The automotive stamping industry in India is experiencing steady growth driven by the increasing vehicle production, rising demand for lightweight and fuel-efficient vehicles, and continuous advancements in stamping technology. The market’s future outlook is defined by the growing integration of automation and digital manufacturing solutions that enhance precision, productivity, and cost efficiency in component production.

The expansion of domestic manufacturing under government initiatives like Make in India has further encouraged investments in local stamping facilities, fostering self-reliance in automotive component supply. Additionally, the shift toward electric and hybrid vehicles is expected to generate new stamping requirements for lightweight structural and battery housing components.

The increasing focus on safety and structural integrity, coupled with the use of advanced high-strength materials, is also influencing the development of next-generation stamping processes As India strengthens its position as a global automotive manufacturing hub, the automotive stamping industry is expected to continue evolving toward higher efficiency, material optimization, and technological sophistication.

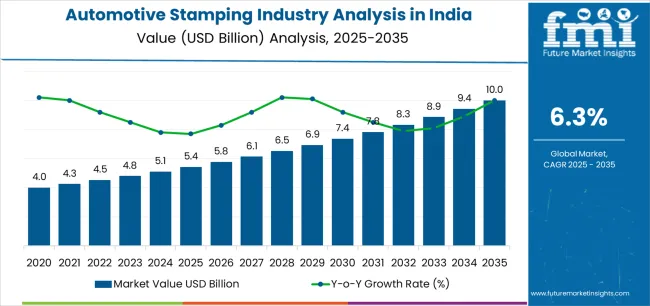

| Metric | Value |

|---|---|

| Automotive Stamping Industry Analysis in India Estimated Value in (2025 E) | USD 5.4 billion |

| Automotive Stamping Industry Analysis in India Forecast Value in (2035 F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

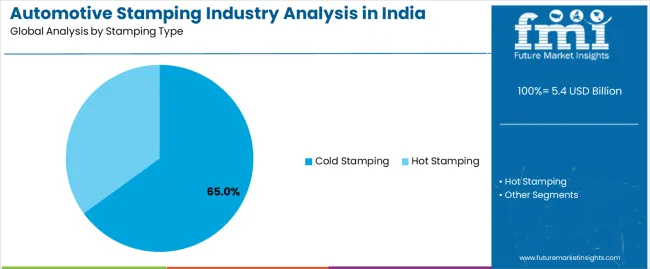

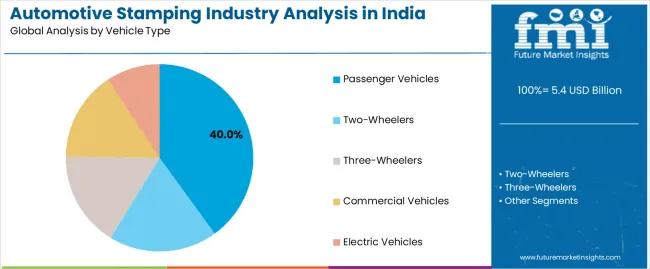

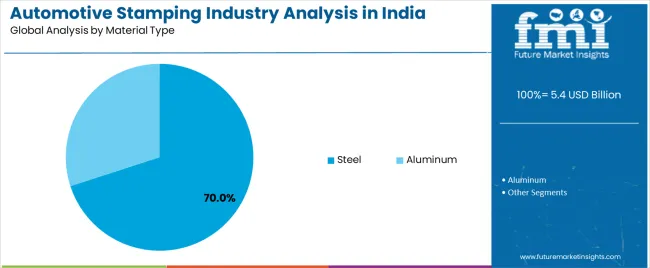

The market is segmented by Stamping Type, Vehicle Type, Material Type, Process Type, and Product Type and region. By Stamping Type, the market is divided into Cold Stamping and Hot Stamping. In terms of Vehicle Type, the market is classified into Passenger Vehicles, Two-Wheelers, Three-Wheelers, Commercial Vehicles, and Electric Vehicles. Based on Material Type, the market is segmented into Steel and Aluminum. By Process Type, the market is divided into Progressive Die Stamping, Transfer Stamping, and Tandem Stamping. By Product Type, the market is segmented into Body Parts Stamping and Non-Body Parts Stamping. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cold stamping segment is projected to hold 65.00% of the automotive stamping market revenue share in 2025, positioning it as the leading stamping type. This dominance is attributed to its superior precision, high production speed, and lower operational costs compared to other methods. Cold stamping has been widely adopted due to its ability to produce complex and durable automotive components without significant heat distortion, ensuring consistent quality across large production volumes.

The technique’s suitability for mass production aligns with the needs of India’s expanding automotive manufacturing base. The continuous advancements in press machinery, tool design, and automation have further improved process efficiency and material utilization.

Moreover, the growing emphasis on sustainability and reduced energy consumption has favored cold stamping as an environmentally efficient solution The segment’s strong foothold in both passenger and commercial vehicle production underscores its essential role in meeting the industry’s cost, precision, and scalability requirements.

The passenger vehicles segment is expected to account for 40.00% of the automotive stamping market revenue share in 2025, making it the leading vehicle type. This segment’s prominence is driven by the rising demand for passenger cars across urban and semi-urban regions, supported by increasing disposable incomes and improved financing options. The rapid expansion of domestic automotive manufacturing has encouraged significant investment in stamping technologies to meet production efficiency and quality standards.

The passenger vehicle segment benefits from the growing adoption of advanced materials and lightweight designs aimed at improving fuel efficiency and reducing emissions. Additionally, the integration of safety and comfort features has increased the complexity of stamped components, creating higher demand for precision stamping.

The push toward electric vehicles and hybrid models is further expanding stamping applications in chassis and battery enclosures As consumer preferences shift toward compact and mid-sized cars, the passenger vehicle segment continues to be a key growth driver for the Indian automotive stamping industry.

The steel material segment is anticipated to hold 70.00% of the automotive stamping market revenue share in 2025, making it the dominant material type. This dominance is attributed to steel’s superior strength, durability, and cost-effectiveness, which make it ideal for mass vehicle production. The widespread use of advanced high-strength and ultra-high-strength steels in automotive body structures has enhanced crash resistance while allowing for weight reduction.

The easy formability and recyclability of steel also contribute to its continued preference in the stamping industry. Growing collaborations between steel manufacturers and automakers have LED to the development of specialized steel grades optimized for stamping applications. Additionally, India’s strong domestic steel production capacity ensures reliable material availability at competitive prices, supporting large-scale stamping operations.

The segment’s growth is further reinforced by the steady demand for stamped steel components in both conventional and electric vehicles As sustainability and structural performance remain key priorities, steel is expected to maintain its leading position within the Indian automotive stamping market.

The annual growth rates of the automotive stamping industry from 2025 to 2035 are illustrated in the table below. Starting with the base year 2025 and going up to the present year 2025, the report examined how the growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2).

This gives stakeholders a comprehensive picture of the industry’s performance over time and insights into potential future developments.

The table provided below shows the growth rate for each half-year between 2025 and 2025. The industry was projected to rise at a CAGR of 6.1% in the first half (H1) of 2025. However, in the second half (H2), there is a noticeable increase in the growth rate of 6.5%.

| Particular | Value CAGR |

|---|---|

| H1 | 6.1% (2025 to 2035) |

| H2 | 6.5% (2025 to 2035) |

| H1 | 6.2% (2025 to 2035) |

| H2 | 6.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to drop to 6.2% in the first half and surge to 6.4% in the second half. In the first half (H1), it witnessed an increase of 10 BPS, while in the second half (H2), it showcased a decline of 10 BPS.

Emergence of Collaborative Robotics or Cobots Spurs Growth in India

The rise of collaborative robotics or cobots is reshaping India's automotive stamping industry by boosting efficiency and adaptability. Cobots, designed to work alongside human operators, handle repetitive tasks and precise operations, enhancing production speed and accuracy.

AutoComp Systems, for instance, has integrated cobots in its stamping lines to manage part alignment and quality inspection, leading to quick changeovers and minimized downtime. This adoption not only improves manufacturing flexibility but also creates a safe work environment by reducing manual handling and ergonomic risks.

As the automotive business in India grows, increased use of cobots is projected to bolster innovation and operational efficiencies. These are anticipated to line up with the country’s shift toward automation and smart manufacturing practices.

Rising Adoption of 3D Stamping Technology is a Key Trend

The adoption of 3D stamping technology is revolutionizing India’s automotive stamping industry by enabling the production of complex and highly customized parts. This technology enhances design flexibility, allowing manufacturers to create intricate geometries and optimize material usage.

For instance, Bharat Forge is leveraging 3D stamping to produce lightweight, high-strength components that improve vehicle performance and fuel efficiency. The ability to rapidly prototype and manufacture components with precise specifications accelerates innovation and reduces production lead times.

As automotive companies in India increasingly seek to meet evolving design requirements and regulatory standards, 3D stamping technology is anticipated to push significant innovations. This shift not only supports the production of unique vehicle parts but also boosts competitiveness by offering more efficient and versatile manufacturing solutions.

Introduction of Smart Manufacturing Technologies Fuels Innovations in India

Smart manufacturing is boosting significant innovations in India’s automotive stamping industry by integrating cutting-edge technologies such as IoT, AI, and automation. This approach enhances production efficiency and accuracy while reducing operational costs.

Mahindra CIE Automotive, for instance, is utilizing smart manufacturing techniques to optimize its stamping processes. It is further implementing real-time data analytics to monitor machine performance and predict maintenance needs. This capability not only improves production reliability but also allows for rapid adjustments to meet changing design and regulatory requirements.

As smart manufacturing continues to evolve, it is projected to enhance the precision and flexibility of stamping operations, driving growth in the country. The increased adoption of these technologies will likely help local manufacturers stay competitive, meet high standards, and respond more effectively to the dynamic demands of automotive companies.

Growth in EV Production Presents a Significant Opportunity for Manufacturers

Surging electric vehicle (EV) production offers a key opportunity to India’s automotive stamping manufacturers. With the rising adoption of EVs, there is an increasing demand for specialized stamped components, including battery enclosures and lightweight structural elements.

Companies like Tata Motors and Mahindra Electric are broadening their EV portfolios, bolstering the need for high-performance stamped parts that meet the unique requirements of electric powertrains. For instance, Bharat Forge is developing cutting-edge stamping solutions to produce robust battery enclosures and lightweight frames for EVs. This trend pushes manufacturers to invest in innovative stamping technologies and materials to enhance performance and efficiency.

As the EV industry surges, stamping companies in India can leverage these opportunities to extend their product offerings, improve manufacturing capabilities, and capture a large share of the evolving automotive landscape. This shift is anticipated to stimulate growth and foster technological innovations in the country.

Supply Chain Disruptions Can Pose a Challenge in India

Supply chain disruptions are impacting India's automotive stamping industry by causing delays and increasing costs. Issues, such as fluctuating raw material prices and logistical bottlenecks hinder the timely production and delivery of stamping components.

For instance, disruptions in the supply of steel, a critical material, have affected companies like Mahindra CIE Automotive, resulting in production slowdowns and increased operational costs. These interruptions compel manufacturers to seek alternative suppliers or invest in inventory management solutions, both of which can raise expenses.

Delays in sourcing components can also affect the production schedules of vehicle manufacturers. To mitigate these issues, stamping companies are exploring strategies, such as diversifying their supplier base and investing in supply chain technology to enhance resilience and efficiency. Adapting to these disruptions is important for maintaining competitiveness and meeting the growing demands of the automotive business.

India’s automotive stamping industry recorded a CAGR of 2.6% during the historical period between 2020 and 2025. The growth rate was positive as it reached a value of USD 4,823.1 million in 2025 from USD 4,345.1 million in 2020.

Between 2020 and 2025, the country experienced notable fluctuations, influenced by the automotive industry's cyclical nature and disruptions caused by the COVID-19 pandemic. The pandemic LED to a significant drop in vehicle production, with India's overall automotive sales declining from 3.8 million units in 2020 to 5.1 million units in 2025.

The significant downturn also impacted the demand for automotive stampings, which are considered essential components in vehicle manufacturing. However, a recovery began in 2025, fueled by a rebound in economic activities and rising consumer confidence.

Electric vehicle (EV) sales in India saw a remarkable surge during this period, growing from just 130,000 units in 2020 to over 430,000 units in 2025. This increase was pushed by supportive government policies, rising fuel prices, and growing consumer awareness of environmental sustainability.

Looking ahead from 2025 to 2035, the country is poised for steady growth, augmented by a resurgence in vehicle production and the continued rise in EV adoption. The push for fuel efficiency, lightweight components, and compliance with stringent emission norms will likely amplify demand for unique stamping techniques.

The growing EV industry is set to reach 10 million units by 2035. It will likely require specialized stampings for battery enclosures and electric drivetrains. Manufacturers are projected to focus on innovation. They are anticipated to develop stamping technologies that cater to the evolving needs of both conventional and electric vehicles, aligning with new designs and performance demands in the country.

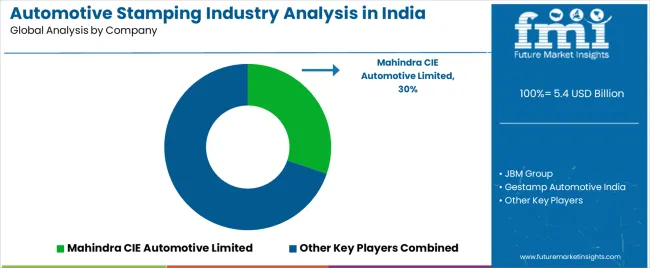

Tier 1 companies comprise players with a revenue of above USD 50 million, capturing a significant share of 45 to 50% in India. These players are characterized by high production capacity and a wide product portfolio.

The leaders are distinguished by their extensive expertise in manufacturing across multiple product formats and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include JBM Group, Gestamp Automotive India, Mahindra CIE Automotive Limited, and Autocomp Corporation Panse Pvt Ltd (ACPPL).

Tier 2 companies include mid-sized players with revenue of below USD 50 million, having a significant presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and robust industry knowledge.

The players have good technology and ensure regulatory compliance but may not have cutting-edge technology and wide reach in the country. Prominent companies in Tier 2 include Omax Auto Limited, Caparo India, Yeshshree Press Comps Private Limited, and KLT Group.

The section covers the analysis of automotive stamping sales in different states of India. The demand analysis was carried out for various states located in different regions, such as North India, West India, East India, and South India.

Uttar Pradesh is projected to capture 27.6% of the share in North India in 2025. Maharashtra, holding 38.8% of the share in West India benefits from Mumbai's extensive industrial network and Pune's automotive hubs. Tamil Nadu, on the other hand, is set to lead South India with a 26.4% share in the same year.

| States | CAGR 2025 to 2035 |

|---|---|

| Madhya Pradesh | 6.6% |

| Karnataka | 6.4% |

| Tamil Nadu | 6% |

| Maharashtra | 5.5% |

| Uttar Pradesh | 5.1% |

The demand for automotive stampings in Uttar Pradesh is projected to reach USD 10 million by 2035 and is estimated to surge at a 5.1% CAGR in the assessment period. The state is gaining momentum due to its rapidly developing automotive industry in Greater Noida and significant investments from leading manufacturers.

The establishment of unique facilities by companies like Tata AutoComp Systems has bolstered local production capabilities, addressing the rising demand for automotive components. Recent expansions, such as those by JBM Group, have further enhanced the state's stamping infrastructure.

Favorable government policies and incentives for automotive manufacturing in Uttar Pradesh are attracting hefty investment, supporting the growth of local stamping operations. These developments are positioning Uttar Pradesh as a key state in India.

Sales in Maharashtra are projected to reach USD 973.8 million by 2035. Over the forecast period, demand in the state is predicted to surge at a 5.5% CAGR.

Maharashtra's substantial share of 38.8% in West India's automotive stamping industry in 2025 is driven by its robust industrial infrastructure and strategic automotive hubs. Mumbai’s extensive industrial network, with its well-established supply chains and manufacturing facilities, plays a pivotal role in supporting the state’s stamping business.

Pune's emergence as a leading automotive hub, with investments from prominent players, such as Tata Motors and Mahindra & Mahindra, further strengthens the state’s position. These factors, combined with Maharashtra’s favorable business environment, continue to spur regional dominance in automotive stamping.

Demand for automotive stampings in Tamil Nadu is projected to reach USD 551.7 million by 2035 and surge at a CAGR of 6% in the evaluation period. The state is poised to lead South India with a 26.4% share in 2025, which is attributed to Chennai's key role as a prominent automotive manufacturing hub.

The city's high concentration of global automotive players, including Hyundai and Renault, along with substantial investments in state-of-the-art production facilities, underpins this dominance. The robust automotive infrastructure and favorable state policies further enhance Tamil Nadu’s competitive edge. This strategic positioning and investment in manufacturing capabilities ensure the state’s continued leadership in South India.

The section explains the growth trajectories of the two leading segments. In terms of stamping type, the cold stamping segment will likely dominate and generate a share of around 78.9% in 2025.

Based on the process type, the progressive die stamping segment is set to hold a leading share of 48.3% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Cold Stamping (Stamping Type) |

|---|---|

| Value Share (2025) | 78.9% |

Cold stamping dominates India's automotive stamping industry, mainly due to its cost-efficiency and adaptability across several materials. This method is considered significant for producing high-volume components, such as body panels and structural parts, with precision and consistency.

Leading manufacturers like Tata Motors utilize cold stamping to efficiently produce durable components, benefiting from relatively low production costs. The process's compatibility with diverse metals, including high-strength steel, ensures its relevance as automotive designs evolve. The surging demand for economical and efficient production solutions in India is set to create new opportunities for cold stamping.

| Segment | Progressive Die Stamping (Process Type) |

|---|---|

| Value Share (2025) | 48.3% |

In terms of process type, the progressive die stamping category will likely lead due to its ability to meet high-volume production needs with precision and speed. Progressive dies perform multiple operations in a single press stroke, allowing for rapid production cycles and reduced lead times. The method is particularly advantageous for manufacturing components like automotive body panels, where consistency and throughput are critical.

India-based automotive suppliers, such as Subros Ltd. utilize progressive die stamping to produce complex parts efficiently, thereby meeting the demands of OEMs for large-scale, reliable production. This capability positions progressive die stamping as a key process in the country's rapidly growing automotive industry.

Key companies manufacturing automotive stampings in India moderately consolidate the industry with about 45 to 50% share. They are prioritizing technological innovations, integrating sustainable practices, and broadening their footprints in the country. A few companies are focusing on showcasing their innovative products across trade fares and exhibitions to gain a competitive edge.

Customer satisfaction remains paramount, with a keen focus on tailoring machines to meet diverse automotive industry needs. Leading companies are actively fostering collaborations to stay at the forefront of innovation, ensuring their automotive stampings align with the evolving demands and maintain high standards of quality and adaptability.

Industry Updates

Hot stamping and cold stamping are the two key types.

Two-wheelers, three-wheelers, passenger vehicles, commercial vehicles, and electric vehicles are the prominent vehicle types.

Steel and aluminum are the two material types.

The process type segment is categorized into progressive die stamping, transfer stamping, and tandem stamping.

Body parts stamping and non-body parts stamping are the main product types.

Regions considered in the study include North India, West India, East India, and South India.

The global automotive stamping industry analysis in india is estimated to be valued at USD 5.4 billion in 2025.

The market size for the automotive stamping industry analysis in india is projected to reach USD 10.0 billion by 2035.

The automotive stamping industry analysis in india is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in automotive stamping industry analysis in india are cold stamping and hot stamping.

In terms of vehicle type, passenger vehicles segment to command 40.0% share in the automotive stamping industry analysis in india in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

Automotive Stamping Market Growth - Trends & Forecast 2025 to 2035

Automotive Plastic Market in BRIC Countries - Size, Share, and Forecast 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Decor Paper Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Automotive Performance Tuning and Engine Remapping Industry Analysis in Japan Forecast & Analysis: 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA