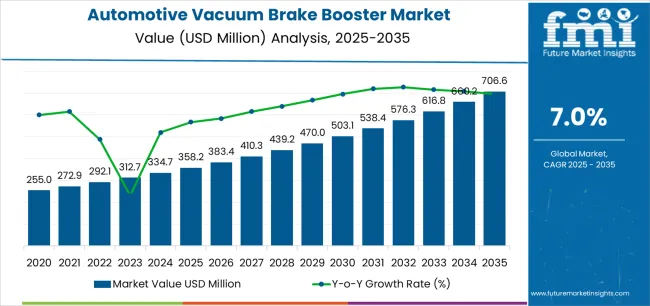

The Automotive Vacuum Brake Booster Market is estimated to be valued at USD 358.2 million in 2025 and is projected to reach USD 706.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The Automotive Vacuum Brake Booster market is experiencing robust growth driven by the increasing demand for enhanced vehicle safety and performance across passenger and commercial vehicles. The future outlook for this market is shaped by ongoing advancements in braking system technologies and the growing emphasis on road safety regulations globally. Rising vehicle production, particularly in emerging markets, is fueling the adoption of advanced brake booster systems.

The shift toward passenger vehicles with higher safety standards has accelerated the use of vacuum brake boosters, which provide improved braking efficiency and driver comfort. Additionally, the integration of electronic stability control systems and automated braking technologies is further enhancing the demand for efficient brake booster mechanisms.

Continuous research and development in lightweight and durable materials is also contributing to market expansion by offering cost-effective and reliable solutions As vehicle safety standards continue to tighten and consumer preference for high-performance braking systems grows, the Automotive Vacuum Brake Booster market is expected to witness sustained growth across both developed and developing regions.

| Metric | Value |

|---|---|

| Automotive Vacuum Brake Booster Market Estimated Value in (2025 E) | USD 358.2 million |

| Automotive Vacuum Brake Booster Market Forecast Value in (2035 F) | USD 706.6 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

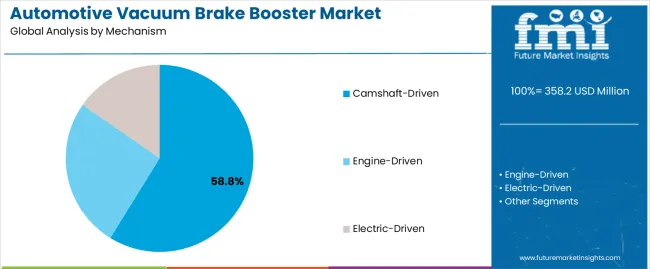

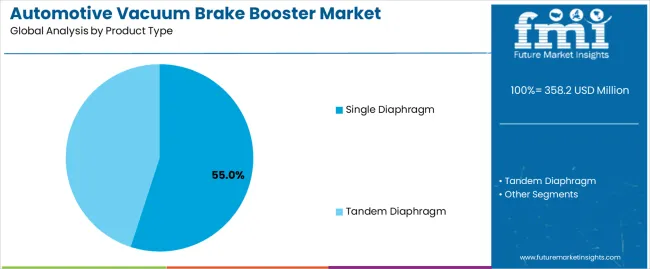

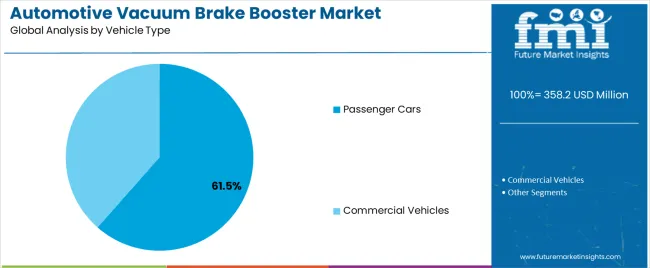

The market is segmented by Mechanism, Product Type, Vehicle Type, and Sales Channel and region. By Mechanism, the market is divided into Camshaft-Driven, Engine-Driven, and Electric-Driven. In terms of Product Type, the market is classified into Single Diaphragm and Tandem Diaphragm. Based on Vehicle Type, the market is segmented into Passenger Cars and Commercial Vehicles. By Sales Channel, the market is divided into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The camshaft-driven mechanism segment is projected to hold 58.8% of the Automotive Vacuum Brake Booster market revenue share in 2025, establishing it as the leading mechanism type. The growth of this segment has been driven by its reliable and consistent performance in delivering high braking force across various driving conditions.

Camshaft-driven mechanisms provide precise response and enhanced control, which are critical for passenger safety and comfort. The segment has benefited from technological improvements that reduce energy loss and improve system efficiency.

Additionally, its compatibility with both traditional and modern vehicle architectures has reinforced adoption across a wide range of passenger vehicles The segment’s growth is further supported by stringent safety regulations and increasing consumer awareness regarding braking performance, making camshaft-driven systems the preferred choice in the market.

The single diaphragm product type segment is expected to capture 55.0% of the Automotive Vacuum Brake Booster market revenue share in 2025, positioning it as the leading product type. This dominance is influenced by its simple yet efficient design, which offers reliable braking assistance while maintaining cost-effectiveness.

Single diaphragm boosters provide adequate vacuum support for typical passenger car braking requirements, ensuring smooth pedal feel and responsive braking. The segment has been propelled by the demand for lightweight and compact braking solutions that are easy to integrate into various vehicle platforms.

Additionally, the widespread manufacturing and availability of single diaphragm units across OEMs and aftermarket channels have reinforced its market presence Growing adoption of passenger vehicles and the increasing focus on fuel efficiency and system reliability continue to drive the prominence of the single diaphragm product type.

The passenger cars vehicle type segment is anticipated to account for 61.5% of the Automotive Vacuum Brake Booster market revenue in 2025, making it the leading vehicle type segment. This growth is driven by the rising production and sales of passenger cars globally, coupled with heightened safety and performance expectations from consumers.

Vacuum brake boosters in passenger cars improve braking efficiency, provide consistent pedal feel, and contribute to overall driving comfort. The segment has benefited from regulatory mandates for enhanced braking systems in passenger vehicles, further increasing adoption.

Additionally, technological advancements in booster design, such as reduced weight and improved durability, have made these systems more attractive for modern passenger car platforms The segment’s expansion is also supported by increasing consumer awareness regarding vehicle safety features and the growing preference for vehicles equipped with advanced braking assistance technologies.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for global automotive vacuum brake booster industry. This analysis reveals vital shifts in business performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The table represents the expected CAGR for the global vacuum brake booster sector over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of 2025 to 2035, the business is predicted to surge at a CAGR of 6.6%, followed by a slightly higher growth rate of 7.8% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 6.6% (2025 to 2035) |

| H2 | 7.8% (2025 to 2035) |

| H1 | 6.9% (2025 to 2035) |

| H2 | 7.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.9% in the first half and remain relatively moderate at 7.9% in the second half. In the first half (H1) the sector witnessed an increase of 30 BPS while in the second half (H2), the industry showcased an increase of 10 BPS.

Adoption of Electric Vacuum Pumps is an Emerging Trend

An emerging trend in the automobile vacuum brake booster business is the increasing adoption of electric vacuum pumps, particularly in electric and hybrid vehicles. In 2025, electric vehicle sales reached around 358.2 million units, a 35% increase of 3.5 million units compared to 2025. Traditional vacuum sources, such as engine vacuum, can be insufficient or inconsistent in these vehicles, necessitating alternative solutions.

Expansion into Developing Economies to Create Opportunities

Emerging regions are experiencing rapid economic growth, urbanization, and infrastructure development, leading to increased automobile production and sales. As the automotive sector grows in these regions, there is a mounting demand for reliable and efficient braking systems to ensure vehicle safety and regulatory compliance.

By strategically establishing presence in emerging regions, manufacturers are set to capitalize on growing demand, offering expertise in brake booster technology to secure value share. Furthermore, growing into these regions allows manufacturers to diversify revenue streams, mitigate risks associated with business fluctuations, and tap into new growth opportunities in dynamic and evolving automotive ecosystems.

High Costs Associated with Advanced Brake Boosters

A substantial restraint inside the car vacuum brake booster industry is the excessive prices related to manufacturing of advanced brake booster structures. Integration of innovative technology, to decorate braking performance and meet stringent rules entails vast development costs, as well as investments in specialized manufacturing techniques. High price is set to limit the adoption of superior brake booster technologies among automobile manufacturers and customers, hindering growth and innovation.

The global vacuum brake booster industry recorded a CAGR of 5.5% during the historical period between 2020 and 2025. The growth of the sector was positive as it reached a value of USD 358.2 million in 2025 from USD 255 million in 2020.

Manufacturers focused on enhancing the efficiency, reliability, and response times of brake systems, including the development of electronic sensors and actuators during the historical period. Shift towards electric and hybrid vehicles has also impacted sales, as these vehicles require brake systems specifically designed for electric propulsion, such as regenerative braking.

The regulatory landscape has also shaped the dynamics, with stricter regulations imposed by governments in regions such as North America, Europe, and Asia-Pacific. This has driven automakers to invest in advanced brake booster technologies to comply with these standards and enhance vehicle safety.

Consumer demand for enhanced safety features has increased, leading to the integration of efficient brake systems, particularly in developed markets where the safety features of a vehicle play a key role in purchasing decisions. This trend has laid the base for future growth and innovation in brake booster technologies.

Global automotive vacuum brake booster sector is poised for continuous growth from 2025 to 2035, with factors such as automotive growth, technological advancements, regulatory mandates, and post-sales demand pushing sales. By 2035, the market is set to surge at a CAGR of 7.4%.

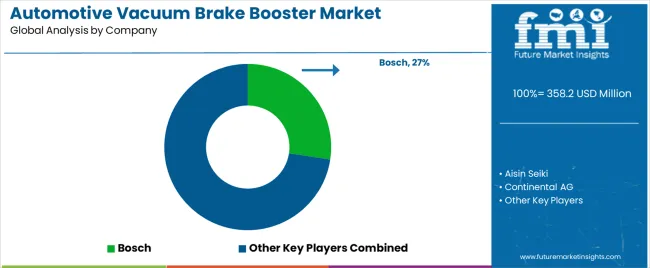

Tier 1 companies comprise industry leaders with a revenue of above USD 100 million capturing significant share of 45% to 50% in global sales. These companies are characterized by high production capacity and a wide product portfolio. Tier 1 companies are distinguished by extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

Tier 1 companies provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include Aisin Seiki, Bosch, Continental AG, HELLA, Delphi Technologies, Denso Corporation.

Tier 2 includes the majority of small-scale companies operating at the local presence and serving niche industries having revenue below USD 50 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 2 share segment.

Tier 2 companies are small-scale businesses and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized business, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the business analysis for the vacuum brake booster industry in different countries. Demand analysis on key countries in several regions of the globe, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa is provided.

The United States is anticipated to remain at the forefront in North America, with a value share of 78.4% through 2035. In South Asia, India is projected to witness a CAGR of 8.5% by 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 8.5% |

| Brazil | 8.2% |

| Spain | 7.9% |

| Kingdom of Saudi Arabia | 7.1% |

| South Korea | 6.5% |

| China | 6.1% |

India’s vacuum brake booster industry is poised to exhibit a CAGR of 8.5% between 2025 and 2035. This growth is attributed to the country’s burgeoning automotive sector, fueled by the aid of elements consisting of rising disposable earnings and urbanization.

India’s rising population and growing middle-class income contribute to the increasing possession of passenger and commercial vehicles, in addition to propelling the demand for brake boosters. With favorable dynamics and a conducive regulatory environment, India is poised to preserve its dominance in the South Asia Pacific, providing profitable possibilities for manufacturers and stakeholders in the automotive sector.

Brazil is anticipated to surge at a CAGR of 8.2% throughout the forecast period. Sturdy automotive manufacturing surroundings, coupled with its good-sized community of suppliers and distributors, position the country as a key manufacturer of vacuum brake boosters.

Several factors, along with monetary development, urbanization, and growing automobile possession throughout the vicinity underpin the country’s boom trajectory. Automotive manufacturers in Brazil are pressured to combine advanced braking technologies, consisting of vacuum brake boosters, into automobiles to cater to evolving client demand.

Spain possesses a strong automotive manufacturing sector. This manufacturing power enables the country to meet both domestic and international demand for vacuum brake boosters, contributing to growth.

Spain's commitment to technological innovation and research and development initiatives fosters the advancement of automotive technologies, including braking systems. As automotive manufacturers strive to enhance vehicle safety and performance, there is a growing demand for advanced braking solutions like vacuum brake boosters.

The section contains information about the leading segments in the industry. Based on the mechanism, the camshaft-driven segment is estimated to hold a 58.8% share in 2035. Furthermore, as per vehicle type, the passenger car segment is projected to account for 61.5% share in 2035.

| Segment | Camshaft-driven (Mechanism) |

|---|---|

| Value Share (2035) | 58.8% |

The camshaft-driven vacuum brake booster segment dominates in terms of revenue, accounting for around 58.8% of the share in 2035. Dominance in revenue share is owing to its superior performance and widespread adoption of camshaft-driven vacuum brake boosters in various automotive applications. This growth is attributed to several key factors that set camshaft-driven vacuum brake boosters apart from other types of brake boosters.

Camshaft-driven vacuum brake boosters are set to be a preferred choice for automotive manufacturers seeking dependable braking solutions. This mechanism provides consistent and reliable vacuum assistance, ensuring optimal braking performance under various driving conditions.

| Segment | Passenger Cars (Vehicle Type) |

|---|---|

| Value Share (2035) | 61.5% |

Passenger cars represent the leading segment of the automotive landscape, accounting for a substantial portion of vehicle sales globally. This sheer volume of passenger cars on the roads drives demand for vacuum brake boosters, which are integral components of the braking systems in these vehicles.

Passenger cars cater to a wide range of consumers across diverse demographics and preferences, including compact hatchbacks, sedans, SUVs, and luxury vehicles. Advancements in automotive technology, such as the adoption of electric and hybrid powertrains, autonomous driving features, and connected car systems, further underscore the importance of vacuum brake boosters in passenger cars. These technological innovations necessitate sophisticated braking solutions capable of delivering enhanced performance and efficiency, driving demand in the passenger cars segment.

Key companies in the automotive vacuum brake booster sector are investing in new technologies and forming partnerships. Leading manufacturers are also acquiring smaller companies to grow presence and further penetrate the vacuum brake booster industry across multiple regions.

Leading companies in the industry are focusing on introducing advanced products and enhancing offerings to meet the growing needs of end-user industries while maintaining competitiveness. Aisin Seiki, Bosch, Continental AG, HELLA, and Delphi Technologies are the leading automotive manufacturers functioning in the sector.

Key companies are focusing on maintaining product quality and innovation, diversifying manufacturing ranges, indulging in mergers and acquisitions, and adopting organic growth strategies to maintain a strong foothold in the global market. They are also emphasizing research and development to increase product offerings, which is set to help the market grow considerably.

Industry Updates

In terms of mechanism, the segment is divided into camshaft-driven, engine-driven, electric-driven.

As per product types, the sector is segregated into single diaphragm and tandem diaphragm.

In terms of vehicle types, the business is divided into passenger cars (compact cars, mid-sized cars, luxury and SUVs) and commercial vehicles (LCVs (light commercial vehicles) and HCVs (heavy commercial vehicles).

Based on sales channels, the business is classified into OEM and aftermarket.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa have been covered in the report.

The global automotive vacuum brake booster market is estimated to be valued at USD 358.2 million in 2025.

The market size for the automotive vacuum brake booster market is projected to reach USD 706.6 million by 2035.

The automotive vacuum brake booster market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in automotive vacuum brake booster market are camshaft-driven, engine-driven and electric-driven.

In terms of product type, single diaphragm segment to command 55.0% share in the automotive vacuum brake booster market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA