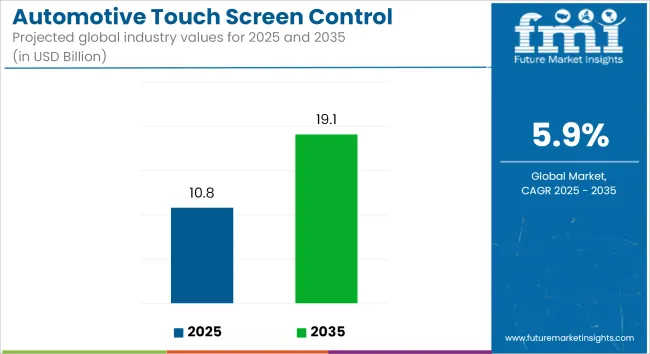

The global automotive touchscreen control system market is estimated at USD 10.8 billion in 2025 and is projected to increase to USD 19.1 billion by 2035, reflecting a CAGR of 5.9% throughout the period. Growth is being driven by integration of larger displays, enhanced human-machine interface functions, and safety-focused notification systems in vehicle cabins.

In October 2024, Infineon Technologies, in collaboration with MediaTek, presented a new PSoC™ 4 HVMS series designed to support touch-enabled HMI architectures in next-generation cockpits. The programmable devices were reported to manage capacitive and resistive input sources, supporting functional safety standards and zonal control system designs.

In February 2025, Microchip Technology introduced its ATMXT3072M1 and ATMXT2496M1 touchscreen controllers. These single-chip solutions were designed to support large, curved, and free-form automotive displays up to 20 in 16:9 format and 34 in 7:1 format.

The controllers were engineered with proprietary Smart Mutual touch sensing algorithms that improve touch signal-to-noise ratio by up to 15 dB-allowing reliable detection even in high-capacitive OLED and microLED screens. According to Microchip’s press release, the devices are compliant with ASIL-A/B and ISO 26262 safety standards and include Knob-on-Display™ and haptic feedback features to reduce driver distraction.

Implementation of large-format displays within vehicle dashboards has been driven by cost-sharing across instrument clusters and infotainment modules. Electric and hybrid vehicle manufacturers have been specifying windshield-spanning panels with integrated touch surfaces, requiring robust controller solutions to manage varying environmental noise and complex bezels.

Integration of physical haptic knobs has been positioned as a response to emerging 2026 Euro NCAP testing protocols, which are expected to require retained physical controls for critical functions. Touchscreen modules with Knob-on-Display designs have been highlighted as compliant alternatives to maintaining tactile interaction while preserving contemporary cabin layouts.

Aftermarket growth has been noted in truck and specialty vehicle segments, where flexible, retrofit-capable modules have been adopted to modernize older dashboard architectures. Single-chip capacitive touch controllers have been preferred for their simplified wiring, EM compatibility, and over-the-air firmware update support, which align with expanding connectivity ecosystems.

Revenue drivers in the segment include increasing cabin integration, cybersecurity requirements under ISO 21434, and manufacturing shifts toward zonal compute architectures. As display use continues to expand, controllers with multi-touch and gesture support are likely to be utilized in rear-seat entertainment modules and second-row interfaces, reinforcing the long-term outlook for market growth through 2035.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 10.8 billion |

| Market Value (2035F) | USD 19.1 billion |

| CAGR (2025 to 2035) | 5.9% |

The market is forecast to increase from USD 10,805.0 million in 2025 to USD 19,168.4 million in 2035, at a CAGR of 5.9% throughout the period. Driving growth are innovations like capacitive and haptic touch technologies, multi-modal human machine interface (HMI) integration, and voice-assisted control systems.

Moreover, automakers are utilizing AI-driven UI/UX designs and cloud-based connectivity platforms to cater to changing user expectations, particularly across premium, mid-range, and electric vehicle segments.

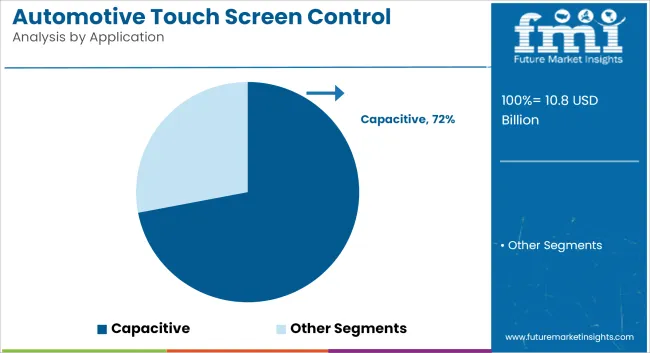

Capacitive touch screen systems are estimated to account for nearly 72% of the global automotive touch screen control system market share in 2025 and are projected to grow at a CAGR of 6.1% through 2035.

Their dominance is driven by enhanced touch sensitivity, multi-finger gesture support, and better display clarity compared to resistive counterparts. Automakers increasingly integrate capacitive systems into infotainment consoles, HVAC control panels, and digital instrument clusters, especially in mid- to high-end vehicles.

In 2025, manufacturers focus on producing laminated, anti-glare screens with haptic feedback and scratch resistance, enabling improved user interaction and safety compliance. The shift toward software-defined vehicle interiors and the need for smartphone-like UI/UX further support capacitive system penetration across global markets.

Touch screen systems sized between 9” to 15” are projected to account for approximately 64% of the market in 2025 and are expected to grow at a CAGR of 6.0% through 2035. This size range offers a balance between visibility, interface complexity, and dashboard integration.

In 2025, these screens are commonly deployed in center stack displays, combining infotainment, navigation, vehicle diagnostics, and camera feeds. OEMs standardize screen sizes in this range across sedans, SUVs, and electric vehicles to support scalable production and software compatibility.

Growth is also supported by consumer demand for larger, intuitive displays that provide seamless connectivity, while adhering to in-cabin ergonomics and safety norms. Suppliers continue to innovate with curved, bezel-less, and dual-display configurations within this screen segment.

Cost and Safety Concerns with Complex Interfaces

One of the biggest obstacles is weighing technological complexity against driver safety and cost efficiency. While very integrated touch systems are attractive they can be distracting when not designed ergonomically. That's an issue from a driver-attention and road-safety standpoint, especially if vital functions need more than one input, or deep menu navigation. The also adds cost to vehicle production, especially for high cost segments where income-per-human unit may be an issue, along with high res touch and multi touch capability.

Growing EV and Connected Car Ecosystem

The global trend toward electric and connected vehicles is creating massive business opportunities for touchscreen control systems. EVs, with their software-defined architecture, have far more design flexibility and require user-friendly UI interfaces that can display real-time battery statistics, range predictions and route optimization.

For automakers, competitive differentiation comes in the form of touchscreen systems integrated with an array of AI-driven personalization, over-the-air updates, and voice assistants. In addition, by utilizing tactile feedback, anti-glare coatings, and multi-display dash board’s technology, you will be able to reach the best user experience on the road and even you will have a kind of intuitive interaction with it in dynamic driving environment.

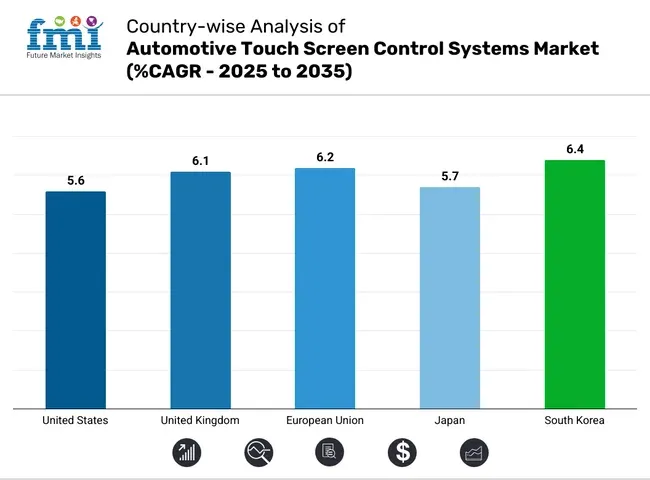

The United States automotive touch screen control systems market is expected to grow with 5.6% CAGR during the forecast period. This growth is driven by growing consumer appetite for connected vehicle experiences and a steady increase in the penetration of infotainment technology in new vehicle models.

Increasing prevalence of intuitive and easy to use interfaces, with bigger and more advanced touch screen displays is focused on by automakers, which has led to broader adoption spanning multiple vehicle segments including sedans, SUVs and light trucks. Finally, OEMs are being compelled to invest in greater control systems owing to regulatory favour in favour of in-vehicle safety & navigation functionality.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

From 2025 to 2035, the United Kingdom automotive touch screen control systems market is expected to expand at a CAGR of 6.1%. The demand for advanced dashboard systems is increasing with technical innovation in HMI (Human Machine Interface) solutions, and increasing preference for electric and hybrid vehicle.

Controls that use a touch screen have become ubiquitous in most premium and mid-tier car models, as consumer expectations around connectivity, voice-assisted functions and digital climate control are on the rise. Tech firms and automakers are working together on a range of innovative products that are also driving faster innovation and greater personalization in this space.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

The automotive touch screen control systems market in the European Union is expected to grow at a CAGR of 6.2% over the next decade. A well-established automotive manufacturing presence in the region, with strict emission and safety regulations, are driving smart cockpit technology development.

Germany, France, and Italy remain primary markets, where car manufacturers are embedding more advanced infotainment systems to satisfy demand for contemporary in-car experiences. In addition, the increasing demand for digitization of instrument clusters and gesture-based controls is opening up new streams of growth for touch screen control system manufacturers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

The automotive touch screen control systems market in Japan is projected to expand at a CAGR of 5.7% from 2023 to 2035. Demand is being driven by healthy domestic vehicle production, consumer tastes for the next level of technology features and the next generation of semi-autonomous driving.

Japanese manufacturers are adopting these large format touch screens with multi layered UI in luxury as well as economy segments of vehicles. Progress in haptic feedback and anti-glare coating technology are adding to the functionalization and durability of screens, including in high-temperature operating environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korea automotive touch screen control systems market is estimated to witness a CAGR of 6.4% during the period, 2025 to 2035. A tech-savvy consumer population and the presence of various global automotive OEMs and electronics manufacturers in the country are driving market growth.

It said Korean automakers have quickly embraced AI-based infotainment systems, and local technology companies can accelerate the development of next-generation display technologies that facilitate multi-use functionality and seamless connectivity with smartphones. Touch screen control systems are also finding expanded roles in vehicle design as the popularity of connected cars and EVs rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The Automotive Touch Screen Control Systems Market have been witnessing growth as consumers drive the need for seamless infotainment, intuitive control interfaces, and an enhanced user experience in modern vehicles. This ranges from capacitive touch technologies and haptic feedback integration to multi-modal control systems. More companies are also investing in AI-enhanced gesture recognition and broader compatibility with connected car platforms.

Other Key Players

These companies contribute through innovation in ICs, touch panels, and system integration, catering to both premium and mass-market automotive segments:

The overall market size for the Automotive Touch Screen Control Systems Market was USD 10.8 billion in 2025.

The Automotive Touch Screen Control Systems Market is expected to reach USD 19.1 billion in 2035.

The demand is driven by the increasing integration of advanced electronics in vehicles, rising consumer preference for enhanced in-car infotainment systems, and the growing adoption of electric and connected vehicles requiring sophisticated touch interfaces.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Passenger Cars segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA