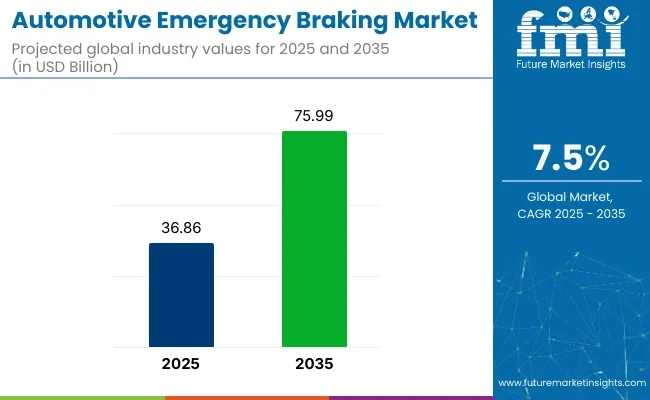

The global automotive emergency braking system market is projected to grow from USD 36.86 billion in 2025 to USD 75.99 billion by 2035, registering a CAGR of 7.5% during the forecast period. This growth is being driven by widespread deployment of advanced driver assistance systems (ADAS), rising regulatory mandates, and heightened public focus on vehicle safety.

In April 2024, the USA National Highway Traffic Safety Administration (NHTSA) finalized Federal Motor Vehicle Safety Standard No. 127, which mandates automatic emergency braking (AEB) systems on all new passenger vehicles and light trucks by 2029. These systems must be capable of stopping vehicles traveling at speeds up to 62 mph and must recognize pedestrians in both daytime and nighttime conditions. NHTSA confirmed that crash prevention is expected to be significantly enhanced through early intervention braking technologies.

Complementing the regulatory push, the USA Department of Transportation, in collaboration with MITRE’s PARTS initiative, released new data in early 2025 on AEB system effectiveness. The report concluded that AEB systems reduced rear-end collisions involving passenger vehicles by approximately 49%. These findings have reinforced global initiatives to adopt forward-collision warning and automatic braking systems across mid-segment models.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 36.86 Billion |

| Projected Market Size in 2035 | USD 75.99 Billion |

| CAGR (2025 to 2035) | 7.5% |

According to a 2024 report by Wired, recent advancements in radar and camera fusion have allowed emergency braking systems to function more reliably at highway speeds and in low-visibility environments. Multi-sensor integration and improved real-time data processing have made AEB more responsive, even in multi-vehicle traffic scenarios.

OEMs have accelerated the rollout of AEB systems as standard features. High-speed emergency braking is now being embedded into EV platforms and crossovers to comply with Euro NCAP and NHTSA ratings. According to Reuters, nearly all vehicles sold in the USA will require AEB by 2029 under the finalized rule, impacting both domestic and international automakers.

As ADAS adoption grows and sensor costs decline, AEB systems are expected to become ubiquitous across vehicle categories, playing a pivotal role in minimizing road accidents and achieving Vision Zero safety goals globally.

Fusion technology accounted for 36% of the global market share in 2025 and is projected to grow at a CAGR of 7.9% through 2035. The adoption of fusion systems was driven by the need to combine data from radar, cameras, and LiDAR to improve detection accuracy and decision-making in emergency braking scenarios.

In 2025, OEMs implemented fusion-based platforms in vehicles equipped with Level 2 and Level 2+ ADAS capabilities to enhance object recognition, eliminate blind zones, and reduce false positives. Fusion-enabled braking systems were prioritized in markets like Japan, Germany, and the USA, where active safety regulations were expanded.

Automakers partnered with Tier-1 suppliers to develop custom fusion algorithms capable of real-time data interpretation across multiple driving conditions. Fusion technology was also scaled to mid-range vehicles, aided by chipset cost optimization and increased processing power.

Forward emergency braking held 58% of the global application share in 2025 and is expected to grow at a CAGR of 7.6% through 2035. This application was integrated as a core ADAS feature across new vehicle models to comply with safety mandates and reduce frontal collision risks. In 2025, regulatory frameworks such as UNECE Regulation No. 152 in Europe and voluntary AEB adoption programs in the USA supported forward emergency braking implementation in both ICE and electric vehicles.

Sensor arrays-primarily radar and camera-based-were calibrated to detect vehicles, pedestrians, and cyclists in urban and highway scenarios. OEMs deployed forward emergency braking systems in compact cars, crossovers, and premium SUVs, making it one of the most widely adopted active safety functions. System refinements included dynamic braking pressure adjustment and adaptive responsiveness based on speed and obstacle proximity.

Challenges

High Implementation Costs and Technical Complexities

High technological costs of advanced sensor technologies are limiting the growth of the AEBS market, which includes radar, LiDAR, and camera-based systems. This cost limitation restricts the penetration of AEBS into affordable and entry-level cars. Moreover, the integration of AEBS into existing vehicle architectures creates technical challenges, as it necessitates the upgrading of vehicle control systems and sensor networks by automakers.

In addition, false braking activates a safety condition by environmental and road conditions and sensor calibration issues that leads to consumer hesitancy. The need for accurate threat detection and to avoid unnecessary braking continues to be a key challenge for AEBS manufacturers.

Opportunities

Regulatory Push and Increasing Adoption in Commercial Vehicles

However, the implementation of AEBS is being driven by government mandates and safety regulations, especially in North America and Europe. The National Highway Traffic Safety Administration (NHTSA) and European Commission are implementing stricter safety regulations, making it mandatory for new vehicles to have automatic braking systems.

Further, the growing penetration of AEBS in commercial fleets and heavy-duty trucks is also expected to create high growth opportunity. Rising adoption of AEBS by logistics and transport firms to mitigate the risk of accidents and meet safety regulations is contributing to market growth.

The automotive emergency braking system market will be cross-functional in nature, covering varied industrial needs related to electric and autonomous; the demand for electric and autonomous vehicles is on the rise, owing to the continuous efforts of governments across the globe to put regulations in place for safer driving.

The vast adoption of automatic emergency braking (AEB) is ramping up, thanks to new mandates from the National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS) requiring the technology in every new vehicle by 2029 - and speeding the expansion to passenger cars, SUVs and commercial fleets.

As automotive manufacturers like Tesla, General Motors, and Ford push radar- and camera-supported AEB systems into their latest vehicles, lead demand for such advanced sensor, LiDAR, and AI-enhanced braking will grow. Smart city growth, 5G connectivity, and vehicle-to-everything (V2X) communication are also improving the capabilities of emergency braking systems through real-time data sharing about on-road vehicles, obstacles, and traffic compatibility.

Increasing concerns about pedestrian and cyclist safety in urban settings also are helping spur adoption of upgraded automatic braking technologies. The aftermarket sector is booming in the USA, too, as more consumers are retrofitting collision avoidance systems on older cars to improve safety.

| Country | CAGR (2025 to 2035) |

|---|---|

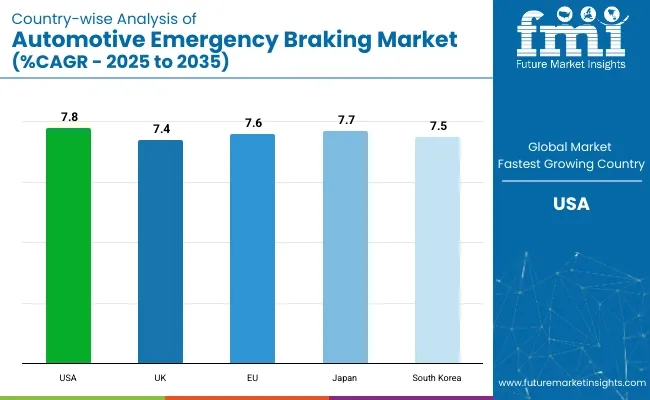

| USA | 7.8% |

The UK automotive emergency braking system market is growing rapidly, propelled by government safety initiatives, increasing uptake of electric and connected vehicles, and the rising awareness of accident prevention technologies among consumers.

The UK Department for Transport (DfT) will implement its own version of the EU General Safety Regulations (GSR), which calls for new cars to come with advanced emergency braking (AEB) and lane-keeping assist systems by 2026.

Jaguar Land Rover, for example, is benefiting from the rapid electrification of the UK’s automotive sector, as are Aston Martin and Nissan’s EV production plants, while next-gen emergency braking solutions integrate with AI-powered sensor fusion, LiDAR and predictive analytics.

The increasing adoption of autonomous vehicles, aligned with the UK government's self-driving plan for 2025, is driving the need for such machine-learning based braking systems which can predict potential dangers in real-time.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

The European Union (EU) automotive emergency braking system market is expected to grow at a steady pace during the forecast period, with the increasing adoption of electric vehicles (EVs) and stringent vehicle safety regulations driving demand for automatic emergency braking systems across the region.

Volkswagen, BMW and Stellantis are among major automakers that have committed significant resources toward radar, LiDAR and artificial intelligence big braking solutions to fulfill these mandates. Moreover, the growing adoption of urban mobility solutions, such as e-scooters and shared vehicles, is driving the demand for pedestrian detection and rear-end collision prevention systems.

If the EU continues to push smart city initiatives and the evolution of V2X communication networks, it could lead to a future where emergency braking systems are able to use real-time traffic warnings and will be able to brake for you automatically.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.6% |

Japan automotive emergency braking system market witnessed a significant growth during the past few years with rise in demand for advanced vehicle safety, strict government regulations and expansion in autonomous vehicle technologies.

Japan's New Car Assessment Program (JNCAP) has added automatic emergency braking to its list of mandatory requirements for all new vehicle models by 2025, and automakers are looking to tackle this with high-precision radar, LiDAR, and AI-related braking assistance systems.

OEMs like Toyota, Honda, and Nissan are heavily invested in next-gen brakes that feature predictive analytics, driver behaviormonitoring, and multi-camera setups. Moreover, Japan’s advanced 5G ecosystem is facilitating real-time V2X braking communication, which enhances vehicle safety in high-density urban areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

Rapid Growth of South Korea's Automotive Emergency Braking System Market Fueled by Government Safety Mandates, Rising EV Adoption, and Innovations in AI-Driven Braking Solutions In South Korea, the Ministry of Land, Infrastructure and Transport (MOLIT) requires all new vehicles to be AEB equipped by 2025 and has also driven automakers such as Hyundai and Kia to implement next-generation ADAS braking technologies.

South Korea has a strong presence in AI and semiconductor industries, allowing the braking systems to evolve through AI-based predictive analytics, smart sensors, and machine learning algorithms. This drive towards autonomous driving in the country is also giving rise to developments in the way V2X communication happens, with real-time hazard recognition and automated braking solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

The Automotive Emergency Braking System (AEBS) Market is at a very high pace owing to multiple factors, such as stringent vehicle safety regulations, increasing consumer awareness regarding safety, and technological advancements in AI-integrated braking systems. Automakers and Tier 1 suppliers are adopting radar-based, LiDAR-assisted, and camera-enabled automatic braking systems to avoid collisions and keep passengers safe.

Moreover, with the growth of Advanced Driver Assistance Systems (ADAS) and the market's initiative for fully autonomous vehicles, the adoption of AEBS is on the rise through passenger cars, commercial vehicles, and electric vehicles (EVs).

The overall market size for automotive emergency braking system market was USD 36.86 billion in 2025.

The automotive emergency braking system market is expected to reach USD 75.99 billion in 2035.

The growth of the automotive emergency braking system market will be driven by the increasing emphasis on vehicle safety and accident prevention, supported by rising regulatory mandates for advanced driver-assistance systems (ADAS).

The top 5 countries which drives the development of automotive emergency braking system market are USA, European Union, Japan, South Korea and UK

Camera and LiDAR Technologies to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA