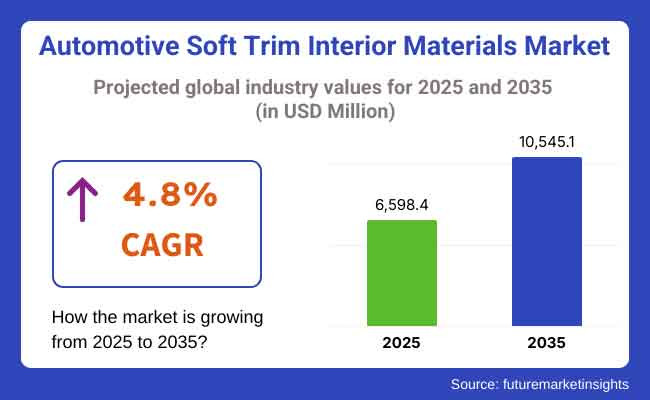

The Automotive Soft Trim Interior Materials Market is poised for steady growth over the forecast period, driven by increasing consumer demand for enhanced vehicle aesthetics, comfort, and sustainability. The market is expected to grow from USD 6,598.4 million in 2025 to USD 10,545.1 million by 2035, registering a CAGR of 4.8%. Factors such as advancements in material technology, stringent regulations for eco-friendly interiors, and the rise of electric vehicles (EVs) are contributing to this expansion.

The automotive sector is in a period of change, where automotive companies are innovating on the design of automotive interiors, the use of weight-saving materials, and eco-friendly sustainable technologies in order to increase vehicle cabin comfort and energy efficiency.

High-performance soft trim materials with outstanding durability, noise absorption, and luxurious touch have found their way in electric and self-driving vehicles, and they are the main reason for the increase in the demand for those materials. On the wave of booming urban population and rising income growth, the trend for luxury and personalized interior design consumers is expected to act as a driver for the segment expansion.

The soft trim interior materials sector in the automotive field undergoes rapid changes thanks to the shifting consumer preferences towards the luxury interior, featherweight materials, and sustainability. The substitution of plastic elements with the bio-based and recyclable ones has changed the face of the industry, as manufacturers are looking for a way to employ environmentally friendly categories to their products in order to avoid sanctions. Furthermore, advancements in the area of textile technologies, synthetic leathers, and foam-based materials now contribute to better durability, comfort, and sound insulation.

The increase of electric and self-driving cars on the roads is also a trigger for the demand for high-quality soft trim materials, since these types of cars have a priority organizational element which is comfort along with aesthetic beauty.. In addition, the strictness of safety and emission standards are offering the foundry using manufacturers a way to mediate the situation by changing to flame-retardant and low-VOC (volatile organic compound) materials.

The North American automotive soft trim interior materials market is in a state of progress, as the production of electric and hybrid cars continues to take a larger market share, and those who purchase them are more concerned about the environment, thus preferring materials that are both sustainable and lighter for use in building materials. The strict car emission regulations of the United States and Canada push car manufacturers to use interior solutions with low-VOC and environmentally friendly alternatives.

In addition, the growing interest in luxury and high-end brands has resulted in the need for more premium leather, technical textiles, and even gadgets. The market, in turn, benefits from the inclusion of notable carmakers like General Motors, Ford, and Tesla plus the funds allocated to R&D for future automated and dogconnected vehicles, which in turn is driving the innovation in new materials. Additionally, the market also draws inspiration from strong consumer demand for comfort-oriented and high-tech interiors.

In the modern automotive soft trim interior materials sector, Europe asserts its strong profile as it is predominantly steered by luxury and premium automobile producers, the likes of BMW, Mercedes-Benz, and Audi. Here, the EU environmental laws on sustainability and carbon emissions are particularly strict, hence the designers are encouraged to go for biodegradable, recyclable, and synthetic alternatives. The surge in electric mobility as well as strict safety regulations has strongly contributed to the need for fire-resistant and high-durability materials.

Demand for high-quality craftsmanship has led European consumers to prefer hand-stitched leather, Alcantara, and advanced textile solutions. The existence of advanced material suppliers and significant R&D investments is the foundation of innovations such as smart materials and antimicrobial coatings, geared towards achieving comfort, hygiene, and regulatory compliance in automotive interior.

The automotive soft trim interior materials market in the Asia-Pacific region is on the rise due to the booming vehicle production and rapid urban development. Drivers of the shift to EVs and HEVs include countries like China, Japan, and South Korea, who are in high demand for the sustainable and cost-effective soft trim materials.

China, the biggest automotive market in the world, is making strides towards electric vehicles and lightweight materials adoption, while Japan and South Korea are backing advancements in textile technology for the secondary use of vehicles and durability decisions. Population growth and an increase in individual disposable income are other reasons for the rise of the market for premium interiors in mass-market vehicles. Also, government led initiatives for biobased materials are diverting attention to recycling used interior components.

The global automotive soft trim interior materials market including regions such as Latin America, the Middle East, and Africa witnesses gradual growth due to the increase in vehicle demand and invest infrastructure. In the Latin American region, the significant contributors are Brazil and Mexico with increasing attractions in the automobile industry and export manufacturing of these products.

The Middle East area sees the high demand of leisure and customized vehicle production which drives the adoption trend of view using coating leather, wood, and soft-touch materials. Apart from that in Africa, the newly emerging automotive sector is asking for cheaper synthetic interior materials. Government policies aimed at enhancing the local manufacturing industry and reducing vehicle import dependency are expected to create a positive impact in the market expansion across these areas.

Challenges

High Material and Production Costs

The production of top quality and eco-friendly soft trim interior materials is very high, and this makes it difficult for automakers to integrate them without the need to raise the vehicle price significantly. Natural and bio-based materials, for instance, organic leather and plant-based textiles, frequently necessitate special processing, resulting in higher production costs.

Moreover, advanced smart textiles and antimicrobial coatings further add to the total cost. Long-lasting research and development (R&D) and the necessity to satisfy the rigorous and green environmental criteria act as the other reasons for the increase in the financial burdens that challenging realities present for small and mid-sized automakers to be the main ones to use the premium soft trim solutions laying down the good for budget and mid-range vehicle segments.

Stringent Environmental Regulations and Supply Chain Disruptions

The industry is under strict environmental regulations regarding carbon emissions, VOC content, and recyclability, which makes it a must for manufacturers to adopt sustainable materials. Regulations like the European Union’s End-of-Life Vehicles Directive and California’s stringent vehicle interior emission norms simulate compliance challenges.

Furthermore, supply chain disruptions like the ones brought about by political tensions, a lack of raw materials, and fluctuating prices, have adversely affected the availability and affordability of soft trim materials. The global pandemic of COVID-19 and the worldwide semiconductor shortage were also factors that have had long-term consequences on automotive material procurement and production schedules.

Opportunities

Advancements in Bio-Based and Recycled Materials

Increasing focus on environmental sustainability and circular economy principles is generating strong growth in sales of bio-based and recycled interior materials. For example, manufacturers are now making premium use of the by-products from the hemp plant and recycled PET materials to make car seats and other non-carbon footprint products.

Ford, Honda, and Polestar have taken the lead in sustainability initiatives by introducing plant-derived and waste-derived materials, thereby creating a new trend in automotive interior design based on an environmental-friendly approach. Moreover, new biodegradable and low-VOC materials are present to help automakers with meeting tough environmental standards without sacrificing production quality.

The better and more environment-friendly materials are now available in the market are believed to aid in the growth of new markets, especially in the case of electric vehicles and luxury cars where sustainability is an important selling point.

Integration of Smart Textiles and Advanced Functionalities

The introduction of connected and autonomous vehicles is also significantly responsible for the spread of smart textiles and multifunctional interior materials. The introduction of features like self-cleaning fabrics, temperature-regulating materials, and embedded sensors is causing a revolution in soft trim automotive materials. Automakers are pivots of nanotechnology and conductive fibers to integrate touch-sensitive control and interactive surfaces into vehicle interiors easily.

On the other hand, antimicrobial coatings, as well as odor-resistant fabrics, have especially become popular after the pandemic as a means of increasing hygiene and passenger safety. These ideas not only increase user experience and convenience but also go with the industry's turnaround toward intelligent, adaptive, and ecologically sustainable interiors. Personalized high-tech cars will be in demand, which in turn will propel the market tremendously in the next ten years.

The automotive soft trim interior materials market has experienced a remarkable transformation from 2020 to 2024. The period is characterized by the customers' inclination towards the use of premium vehicle interiors, the drive for sustainability, and the development of lightweight materials for enhancing fuel efficiency.

The production plants prioritized the addition of luxurious components like artificial leather, textiles, and natural fiber, which are both pleasing to look at and the durable. The sustainability in the course of time that was found is also a vital factor, as companies started considering the ecological issues like bio-based and recycled materials.

In the forward-looking period 2025 to 2035, the market is predicted to enjoy the fast-growing changes that result from stricter environmental regulations, the evolution of smart and autonomous vehicle interiors, and the higher demand for electric vehicles (EVs). The introduction of new materials, such as smart textiles with integrated sensors and self-healing surfaces, will totally change the automotive interiors thus making them functional and sustainable.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increasing focus on sustainability; regulations promoting eco-friendly materials. |

| Technological Advancements | Introduction of lightweight synthetic materials and enhanced durability textiles. |

| Industry-Specific Demand | Growth in luxury vehicle segment driving premium interior material demand. |

| Sustainability & Circular Economy | Initial adoption of recycled and bio-based materials. |

| Production & Supply Chain | Reliance on global supply chains for synthetic and natural fibers. |

| Market Growth Drivers | Demand for premium aesthetics, comfort, and lightweight materials. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental mandates, increased use of recycled and bio-based materials. |

| Technological Advancements | Smart textiles, self-healing materials, and AI-integrated interiors. |

| Industry-Specific Demand | Expansion of EVs and autonomous vehicles increasing demand for high-tech, sustainable materials. |

| Sustainability & Circular Economy | Circular economy principles driving widespread use of upcycled and fully recyclable materials. |

| Production & Supply Chain | Increased regionalized production to reduce carbon footprint and improve sustainability. |

| Market Growth Drivers | Integration of smart surfaces, growing EV market, and regulatory pressure for greener materials. |

The USA automotive soft trim interior materials market is experiencing growth due to the increased demand for premium and EVs. Automakers are inclined to use sustainable and lightweight materials to ensure proper fuel consumption and to cope with strict environmental regulations. The generation of luxury cars is on the rise, and customers focus more on high-quality and aesthetically pleasing interiors. Furthermore, the regulatory policies that most manufacturers adopt to promote the use of environment-friendly materials are the major drivers of the innovation process in the sector.

The introduction of electric vehicles is another factor that has further increased the need for high-tech interior materials. Besides, the fact that consumers now expect comfort and sustainability, encourages the manufacturers to replace their traditional materials with bio-based and recyclable input. The market is forecasted to experience consistent growth, with a CAGR of 4.5% expected during the period 2025 to 2035. Factors such as technological advancements and changing consumer preferences will support this market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK automotive soft trim interiors market is mainly driven by the sustainability trend and the government support for the adoption of electric vehicles. The car manufacturers are now more often using biobased and recycled materials in order to meet the environmental expectations. The increase in the number of luxury and high-end cars is the additional reason for the demand for luxurious interior trims.

Also, the preference of British consumers is changing, as they often choose personalized and ecologically friendly car interiors, which, in turn, moves the carmakers to create new materials that would combine both design aspects and usefulness.

Furthermore, the investment that is channeled to electric mobility and smart car interiors is in direct correlation with the expansion of the market. The UK auto market has a solid forecast for the period 2025 to 2035 with a compound annual growth rate of (CAGR) 4.3% because of the robust aspect of developement in green automotive technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The automotive soft trim interior materials market of the European Union is sustained by the imposition of stringent sustainability rules and the rise in electric vehicles. The leading of the automakers have chosen the route of green materials, for instance, vegan leather and plant-based hydrocarbons, in order to comply with the EU that is strict on recyclability standards. Besides, the high-end and luxury cars' demand is also growing.

This is particularly true in the case of countries like Germany, France, and Italy. In addition to this, the discovery of light composites which are advanced and new technologies allowed the producers to make cars not only more efficient but also more durable and comfortable without additional weight.

Moreover, people are starting to be more aware of the environmental impact of car seats, especially, leading to a quicker switch to sustainable materials. In the upcoming years, the EU market is expected to expand at a compound annual growth rate of 4.8% from 2025 to 2035, due to strong regulatory backing and a priority on premium vehicles.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The automotive soft trim materials market in Japan primarily because of technological changes and sustainability actions, The metallic joint automakers Such as Toyota and Honda are leaders in low weight, high-performance interior materials for vehicle efficiency and global environmental objectives. The focus on compact and luxury vehicles drives the demand for this kind of technology.

Furthermore, Japanese automakers are incorporating high-tech features in interiors, advanced fabrics, and smart materials that are used for "passenger experience" technology. Sustainability has always been an important factor concerning the increased use of both recycled and bio-based materials. Backed by strong R&D, Japan's soft trim market is projected to expand at 4.6% CAGR from 2025 to 2035 as a result of ongoing product innovation and policy support.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The automotive soft trim interior materials market in South Korea is facing a rapid increase, contributed mostly by the top companies in the business such as Hyundai Motor Company and Kia Motors. The rise of electric vehicle manufacturing in this country is the chief factor triggering the demand for sustainable and high-tech interior materials. South Korean producers are emphasizing the development of eco-friendly trims, including plant-based leather and recyclable fabrics, in their way of adapting to the world sustainability trend.

The growth of the luxury car segment is also fueling the demand for premium interior styles and the requirement to elaborate more on the subject. Furthermore, the smart interior technology development, such as digital displays and interactive materials, is giving an extraordinary automotive experience. The scenario where the government is backing through both promoting sustainable manufacturing and electric mobility attracts the market to drive toward innovation and continuous changes in consumer preferences allowing it to be expanded at 4.7% CAGR in 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

As far as affordability is concerned, easy to get fabric is the number one choice of material for the automotive sector. It is the most used alternative for weather and sound proof trim that also brings extra comfort and aesthetic visual appearance to the space. The breakthrough in synthetic and blended fabrics is the achievement of higher durability and stain resistance factors, thus, they are convenient even in the case of above-average usage.

Moreover, the shift from conventional cars to electric or self-driven models creates a will for the usage of sustainable and lightweight fabrics. Looking at the consumer market, Asia-Pacific, and primarily China and India have experienced the highest fabric users because of affordable prices for clothing and the production of vehicles.

The green fabrics are ones for re-using and/or are made from 100% organic materials and are the cause of demand which is evident in the current situation in Europe that compels fabric manufacturers to switch toward eco-friendlier production processes.

Leather has preserved its classic style in the luxury and top car segments by giving above-average aesthetics, long-lasting durability, and extra comfort. Genuine and synthetic leather options give to the customers a variety of choices, with artificial alternatives like polyurethane-based leather catching the eye due to cost advantage and a reduced bast on the environment. Auto manufacturers build the collectible vehicles which have the vegan and bio-based leather interior widely available for purchase, thus their businesses really take root in Europe and North America.

The segment is positively impacted due to the rise in demand for SUVs and electric vehicles which focus on interior trim with premium quality. Nevertheless, leather's popularity might be affected due to the high maintenance issue, speak-out about the environment, the dynamic raw-material prices which ultimately might result in the leaving out of this fabric option from the list thus forcing the manufacturers to resort to high-quality, eco-friendly synthetics instead.

The application of seating in automotive soft trim materials has a prime place as it literally influences passenger comfort, ergonomics, and safety. The need for seat materials such as breathable fabrics, top-grade leather, and creative thermoplastic polymers has kept pushing the car manufacturers to the forefront of innovation with smart and easy maintenance design.

Embedding features such as temperature control and memory foam, which are commonly associated with smart seating, drives the market for performance-high trim materials. Also, the fast-changing electric vehicle industry should use materials that are lightweight, sustainable, and recyclable to make seats. North America and Europe hold a market share of premium seating, while Asia-Pacific registers high demand for cost-effective durable materials, especially in the mass and mid-range vehicle segments.

The cockpit and dashboard section in a vehicle is significant as it makes use of high-quality materials that have both aesthetic and functional features, ensuring safety and durability. Shifting to the cabins of cars in which some of the illuminating parts are replaced by lumina soft-touch, thermoplastics, and other synthetic leather has stood at the top of car manufacturers' priority with giving dashboards a premium feeling in it.

The movement towards digital cockpits and advanced infotainment systems is a driver for demand of the material which is invisible glare, scratch-resistant, and UV-stable. Thermoplastic polymers and elastomers, akin to TPU and TPO, are chosen widely due to the properties of moldability, weightlessness, and wear and tear resistance.

The growth of electric and autonomous driving vehicles has become the major driver to the innovation of dashboard materials, specifically the target for sustainability and recyclability predominantly in the places with strict environmental laws which are the EU and the USA.

The global automotive soft trim upholstery materials market is developing steadily due to the increasing need of consumers for comfort, beauty, and sustainability in car interiors. Car manufacturers are using more durable and more attractive materials such as leather, fabric, vinyl, and synthetic polymers. They are also signing lightweight materials to these details in order to improve the fuel economy and application of the elements. The sustainability efforts are shaping the selection of materials, as there is a growing trend towards recycled and biobased materials.

Technological innovations, such as smart textiles and antimicrobial coatings, have also revolutionized the industry. In addition, the market constellated through mergers and acquisitions is solidifying the rivalry and extending the assortment of products. The key players still focus on innovation, not only to stay upstream in the market but also to be compliant with regulatory trends and cater to the evolving needs of consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Adient PLC | 12-17% |

| Lear Corporation | 10-14% |

| Toyota Boshoku Corporation | 8-12% |

| Faurecia S.A. | 5-9% |

| Grupo Antolin | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Adient PLC | Leading supplier of seating and interior components, emphasizing comfort, safety, and modularity. |

| Lear Corporation | Specializes in automotive seating and electrical systems, focusing on innovation and sustainability. |

| Toyota Boshoku Corporation | Develops seats, door trims, and other interior components with a focus on high-quality production. |

| Faurecia S.A. | Supplies interior systems with an emphasis on sustainable materials and lightweight solutions. |

| Grupo Antolin | Manufactures headliners, door panels, and other components, targeting customization and energy efficiency. |

Key Company Insights

Adient PLC

Adient PLC is a world-class player in the automotive seating and interior solutions sector, with its emphasis on ergonomics, safety, and sustainability. This company is devoted to the development of modular seating systems, which is a major step towards increased comfort and functionality in vehicles. Adient meets environmental regulations and adapts to the changing needs of consumers by including recycled and sustainable materials in its product categories.

With a stronghold in North America, Europe, and Asia, Adient maintains a partnership with well-known OEMs to provide tailor-made solutions. Furthermore, the automation technology and smart manufacturing that are invested in, are the reasons Adient is able to deliver high production efficiency and remain cost-effective. Strategic partnerships and ongoing research and development consistently put Adient to the forefront of the industry, which in turn makes it a key player in the advancement of the auto interior materials.

Lear Corporation

Lear Corporation is predominantly engaged in the automotive sector and focuses on both electronic systems and the associated seating system with a very high degree of innovation and a significant commitment to sustainability. Among the breakthroughs that Lear is doing in their course is the combination of smart textiles, heating and cooling technologies, and antimicrobial fabrics to the overall comfort and function of the space for the owner to be more.

Along with extending this functionality, Lear seeks to reduce environmental footprint by using recyclable and bio-based materials in their products. Lear's various segments of the vehicle line include electric and luxury cars and the company serves them through its well-structured global supply chain.

Strategic acquisitions and partnerships with OEMs strengthen its competitive position. The company's leadership position in the automotive soft-trim materials sector is due to its persistent commitment to new technological advancements and adhering to the standards required.

Toyota Boshoku Corporation

Toyota Boshoku Corporation is an indispensable supplier of automotive interior components, such as seats, door trims, and headliners. The company focuses on high-quality craftsmanship, the introduction of innovative materials, and long-lasting durability. Being a part of the Toyota Group, it enjoys the privileges of an integrated supply chain that guarantees efficiency and cost-effectiveness.

Toyota Boshoku has been investing in state-of-the-art production processes like automated stitching and lightweight composite materials in order to promote the performance and sustainability of the products. The company is also engaged in the development of the next-generation interior solutions that reduce noise pollution and have smart seating features. The commitment to excellent quality, research-oriented progress, and international collaboration has been the backbone of its position in the market.

Faurecia S.A.

Faurecia S.A. is widely recognized globally as a major player in the automotive interior sector and a specialist in lightweight as well as durable materials. Through the expansion of the eco-friendly alternatives, the company is exploring the use of plant-based and recycled plastics as substitutes for the traditional materials in order to reach the industry& 39;s aims regarding sustainability.

In partnership with automotive manufacturers, Faurecia made it possible to include digital and customizable interior options, such as, ambient lighting, and interactive surfaces. The main feature of Faurecia is the highly innovative approach, which is why the company has made commitments towards investment in artificial intelligence-driven material testing and the usage of smart manufacturing techniques.

The company has become a sought-after supplier for major automobile manufacturers all over the world having the ability to provide soft trim materials that are both cost-effective, high-performance, and visually attractive.

Grupo Antolin

Automotive headliners, door panels, and trim components are the exclusive products of Grupo Antolin, which is one of the biggest companies that make them. The organization is mainly devoted to coming up with lightweight materials and manufacturing them cost-effectively. The company benefits from the newest manufacturing processes, like injection molding and the mixing of renewable materials, which are used to produce more efficiently.

Grupo Antolin accompanies automotive companies in the planning and development of special interior designs that, on the one hand, raise the aesthetic value of the vehicle and, on the other hand, also solve the interior space-related problem.

Environment conservation is a challenge that the company tackles using natural fibrous composites and manufacturing processes that require less energy. Grupo Antolin remains dedicated to its core as a global player in the automotive sector by increasing its market share in soft trim materials with a wide range of products.

In terms of Material Type, the industry is divided into Fabric, Leather, Thermoplastic Polymers (Includes PVC), Thermoplastic Elastomers, Thermoplastic Olefins (TPO), Thermoplastic Polyurethanes (TPU)

In terms of Application, the industry is divided into Door Trim, Seating, Cockpit and Dashboard, Pillar Trim, Headliner, Floor/Acoustic Systems, Trunk

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Automotive Soft Trim Interior Materials market is projected to reach USD 6,598.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.8% over the forecast period.

By 2035, the Automotive Soft Trim Interior Materials market is expected to reach USD 10,545.1 million.

The Fabric segment is expected to dominate the market, due to its cost-effectiveness, lightweight nature, comfort, aesthetic appeal, customization options, and growing demand for premium interiors in passenger vehicles, enhancing durability and driving experience.

Key players in the Automotive Soft Trim Interior Materials market include Adient PLC, Lear Corporation, Toyota Boshoku Corporation, Faurecia S.A., Grupo Antolin.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type , 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 24: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 49: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 174: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Vehicle Type , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type , 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type , 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type , 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Vehicle Type , 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA