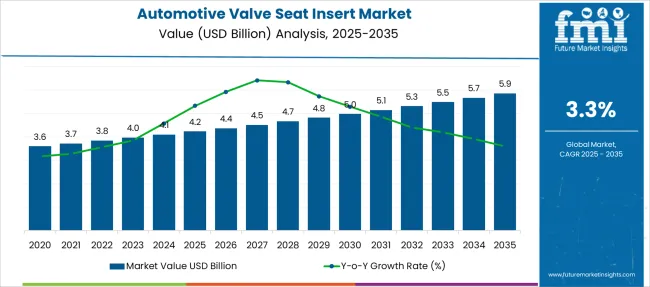

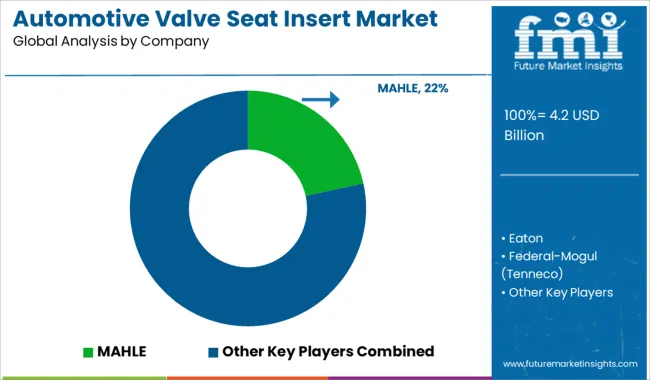

The Automotive Valve Seat Insert Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Valve Seat Insert Market Estimated Value in (2025 E) | USD 4.2 billion |

| Automotive Valve Seat Insert Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The automotive valve seat insert market is advancing steadily, propelled by rising vehicle production and the need for enhanced engine performance and durability. Increasing focus on reducing emissions and improving fuel efficiency has driven demand for high-quality valve seat inserts that can withstand high temperatures and pressures.

Growth in passenger vehicle production, particularly in emerging markets, has contributed to the expansion of this market. Advances in material science have led to better wear resistance and longer service life of valve seat inserts, aligning with industry trends toward more reliable and efficient engines.

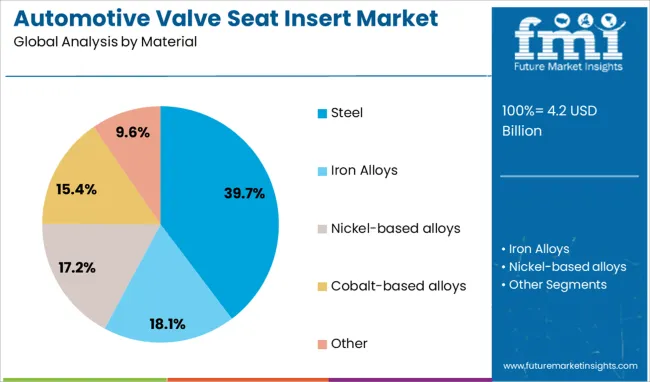

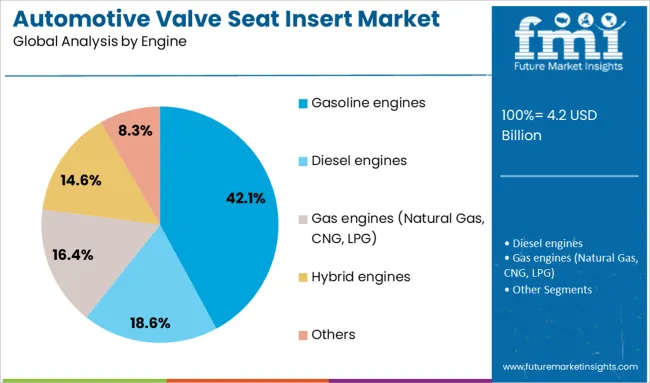

The shift toward gasoline engines continues to dominate due to their widespread use in passenger cars and light vehicles. Regulatory pressures and consumer demand for cleaner engines are encouraging innovations in valve seat insert materials and designs. The market outlook remains positive, supported by growing vehicle sales and continuous engine technology upgrades. Segment growth is expected to be led by steel as the preferred material, passenger vehicles as the dominant vehicle type, and gasoline engines as the leading engine segment.

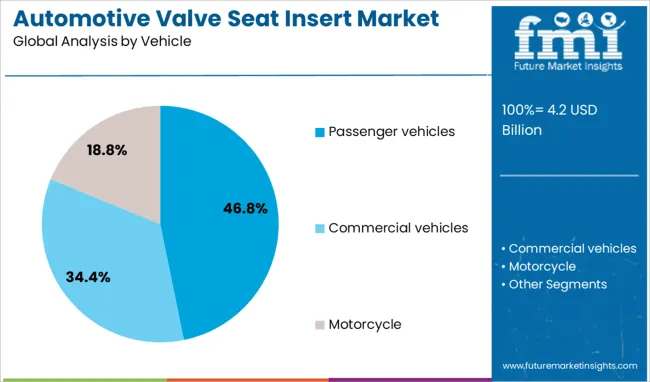

The automotive valve seat insert market is segmented by material, vehicle, engine, and sales channel and geographic regions. The automotive valve seat insert market is divided by material into Steel, Iron Alloys, Nickel-based alloys, Cobalt-based alloys, and Other. In terms of vehicles, the automotive valve seat insert market is classified into Passenger vehicles, Commercial vehicles, and motorcycles. Based on the engine, the automotive valve seat insert market is segmented into Gasoline engines, Diesel engines, Gas engines (Natural Gas, CNG, LPG), Hybrid engines, and Others. The automotive valve seat insert market is segmented by sales channel into OEM and Aftermarket. Regionally, the automotive valve seat insert industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel is expected to account for 39.7% of the automotive valve seat insert market revenue in 2025, establishing its position as the leading material. Steel’s popularity is attributed to its excellent mechanical strength, thermal stability, and wear resistance, which are critical for valve seat performance under harsh engine conditions.

Its ability to endure high combustion temperatures and resist deformation has made steel the material of choice for many engine manufacturers. Advances in alloying techniques and heat treatment processes have further enhanced steel valve seat inserts’ durability and reliability.

These attributes reduce maintenance requirements and extend engine life. Additionally, steel’s compatibility with various engine designs supports its wide adoption. Given its balance of cost and performance, the steel segment is expected to maintain its dominant market share.

The passenger vehicle segment is projected to hold 46.8% of the automotive valve seat insert market revenue in 2025, continuing its leadership among vehicle types. This growth is supported by the high volume of passenger vehicle production worldwide, driven by increasing disposable incomes and urbanization.

The segment’s demand is fueled by the need for durable engine components that support better fuel efficiency and lower emissions. Passenger vehicles often utilize gasoline engines, which require reliable valve seat inserts to maintain engine integrity and performance.

Manufacturers are increasingly focusing on lightweight materials and efficient designs to meet regulatory standards while ensuring durability. As consumer demand for high-performance vehicles grows, the passenger vehicle segment is expected to sustain its leading position in the valve seat insert market.

The gasoline engine segment is expected to contribute 42.1% of the market revenue in 2025, solidifying its role as the dominant engine type for valve seat inserts. The extensive use of gasoline engines in passenger cars and light commercial vehicles underpins this segment’s growth.

Gasoline engines require valve seat inserts that can withstand high thermal and mechanical stresses while ensuring precise sealing and combustion efficiency. Advances in material engineering have led to valve seat inserts that optimize fuel combustion and reduce emissions, aligning with evolving environmental regulations.

Furthermore, ongoing improvements in gasoline engine designs, including turbocharging and direct injection technologies, have increased the demand for high-performance valve seat inserts. As gasoline engines remain prevalent globally, this segment is expected to continue driving the automotive valve seat insert market growth.

The global automotive valve seat insert market is witnessing stable growth due to rising production of passenger vehicles, commercial trucks, and alternative fuel engines. Iron-based inserts continue to dominate owing to their durability, heat resistance, and cost-efficiency. However, demand for high-performance materials such as nickel alloys, cobalt alloys, and ceramic composites is expanding. Precision manufacturing and tighter tolerances are also gaining importance. Both OEM supply and growing aftermarket replacement needs contribute to the market’s long-term expansion globally.

Designing valve seat inserts suitable for gasoline, diesel, CNG, LPG, and hybrid engines requires balancing thermal resistance, wear tolerance, and sealing accuracy. Frequent valve action in small turbocharged gasoline engines and high combustion pressure in gas-fueled applications increase stress on the insert. Suppliers must ensure materials can endure high temperature cycles and corrosive combustion byproducts. Validating performance across engine types and fuels can be lengthy and costly. Add to that, certification processes for each OEM and powertrain combination add time and complexity. Fitting requirements differ by cylinder head material and engine geometry. All of this means longer development cycles, higher engineering costs, and delays in market entry for suppliers especially smaller firms.

Opportunities are expanding as engine platforms diversify into heavy-duty, off‑highway, and hybrid powertrains. Commercial vehicle sectors such as trucks, buses, and agricultural machinery demand durable inserts that perform under high load and long operating hours. At the same time, hybrid passenger and commercial vehicles use downsized engines running hotter, raising the need for heat‑resistant inserts. Regions like Asia-Pacific, driven by India and China automotive production, show strong demand momentum. Aftermarket demand is also growing, as vehicle lifecycles extend and maintenance needs rise. Suppliers that can offer inserts tailored for hybrid engines, dual‑fuel vehicles, or high-mileage commercial fleets can capture new segments and expand their footprint.

A key trend is the adoption of higher-grade materials and precision production methods. Many manufacturers are using nickel-based or cobalt-alloy inserts, ceramic-reinforced composites, and multi-layer coatings to extend lifespan and thermal stability. Powder metallurgy and sintering enable tighter tolerances and improved microstructure control. Machining methods such as laser welding, additive techniques, and digital simulations support more accurate geometry and reduced defects. These upgrades extend service intervals, lower maintenance, and meet more challenging emission and fuel-efficiency requirements. As OEMs demand longer-lasting components and higher quality standards, suppliers with stronger material engineering and advanced manufacturing capabilities gain an edge in winning contracts.

Material markets for iron, nickel, cobalt, and ceramic powders introduce volatility into manufacturing costs. Premium-grade alloys and composites carry significantly higher raw material prices and may face supply bottlenecks. Sudden price increases affect supplier margins and introduce uncertainty into long-term cost forecasts. Smaller producers without long-term contracts or diversified sourcing options are most vulnerable. Elevated costs often shift to OEMs or aftermarket partners, but if end users cannot justify the premium through longer service life or reduced downtime, adoption slows. This constraint pressures pricing and restricts adoption of higher-end materials in mid-tier or value segments.

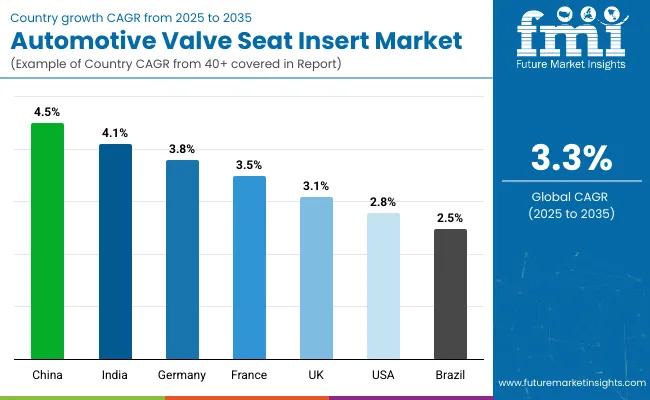

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The global automotive valve seat insert market is projected to grow at a CAGR of 3.3% through 2035, supported by consistent demand in internal combustion engine production and engine part replacements. Among BRICS nations, China leads with 4.5% growth, driven by large-scale engine manufacturing and domestic vehicle output. India follows at 4.1%, where production has been maintained through supply to compact car and two-wheeler segments. In the OECD region, Germany reports 3.8% growth, supported by precision component manufacturing and regulatory adherence in engine assemblies. The United Kingdom, at 3.1%, has retained demand through aftermarket services and legacy engine support. The United States, at 2.8%, remains a mature market with demand led by commercial vehicles and remanufactured engines. Market activity has been shaped by emissions compliance, material hardness standards, and supplier qualification processes. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Expansion in the automotive valve seat insert market across China has been observed at a 4.5% CAGR, driven by consistent growth in internal combustion engine production for both passenger and light commercial vehicles. Manufacturing units have increased their intake of powdered metal inserts designed for high wear resistance and temperature stability. Demand has been reported from both engine rebuilders and OEMs operating in vehicle hubs such as Shanghai, Changchun, and Guangzhou. Technical preferences have shifted toward alloy-based valve seat inserts optimized for higher compression ratios. Machine shops and engine component suppliers have adopted sintered and forged types depending on model specifications. Continuous production of dual-fuel and diesel vehicles has sustained requirements across rural and export-focused vehicle platforms. Integration into cylinder heads with cast iron and aluminum blocks has remained standard in large-volume models.

In India, the automotive valve seat insert market has progressed at a 4.1% CAGR, with requirements being supported by robust engine manufacturing across utility, hatchback, and two-wheeler segments. The inserts have been incorporated into cylinder heads to maintain sealing integrity and reduce valve face erosion, particularly in small-displacement engines. Machining centers across Tamil Nadu and Maharashtra have maintained bulk sourcing of hardened and sintered steel inserts aligned with domestic engine specs. Local automotive suppliers have procured inserts in standard dimensions, with adjustments made for material density and grain structure to withstand fuel variations. Preference has been recorded for insert types compatible with LPG and CNG conversions, which are prevalent in regional fleets. Vendors have responded by streamlining sizing tolerances and enhancing surface hardness to improve seat longevity under mixed combustion cycles.

Germany has registered a 3.8% CAGR in the automotive valve seat insert market, reflecting steady demand from premium automotive brands and performance engine builders. Inserts have been selected based on metallurgical precision, heat cycling endurance, and compatibility with high-output engine configurations. Specialty automotive foundries located in Bavaria and Baden-Württemberg have sourced powder-forged variants known for dimensional accuracy. Demand has remained consistent in both original engine platforms and precision rebuild operations for export models. Insert geometry has been refined to accommodate multi-valve combustion chambers and tight valve lash specifications. Suppliers have emphasized low-porosity materials and narrow tolerances to meet German auto engineering standards. Advanced coating processes such as nitriding and chrome plating have been applied to extend insert lifespan under high-rpm usage.

The automotive valve seat insert market in the United Kingdom has grown at a 3.1% CAGR, with adoption supported by both niche engine manufacturing and aftermarket cylinder head refurbishment. Insert types used have included heat-treated and sintered steel variants, primarily designed for inline four-cylinder and small-displacement engines. Technical workshops have favored British-standard inserts due to their compatibility with legacy engine types still prevalent in commercial vans and agricultural vehicles. Manufacturing facilities across the Midlands and North East have placed repeat orders for insert lots that meet localized machining and thermal tolerance criteria. Utilization has also extended into motorsport engine builds, where longevity under extreme thermal stress is essential. Inventory management by engine reconditioners has focused on pre-sized, grind-ready inserts that minimize machining steps during head assembly.

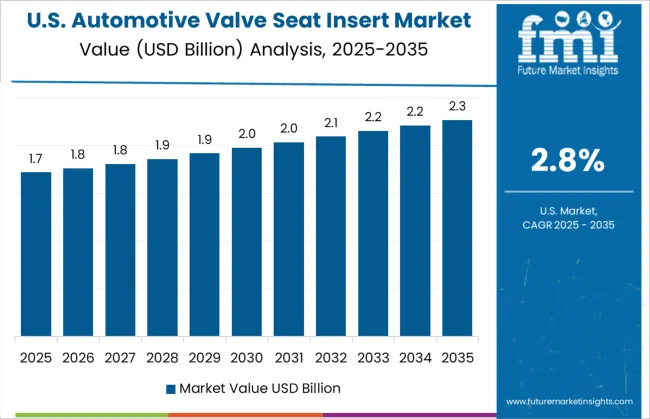

A 2.8% CAGR has been observed in the automotive valve seat insert market within the United States, sustained by long-running demand in heavy-duty, off-road, and performance vehicle categories. Inserts have been utilized in V6, V8, and straight-six engines across pickup trucks, sedans, and SUV lines. Foundries and component rebuilders have relied on induction-hardened and sintered metal variants capable of handling ethanol-blended fuels and extended service intervals. Midwestern states have led in bulk procurement by automotive parts warehouses serving local rebuilders. Insert designs with beveled seating angles and heat sink properties have been favored for high-torque engines. Aftermarket volume has been supported by the prevalence of classic car restorations and crate engine assemblies, which continue to require robust valve seating materials.

The automotive valve seat insert market is supported by a combination of global manufacturing giants and niche precision component producers, each offering unique capabilities tailored to evolving engine technologies. MAHLE stands as a core supplier, renowned for its metallurgy expertise and heat-resistant inserts used extensively in high-performance combustion engines, including turbocharged and downsized powertrains.

Eaton, with its strong OEM ties, provides inserts that not only endure high thermal loads but also adapt to emerging valve train designs in hybrid power units. Federal-Mogul, operating under Tenneco, delivers value through decades of engineering excellence, offering inserts that optimize sealing, resist micro-welding, and extend cylinder head life.

GKN Automotive leverages its experience in precision forging and powder metallurgy to manufacture custom valve seat profiles for modern fuel-efficient engines. Meanwhile, Mitsubishi Materials supplies high-purity alloy inserts widely used in Asian automotive platforms, with a focus on weight reduction and fuel compatibility.

Nippon Piston Ring and TPR contribute through integrated piston-valve systems that ensure thermal expansion compatibility and minimal valve bounce, particularly in high-rev engines. Hutchinson supports limited-volume and specialty applications, while Goodson Tools & Supplies serves engine rebuilders with ready-to-fit aftermarket solutions.

Kavya International, though emerging, has carved a niche in cost-sensitive markets, offering durable inserts customized to specific engine geometries. As emission norms tighten and engine loads increase, the market’s competitive edge increasingly rests on metallurgical innovation, dimensional accuracy, and life-cycle performance under harsh combustion conditions.

MAHLE focuses on advanced alloy development (e.g., cobalt-based inserts) for high-performance, emission-compliant engines and expands regional manufacturing in Asia and Europe to support OEMs. Federal-Mogul invests in powder metallurgy for durability and introduces thermal interface coatings to enhance heat dissipation in turbocharged and downsized engines.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Material | Steel, Iron Alloys, Nickel-based alloys, Cobalt-based alloys, and Other |

| Vehicle | Passenger vehicles, Commercial vehicles, and Motorcycle |

| Engine | Gasoline engines, Diesel engines, Gas engines (Natural Gas, CNG, LPG), Hybrid engines, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MAHLE, Eaton, Federal-Mogul (Tenneco), GKN Automotive, Goodson Tools & Supplies, Hutchinson, Kavya International, Mitsubishi Materials, Nippon Piston Ring, and TPR |

| Additional Attributes | Dollar sales by valve seat insert type span iron alloy, steel, nickel- and cobalt-based variants, for use in passenger and commercial vehicles, and motorcycles across North America, Europe, and Asia-Pacific. Driven by engine durability needs and emissions rules, growth is supported by alloy innovation, additive manufacturing, and rising hybrid and aftermarket demand. |

The global automotive valve seat insert market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the automotive valve seat insert market is projected to reach USD 5.9 billion by 2035.

The automotive valve seat insert market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in automotive valve seat insert market are steel, iron alloys, nickel-based alloys, cobalt-based alloys and other.

In terms of vehicle, passenger vehicles segment to command 46.8% share in the automotive valve seat insert market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA