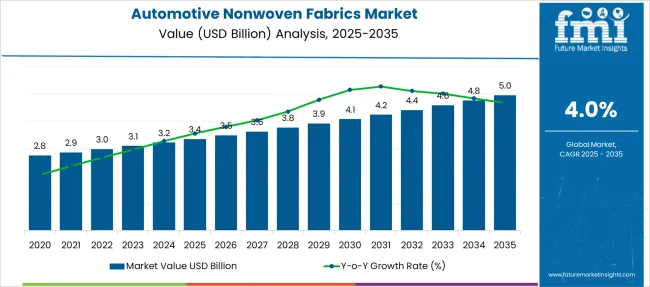

The Automotive Nonwoven Fabrics Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Nonwoven Fabrics Market Estimated Value in (2025 E) | USD 3.4 billion |

| Automotive Nonwoven Fabrics Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The automotive nonwoven fabrics market is expanding steadily, driven by rising demand for lightweight, durable, and cost-effective materials that enhance vehicle performance and fuel efficiency. Increasing pressure on automakers to reduce emissions and comply with stringent environmental regulations has led to the widespread adoption of nonwoven fabrics for various automotive components.

These materials offer advantages such as sound insulation, filtration, and comfort, making them suitable for diverse applications across the vehicle interior and exterior. Continued advancements in manufacturing technologies and the rising integration of electric vehicles have further broadened usage across thermal and acoustic insulation areas.

As consumer expectations evolve toward enhanced comfort and sustainability, nonwoven fabric solutions are being tailored to meet both aesthetic and functional needs. The future of the market appears strong, with increased investments in eco-friendly, recyclable fabric solutions and innovation in bio-based nonwovens playing a key role in shaping next-generation automotive interiors.

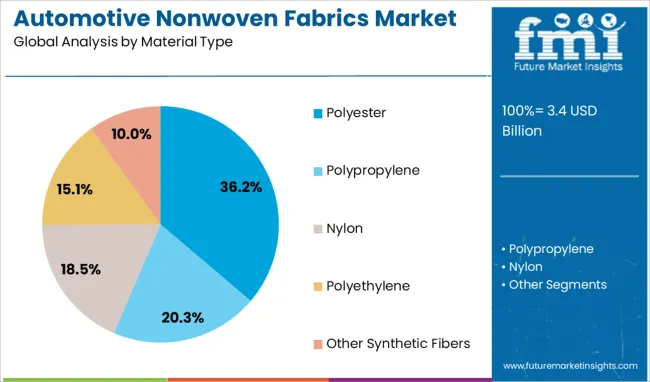

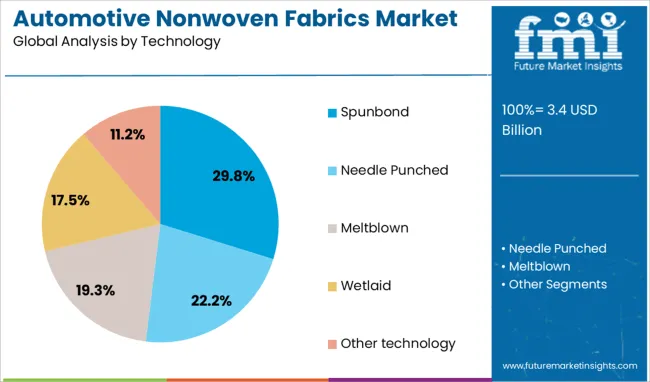

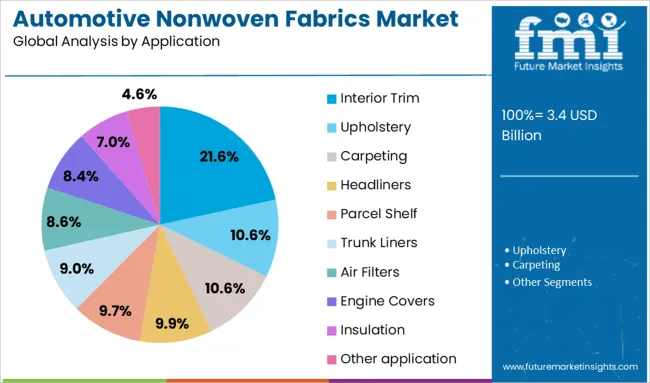

The automotive nonwoven fabrics market is segmented by material type, technology, application, vehicle type, sales channel and geographic regions. The automotive nonwoven fabrics market is divided by material type into Polyester, Polypropylene, Nylon, Polyethylene, and Other Synthetic Fibers. In terms of technology, the automotive nonwoven fabrics market is classified into Spunbond, Needle Punched, Meltblown, Wetlaid, and Other technologies. The automotive nonwoven fabrics market is segmented into Interior Trim, Upholstery, Carpeting, Headliners, Parcel Shelf, Trunk Liners, Air Filters, Engine Covers, Insulation, and Other applications. The automotive nonwoven fabrics market is segmented by vehicle type into Passenger Vehicles, Commercial Vehicles, and Electric Vehicles. The automotive nonwoven fabrics market is segmented by sales channel into OEM and Aftermarket. Regionally, the automotive nonwoven fabrics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester segment leads the material type category with a 36.2% market share, driven by its strong mechanical properties, cost-effectiveness, and compatibility with various nonwoven technologies. Polyester-based fabrics are widely used for their resistance to moisture, stretching, and abrasion, making them suitable for automotive interiors, insulation layers, and structural reinforcements.

Their thermal stability and recyclability have made them a preferred choice for manufacturers aiming to reduce environmental impact without compromising on performance. Growth in this segment is further supported by consistent availability, scalability in production, and adaptability to different molding and bonding techniques.

The segment’s dominance is expected to continue, especially as OEMs prioritize lightweight materials that align with global emission reduction targets. The combination of durability, processability, and sustainability positions polyester as a reliable and preferred material in the automotive nonwoven fabrics market.

The spunbond segment holds a notable 29.8% share within the technology category, driven by its ability to produce uniform, high-strength fabrics that are well-suited for automotive applications. Spunbond technology enables the creation of lightweight, breathable, and dimensionally stable materials, which are critical in applications such as carpet backing, headliners, and insulation barriers.

Its efficiency in high-speed production and reduced processing time also contribute to lower manufacturing costs, making it favorable for large-scale automotive deployment. The segment has gained traction due to its compatibility with synthetic polymers like polypropylene and polyester, offering flexibility in design and functionality.

As the industry moves towards high-performance nonwoven solutions with enhanced acoustic and thermal features, the spunbond segment is expected to maintain strong growth. Its integration into eco-friendly manufacturing processes and alignment with circular economy goals further reinforces its appeal among automotive suppliers.

The interior trim segment commands 21.6% of the application category, reflecting its essential role in delivering comfort, aesthetics, and functional enhancements within vehicle cabins. Nonwoven fabrics are widely used in headliners, seat backs, door panels, and trunk liners due to their lightweight nature, design flexibility, and acoustic insulation capabilities.

Increasing consumer preference for noise reduction, thermal comfort, and premium interior finishes has driven adoption of nonwovens in trim applications. The shift toward electric and hybrid vehicles, which require quieter cabins and enhanced occupant comfort, further amplifies demand in this segment.

Manufacturers are leveraging nonwoven technology to offer customizable, durable, and environmentally responsible trim solutions that meet automotive interior standards. As vehicle interiors become a key differentiator in consumer purchase decisions, the interior trim segment is expected to maintain steady growth supported by ongoing design innovations and material improvements.

The automotive nonwoven fabrics market is expanding as automakers seek lightweight, durable, and cost-effective materials for interiors, insulation, and filtration. These fabrics offer advantages such as improved acoustic performance, thermal insulation, and recyclability, making them increasingly essential for modern vehicle design. The growing need for cabin comfort, emissions control, and modular construction methods reinforces demand. Nonwovens support rapid part production, reduce waste, and integrate easily into hybrid and electric vehicle platforms. Their adaptability across functions ensures continued relevance in evolving vehicle architectures.

Nonwoven fabrics are used extensively in headliners, carpets, seat linings, trunk liners, and door panels due to their lightweight properties and excellent formability. Automakers leverage these materials to reduce vehicle mass, improving fuel economy and meeting emissions targets.

Nonwovens also contribute to acoustic insulation by dampening noise, vibration, and harshness in passenger cabins. Their compatibility with molding processes like thermoforming makes them ideal for complex interior shapes. In luxury segments, these fabrics are laminated with decorative surfaces to achieve both aesthetic and functional goals. As consumer preferences shift toward quiet, comfortable cabins, manufacturers increasingly adopt multi-functional nonwoven solutions. Their recyclability and compatibility with natural fibers like jute and kenaf also appeal to OEMs seeking to reduce their environmental footprint. This intersection of cost-efficiency, comfort, and compliance keeps nonwoven fabrics integral to future automotive interior strategies, particularly as electric vehicles demand quieter, more refined driving environments.

In under-the-hood environments, nonwoven fabrics are used for heat shields, engine covers, and thermal insulation mats. These materials withstand high temperatures, resist oil and fluid exposure, and help manage engine compartment noise. With the rise of turbocharged and hybrid powertrains, thermal performance and acoustic control have become critical design considerations.

Nonwoven composites, often reinforced with aluminum or polymer films, offer lightweight alternatives to traditional molded parts. Their adaptability in thickness and shape makes them suitable for tight engine layouts and multifunctional modules. Automotive engineers value the material's consistency and compatibility with automated lamination and die-cutting equipment. This facilitates seamless integration into engine assembly lines while reducing material waste. As powertrain designs evolve and emission controls tighten, demand for lightweight thermal and acoustic insulation grows. Nonwovens offer a performance- and cost-balanced solution for meeting both safety and comfort standards in engine and battery enclosures.

Nonwoven fabrics are a core component in cabin air filters, oil filters, and fuel filtration systems. Their fine fiber structure enables efficient particulate capture while maintaining low pressure drop, which is essential for airflow and engine efficiency. Cabin air filters made with electrostatically charged nonwoven media remove allergens, dust, and exhaust gases, enhancing passenger health and comfort. In powertrains, nonwoven filter media resist high temperatures and chemical exposure, providing reliable separation performance. As air quality standards increase and vehicle architectures become more compact, nonwovens allow flexible filter design in limited spaces. Manufacturers can customize pore sizes, material blends, and coatings to optimize filter life and efficiency. Nonwoven filters also support the performance of EV battery cooling systems and thermal management modules. Their scalability and versatility keep them central to both legacy and next-gen vehicle filtration needs. This adaptability ensures continued relevance as engine designs evolve and filtration requirements become more stringent.

Nonwoven fabrics help streamline automotive manufacturing by enabling modular and integrated part production. Large rolls of nonwoven material can be cut, laminated, or molded into various parts, reducing the number of components and assembly steps. This simplification not only lowers production time but also cuts labor and logistics costs. For tier suppliers and OEMs, this results in shorter lead times and improved inventory flexibility. Nonwovens also support just-in-time and lean manufacturing strategies by facilitating faster part switching and retooling. Their uniformity and low defect rates contribute to consistent quality across production batches. As automakers seek to balance rising input costs with competitive pricing, nonwoven solutions provide a scalable, high-throughput material platform. This cost-to-performance balance, paired with ease of customization, makes nonwoven fabrics a preferred choice for next-generation manufacturing lines. Their ability to integrate into fully automated systems positions them well for smart factories and future-ready assembly ecosystems.

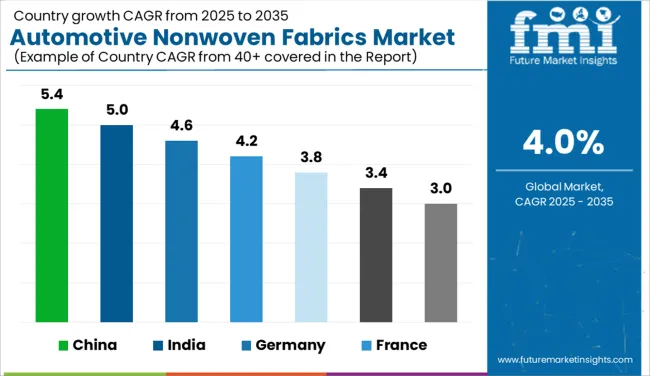

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global automotive nonwoven fabrics market is projected to grow at a CAGR of 4.0% through 2035, supported by demand across vehicle interiors, acoustic insulation, and filtration components. Among BRICS nations, China leads with 5.4% growth, driven by scaled-up vehicle production and increased use of lightweight materials in cabin and trunk components. India follows at 5.0%, where suppliers have expanded output for domestic manufacturers and aftermarket customization. In the OECD region, Germany reports 4.6% growth, supported by high-performance fabric usage in premium automotive segments. The United Kingdom, at 3.8%, has maintained steady integration in seat backing, floor liners, and air management systems. The United States, at 3.4%, remains a mature market with applications driven by compliance with interior material standards. Flammability regulations, recycling mandates, and product testing protocols have shaped market development. This report includes insights on 40+ countries; the top markets are shown here for reference.

Demand for automotive nonwoven fabrics in China has expanded at a 5.4% CAGR, supported by a large-scale vehicle production ecosystem. Nonwoven fabric applications have been widely integrated into trunk liners, headliners, seat padding, and floor insulation layers. Leading textile converters have maintained output of thermally bonded and needle-punched varieties tailored for passenger and commercial vehicle interiors. Usage has also been observed in cabin air filtration systems and engine covers requiring temperature resistance. Supply partnerships between nonwoven producers and OEMs have contributed to stable consumption levels across multiple assembly platforms. Material formulations using polyester and polypropylene blends have gained volume due to affordability and ease of lamination. Regional automotive hubs such as Chongqing and Guangzhou have seen greater deployment of roll goods in high-throughput plants.

India has recorded a 5.0% CAGR in the automotive nonwoven fabrics market, with demand being driven by rising vehicle manufacturing in key states. Usage of nonwoven textiles has been reported in door trims, acoustic barriers, seat reinforcements, and dashboard panels. Nonwoven converters have catered to domestic brands by supplying spunbond and stitch-bonded formats suitable for compact and mid-size models. Interior upgrades in entry-level vehicles have encouraged greater fabric integration across trim levels. Lightweight properties and ease of molding have favored adoption over traditional wovens and foams. Local component assemblers have procured rolls from regional hubs for just-in-time supply to major carmakers. Investments in thermoforming and lamination lines have increased among small-scale textile processors, particularly in Gujarat and Tamil Nadu.

A 4.6% CAGR has been reported in Germany’s automotive nonwoven fabrics market, with long-standing application in premium car interiors. High-quality needle-punched fabrics have been utilized in vehicle headliners, sidewalls, and seat structures due to their dimensional stability and tactile finish. Leading nonwoven manufacturers have collaborated with Tier-1 suppliers to provide moldable substrates engineered for durability and acoustic control. Fabric specifications have been adapted to support heat resistance, recyclability, and fire retardancy for in-cabin applications. Roll-fed systems have been standardized in automated press and die-cutting units within assembly lines in Bavaria and Baden-Württemberg. Demand for multilayer composites combining foam, nonwovens, and textile overlays has gained prominence in luxury segments. Engineering design teams have emphasized precise material tolerances and surface conformity.

The United Kingdom has observed a 3.8% CAGR in the automotive nonwoven fabrics market, with integration of lightweight materials being favored across compact and hybrid models. Applications have spanned floor carpets, wheel arch liners, rear parcel shelves, and cargo area trims. Suppliers have targeted niche volumes by offering tufted and embossed nonwoven fabrics compatible with variable design layouts. Interior customization has been supported by semi-automated textile shaping systems within specialty plants across the Midlands. Laminated nonwoven mats have gained attention for their ability to combine structural integrity and noise absorption. Importation of fiber rolls has supplemented local capacity in high-precision upholstery. OEM contracts have defined material requirements including abrasion resistance and dimensional conformity for final installation stages.

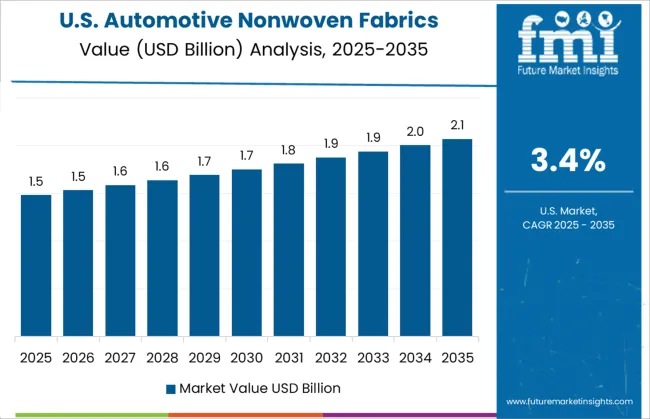

In the United States, the automotive nonwoven fabrics market has expanded at a 3.4% CAGR, supported by applications in light trucks, SUVs, and passenger cars. Fabrics have been used in seat backings, trunk liners, headliners, and HVAC filtration. Regional manufacturers have delivered hydroentangled and thermal-bonded rolls to tiered suppliers through distribution hubs in the Midwest and South. OEM requirements for weight savings and cabin noise reduction have increased the usage of multi-density nonwoven composites. Polyester and polyolefin fiber blends have been selected for their compatibility with automated bonding and molding equipment. Fabric converters have configured products for integration into trim lines serving domestic and imported vehicle models. Aftermarket demand for noise-dampening mats and retrofit liners has added to volume stability.

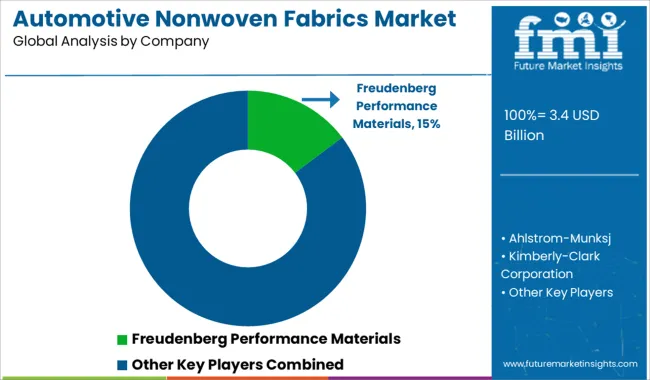

The automotive nonwoven fabrics market is led by globally recognized material manufacturers supplying engineered textiles used across interior, insulation, filtration, and acoustic applications in vehicles. Freudenberg Performance Materials holds a dominant position, offering a comprehensive range of nonwoven solutions tailored for headliners, carpets, cabin air filters, and underbody components. Known for their durability, formability, and lightweight properties, Freudenberg's products are widely adopted by leading automotive OEMs. Ahlstrom-Munksjö is also a key supplier, delivering high-performance nonwoven materials for engine filtration and thermal insulation systems, focusing on consistent performance under high-temperature and chemically aggressive environments. Kimberly-Clark Corporation and DuPont de Nemours provide advanced nonwoven fabrics engineered for comfort and hygiene applications in seating and cabin air systems. Their materials enhance moisture control, breathability, and dust protection within vehicle interiors. Lydall, now part of Unifrax, is widely known for thermal and acoustic barrier materials, supporting both ICE and electric vehicle platforms. Hollingsworth & Vose Company contributes high-efficiency filtration media, especially for HVAC and engine systems. Toray Industries and Mitsui Chemicals support the Asian automotive market with lightweight, recyclable nonwoven solutions aligned with evolving efficiency standards. Berry Global Group focuses on meltblown and spunbond nonwovens for fluid management and acoustic dampening. Asahi Kasei Corporation offers advanced nonwoven applications for interior trim and structural reinforcement, emphasizing reduced vehicle weight without compromising comfort or strength. Together, these companies form a competitive landscape driven by quality, customization, and compliance with stringent automotive performance standards.

On July 17, 2025, AJ Nonwovens relaunched Multipile, a specialized nonwoven fabric for automotive aftermarket use. Designed for insulation, trim, and performance liners, Multipile offers versatility, durability, and enhanced acoustic and thermal properties. At IDEA® 25 (April 29–May 1, 2025), AGC launched FibraLAST, a pioneering non‑fluorinated oil and water repellent coating tailored for automotive and technical nonwoven fabrics. FibraLAST offers strong barrier performance and sustainability certification for industrial textiles.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Material Type | Polyester, Polypropylene, Nylon, Polyethylene, and Other Synthetic Fibers |

| Technology | Spunbond, Needle Punched, Meltblown, Wetlaid, and Other technology |

| Application | Interior Trim, Upholstery, Carpeting, Headliners, Parcel Shelf, Trunk Liners, Air Filters, Engine Covers, Insulation, and Other application |

| Vehicle Type | Passenger Vehicles, Commercial Vehicles, and Electric Vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Freudenberg Performance Materials, Ahlstrom-Munksj, Kimberly-Clark Corporation, DuPont de Nemours, Lydall, Hollingsworth & Vose Company, Toray Industries, Mitsui Chemicals, Berry Global Group, and Asahi Kasei Corporation |

| Additional Attributes | Dollar sales by automotive nonwoven fabric type including needle-punched, spunbond, meltblown, and composite variants, by application in interior trims, insulation, cabin air filtration, and battery components, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by vehicle lightweighting, acoustic comfort, and EV growth; innovation in recycled fibers and bio-based materials; costs influenced by polymer prices, processing technology, and sustainability regulations. |

The global automotive nonwoven fabrics market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the automotive nonwoven fabrics market is projected to reach USD 5.0 billion by 2035.

The automotive nonwoven fabrics market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in automotive nonwoven fabrics market are polyester, polypropylene, nylon, polyethylene and other synthetic fibers.

In terms of technology, spunbond segment to command 29.8% share in the automotive nonwoven fabrics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA