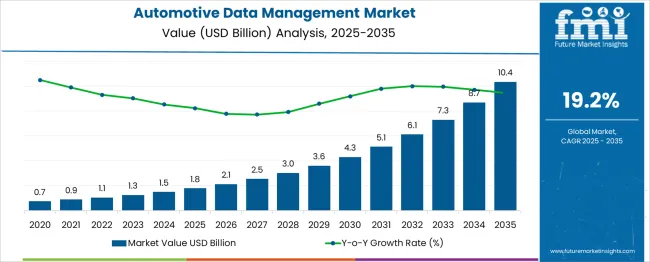

The Automotive Data Management Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 19.2% over the forecast period. From 2025 to 2030, the market is expected to grow from USD 1.8 billion to USD 4.3 billion, showcasing strong demand for connected vehicle technologies and real-time data analytics.

Year-on-year analysis reveals significant gains, with the market reaching USD 2.1 billion in 2026 and USD 2.5 billion in 2027, supported by enhanced telematics adoption and cloud-based storage solutions across automotive ecosystems. By 2028, the market is forecasted to reach USD 3.0 billion, followed by USD 3.6 billion in 2029 and USD 4.3 billion in 2030. Growth momentum is driven by the integration of big data platforms for predictive maintenance, in-vehicle infotainment, and advanced driver-assistance systems.

OEMs and technology providers are expected to collaborate on developing secure data frameworks to address privacy and cybersecurity concerns while optimizing fleet and performance management. These developments position automotive data management as a critical enabler for next-generation mobility solutions, supporting autonomous driving, connected infrastructure, and the evolution of smart transportation ecosystems globally.

| Metric | Value |

|---|---|

| Automotive Data Management Market Estimated Value in (2025 E) | USD 1.8 billion |

| Automotive Data Management Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 19.2% |

The automotive data management market occupies an emerging yet strategically important position across multiple technology-driven automotive domains. In the automotive software market, its share is approximately 8–10%, reflecting its critical role in structuring, storing, and processing large-scale vehicle data. Within the connected vehicle solutions market, it accounts for nearly 12–14%, as real-time telematics, over-the-air updates, and V2X communication depend on robust data frameworks.

In the automotive cloud services market, the contribution stands at 15–18%, as cloud platforms form the backbone of modern data storage and analytics systems. For the automotive big data and analytics market, the share is substantial at around 20–22%, given that data management is the foundation for predictive analytics, fleet optimization, and personalized services.

In the automotive IoT market, the share remains moderate at 10–12%, driven by growing deployment of IoT sensors and connected ecosystems in vehicles. This segment is witnessing rapid expansion due to rising data volumes generated by ADAS, autonomous driving tests, infotainment systems, and connected fleets.

OEMs and mobility service providers are increasingly adopting AI-powered data orchestration, edge computing, and cybersecurity frameworks, positioning automotive data management as a core enabler of next-generation mobility solutions, autonomous driving capabilities, and intelligent transportation systems globally.

The automotive data management market is advancing steadily as vehicles become more connected, data-centric, and integrated with intelligent infrastructure. Growing volumes of vehicle-generated data, coupled with rising demand for real-time analytics, have compelled automakers and ecosystem players to adopt robust data management solutions.

This shift has been further reinforced by regulatory emphasis on data privacy, operational efficiency goals, and the competitive need to extract actionable insights from vast datasets. Structured investments in cloud platforms, edge computing, and artificial intelligence are paving the way for enhanced data governance and monetization opportunities.

Future growth is expected to benefit from the proliferation of connected vehicles, advancements in in-vehicle sensors, and strategic partnerships aimed at creating interoperable and secure data ecosystems. Operational efficiency, regulatory compliance, and revenue generation through data-driven services are collectively shaping the trajectory of this market toward sustained growth.

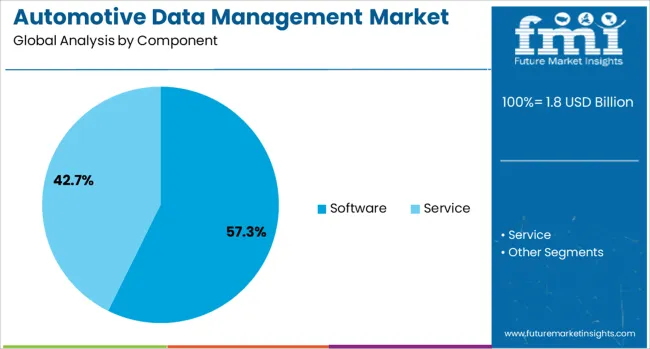

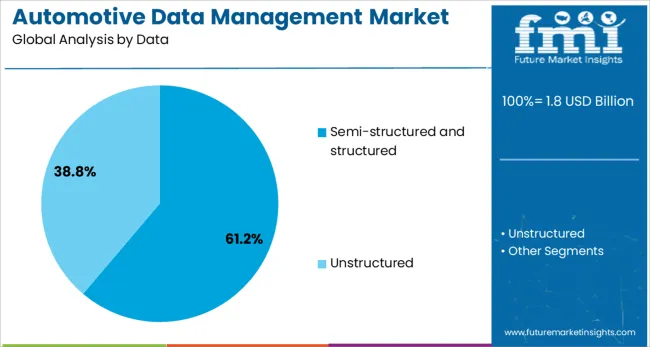

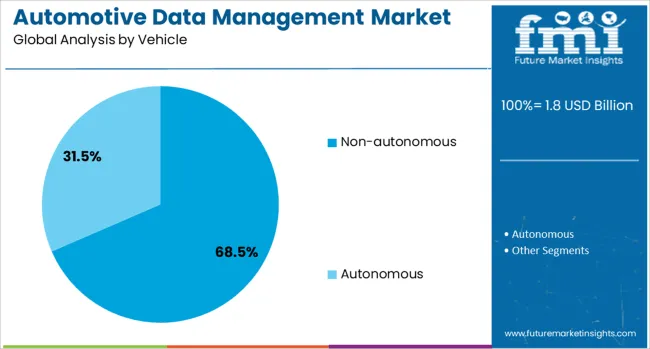

The automotive data management market is segmented by component, data, vehicle, deployment, application, and geographic regions. By component of the automotive data management market is divided into Software and Service. In terms of data, the automotive data management market is classified into Semi-structured and structured, and Unstructured. Based on the vehicle, the automotive data management market is segmented into Non-autonomous and Autonomous.

The automotive data management market is segmented by deployment into Cloud and On-premise. The automotive data management market is segmented into Predictive maintenance, Warranty analytics, Safety and security management, Driver and user behavior analysis, Dealer performance analysis, and Others. Regionally, the automotive data management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, software is expected to account for 57.3% of the total market revenue in 2025, making it the leading segment. This leadership has been reinforced by the increasing need for scalable platforms that can store, process, and analyze vast quantities of automotive data in real time.

Sophisticated software solutions have enabled automakers and service providers to build end-to-end data pipelines that facilitate predictive maintenance, fleet optimization, and customer personalization. The ability of software to adapt quickly to regulatory changes, integrate with cloud and edge environments, and support machine learning workflows has driven its prominence.

Enhanced security features and modular architectures have further improved reliability and reduced operational complexities, encouraging widespread deployment. The demand for seamless integration with existing enterprise systems and the flexibility to handle diverse data formats has firmly positioned software as the cornerstone of automotive data management initiatives.

Segmented by data type, semi-structured and structured data is projected to hold 61.2% of the market revenue in 2025, underscoring its leading position. This dominance has been driven by the prevalence of vehicle telematics, diagnostic logs, and driver behavior records, which primarily exist in structured and semi-structured formats.

Such data has been easier to organize, process, and derive value from using existing data management tools and practices. The consistency and predictability of structured datasets have allowed faster adoption of analytics and reporting solutions. Semi-structured data, such as sensor metadata and event logs, has provided flexibility without overwhelming complexity.

The increasing standardization of data formats in the automotive industry has further facilitated interoperability and accelerated the deployment of data-driven services. Superior data quality, ease of integration, and lower processing costs have collectively reinforced the leadership of this segment.

When segmented by vehicle type, non-autonomous vehicles are forecast to capture 68.5% of the market revenue in 2025, securing their place as the leading segment. This leadership has been underpinned by the overwhelming dominance of non-autonomous vehicles on the roads today, which continue to generate substantial volumes of data through connected features.

Data streams from infotainment systems, navigation, telematics, and driver assistance systems in non-autonomous vehicles have remained central to manufacturers’ data strategies. The maturity of technologies supporting connected yet human-driven vehicles has allowed for scalable data collection, analysis, and monetization without the complexities of fully autonomous systems.

The readiness of infrastructure and regulatory frameworks has favored deployment in this segment, while autonomous vehicles remain in earlier stages of adoption. Strong installed base, proven business models, and lower technological barriers have ensured that non-autonomous vehicles continue to lead data generation and management efforts.

The automotive data management market is witnessing significant growth as connected vehicles generate vast amounts of sensor, telematics, and infotainment data. In 2024, automakers implemented advanced platforms to handle V2X communication and real-time analytics for connected fleets.

By 2025, the introduction of software-defined vehicles and new regulatory standards for secure data usage will further accelerate adoption. Providers delivering scalable, compliant, and secure data handling systems tailored to automotive ecosystems are emerging as key enablers of this market’s evolution.

The surge in connected vehicle deployments has created unprecedented data handling requirements across the automotive sector. In 2024, integrated telematics and in-vehicle systems produced large-scale structured and unstructured datasets from diagnostics, GPS tracking, and safety systems. In 2025, the shift toward software-defined vehicles introduced additional complexity, requiring real-time analytics and remote update capabilities.

These changes indicate that sheer data complexity—not just volume—is influencing technology adoption. Vendors delivering high-throughput platforms that support seamless integration, analytics, and compliance are increasingly being selected by OEMs and fleet operators to maintain operational continuity and unlock service innovation.

Evolving regulations on vehicle data ownership and accessibility are opening major opportunities for platform providers. In 2024, industry stakeholders initiated frameworks for controlled third-party data access, while 2025 saw legislation advancing data-sharing rights for insurers, repair shops, and mobility operators. These developments indicate that compliant and secure data exchange will become a key differentiator for technology providers. Companies offering governance-focused platforms with robust privacy, interoperability, and monetization models are likely to capture early advantage as automotive ecosystems embrace standardized data-sharing protocols.

In 2024 and 2025, automotive data management encountered challenges due to the escalating cost of storing and processing large volumes of connected vehicle data. Automakers faced substantial expense in implementing secure cloud infrastructure and real-time analytics platforms. Smaller OEMs were particularly affected, as compliance with data privacy regulations required additional investment in encryption and access control frameworks. Reports indicated that these financial burdens delayed implementation timelines for advanced data-driven services across emerging markets. Unless cost-efficient storage and streamlined security solutions are adopted, the full-scale deployment of automotive data platforms will remain financially restrictive for many manufacturers.

The automotive data management landscape in 2024 and 2025 witnessed a growing emphasis on predictive analytics for operational efficiency. OEMs integrated machine learning algorithms to forecast component failures and schedule proactive maintenance, reducing unplanned downtime for fleets. Real-world applications were observed in premium electric and hybrid vehicles, where predictive systems improved performance, reliability and customer satisfaction. Data gathered from sensors, telematics, and service history was utilized to deliver actionable insights for both manufacturers and end-users. This trend signals a clear opportunity for companies that prioritize predictive data strategies to build advanced vehicle health monitoring and aftermarket service offerings.

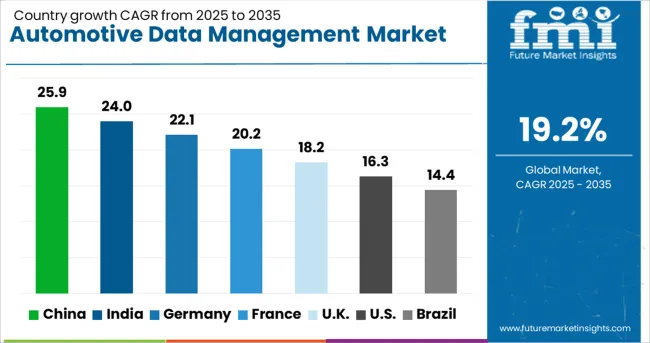

| Country | CAGR |

|---|---|

| China | 25.9% |

| India | 24.0% |

| Germany | 22.1% |

| France | 20.2% |

| UK | 18.2% |

| USA | 16.3% |

| Brazil | 14.4% |

The global automotive data management market is projected to grow at a CAGR of 19.2% from 2025 to 2035. China leads with 25.9%, followed by India at 24.0% and Germany at 22.1%. France records 20.2%, while the United Kingdom posts 18.2%. Growth is driven by connected car ecosystems, real-time data analytics, and rising adoption of AI-powered telematics. China and India dominate due to strong EV integration and smart mobility initiatives, while Germany focuses on premium automotive brands implementing big data platforms. France and the UK emphasize cybersecurity and regulatory compliance in connected vehicle networks.

China is forecast to grow at 25.9%, driven by large-scale connected vehicle deployments and government-backed smart mobility programs. Advanced cloud-based data management platforms dominate EV ecosystems. Automakers adopt AI-driven analytics for predictive maintenance and fleet optimization. Strategic partnerships between tech firms and OEMs strengthen data monetization strategies.

India is projected to grow at 24.0%, supported by rapid connected car adoption and regulatory emphasis on data localization. Affordable telematics solutions dominate mid-segment passenger vehicles. Domestic automakers invest in edge computing to enable faster data processing in real time. Expansion of ride-hailing and shared mobility platforms boosts data-driven services.

Germany is expected to grow at 22.1%, driven by premium automakers leveraging advanced data architectures for autonomous driving and infotainment systems. High-end OEMs prioritize blockchain for secure data sharing and compliance with GDPR. AI-enabled platforms integrate predictive analytics to improve supply chain and fleet management efficiency.

France is forecast to grow at 20.2%, supported by government initiatives on smart transportation and data security. Cloud-native automotive platforms dominate fleet operators and connected vehicle networks. Automakers develop cybersecurity-enhanced solutions to safeguard sensitive data. Adoption of digital twins improves operational insights for EV and hybrid vehicle performance.

The UK is projected to grow at 18.2%, driven by growing EV penetration and vehicle connectivity mandates under clean transport goals. Data-as-a-Service models dominate telematics-based offerings for insurers and fleet operators. Manufacturers integrate AI-driven personalization in infotainment platforms to enhance user engagement. Data-sharing partnerships support innovation in smart city mobility.

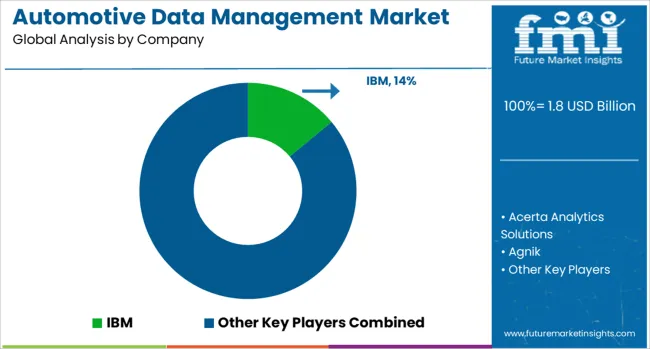

The automotive data management market is moderately consolidated, with IBM recognized as a leading player for its advanced cloud platforms, AI-driven analytics, and robust security solutions tailored to connected and autonomous vehicle ecosystems. The company’s offerings enable real-time data processing, predictive maintenance, and integration with mobility services for automotive OEMs and fleet operators.

Key players include Acerta Analytics Solutions, Agnik, AWS, National Instruments, NetApp, SAP, Teradata, Vinli, and Wejo, each providing specialized solutions for telematics, vehicle data monetization, and advanced analytics. These companies support applications such as driver behavior analysis, over-the-air updates, and data-driven decision-making to improve vehicle performance and safety. Market growth is fueled by the proliferation of connected vehicles, increasing demand for real-time insights, and regulatory emphasis on data compliance and cybersecurity.

Players are focusing on scalable data platforms, edge computing integration, and AI-based algorithms for anomaly detection and predictive diagnostics. Emerging trends include the rise of data-as-a-service (DaaS) models, blockchain for secure transactions, and partnerships between OEMs and tech firms to leverage big data for autonomous driving development. Regional demand is strongest in North America and Europe, while the Asia-Pacific is rapidly growing due to smart mobility initiatives and electric vehicle adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Component | Software and Service |

| Data | Semi-structured and structured and Unstructured |

| Vehicle | Non-autonomous and Autonomous |

| Deployment | Cloud and On-premise |

| Application | Predictive maintenance, Warranty analytics, Safety and security management, Driver and user behavior analysis, Dealer performance analysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, Acerta Analytics Solutions, Agnik, AWS, National Instruments, NetApp, SAP, Teradata, Vinli, and Wejo |

| Additional Attributes | Dollar sales by solution type (software vs managed services), regional demand trends (North America ~36% share, Asia-Pacific fastest growth), competitive landscape, buyer preferences for cloud vs on-prem, integration with connected car platforms, innovations in AI/ML-based analytics and data security systems. |

The global automotive data management market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the automotive data management market is projected to reach USD 10.4 billion by 2035.

The automotive data management market is expected to grow at a 19.2% CAGR between 2025 and 2035.

The key product types in automotive data management market are software, _data security, _data integration, _data migration, _data quality, service, _professional service and _managed service.

In terms of data, semi-structured and structured segment to command 61.2% share in the automotive data management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA