The automotive interior market is evolving rapidly, influenced by advancements in vehicle design, material innovation, and consumer demand for enhanced comfort and aesthetics. Increasing focus on in-cabin experience, ergonomic layouts, and infotainment integration has transformed interiors into key differentiating factors in vehicle purchasing decisions.

The market benefits from the growing use of lightweight materials, sustainable composites, and modular assemblies that optimize both performance and luxury. Electrification and autonomous driving trends are reshaping interior architecture, emphasizing flexibility and digital integration.

The current landscape is characterized by rising investment in smart cabin technologies, including gesture control systems, ambient lighting, and air purification modules. With global vehicle production recovering and consumer expectations advancing, the automotive interior market is positioned for steady long-term growth.

| Metric | Value |

|---|---|

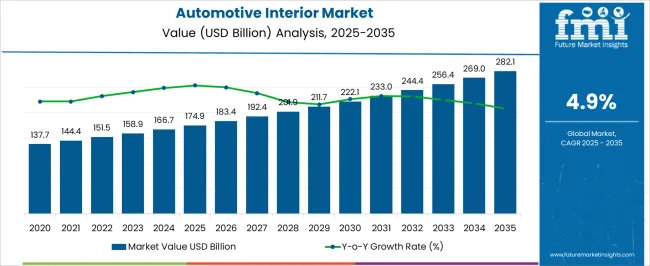

| Automotive Interior Market Estimated Value in (2025 E) | USD 174.9 billion |

| Automotive Interior Market Forecast Value in (2035 F) | USD 282.1 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The market is segmented by Component and Vehicle Type and region. By Component, the market is divided into Cockpit Module, Flooring, Door Panel, Automotive Seat, Interior Lighting, and Other. In terms of Vehicle Type, the market is classified into Passenger Car and Commercial Vehicle. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cockpit module segment holds approximately 29.4% share in the component category, underscoring its significance in modern vehicle architecture. This segment’s dominance is supported by the increasing integration of digital interfaces, display clusters, and centralized control systems.

Automakers are investing in modular cockpit solutions to streamline manufacturing and enhance cabin connectivity. Lightweight materials and ergonomic layouts have improved safety and user convenience, further driving demand.

The segment’s growth is reinforced by the shift toward electric vehicles, where interior space optimization and infotainment enhancements are key design priorities. With continued innovation in human-machine interaction and digital cockpit platforms, the cockpit module segment is expected to maintain its strong position globally.

The passenger car segment leads the vehicle type category, representing approximately 53.6% share of the automotive interior market. High production volumes and consistent consumer demand for comfort, luxury, and advanced infotainment systems have reinforced this dominance.

Passenger cars increasingly feature premium materials, smart surfaces, and customizable ambient lighting to enhance the driving experience. The segment benefits from rising disposable incomes, particularly in emerging markets, driving demand for mid-range and luxury models.

Continuous innovation in seat design, acoustic insulation, and interior ergonomics has further strengthened its position. With the ongoing transition toward electric and connected vehicles, the passenger car segment is expected to remain the key contributor to automotive interior market growth.

From 2020 to 2025, the automotive interior market experienced a CAGR of 6.6% in market value. Rising demand for advanced infotainment systems, touchscreens, voice recognition, augmented reality displays, and connectivity options. The trend towards electric and autonomous vehicles is also driving the need for innovative automotive interior technologies.

Manufacturers are constantly exploring new materials for interiors to improve durability, reduce weight, and enhance aesthetics. This includes advancements in materials such as leather alternatives, sustainable materials, and smart fabrics.

Consumers increasingly demand personalized and customizable interiors. This has led to manufacturers offering a range of interior customization options, allowing buyers to choose from different materials, colors, and design elements.

Changing consumer preferences and lifestyle trends also impact the automotive interior market. For example, the increasing demand for SUVs and crossovers has influenced the design of interiors to provide a more spacious and versatile environment. Projections indicate that the global automotive interior market is expected to experience a CAGR of 4.9% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 6.6% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.9% |

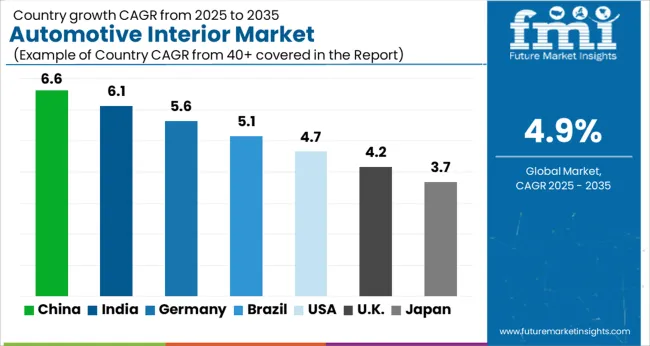

The following table shows the top five countries by revenue, led by Japan and South Korea. In South Korea, a robust focus on technological advancements is evident, with market growth driven by advanced infotainment systems, connectivity features, and intelligent interiors.

In Japan, the incorporation of cutting-edge technology, such as advanced infotainment systems and safety features, is a key driver propelling growth in the automotive interior market.

The automotive interior market in the United States is expected to grow with a CAGR of 5.3% from 2025 to 2035. Consumers in the country often place a high value on comfort, convenience, and the latest technology when it comes to vehicle interiors. Features such as advanced infotainment systems, connectivity options, and premium materials are in demand in the United States.

The demand for luxury and premium vehicles with high-quality interiors has been strong in the United States market. Consumers in this segment often seek sophisticated designs, premium materials, and advanced features.

Advancements in material science, including the use of lightweight materials, durable fabrics, and eco-friendly options, contribute to the growth of the automotive interior market.

The automotive interior market in the United Kingdom is expected to grow with a CAGR of 6.0% from 2025 to 2035. The demand for luxury vehicles with premium interiors is notable in the United Kingdom. Consumers seeking upscale and sophisticated driving experiences contribute to the demand for high-end automotive interiors.

The increasing awareness of environmental issues in the United Kingdom has led to a growing demand for eco-friendly and sustainable interior designs. Automakers incorporating environmentally conscious materials and manufacturing processes may find favor among consumers.

The market in China is expected to expand with a 5.7% CAGR through 2035. China holds a prominent position in the global automotive industry, both as a major manufacturer and consumer. The nation commands a significant share of the worldwide market, driven by the expansion of its middle class and its increasing demand for automobiles featuring opulent and aesthetically pleasing interiors.

This growing desire for luxurious and visually appealing automotive interiors serves as a key catalyst propelling the overall market growth in China. Consumers often seek premium materials, advanced technologies, and sophisticated designs.

The demand for vehicles with cutting-edge infotainment systems, connectivity features, and driver-assistance technologies is on the rise, influencing the design of automotive interiors.

Government support for electric vehicles (EVs) and new energy vehicles (NEVs) has led to the growth of this market segment. The unique interior features of EVs, such as spacious cabins due to the absence of a traditional engine, contribute to market demand.

The automotive interior market in Japan is anticipated to develop with a 6.6% CAGR from 2025 to 2035. Japan is known for its technological innovation, and this is reflected in the automotive sector. Advanced technology integration, including infotainment systems and safety features, influences the demand for automotive interiors.

Compact cars are popular in Japan due to urbanization and limited parking space. Efficient use of interior space and features that cater to urban mobility needs are crucial in the design of interiors.

The Japanese automotive market is experiencing a surge in the demand for personalized vehicle interiors, propelling market growth. This trend is driven by a growing consumer preference for customized features, reflecting a desire for unique and tailored driving experiences.

The adoption of lightweight materials for automotive interiors is gaining momentum, particularly in response to heightened interest in fuel efficiency. This shift is evident in the increasing sales of lightweight vehicles, aligning with both manufacturers and consumers aiming to maximize fuel efficiency and environmental sustainability.

The automotive interior market in South Korea is expected to grow with a CAGR of 7.0% from 2025 to 2035. South Korean consumers often prioritize modern and technologically advanced interiors. Features such as advanced infotainment systems, connectivity options, and high-quality materials are likely to be in demand.

South Korea is known for its technological innovation, and this is reflected in the automotive sector. The demand for cutting-edge technology, including smart connectivity and safety features, influences interior design.

South Korean consumers may place a strong emphasis on safety features within vehicles. Interior designs that prioritize occupant safety, including airbags and advanced driver assistance systems (ADAS), align with consumer expectations.

The below section shows the leading segment. The cockpit module segment is anticipated to register a CAGR of 4.7% from 2025 to 2035. Based on application, the passenger car segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 4.5% from 2025 to 2035.

| Category | CAGR |

|---|---|

| Cockpit Module | 4.7% |

| Passenger car | 4.5% |

Based on vehicle type, the passenger car segment is anticipated to thrive at a CAGR of 4.5% from 2025 to 2035. Passenger car buyers place a high emphasis on the overall driving experience and comfort. A well-designed and comfortable interior contributes significantly to the satisfaction of the occupants during their journeys.

Passengers in personal vehicles often expect the integration of advanced technologies for entertainment, navigation, connectivity, and safety. Features like touchscreen infotainment systems, voice recognition, and advanced driver assistance systems (ADAS) contribute to the appeal of the interior.

Based on components, the cockpit module segment is anticipated to thrive at a CAGR of 4.7% from 2025 to 2035. Many essential safety features, such as airbags, collision warning systems, lane departure warning, and adaptive cruise control, are integrated into the cockpit module. This prioritization of safety features contributes to the demand for automotive interiors.

The demand for seamless connectivity and intuitive user interfaces has driven the need for well-designed cockpit modules. Integration with smartphones, voice recognition, and easy-to-use controls contribute to the appeal of the interior.

Automakers use cockpit design as a way to differentiate their brands and models. A unique and well-designed cockpit can become a signature element, helping a brand stand out in a competitive market.

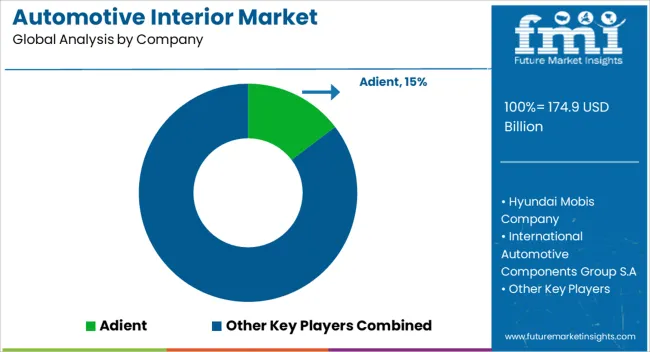

Key players in the automotive interior market are actively engaging in research and development initiatives to deliver advanced, premium, and comfortable interior systems. Many of these leading companies are forming strategic collaborations with local partners in developing countries, aiming to expand their distribution networks.

The industry is witnessing a notable trend towards increased emphasis on product differentiation, and the expansion of regional players is anticipated to pose a significant challenge for global market leaders in the foreseeable future.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 166.7 billion |

| Projected Market Valuation in 2035 | USD 270 billion |

| Value-based CAGR 2025 to 2035 | 4.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Component, Vehicle Type, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Hyundai Mobis Company; International Automotive Components Group S.A; Adient;Lear Corporation; Grupo Antolin; Visteon Corporation; Faurecia S.A; Calsonic Kansei Corporation; Robert Bosch; Yanfeng Automotive Interiors |

The global automotive interior market is estimated to be valued at USD 174.9 billion in 2025.

The market size for the automotive interior market is projected to reach USD 282.1 billion by 2035.

The automotive interior market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive interior market are cockpit module, flooring, door panel, automotive seat, interior lighting and other.

In terms of vehicle type, passenger car segment to command 53.6% share in the automotive interior market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Leather Market Analysis Size Share and Forecast Outlook 2025 to 2035

Automotive Interior Trim Parts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Automotive Plastic Interior Trims Market Growth - Trends & Forecast 2025 to 2035

Automotive Soft Trim Interior Materials Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Demand for Automotive Interior Leather in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA