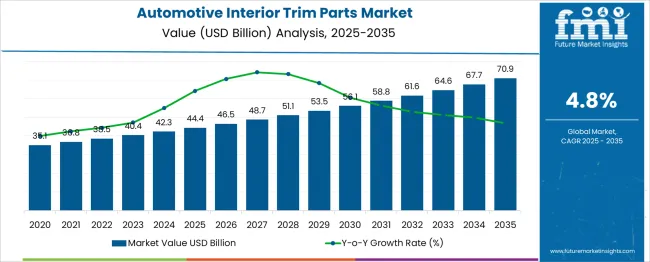

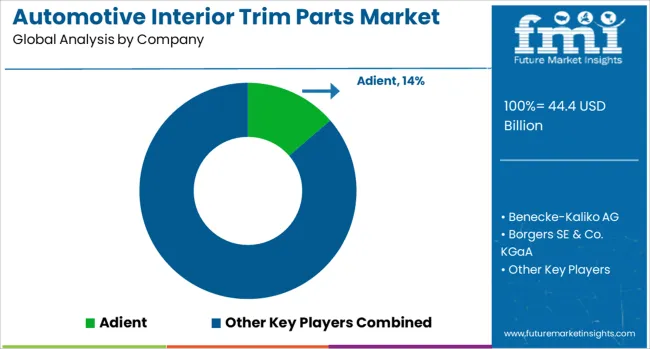

The Automotive Interior Trim Parts Market is estimated to be valued at USD 44.4 billion in 2025 and is projected to reach USD 70.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Interior Trim Parts Market Estimated Value in (2025 E) | USD 44.4 billion |

| Automotive Interior Trim Parts Market Forecast Value in (2035 F) | USD 70.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Automakers are increasingly focused on delivering premium in-vehicle experiences, prompting the integration of advanced materials and innovative design in trim components. Growth in electric and luxury vehicles has intensified demand for lightweight, durable, and visually appealing interior parts. Additionally, regulatory requirements for fuel efficiency and emissions are influencing material choices, with manufacturers favoring components that contribute to overall vehicle weight reduction.

The market outlook remains optimistic as OEMs invest in customization, digital interfaces, and sustainable interiors. Evolving design trends, along with rapid advancements in manufacturing technologies, are expected to further support market expansion, particularly in high-volume segments such as passenger cars.

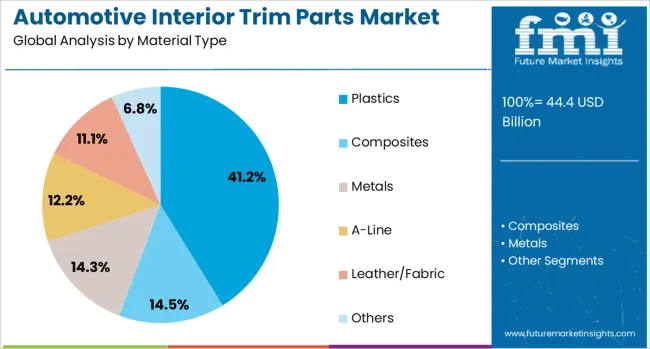

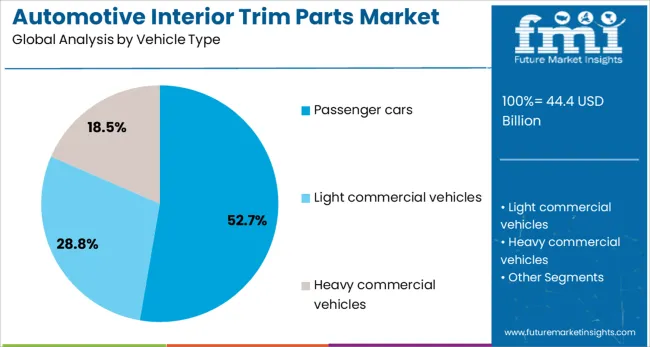

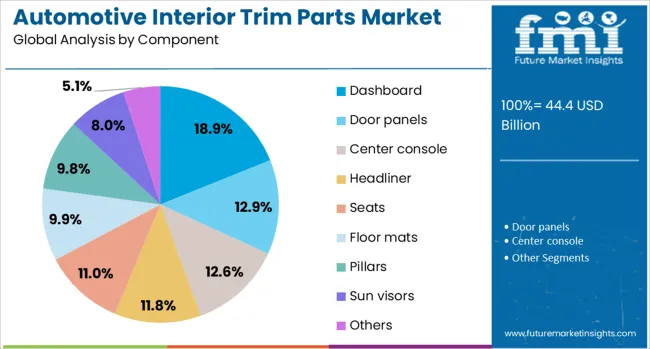

The automotive interior trim parts market is segmented by material type, vehicle type, component, design, application, and geographic regions. The automotive interior trim parts market is divided by material type into Plastics, Composites, Metals, A-Line, Leather/Fabric, and Others. The automotive interior trim parts market is classified by vehicle type into Passenger cars, Light commercial vehicles, and Heavy commercial vehicles. The automotive interior trim parts market is segmented into Dashboard, Door panels, Center console, Headliner, Seats, Floor mats, Pillars, Sun visors, and Others. The automotive interior trim parts market is segmented into Standard trim and Customized/Personalized trim. The automotive interior trim parts market is segmented into Economy/Budget vehicles, Mid-range vehicles, and Premium/Luxury vehicles. Regionally, the automotive interior trim parts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastics segment leads the material type category with a 41.2% market share, supported by its lightweight nature, cost efficiency, and versatility in forming complex interior shapes. Plastics are extensively used in dashboards, panels, consoles, and door trims due to their ability to offer aesthetic flexibility while meeting durability and safety standards.

The adoption of engineered polymers and thermoplastics has allowed for high-impact resistance, superior finishes, and compatibility with advanced infotainment systems. Manufacturers are also focusing on bio-based and recyclable plastics to align with sustainability goals, further boosting segment demand.

The ongoing electrification of vehicles and focus on cabin noise reduction have also driven the development of plastic-based acoustic and thermal insulation solutions. As automotive interiors become increasingly functional and stylish, the plastics segment is expected to maintain its dominance through continued innovation and scalability.

Passenger cars dominate the vehicle type category with a 52.7% market share, owing to their global production volumes and evolving consumer preferences for personalized and high-quality cabin interiors. The segment has witnessed a shift from basic trim components to more sophisticated materials and multifunctional designs that enhance driving comfort and connectivity.

Increasing demand for mid-range and premium vehicles, particularly in emerging markets, has driven investments in advanced interior technologies and materials. Automakers are emphasizing seamless integration of displays, ergonomic controls, and smart storage solutions, further expanding the role of interior trim parts.

Safety regulations and occupant comfort standards are also influencing component design and material selection. As consumer lifestyles become more mobile-centric, passenger cars are expected to remain the primary contributors to interior trim innovation and volume growth.

The dashboard segment leads the component category with an 18.9% market share, driven by its central role in housing key vehicle controls, displays, and infotainment systems. Dashboards are increasingly designed to support digital integration, including touchscreens, ambient lighting, and driver-assist features, which has elevated their functional and aesthetic importance.

Material selection for dashboards emphasizes durability, tactile quality, and thermal resistance, with manufacturers adopting soft-touch plastics, foams, and composite materials to meet consumer expectations. The growing trend of minimalist and futuristic cabin designs has also spurred demand for seamless dashboard configurations that enhance spatial perception.

As automotive interiors evolve toward smart, connected environments, the dashboard segment is positioned to capture ongoing demand through design upgrades and material enhancements that align with safety, usability, and comfort standards.

Demand for automotive interior trim parts is being shaped by consumer expectations for comfort, aesthetics and cabin durability. Components such as door panels, instrument panel covers, and center consoles are being produced with upgraded materials including molded foams, leather-like surfaces and thermoplastic overlays. Integration of ambient lighting inserts and embedded sensors is being observed in both luxury and mainstream vehicles. Manufacturers are supplying customized trim modules that match vehicle lines and regulatory standards. Emphasis is being placed on material durability, tactile feel and design coherence to enhance perceived cabin quality.

Interior trim parts are being designed with enhanced tactile and visual quality using coloring methods such as overmolding and soft-touch coatings to increase perceived value. Light-guiding films and LED backlit inserts are being embedded within dashboards and door sills to create branded ambience illusions. Compatibility with micro-structured surfaces has allowed scratch-resistant and fingerprint-reducing finishes to be achieved while maintaining manufacturing efficiency. Adhesive element integration for airbag and sensor mountings has been perfected to support safety regulations and component integration. Supply chain relationships have been strengthened through the co-development of modular trim assemblies that allow platform sharing and reduced part variety. As consumer vehicle preferences have included premium ambiance at accessible cost positions, trim suppliers have responded with scalable designs that replicate high-end cabin experiences.

Manufacturers of interior trim modules have faced challenges in balancing lightweight design requirements with durability and aesthetic standards. Multilayer trim constructions incorporating foam cores, metal inserts, and electronic wiring have increased production complexity and material handling costs. Emission regulations for volatile organic compounds have added certification overhead across supplier networks requiring solvent-free coatings and standardized testing protocols. Variation in global automotive safety standards has required trim redesigns for airbag deployment zones and passenger impact requirements. Cost management has been constrained by rising resin prices and high tooling expenses associated with bespoke texture patterns. As assembly lines have required just-in-time delivery and zero-defect quality assurances, supplier networks have needed robust traceability systems, increasing the administrative burden.

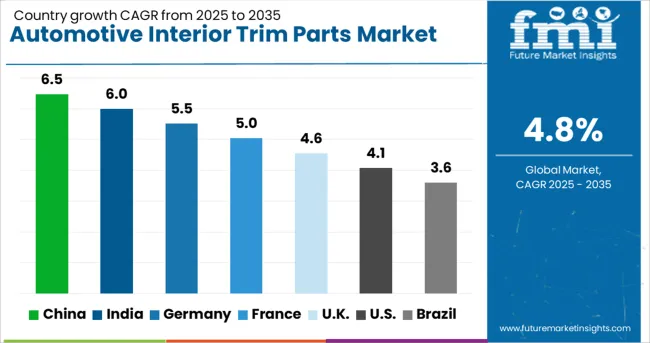

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global automotive interior trim parts market is projected to expand at a 4.8% CAGR from 2025 to 2035. Of the five profiled markets among 40 analyzed, China leads at 6.5%, followed by India at 6.0% and Germany at 5.5%, while France posts 5.0% and the United Kingdom records 4.6%. These rates represent growth premiums of +35% for China, +25% for India, and +15% for Germany above the global baseline, whereas France and the UK trail slightly at +4% and -4%, respectively. Divergence reflects local catalysts: high vehicle output and luxury demand in China, affordable interior innovation in India, advanced material integration in Germany, smart-surface adoption in France, and modular EV-focused interiors in the UK.

China is expected to grow at a 6.5% CAGR, driven by strong automotive production and rising consumer demand for premium vehicle interiors. Automakers are focusing on lightweight materials such as thermoplastic composites and advanced polymers to enhance fuel efficiency and sustainability compliance. Increasing adoption of luxury trims, soft-touch surfaces, and leather substitutes in mid-segment vehicles accelerates market growth. OEMs are integrating decorative elements like ambient lighting and textured panels to attract younger buyers. Domestic suppliers are partnering with global Tier-1 companies to expand design capabilities and meet evolving aesthetic trends in electric and connected vehicle segments.

India is forecast to grow at a 6.0% CAGR, supported by increased passenger car production and a shift toward premium interior features. Growing preference for comfort-driven components like padded panels, fabric-wrapped consoles, and high-durability floor systems drives demand. Local manufacturers are emphasizing cost-efficient production of molded plastic trims to cater to budget segments while meeting OEM quality standards. Expansion of electric vehicle models with customizable interiors introduces new opportunities for lightweight and eco-friendly materials. OEM partnerships with interior specialists are focusing on delivering advanced aesthetics and tactile quality at competitive price points.

Germany is projected to grow at a 5.5% CAGR, driven by demand for high-end interior finishes in luxury and premium vehicles. Automotive brands are prioritizing sustainable materials such as recycled plastics and bio-based polymers for trims and panels. Advanced manufacturing techniques, including 3D-printed decorative inserts, are improving design flexibility. Connectivity trends are influencing the integration of illuminated accents and digital touch surfaces in interior trims. German suppliers are investing heavily in modular systems that allow personalization while reducing overall weight. These innovations align with automakers’ objectives for enhanced aesthetics, durability, and sustainability across vehicle categories.

The United Kingdom is forecast to grow at a 4.6% CAGR, driven by rising customization demand and modernization of vehicle interiors. Automakers are integrating premium-grade materials in mid-segment cars to capture value-conscious buyers seeking comfort and aesthetics. Lightweight polymer trims with scratch-resistant coatings are increasingly preferred for durability. Market growth is also fueled by the rise of electric and hybrid vehicles requiring modern, tech-enabled interiors. Suppliers are innovating modular trim solutions compatible with connected infotainment systems to enhance the in-cabin experience. Eco-compliant materials remain a focal point in line with UK’s regulatory standards on vehicle interiors.

France is expected to grow at a 5.0% CAGR, driven by the premiumization trend and emphasis on high-quality finishes in mainstream models. Automakers are expanding the use of soft-touch materials and decorative inserts to enhance perceived value. Focus on sustainable design is pushing adoption of natural fibers and low-VOC adhesives in trim production. OEMs are collaborating with interior component manufacturers to develop lightweight and heat-resistant panels for EV platforms. Demand for trims with integrated ambient lighting and smart surface technology is increasing in higher-end models, creating growth opportunities for innovation-oriented suppliers.

The construction equipment finance market is anchored by industry and finance giants such as AB Volvo, Caterpillar Inc., Deere & Company, Komatsu, and CNH Industrial, which offer integrated financing solutions directly to their OEM customers. Major financial institutions like Bank of America, JPMorgan Chase, Wells Fargo, and GE Capital enhance market depth by providing competitive leasing, equipment, and working-capital loans. In 2023, Caterpillar and Deere each held approximately a 4% share of the finance segment, underpinned by their OEM-tied lending arms . The market growth—projected from $54 billion in 2023 to $82 billion by 2028—has been driven by flexible financing models and digital credit platforms . Competition revolves around interest rates, loan tenors, digital application tools, and partnerships with construction and rental firms, particularly in fast-growing Asia-Pacific and North American regions.

On February 26, 2025, Mutares signed an agreement to acquire NBHX Trim Europe (based in Germany, Romania & the UK) from Ningbo Lawrence Automotive Interiors, adding approximately €200 million in annual revenue and 2,000 employees to its Automotive & Mobility segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.4 Billion |

| Material Type | Plastics, Composites, Metals, A-Line, Leather/Fabric, and Others |

| Vehicle Type | Passenger cars, Light commercial vehicles, and Heavy commercial vehicles |

| Component | Dashboard, Door panels, Center console, Headliner, Seats, Floor mats, Pillars, Sun visors, and Others |

| Design | Standard trim and Customized/Personalized trim |

| Application | Economy/Budget vehicles, Mid-range vehicles, and Premium/Luxury vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adient, Benecke-Kaliko AG, Borgers SE & Co. KGaA, Draexlmaier Group, Faurecia, Grupo Antolin, Grupo Kuo, GST AutoLeather, Inc., International Automotive Components (IAC), Lear Corporation, Magna International, Sage Automotive Interiors, Toyoda Gosei, TS Tech Co., Ltd., and Yanfeng Automotive Interiors |

| Additional Attributes | Dollar sales by component type (dashboard, door panels, seats, headliners) and material (plastic, leather, fabric, composites), with plastic dominating for versatility and cost-efficiency. Regional trends are led by Asia-Pacific, driven by high vehicle production in China and India, while Europe emphasizes advanced manufacturing and material innovation. Key players focus on lightweight designs, premium finishes, and enhanced durability. |

The global automotive interior trim parts market is estimated to be valued at USD 44.4 billion in 2025.

The market size for the automotive interior trim parts market is projected to reach USD 70.9 billion by 2035.

The automotive interior trim parts market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in automotive interior trim parts market are plastics, composites, metals, a-line, leather/fabric and others.

In terms of vehicle type, passenger cars segment to command 52.7% share in the automotive interior trim parts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA