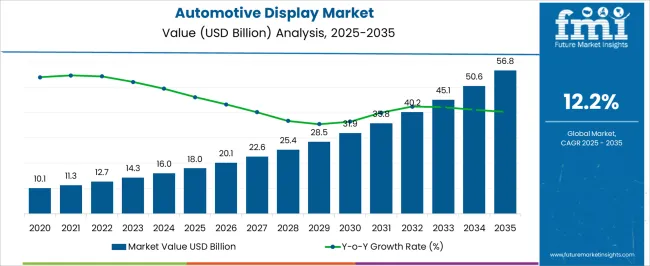

The automotive display market, valued at USD 18.0 billion in 2025 and projected to reach USD 56.8 billion by 2035 at a CAGR of 12.2%, demonstrates significant growth driven by the increasing adoption of advanced display technologies in vehicles. The deployment of diverse display types, including Liquid Crystal Displays, Organic Light-Emitting Diodes, Head-Up Displays, and touch-sensitive interfaces, influences the market’s expansion.

Each technology contributes differently to overall market value, with OLED and advanced interactive displays capturing a substantial share due to superior image quality, energy efficiency, and integration flexibility with digital cockpits and infotainment systems. The year-on-year value growth indicates that incremental contributions from emerging display technologies are becoming more pronounced, particularly in premium and electric vehicle segments, where demand for high-resolution, customizable, and driver-assist compatible displays is accelerating.

LCD technology maintains a steady contribution by providing cost-effective solutions for instrument clusters and secondary screens, whereas OLED and micro-LED displays are driving premium segments through enhanced contrast ratios, thinner form factors, and improved color fidelity. The integration of augmented reality features, multi-zone dashboards, and adaptive displays is enhancing consumer experience and creating differentiated value across vehicle classes. The contribution analysis highlights that technology-driven differentiation is central to revenue growth, with innovative display solutions increasingly defining competitive positioning and facilitating adoption, ultimately reinforcing the market’s robust trajectory from 2025 to 2035.

| Metric | Value |

|---|---|

| Automotive Display Market Estimated Value in (2025 E) | USD 18.0 billion |

| Automotive Display Market Forecast Value in (2035 F) | USD 56.8 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The automotive display market is regarded as a key segment within vehicle electronics and infotainment systems. It is estimated to hold 7.8% of the global automotive electronics market, driven by growing adoption of digital dashboards and advanced human-machine interfaces. Within in-vehicle infotainment systems, a 12.1% share is observed, reflecting the use of touchscreen displays, head-up displays, and central multimedia units. The instrument cluster and dashboard sector contributes 10.4%, supported by full LCD, OLED, and hybrid display integration.

Connected and smart vehicles account for 5.6%, emphasizing real-time data visualization and interactive controls. Automotive components and accessories hold 3.2%, reflecting integration in retrofit solutions and auxiliary displays. Recent industry trends are shaped by advancements in OLED, curved, and flexible displays, integration with augmented reality head-up displays, and enhanced driver assistance systems. Groundbreaking developments include multi-functional touchscreens, voice and gesture controls, and AI-driven display personalization.

Key players are forming partnerships with automotive OEMs, chipset manufacturers, and software developers to enable seamless infotainment and safety features. Strategies include the development of energy-efficient displays, high-resolution and high-brightness technologies, and modular dashboards for rapid customization. Regional growth is led by the Asia Pacific due to high vehicle production and electronics adoption, while North America and Europe emphasize premium and connected vehicle display solutions.

The automotive display market is advancing steadily, driven by increasing integration of advanced infotainment, navigation, and driver-assistance systems across vehicle categories. Market growth is being supported by rising consumer demand for enhanced in-vehicle user experiences, coupled with regulatory momentum toward safety-focused driver information systems. Original equipment manufacturers are investing in display innovation to deliver higher resolution, faster response times, and improved energy efficiency, aligning with evolving design aesthetics and digital cockpit architectures.

Demand is being amplified by the transition toward connected and autonomous vehicles, where displays serve as primary human–machine interfaces. Global production capacity is expanding to meet rising orders, with supply chain optimization ensuring competitive pricing in both premium and mass-market segments.

Technological convergence between consumer electronics and automotive systems is influencing feature adoption cycles, while regional market expansion is being fueled by increasing vehicle production and rising disposable incomes in emerging economies. Over the forecast period, the integration of multi-display layouts, augmented reality overlays, and advanced visualization technologies is expected to reinforce market competitiveness and sustain revenue growth momentum.

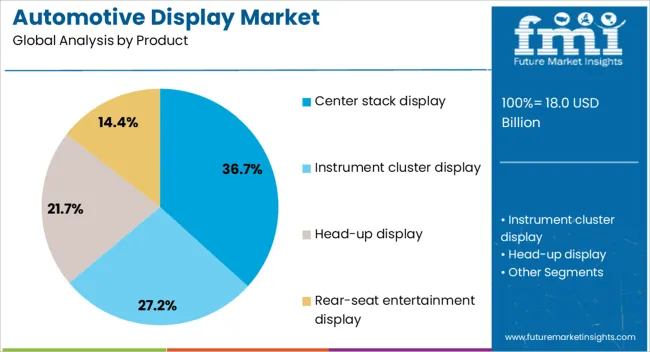

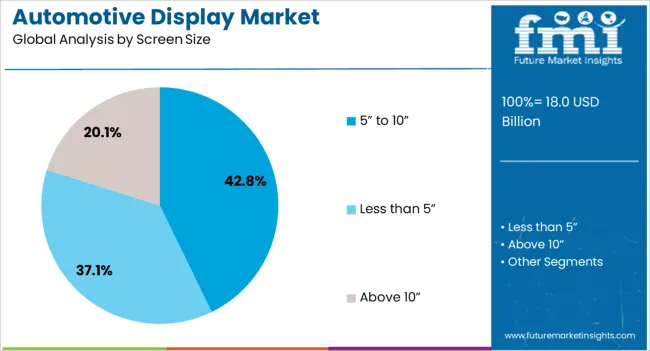

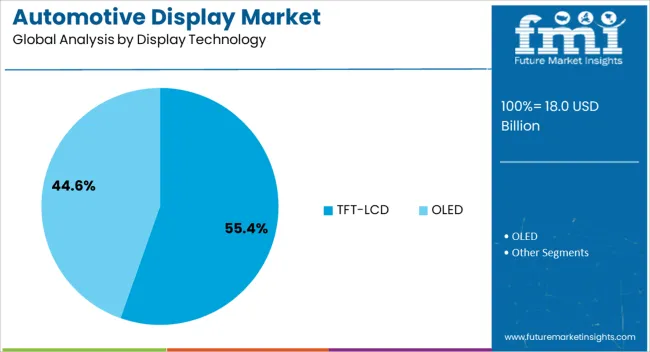

The automotive display market is segmented by product, screen size, display technology, and geographic regions. By product, automotive display market is divided into Center stack display, Instrument cluster display, Head-up display, and Rear-seat entertainment display. In terms of screen size, automotive display market is classified into 5” to 10”, Less than 5”, and Above 10”. Based on display technology, automotive display market is segmented into TFT-LCD and OLED.

Regionally, the automotive display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The center stack display segment, holding 36.70% of the product category, remains the leading segment due to its central role in providing infotainment, navigation, and climate control functionalities within the driver’s immediate line of sight. Its share is being maintained by consistent adoption across both entry-level and premium vehicles, with design flexibility enabling integration into various dashboard configurations.

Automotive manufacturers are prioritizing center stack displays as key components of digital cockpit systems, leveraging advancements in user interface design and touch responsiveness to enhance functionality. Demand resilience has been supported by consumer familiarity, ergonomic placement, and compatibility with connected services.

Production scalability and competitive pricing from tier-1 suppliers have further bolstered adoption, while continuous improvements in resolution, brightness, and display durability are enabling enhanced performance in diverse driving conditions. The segment’s position is expected to be reinforced by the integration of AI-driven voice controls and personalized display settings, ensuring its continued prominence in the evolving automotive display ecosystem.

The 5” to 10” screen size category, accounting for 42.80% of the segment share, is leading the market owing to its optimal balance between functionality, driver visibility, and dashboard integration flexibility. This size range is widely adopted across various vehicle classes, offering sufficient display area for navigation maps, media playback, and vehicle status information without obstructing the driver’s field of view.

The segment benefits from high-volume production efficiencies, enabling cost-effective deployment in mass-market vehicles while maintaining applicability in premium models through enhanced resolution and touch sensitivity. Its dominance is further supported by adaptability to evolving software features and compatibility with multiple display technologies.

Suppliers are focusing on thin-bezel designs, improved backlighting, and enhanced touch accuracy to increase consumer appeal. As automakers standardize on versatile display sizes for modular cockpit platforms, the 5” to 10” category is expected to retain its leadership position, supported by strong aftermarket replacement demand and continuous upgrades in display performance.

The TFT-LCD technology segment, holding 55.40% of the display technology category, leads the market due to its mature manufacturing ecosystem, proven reliability, and cost efficiency. Its dominance is reinforced by high compatibility with a broad range of automotive applications, from infotainment to instrument clusters, enabling widespread adoption across vehicle price segments.

TFT-LCD displays deliver sufficient brightness, resolution, and responsiveness to meet automotive standards, while benefiting from incremental improvements in contrast ratios, energy efficiency, and wide viewing angles. Established supply chains and economies of scale have contributed to competitive pricing, ensuring continued preference among OEMs seeking performance at cost-effective production levels.

Although emerging technologies such as OLED and microLED are gaining attention, TFT-LCD remains the preferred choice for most current models due to its durability under varying environmental conditions and established integration processes. Over the forecast horizon, ongoing enhancements in panel design, optical bonding, and backlight systems are expected to sustain its market leadership.

The market has witnessed significant growth due to the increasing integration of advanced display technologies in vehicles for enhanced user experience, safety, and connectivity. LCD, OLED, and TFT displays are being incorporated into instrument clusters, infotainment systems, head-up displays, and passenger entertainment units. Rising consumer preference for digital dashboards, interactive interfaces, and connected vehicle features is driving adoption.

Technological advancements in touch sensitivity, brightness, energy efficiency, and resolution have improved functionality and aesthetics. Regional growth is influenced by automotive production volumes, premium vehicle adoption, and regulatory mandates for driver information systems, highlighting the strategic importance of displays in modern vehicles.

The shift toward digital instrument clusters and infotainment displays is transforming vehicle interiors. Analog gauges are being replaced with LCD and TFT screens that provide real-time information, navigation guidance, multimedia integration, and safety alerts. Head-up displays project critical data onto the windshield, improving driver focus and situational awareness. Passenger-focused entertainment displays are incorporated into luxury vehicles, enhancing comfort and convenience during travel. Connected vehicle platforms utilize displays for integration with smartphones, voice assistants, and IoT devices. The growing demand for customizable interfaces and advanced visualization has incentivized manufacturers to adopt high-resolution, energy-efficient, and durable display solutions, creating a competitive advantage in automotive design and consumer appeal.

Technological innovations in automotive displays have improved image clarity, energy efficiency, and responsiveness. OLED and AMOLED screens offer high contrast, wide viewing angles, and reduced power consumption, making them suitable for both instrument panels and infotainment applications. Touchscreen interfaces, haptic feedback, and gesture recognition allow intuitive interaction and safer operation. Anti-glare coatings, adaptive brightness control, and temperature-resistant designs ensure performance under varying environmental conditions. Flexible and curved displays are being explored to maximize cabin ergonomics and design flexibility. These advancements improve reliability, aesthetics, and functionality, positioning modern displays as a critical component in enhancing both driver safety and passenger satisfaction.

Automotive displays play a key role in compliance with safety standards and advanced driver assistance systems (ADAS). Displays are integrated with lane departure warning, blind-spot monitoring, adaptive cruise control, and parking assistance, providing real-time feedback and alerts to drivers. Regulatory mandates in multiple regions require vehicles to provide clear visual information to reduce distractions and improve road safety. Instrument clusters and heads-up displays deliver speed, fuel, and diagnostic information in a centralized, accessible manner. Integration with sensors and connectivity platforms ensures seamless interaction between safety systems and drivers. These factors reinforce the need for reliable, high-performance displays in both passenger and commercial vehicles, driving sustained market growth.

Regional production volumes, technological infrastructure, and consumer preferences influence the adoption of automotive displays. North America and Europe focus on premium vehicles with advanced infotainment and safety systems, driving OLED and high-resolution display demand. Asia Pacific, led by China, India, and Japan, is experiencing rapid adoption due to the growth of automotive manufacturing, rising middle-class income, and a preference for connected and smart vehicles. Latin America and the Middle East are gradually incorporating digital displays in new vehicle models, supported by rising urbanization and awareness of advanced driver interfaces. Regional trends highlight the interplay of industrial capacity, consumer expectations, and regulatory compliance in shaping market expansion.

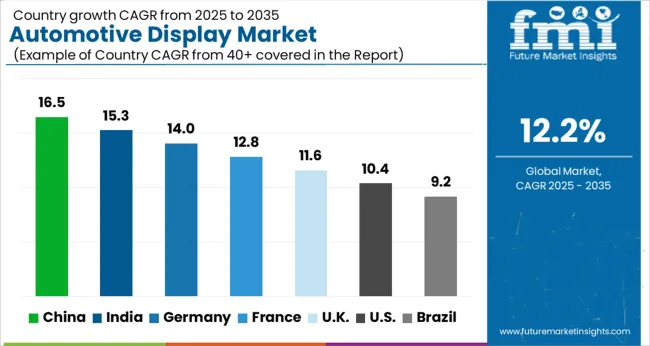

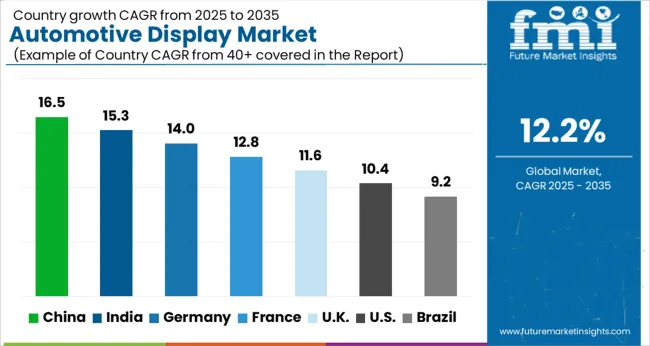

| Country | CAGR |

|---|---|

| China | 16.5% |

| India | 15.3% |

| Germany | 14.0% |

| France | 12.8% |

| UK | 11.6% |

| USA | 10.4% |

| Brazil | 9.2% |

China maintains the strongest growth in the market with a forecast CAGR of 16.5%, driven by adoption in connected vehicles, digital dashboards, and in-vehicle infotainment systems. India follows at 15.3%, supported by the rising integration of smart displays in passenger and commercial vehicles. Germany records 14.0%, benefiting from advanced automotive engineering and deployment in luxury and electric vehicles. The United Kingdom posts 11.6%, where innovation in HUD and customizable displays fuels market expansion. The United States registers 10.4%, driven by increasing demand in EVs and infotainment technology. Together, these countries represent key hubs for production, technology adoption, and market innovation in automotive displays. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 16.5% in the market, propelled by rising demand for advanced in-vehicle infotainment systems, digital instrument clusters, and heads-up displays. Increasing consumer preference for connected cars and smart vehicle interfaces is fueling the adoption of high-resolution and customizable display solutions. OEMs are integrating touchscreens, OLED, and LCD technologies to enhance user experience and safety. Government initiatives promoting electric and smart vehicles also drive market expansion. Urban population growth, rising disposable income, and technological advancements further support the market growth in China.

India is expected to register a CAGR of 15.3% in the market, driven by the increasing penetration of connected vehicles and smart mobility solutions. Growing automotive production and rising consumer awareness about convenience and safety features push demand for interactive displays. Manufacturers are integrating digital clusters, multifunctional screens, and infotainment panels in mid-range and premium vehicles. Expansion of EVs, government initiatives for intelligent transport systems, and the rising adoption of technology-enabled vehicles contribute to the market growth. Urbanization and rising purchasing power further support the adoption of advanced automotive display solutions across India.

Germany is projected to grow at a CAGR of 14% in the market due to strong automotive manufacturing and high consumer demand for technologically advanced vehicles. Premium and luxury car segments are increasingly equipped with digital dashboards, heads-up displays, and touch-sensitive interfaces. OEMs focus on integrating OLED, TFT-LCD, and curved displays to enhance driver experience. Government support for electric and autonomous vehicles, combined with rising adoption of connected car technologies, strengthens the market. Consumer preference for ergonomics, safety, and infotainment solutions further propels the market in Germany.

The United Kingdom is anticipated to register a CAGR of 11.6% in the market, supported by growing demand for intelligent vehicle interfaces and infotainment systems. Automotive manufacturers are incorporating large-format digital displays, heads-up displays, and touchscreen clusters to meet consumer expectations. Increasing EV penetration, connected vehicle adoption, and government regulations for safety and emissions standards further enhance market growth. Technological innovations, rising consumer focus on safety, and lifestyle-driven vehicle preferences are key factors driving the adoption of advanced automotive display solutions in the UK.

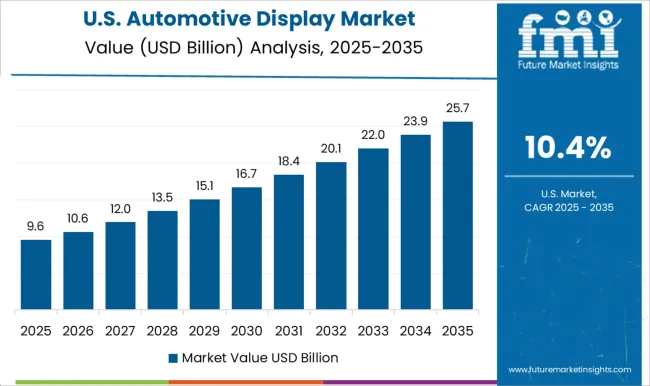

The United States is expected to witness a CAGR of 10.4% in the market as consumers increasingly demand advanced infotainment, navigation, and instrument display systems. OEMs are integrating high-definition screens, curved OLED displays, and multifunction touch-sensitive interfaces to enhance user experience. Rising EV adoption, connected car technologies, and smart mobility trends drive market expansion. Government regulations encouraging safety and efficiency, combined with consumer preference for customization and ergonomics, support growth. Technology-focused automotive consumers and robust automotive manufacturing infrastructure further strengthen the market in the United States.

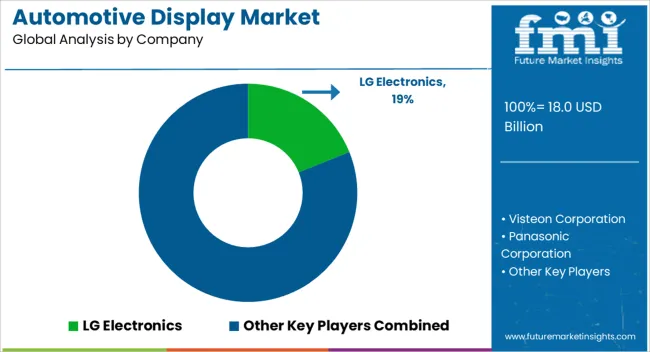

The market has evolved rapidly as vehicles integrate more advanced technologies, making displays central to both driver assistance and passenger experience. LG Electronics and Panasonic Corporation are at the forefront, offering high-resolution, energy-efficient panels that support dynamic interfaces, touch interactivity, and heads-up functionality. These displays are increasingly designed to integrate augmented reality and navigation overlays, providing real-time insights to drivers while enhancing safety and convenience. Their innovations focus on durability, wide viewing angles, and adaptability across vehicle types, from compact cars to luxury models.

Visteon Corporation specializes in complete digital cockpit solutions that combine instrument clusters, infotainment screens, and driver-assistance displays into unified systems. By delivering customizable layouts, responsive touch panels, and seamless integration with vehicle software, Visteon supports the industry’s shift toward user-centric, connected mobility solutions. Robert Bosch GmbH and Continental AG contribute through robust, high-performance displays that integrate sensor data, telematics, and real-time diagnostics. Hyundai Mobis rounds out the market by offering scalable and modular display solutions suitable for multiple vehicle segments, enabling manufacturers to deploy advanced cockpit technologies efficiently.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.0 Billion |

| Product | Center stack display, Instrument cluster display, Head-up display, and Rear-seat entertainment display |

| Screen Size | 5” to 10”, Less than 5”, and Above 10” |

| Display Technology | TFT-LCD and OLED |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Electronics, Visteon Corporation, Panasonic Corporation, Robert Bosch GmbH., Continental AG, and Hyundai Mobis |

| Additional Attributes | Dollar sales by display type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in in-vehicle infotainment and instrument cluster adoption, innovation in touchscreen technology, resolution, and connectivity, environmental impact of electronic waste and material sourcing, and emerging use cases in augmented reality displays and smart dashboards. |

The global automotive display market is estimated to be valued at USD 18.0 billion in 2025.

The market size for the automotive display market is projected to reach USD 56.8 billion by 2035.

The automotive display market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in automotive display market are center stack display, instrument cluster display, head-up display and rear-seat entertainment display.

In terms of screen size, 5” to 10” segment to command 42.8% share in the automotive display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Display Units Market Growth - Trends & Forecast 2025 to 2035

Automotive Head-up Display Market Trends - Growth & Forecast 2025 to 2035

Automotive Active Window Display Market

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA