The automotive microcontroller market is experiencing rapid growth, driven by advancements in vehicle electronics, safety technologies, and electrification. Increasing integration of digital control systems across drivetrain, infotainment, and safety applications has intensified demand for high-performance microcontrollers. The transition toward electric and hybrid vehicles has further boosted adoption due to the need for efficient power management and real-time data processing.

The market is characterized by technological convergence between hardware and software architectures, enabling improved communication between vehicle subsystems. Enhanced computational capabilities, energy efficiency, and miniaturization have expanded their use in both high-end and mass-market vehicles.

With rising regulatory focus on safety, connectivity, and emission control, automotive microcontrollers have become indispensable for compliance and innovation. Continuous R&D investment in AI-based processing and system integration is expected to drive sustained market expansion over the coming years.

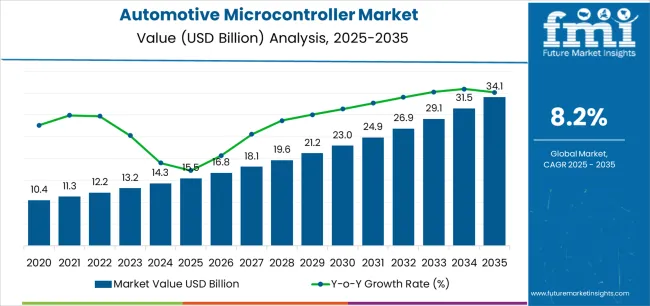

| Metric | Value |

|---|---|

| Automotive Microcontroller Market Estimated Value in (2025 E) | USD 15.5 billion |

| Automotive Microcontroller Market Forecast Value in (2035 F) | USD 34.1 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

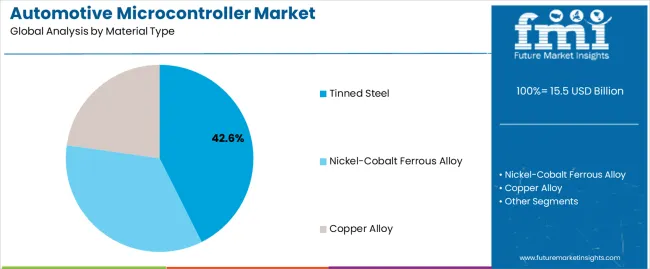

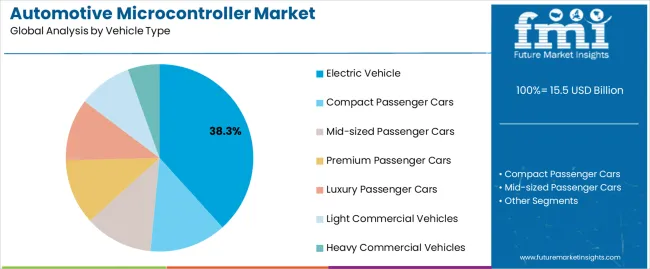

The market is segmented by Material Type, Vehicle Type, and Application and region. By Material Type, the market is divided into Tinned Steel, Nickel-Cobalt Ferrous Alloy, and Copper Alloy. In terms of Vehicle Type, the market is classified into Electric Vehicle, Compact Passenger Cars, Mid-sized Passenger Cars, Premium Passenger Cars, Luxury Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles.

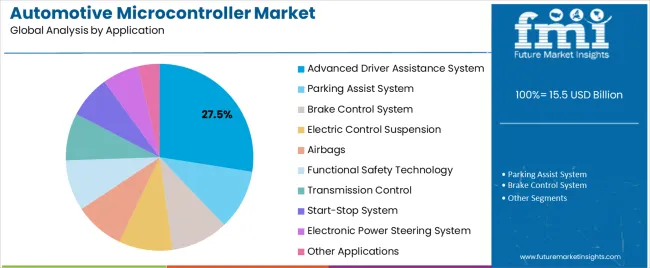

Based on Application, the market is segmented into Advanced Driver Assistance System, Parking Assist System, Brake Control System, Electric Control Suspension, Airbags, Functional Safety Technology, Transmission Control, Start-Stop System, Electronic Power Steering System, and Other Applications.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tinned steel segment leads the material type category, accounting for approximately 42.6% share of the automotive microcontroller market. This dominance is supported by the material’s excellent conductivity, corrosion resistance, and thermal stability, which are critical for electronic component reliability.

Tinned steel’s ability to withstand high-temperature environments and provide effective electromagnetic shielding enhances its suitability for microcontroller housings and connectors. Manufacturers favor this material due to its durability and cost-effectiveness compared to alternative metals.

The segment’s performance is further strengthened by established production processes and recyclability, aligning with automotive sustainability goals. As demand for robust electronic architectures in vehicles continues to rise, the tinned steel segment is projected to maintain a strong presence in the market.

The electric vehicle segment holds approximately 38.3% share in the vehicle type category, reflecting the increasing reliance on microcontrollers for powertrain management, battery control, and energy optimization. The shift toward electrification has intensified the need for intelligent control systems capable of monitoring complex functions such as regenerative braking, thermal management, and energy distribution.

Electric vehicles require multiple microcontrollers for real-time operation coordination, driving significant demand across OEMs. Government incentives promoting EV adoption and continuous expansion of charging infrastructure further support market growth.

With the increasing sophistication of EV architectures, microcontrollers designed for high efficiency and functional safety are expected to play a central role, ensuring continued dominance of this segment in the forecast period.

The advanced driver assistance system segment accounts for approximately 27.5% share within the application category. This segment’s expansion is driven by rising integration of electronic safety features, including adaptive cruise control, lane keeping assist, and automated emergency braking.

Microcontrollers play a vital role in processing sensor data and executing real-time control functions that enhance driver safety and comfort. Increasing regulatory mandates for ADAS implementation and consumer preference for enhanced safety have accelerated deployment across vehicle classes.

Ongoing advancements in processor speed, memory capacity, and communication protocols further improve ADAS reliability and performance. As vehicles evolve toward higher automation levels, the segment is expected to remain a key growth area for automotive microcontrollers.

The market size in 2020 was nearly USD 15.5 billion and it expanded at a CAGR of 7.3% until 2025. In 2025, the net worth of the market was USD 13.23 billion.

The cost of microcontrollers has witnessed a decline over the past few years. However, tags for microcontrollers are expected to increase in the upcoming years, thereby spurring their costs.

| Attributes | Details |

|---|---|

| Automotive Microcontroller Market Value (2020) | USD 15.5 billion |

| Historical Market Size (2025) | USD 13.23 billion |

| Historical CAGR (2020 to 2025) | 7.3% |

Tinned steel is expected to continue to be the preferred material for automotive microcontrollers. The revenue from sales of tinned steel is projected to account for a substantial share of the market. Copper alloys are also anticipated to remain the second most desired material for in-vehicle microcontrollers.

So, the expansion of raw material sources and the strengthening of international trade channels are anticipated to boost affordable automotive microcontroller production during this forecast period.

With the advent of electric vehicles, automotive microcontroller applications have increased manifold for controlling electric drivetrains, battery systems, and power distribution in electric cars. The rising concern for global warming has caused many nations to implement regulations and encourage electric mobility solutions that are expected to drive sales of automotive microcontrollers.

The table below lists the countries that are expected to be the leading markets during the forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

| Germany | 5.1% |

| China | 12.1% |

| India | 11.1% |

| Australia | 8.7% |

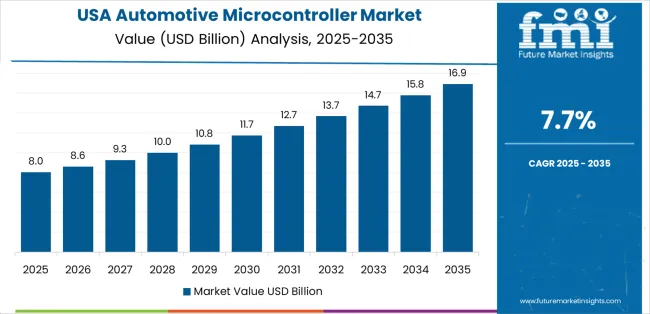

The United States market is forecasted to expand at a CAGR of 6.4% over the forecast years.

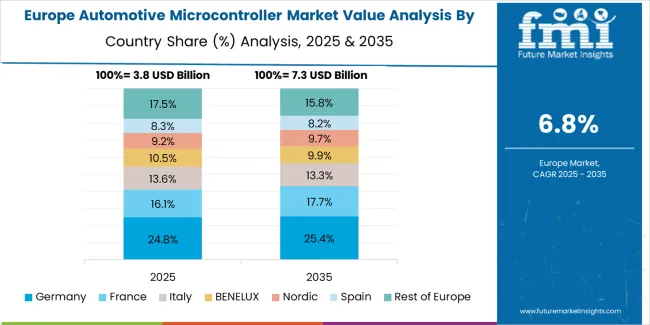

Germany is expected to dominate the European market and thrive at a 5.1% CAGR through 2035.

The automotive microcontroller industry in China is anticipated to witness a CAGR of 12.1% during the projected years.

Automotive microcontroller sales in India are poised to increase at a CAGR of 11.1% from 2025 to 2035.

The demand for automotive microcontrollers in Australia is expected to witness a year-on-year growth rate of 8.7% through the forecast years.

On the basis of vehicle type, heavy commercial vehicles are expected to dominate the automotive microcontroller market in terms of revenues, followed by premium passenger cars and electric vehicles. However, sales of automotive microcontrollers in the mid-size passenger vehicles segment are expected to account for a market share of 23.4%.

| Attributes | Details |

|---|---|

| Top Vehicle Type | Mid-size Passenger Vehicle |

| Market Share in 2025 | 23.4% |

The revenue from sales of automotive microcontrollers for application in electronic power steering is expected to account for 37.67% of the market.

| Attributes | Details |

|---|---|

| Top Application segment | Electronic Power Steering |

| Market Share in 2025 | 37.67% CAGR |

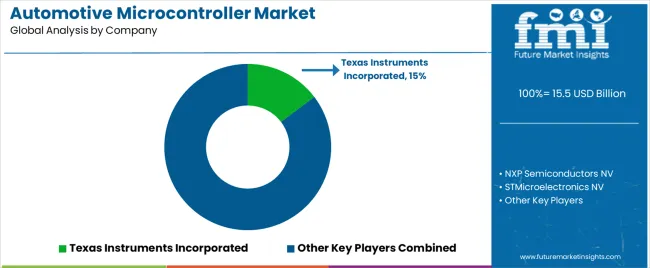

The overall market remained concentrated as very few manufacturers were able to compete at a global level with sufficient technical knowledge and infrastructure to produce reliable automotive microcontrollers. However, greater government support for establishing original equipment manufacturing (OEM) industries in emerging economies is currently fragmenting the global market.

Recent Developments

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 14.32 billion |

| Projected Market Size (2035) | USD 31.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 8.27% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Material Type, By Application, By Vehicle Type, and By Region |

| Key Companies Profiled | Texas Instruments Incorporated; NXP Semiconductors NV; STMicroelectronics NV; Microchip Technology Inc.; Renesas Electronics Corporation; Silicon Labs Private Limited; Fujitsu Limited; Maxim Integrated Products, Inc.; Infineon Technologies; Toshiba Corporation |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global automotive microcontroller market is estimated to be valued at USD 15.5 billion in 2025.

The market size for the automotive microcontroller market is projected to reach USD 34.1 billion by 2035.

The automotive microcontroller market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in automotive microcontroller market are tinned steel, nickel-cobalt ferrous alloy and copper alloy.

In terms of vehicle type, electric vehicle segment to command 38.3% share in the automotive microcontroller market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA