacturers are still relying on more affordable 3D radars (USD 50-USD 100 unit price) to keep the car at an affordable price point.

Operating with such high production costs, many OEMs have aligned themselves with companies like NXP and Texas Instruments, who both guide groups of chipmakers, to benefit from economies of scale and reduce costs in the components. In addition, certain companies package four-dimensional (4D) radars with other sensor technologies and give volume pricing to promote broader adoption.

This is cool because it balances the higher unit cost with innovative technology, which makes it more competitive in each segment while maintaining its premium positioning. That pricing model is conducive to long term innovation and market expansion.

Long-range radar accounts for the single largest segment of automotive HD/imaging radar, owing to their ability to detect objects beyond 250 meters and the increased situational awareness/early notifications of hazards within the automotive domain afforded by their utilization. Essential for advanced driver-assistance systems (ADAS), this technology is key for functions like adaptive cruise control, collision avoidance, and highway driving assistance. Enabling faster reaction times and significantly increasing road safety and the driving experience.

Short- and medium-range radar technologies are useful for detecting objects at close range but lack the range for long-range detecting scenarios. These systems are complemented by long-range radar, capable of high-resolution imaging that is critical to safety and autonomy of driving in modern vehicles.

With the ability to detect objects over longer distances and with more precision, be it above or below systems and combat vehicle, it offers timely information on threats further out, allowing the vehicle to take preventative action not just to its immediate surroundings.

A full radar network is constructed using long-range radar combined with short and medium-range systems. This rich integration allows vehicles to have optimal coverage, detecting objects from long ranges down to very close range high precision in a large field of view. This level of comprehensive coverage is crucial for modern cars, allowing for advanced capabilities like seamless lane changes, accurate obstruction detection, and mirroring high-speed operations.

7X-GHz radar systems (such as 77 GHz and 79 GHz) are the best frequency range for HD/imaging radar for next-generation automotive applications, owing to high resolution, as well as the capability of detecting an object from near point to a far point. These systems' high frequency range advantages include superior object detection and recognition capabilities over lower frequencies, as well as the ability to separate multiple targets.

Because it meets regulatory criteria and offers a reasonable mix between accuracy and operational range, the 77 GHz frequency is also utilized in many applications. It's well suited for advanced driver-assistance systems (ADAS) including adaptive cruise control, lane-keeping assistance, and collision warning applications. However, although 79 GHz is slightly higher than 77 GHz, the resolution is much better and can be used for accurate identification while operating in dense traffic and complex environments.

7X-GHz systems assist to improve situational awareness, hence they are ideal for autonomous vehicles, as well as high-resolution imaging radar systems.

One of the older technologies that is still used for automotive applications are0X-GHz radar systems, like the 24 GHz radar systems. These systems work well for short-range detection tasks, such as blind spot detection and parking assistance, where high resolution and long range are not as important.2X-GHz systems, being cheaper and simpler to realize, are lower in resolution and target separation than their 7X-GHz counterparts. This limits their effectiveness for advanced safety and autonomy applications that require higher precision.

Modern automotive designs with 2X-GHz systems are increasingly being replaced or supplemented with 7X-GHz systems to provide total radar coverage, leveraging the advantages of both bands for optimal performance.

North America, particularly the United States, is one of the leading markets for automotive HD radar systems. The USA is witnessing huge investment in autonomous driving technology, and high-definition radar is one of the key building blocks of the advanced driver-assistance systems (ADAS) being rapidly integrated into newer models of cars.

With prominent auto manufacturers and tech companies focused on creating and testing autonomous vehicles, the call for HD radar systems will mount slowly. The USA regulators to ramp up the safety standards for automobiles has been complemented by an increasing demand for radar systems offering diverse functionalities such as emergency braking, blind-spot monitoring, and lane-keeping within ADAS.

Europe is another prominent region for the automotive HD radar market, driven by the strong automotive industry and stringent safety regulations in the region. Germany, France, and the UK are some of the countries with prominent automakers that actively feature ADAS in their vehicles. Radar-based solutions are increasingly used by European automobile manufacturers to enhance vehicle security as well as automation features.

The focus of the European Union on reducing road traffic accidents and deaths through advanced safety technologies is one of the key drivers for the automotive HD radar market. The drive for European autonomous vehicle development also powers the demand for high-definition radar systems with better accuracy, range, and reliability in sensing other vehicles and roadblocks.

The Asia-Pacific region, particularly China, Japan, and South Korea, is projected to experience the fastest growth in the automotive HD radar market. China, the largest car market across the globe, is aggressively implementing ADAS technologies; the government itself is propelling the regulatory and subsidy framework in favor of development and deployment of autonomous vehicles.

Major incumbents in automotive manufacturing sectors in Japan and South Korea are gradually working on incorporating state-of-the-art radar systems as an integral part of vehicles targeted to develop safety and driver assistance features. Additionally, the increased use of high-definition radar systems in these nations is remarkable, especially as the automotive industry works towards higher mobility autonomy and more advanced driver behaviors.

The automotive HD radar market in Latin America, the Middle East, and Africa (LAMEA) is gradually expanding as well. There is raising vehicle sales productivity in Brazil and Mexico, countries in Latin America. As these nations continuously improve their automotive infrastructure with regards to vehicle safety, then the demand for HD radar systems will continue to grow.

ADAS technologies, like radar-based, are being embraced. Emerging markets like the UAE and Saudi Arabia in the Middle East are inviting more investment in autonomous vehicle technologies, of which high definition radar is becoming an increasingly integrated component. Safety features in commercial vehicles are expected to grow rapidly in Africa, thereby increasing the demand queue for HD radar systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 8.8% |

| European Union | 9.1% |

| Japan | 8.9% |

| South Korea | 9.3% |

The United States is experiencing explosive growth of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle technology due to stringent safety regulations and high-speed placement radar technology advancements.

The National Highway Traffic Safety Administration (NHTSA) has made compulsory these ADAS technologies such as automatic emergency braking and lane departure warning on new vehicles. Besides that, 5G and edge computing investments have pushed real-time processing of radar data to support greater situational awareness in autonomous vehicles.

Tesla, General Motors, and Ford leverage multi-channel image radars with AI-handling processing to get enhanced accuracy even under poor weather and city street conditions. Tesla's Full Self-Driving (FSD), for instance, employs high-definition radar augmented by neural networks to identify objects and navigate.

Growth Drivers in The USA

| Key Drivers | Details |

|---|---|

| ADAS Regulations | NHTSA requires ADAS features such as automatic braking and lane-keeping aid on all new cars. |

| 5G & Edge Computing | Real-time detection of objects and response based on sophisticated radar processing and reduced reaction time. |

| AI-Powered Radar Solutions | Tesla, GM, and Ford are utilizing AI-powered imaging radars for improved precision in autonomous drives. |

The United Kingdom is redefining autonomous mobility based on its Self-Driving Vehicles Bill, providing a legal basis for self-driving technology. ITS has been supported by the UK government to provide a safer and more efficient city mobility.

Radar technology is being implemented in AI-powered vehicles for better pedestrian detection and adaptive cruise control. Jaguar Land Rover and Arrival are leading the innovation for high-frequency radar systems that enhance car perception in urban environments. London's Smart Mobility Living Lab is another example, piloting self-driving cars with high-end radar solutions to enhance city transport.

Growth Drivers in The UK

| Key Drivers | Details |

|---|---|

| Self-Driving Legislation | UK’s Self-Driving Vehicles Bill makes systematic AV rollout and radar system integration possible. |

| Investment in Smart Mobility | Government-backed projects such as Smart Mobility Living Lab enhance urban ADAS technology. |

| ADAS Expansion | Jaguar Land Rover and Arrival use high-frequency radars for pedestrian and lane monitoring. |

The globe is behind the European Union when it comes to vehicle safety, thanks to Euro NCAP's strict standards of crash avoidance technology. The EU effort to electrify and load up intelligent transport systems (C-ITS) has utilized 4D radar sensing and AI object tracking.

Germany, France, and Sweden lead the charge on radar technology using multimodal sensor fusion to maximize road safety. Bosch, Continental, and Valeo have already led the way with high-resolution imaging radars with sophisticated lane tracking and collision avoidance capabilities. More sophisticated imaging radar capabilities are now mandated by Euro NCAP’s new safety ratings, which are accelerating their adoption in the automotive sector at a faster rate.

Growth Drivers in European Union

| Key Drivers | Details |

|---|---|

| Strict Safety Regulations | Euro NCAP compels new cars to be equipped with high-resolution radars to offer more safety. |

| AI-Powered Object Detection | Bosch and Continental design 4D radar with AI object recognition for collision warning. |

| Connected Transport Systems | Investment in C-ITS by EU funds V2X communication-backed imaging radars. |

Japan spearheads the vehicle safety technologies with its zero-accident vision on roads with intelligent city planning. The government has encouraged high-frequency millimeter-wave radar technology, which improves object detection in heavy traffic.

Toyota, Honda, and Nissan have created AI-enhanced scene understanding radars to enhance vehicle perception and lane-keeping. V2X radar applications are being funded by the Japanese government to make traffic more smooth and reduce collisions. Nissan’s ProPILOT 2.0, for example, employs AI-enhanced radar to provide hands-free highway driving with accurate obstacle detection.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Zero-Accident Roadmaps | Rollout of high-resolution radar and government-sponsored ADAS product development. |

| Millimeter-Wave Radar | Investments in Japanese high-frequency radar strengthen lane detection and obstacle perception. |

| AI-Based Traffic Perception | Toyota and Nissan combine AI-based radars for safety and adaptive cruise control. |

South Korea leads the world in the development of next-generation radar chipset, AI-based sensor fusion, and 5G-based automotive use cases. The Ministry of Trade, Industry, and Energy (MOTIE) has strategically invested in autonomous vehicle infrastructure and smart radar technologies to ensure maximum safety and efficiency.

Hyundai Mobis, Samsung Electronics, and LG Innotek are developing miniaturized high-frequency 4D radars that are immune to environmental interference and can execute sophisticated object classification. South Korea’s AI-based radar perception software development provides accurate measurement of distance and object distance in crowded cities, making self-driving technology easily mass-adopted.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Government Investments | MOTIE invests its capital in high-resolution radar in autonomous cars. |

| 5G-Enabled Radar Systems | Real-time processing of radar data with South Korea’s high-end 5G networks. |

| AI-Based Radar Perception | Hyundai Mobis and Samsung create radars that are immune to environmental interference. |

Breakthroughs in quantum radar, edge computing, as well as self-learning radar networks are in store for the future of the market. Quantum radar, on the other hand, uses quantum entanglement to identify objects with accuracy unrivaled by classical radar systems, enhancing immunity to interference and stealth technology.

Edge-enabled radar systems will help to reduce that latency-and improve situational awareness-by processing in-vehicle radar data in the same vehicle rather than waiting for cloud-based computation.

Self-learning radar networks, powered by AI and machine learning, will revolutionize predictive analytics, enabling vehicles to adapt radar detection capabilities based on driving patterns, road conditions, and evolving urban infrastructure. These smart radar networks will continuously refine object recognition, making autonomous driving safer and more efficient.

These advancements in automotive high-definition (HD) imaging radars are significantly bolstering the market toward autonomous driving and advanced driver assistance system (ADAS) integration. Major players with market space consist of Continental AG, Bosch, Aptiv, ZF Friedrichshafen AG, and NXP Semiconductors.

Their focus lies in continuous innovation on sensor technologies with a focus on unmatched investment potentials on autonomous driving solutions and developing advanced ADAS features for vehicle safety and performance. For instance, Continental AG and Bosch are spearheading advanced radar sensors to supplement vehicular perception capacities, which are essential for the positional 4D imaging for the surroundings with accurate as well as real-time information_flow.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Bosch | 15-20% |

| Aptiv | 12-16% |

| NXP Semiconductors | 10-14% |

| Arbe Robotics | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Develops high-resolution 4D imaging radar for advanced driver-assistance systems (ADAS). |

| Bosch | Innovates in AI-integrated imaging radar for enhanced object recognition and real-time processing. |

| Aptiv | Provides modular radar platforms with software-defined capabilities for autonomous applications. |

| NXP Semiconductors | Specializes in high-frequency radar chipsets for long-range and high-precision detection. |

| Arbe Robotics | Pioneers ultra-high-resolution 4D radar solutions for next-generation autonomous driving. |

Key Company Insights

Continental AG (18-22%)

Continental brings out imaging radar technology, for it is a high-resolution solution used for understanding better ADAS and autonomous vehicles, where radar sensors have worked more in the classification of objects and environmental mapping.

Bosch (15-20%)

Bosch stands out in the best AI-powered radar processing today, where real imaging in real-time within the autonomous vehicle helps in increased safety and situational awareness.

Aptiv (12-16%)

Aptiv is geared towards constructing the modular radar platforms that seamlessly match ADAS to offer a flexible software-defined improvement to how adaptive cruise control and collision avoidance are improved.

NXP Semiconductors (10-14%)

NXP is best known for its radar chipsets that accuracy detect and pinpoint objects-essential for high-speed driving in highways and the complexities of urban environments.

Arbe Robotics

Arbe Robotics brings the first nuclear 4D ultra-high resolution radar that classifies objects and measures depth to stride towards full autonomy in navigation.

Other Key Players (30-40% Combined)

And many more such companies, which bring advances with respect to HD/imaging radar in the automotive space, create new radar architecture and ingenious perception algorithms using AI.

Based on range, the market is segmented into short range, medium range, and long range.

Based on application, the market is segmented into adaptive cruise control, autonomous emergency braking, blind spot detection, forward collision warning system, and intelligent park assist.

According to frequency, the market is categorized into 24 GHz, 77 GHz, and 79 GHz.

Based on vehicle type, the market is segmented into commercial vehicle and passenger vehicle.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The overall market size for the market is expected to be USD 14.8 Billion in 2025.

The market is expected to reach USD 88.11 Billion in 2035.

The demand will grow due to increasing adoption of advanced driver-assistance systems (ADAS), rising demand for autonomous vehicles, and advancements in radar sensor technology.

Continental AG, Robert Bosch GmbH, Infineon Technologies AG, Texas Instruments, NXP Semiconductors are some of the key players in the market.

Short-range and long-range imaging radar systems are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Frequency, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Range, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Range, 2023 to 2033

Figure 22: Global Market Attractiveness by Frequency, 2023 to 2033

Figure 23: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Application, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Range, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Attractiveness by Range, 2023 to 2033

Figure 47: North America Market Attractiveness by Frequency, 2023 to 2033

Figure 48: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 49: North America Market Attractiveness by Application, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Range, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Range, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Frequency, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Range, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Range, 2023 to 2033

Figure 97: Europe Market Attractiveness by Frequency, 2023 to 2033

Figure 98: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 99: Europe Market Attractiveness by Application, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Range, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Range, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Frequency, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 124: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Range, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Range, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Frequency, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Range, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Range, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Frequency, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 174: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Range, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Frequency, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Frequency, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Frequency, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Frequency, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: MEA Market Attractiveness by Range, 2023 to 2033

Figure 197: MEA Market Attractiveness by Frequency, 2023 to 2033

Figure 198: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 199: MEA Market Attractiveness by Application, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA