The automotive carbon ceramic brake market is experiencing robust expansion. Increasing demand for high-performance braking systems, rising adoption of luxury and sports vehicles, and the continuous push for vehicle weight reduction are key drivers. Current market dynamics are defined by the integration of advanced materials, enhanced thermal stability, and superior stopping performance that carbon ceramic brakes offer compared to conventional systems.

The market is also benefiting from the growing emphasis on safety and durability, as manufacturers prioritize premium braking technologies to meet evolving consumer expectations. Production advancements have lowered manufacturing costs, improving affordability and accelerating adoption across a wider vehicle range.

The future outlook is supported by the transition toward electric and hybrid vehicles, where lightweight and efficient braking systems are critical for performance optimization Strategic collaborations between OEMs and brake manufacturers are strengthening innovation and ensuring supply consistency, collectively positioning the market for steady growth and expanded global penetration.

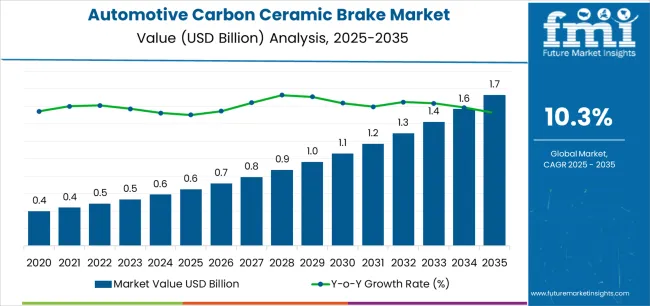

| Metric | Value |

|---|---|

| Automotive Carbon Ceramic Brake Market Estimated Value in (2025 E) | USD 0.6 billion |

| Automotive Carbon Ceramic Brake Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

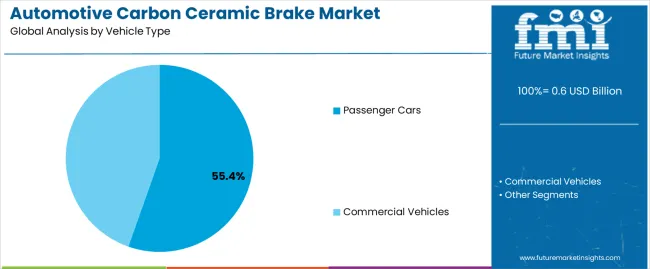

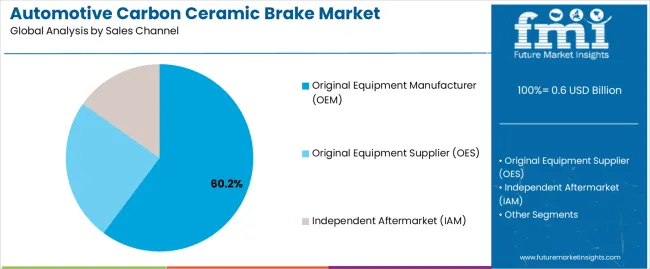

The market is segmented by Vehicle Type and Sales Channel and region. By Vehicle Type, the market is divided into Passenger Cars and Commercial Vehicles. In terms of Sales Channel, the market is classified into Original Equipment Manufacturer (OEM), Original Equipment Supplier (OES), and Independent Aftermarket (IAM). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment, accounting for 55.4% of the vehicle type category, has emerged as the dominant contributor due to increasing consumer preference for premium and high-performance vehicles equipped with advanced braking systems. Demand is being reinforced by continuous technological improvements in braking materials that enhance heat resistance, reduce wear, and improve overall safety.

Manufacturers are focusing on integrating carbon ceramic brakes into a broader range of passenger car models to enhance vehicle performance and appeal. The rising popularity of sports and luxury vehicles in both developed and emerging markets has sustained market share, while expanding automotive production capacities are further supporting segment growth.

The integration of carbon ceramic brakes as a standard or optional feature in top-tier models continues to strengthen the segment’s leadership and ensure consistent revenue contribution within the overall market landscape.

The original equipment manufacturer (OEM) segment, representing 60.2% of the sales channel category, has maintained its lead due to strong partnerships between automotive manufacturers and component suppliers focusing on advanced braking systems. OEMs have increasingly adopted carbon ceramic brakes as factory-installed systems to enhance vehicle safety, performance, and brand differentiation.

Continuous R&D investment by OEMs in material optimization and production scalability has improved cost efficiency and product reliability. The preference for OEM-supplied systems is also supported by warranty assurance and the integration of braking technologies within broader vehicle design frameworks.

Growing deployment across performance-oriented and luxury models has further reinforced this dominance As consumer demand for advanced braking performance continues to rise, OEMs are expected to expand their offerings, ensuring the segment’s sustained leadership and driving long-term growth in the global automotive carbon ceramic brake market.

Carbon ceramic brakes are substantially more expensive to produce than traditional steel brakes, which constricts their adoption of automotive carbon ceramic brakes. They are usually found in premium and high-performance cars, and the limited breadth of applications deterred automotive carbon ceramic brake market expansion.

Developments in alternative brake materials, such as composite materials or improved steel alloys, threaten the competitiveness of automotive carbon ceramic brakes. This inhibits automotive carbon ceramic brake demand because these alternatives are less expensive and provide similar results.

| Attributes | Details |

|---|---|

| Automotive Carbon Ceramic Brake Market Value for 2020 | USD 353.15 million |

| Historical Market Value for 2025 | USD 535.32 million |

| CAGR from 2020 to 2025 | 8.4% |

The segmented automotive carbon ceramic brake market analysis is included in the following subsection. Based on extensive evaluation, the OEM sector dominates the sales channel category, and the passenger cars segment leads the vehicle type category.

| Top Sales Channel | OEM |

|---|---|

| Market Share (2025) | 90.3% |

Since OEMs integrate carbon ceramic brakes directly into new car manufacturing lines, they guarantee widespread adoption, which supports automotive carbon ceramic brake sales. OEMs' dedication to upholding strict safety and performance criteria strengthens the reliability and market acceptability of automotive carbon ceramic brake technologies.

Partnerships between OEMs and automotive carbon ceramic brake producers ensure ongoing development and keep the OEM segment at the pinnacle of sales.

| Top Vehicle Type | Passenger Cars |

|---|---|

| Market Share (2025) | 99.8% |

Due to their large customer base and growing inclination toward high-performance braking systems, passenger cars have a greater demand for automotive carbon ceramic brakes. The increasing popularity of premium and sports automobiles in the passenger car segment contributes to the adoption of automotive carbon ceramic brakes, which prioritize safety and performance aspects.

Owing to its higher performance and durability, automotive carbon ceramic brakes are the preferred option in the sales of passenger cars, which are inclined towards cutting-edge technologies.

The automotive carbon ceramic brake market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Europe has enormous market opportunities for automotive carbon ceramic brakes.

Prospects for Automotive Carbon Ceramic Brake Market in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 13% |

| Italy | 12.8% |

| France | 11.5% |

| United Kingdom | 7.6% |

| Spain | 6.2% |

The desire for sophisticated braking systems is fueled by the nation's strict vehicle safety regulations, which make automotive carbon ceramic brakes the recommended option. Germany offers many opportunities for automotive carbon ceramic brake manufacturers that appeal to performance fans because of its booming automotive aftermarket business.

German technology hubs and globally recognized automotive research organizations support the adoption of automotive carbon ceramic brakes.

Among enthusiasts and sports car manufacturers such as Ferrari, Lamborghini, and Maserati, the adoption of automotive carbon ceramic brakes is fostered by Italy's enthusiasm for high-performance automobiles and its rich automotive tradition.

Italy's involvement in major racing events and its thriving motorsports culture encourage the advancement and validation of carbon ceramic brake technology, which shapes automotive carbon ceramic brake market trends. Renowned producers of carbon composite materials are present in Italy, which fortifies the carbon ceramic brake component supply chain and fosters market expansion for automotive carbon ceramic brakes.

France's rich motorsports legacy and involvement in races such as the 24 Hours of Le Mans foster the development and certification of high-performance automotive carbon ceramic brakes. French government policies and incentives that support emissions reduction and vehicle safety also encourage the use of cutting-edge automobile carbon ceramic brakes.

The adoption of automotive carbon ceramic brakes is facilitated by the United Kingdom's strict safety requirements and emphasis on vehicle performance and handling qualities. The United Kingdom's growth in automotive carbon ceramic brake technology is aided by top-notch engineering firms and research organizations focusing on materials science and automotive engineering.

Due to its advantageous location in Europe and close connections to major automotive industry centers, Spain integrates carbon ceramic brake technology into the global supply chain and increases its competitiveness in the automotive carbon ceramic brake market. Spain's participation in motorsports competitions such as the World Rally Championship and MotoGP validates and promotes high-performance automotive carbon ceramic brakes.

Sales Dynamics of Automotive Carbon Ceramic Brake in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 11.7% |

| Canada | 8.4% |

For producers of automotive carbon ceramic brakes seeking to serve both OEM and aftermarket markets, the United States presents a substantial opportunity due to its robust automobile manufacturing base. The United States' ongoing progress in material science and production techniques fosters innovation and the creation of next-generation automotive carbon ceramic braking solutions.

The requirement for improved braking performance in harsh weather conditions, such as slippery roads and heavy rain, has LED to the adoption of automotive carbon ceramic brakes in Canada. As sustainability grows, automotive carbon ceramic brakes are becoming steadily prevalent in Canada. These brakes also last longer and produce less brake dust.

Insights into the Asia Pacific Automotive Carbon Ceramic Brake Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.3% |

| South Korea | 8.8% |

| Japan | 8.2% |

| Australia | 7.0% |

| India | 6.0% |

The government's drive for greener and more sophisticated car technology contributes to significant automotive carbon ceramic brakes demand in the China market. The rise in sales of performance-oriented vehicles and the trend toward lightweight in China's automotive industry stimulate the adoption of automotive carbon ceramic brakes.

The automotive carbon ceramic brake market in South Korea is propelled by the growing consumer preference for sophisticated braking systems and the need for high-performance automobiles. The focus of South Korean automakers on creating lightweight, high-performance cars is anticipated to increase demand for automotive carbon ceramic brakes.

Japanese automakers' emphasis on improving vehicle safety and performance supports the demand for automotive carbon ceramic brakes. Japanese companies' innovations in braking materials and manufacturing techniques are anticipated to promote automotive carbon ceramic brake market expansion.

The popularity of racing events and a driving culture focused on performance are two factors boosting the adoption of automotive carbon ceramic brakes in Australia's automotive aftermarket. The desire of Australian vehicle enthusiasts for high-performance, lightweight components contributes to the demand for automotive carbon ceramic brakes.

The growing consumer knowledge of improved braking technologies and safety requirements is contributing to growth in the Indian automotive carbon ceramic brake industry. Government measures supporting electric and hybrid automobiles are expected to create opportunities for carbon ceramic brake manufacturers in India's automotive market.

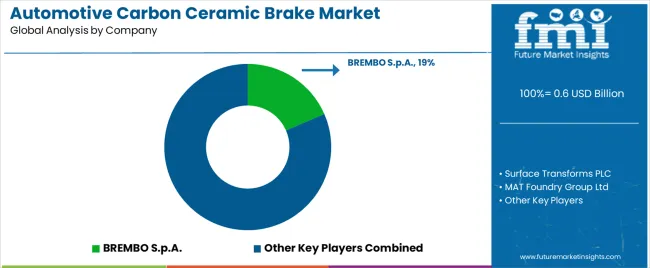

Key automotive carbon ceramic brake manufacturers, including BREMBO S.p.A., Surface Transforms PLC, MAT Foundry Group Ltd., Audi AG, and Volkswagen of America, Inc., stand out as significant players pushing innovation in the highly competitive market. The knowledge of ALPINA Burkard Bovensiepen GmbH + Co. KG, BRABUS GmbH, and Carroll Shelby International, Inc. facilitates the market dynamic of automotive carbon ceramic brakes.

With their distinctive contributions and technological developments, AKEBONO BRAKE INDUSTRY CO., LTD., Automobili Lamborghini S.p.A. (Lamborghini), Rotora, Ferrari N.V., Apollo Automobil GmbH (Gumpert), and Ferrari N.V. enhance the competitive environment. These automotive carbon ceramic brake manufacturers work constantly to improve performance, durability, and safety to satisfy the needs of both industry specialists and car enthusiasts.

These key automotive carbon ceramic brake vendors influence the market's future by collaborating strategically and innovating relentlessly to ensure the market's sustainability and competitiveness in a continually changing sector. These automotive carbon ceramic brake producers stay at the forefront, pushing the limits of vehicle braking technology as the market keeps growing and diversifying.

Notable Breakthroughs and Developments

| Company | Details |

|---|---|

| Brembo | Brembo announced in March 2025 that the DYATOM carbon ceramic brake disc for the Ford Company's GT MK II would be available. This development aimed to significantly increase the performance of carbon ceramic brakes. To provide the best thermal performance, this revolutionary carbon ceramic brake blends racetrack technology with exceptional wear resistance. It fits the Ford GT MK II flawlessly and ensures the greatest braking power range. |

| Surface Transforms PLC | Surface Transforms PLC teamed up with Koenigsegg in June 2025 to assist them in producing the first four-seater hypercar. As per the inked contract between the two firms, Surface Transforms plc was the only carbon ceramic brake disc provider constructing hypercars. |

| Bugatti Automobiles | In January 2020, Bugatti Automobiles designed a titanium eight-piston monoblock brake caliper to create exceptionally stiff brake calipers for racing cars that could tolerate high temperatures. |

| AUDI AG | In May 2020, AUDI AG (Quattro-AUDI) and CIE LT, a supplier of forged components, signed a contract to produce automobile parts in Hungary and Poland. |

| Brembo S.p.A. | Mexico's New Iron Foundry Plant to Be Announced by Brembo S.p.A. in July 2020 to produce aluminum calipers that blend cutting-edge technology with highly effective integrated solutions, the business invested USD36 million to create a production facility in Escobedo, Mexico. |

The global automotive carbon ceramic brake market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the automotive carbon ceramic brake market is projected to reach USD 1.7 billion by 2035.

The automotive carbon ceramic brake market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in automotive carbon ceramic brake market are passenger cars, commercial vehicles, light commercial, heavy buses & trucks and off-road vehicles.

In terms of sales channel, original equipment manufacturer (oem) segment to command 60.2% share in the automotive carbon ceramic brake market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA