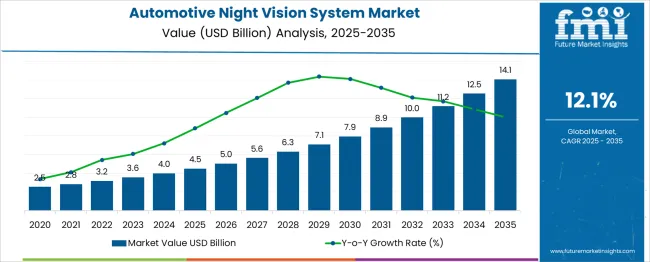

The Automotive Night Vision System Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period. The growth path shows an average annual addition of nearly USD 1 billion in the first five years, rising from USD 4.5 billion to USD 7.9 billion by 2030. This early phase reflects year‑on‑year increases of 10% to 13%, driven by adoption in premium vehicles where infrared and thermal imaging systems are bundled into advanced driver assistance packages.

Between 2030 and 2035, the market accelerates further, gaining USD 6.2 billion in just five years. Annual growth rates in this period remain close to the decade’s 12.1% CAGR, with values moving from USD 7.9 billion to USD 14.1 billion. The steepest annual gain occurs between 2034 and 2035, when revenue jumps by USD 1.6 billion, signaling that mass‑market penetration is well underway.

This pattern indicates a sustained expansion curve with no sign of mid‑term plateauing. If the late‑period momentum is maintained, the market could surpass its current forecast beyond 2035, especially as component costs decline and regulatory pressures for advanced safety technologies intensify.

| Metric | Value |

|---|---|

| Automotive Night Vision System Market Estimated Value in (2025 E) | USD 4.5 billion |

| Automotive Night Vision System Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The automotive night vision system market is viewed as a specialized yet steadily expanding category within broader parent industries. It is estimated to account for about 2.3% of the global advanced driver assistance systems (ADAS) market indicating growing interest in enhanced driver visibility. Within the safety and collision avoidance technologies sector a share of approximately 3.5% is assessed driven by integration of thermal and infrared vision modules.

In the luxury vehicle safety features segment around 2.8% is observed supported by high‑end OEM adoption. Within the aftermarket automotive electronics industry about 2.1% is evaluated as retrofit night vision solutions gain traction. In the road safety infrastructure and smart mobility systems market a contribution of roughly 2.6% is calculated reflecting interest in vehicle‑to‑infrastructure visibility systems.

Trends in this market have been shaped by increasing demand for enhanced driver awareness solutions in low light and poor weather conditions. Innovations have been focused on integration of infrared sensors, thermal imaging and object detection algorithms into vehicle dashboards. Interest has increased in versions offering pedestrian and animal detection alerts along with augmented heads‑up display overlays.

The Europe region has been observed to show early adoption while North America has maintained growing demand in luxury and commercial vehicle segments. Strategic initiatives have included collaborations between sensor technology firms and automotive OEMs to deliver modular night vision modules capable of automatic brightness adjustment, predictive hazard warnings and seamless integration with existing driver assist platforms.

The automotive night vision system market is gaining strong traction due to growing concerns over nighttime road safety, increased adoption of ADAS (Advanced Driver Assistance Systems), and consumer demand for high-end driving features. Automakers are prioritizing safety innovations as regulatory authorities across Europe, North America, and parts of Asia push for reduced fatalities and better visibility in low-light conditions.

Technology advancements in thermal imaging, sensor miniaturization, and digital display integration have enabled manufacturers to offer more affordable and effective night vision solutions. OEM integration is also being accelerated by partnerships with Tier-1 suppliers offering embedded infrared sensors and real-time object recognition.

Future growth is anticipated as urban premium vehicles and luxury segments increasingly adopt night vision to enhance nighttime driving confidence, reduce collision risks, and offer a differentiated user experience.

The automotive night vision system market is segmented by product, display, and component and geographic regions. By product of the automotive night vision system market is divided into Passive system and Active system. In terms of display of the automotive night vision system market is classified into Instrument cluster, Head-up display, and Navigation display.

Based on component of the automotive night vision system market is segmented into Night vision camera, Sensors, and Controlling unit. Regionally, the automotive night vision system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

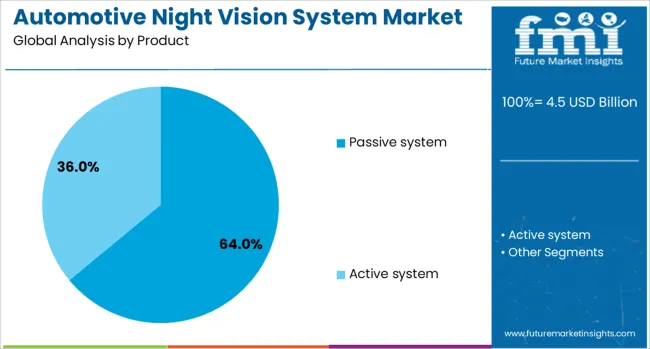

The passive system segment is estimated to account for 64.00% of the total market share in 2025, leading the product category. Growth in this segment is being driven by its ability to detect thermal radiation emitted by objects without relying on external illumination, making it more effective under complete darkness.

Passive infrared systems have demonstrated higher reliability across variable weather conditions such as fog, rain, and snow, increasing their utility for real-world applications. Their improved object detection range and integration with pedestrian and animal detection algorithms have made them more favorable among OEMs aiming to comply with global road safety standards.

As these systems require less power and are less complex to install than active counterparts, they are increasingly being incorporated into mid- and high-end vehicle platforms.

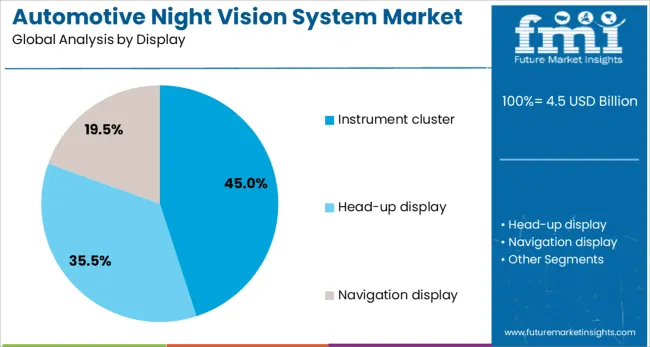

The instrument cluster display segment is projected to contribute 45.00% of the total revenue in 2025, making it the dominant display format. Instrument clusters are preferred for night vision output as they enable drivers to maintain direct line of sight while viewing thermal images or alerts.

Automakers are enhancing these displays with higher resolution and heads-up capabilities, further reinforcing safety without distraction. Placement within the natural field of view allows for faster reaction times during critical driving situations.

Additionally, the increasing shift toward fully digital and customizable instrument clusters has facilitated seamless integration of night vision feeds, offering both visual clarity and reduced driver fatigue during nighttime driving. Manufacturers are prioritizing this interface due to its proven ergonomics and compatibility with other ADAS alerts.

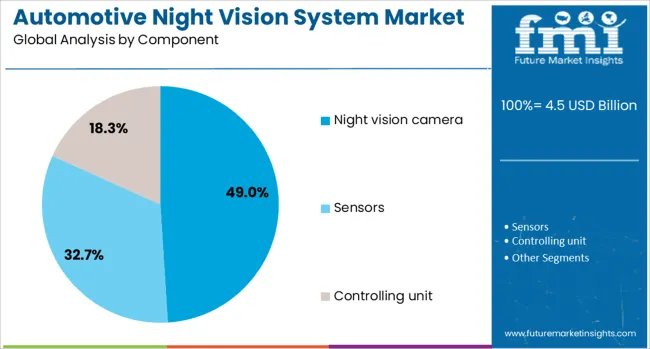

The night vision camera segment is anticipated to command 49.00% of the market share by 2025, representing the leading component. Demand for this segment is fueled by the adoption of high-sensitivity thermal and near-infrared cameras capable of detecting heat signatures at extended ranges.

These cameras are crucial in enhancing driver situational awareness by capturing unseen obstacles in darkness. Advances in sensor resolution, image processing speed, and AI-powered threat recognition have made night vision cameras more accurate and reliable.

The increasing volume of luxury vehicles incorporating these components, along with ongoing cost reductions through semiconductor innovation, is reinforcing their dominance. Furthermore, the emergence of solid-state camera systems and their compatibility with autonomous driving technologies are expected to sustain strong demand in this category.

Automotive night vision systems have been increasingly integrated into premium and high-performance vehicles to enhance driver awareness in low-light and poor-visibility conditions. Using infrared sensors, thermal imaging cameras, and advanced image processing, these systems detect pedestrians, animals, and obstacles beyond the reach of headlights. Demand has been driven by the focus on advanced driver assistance systems (ADAS) and road safety enhancements. Manufacturers have been refining detection accuracy, display clarity, and integration with driver alert systems to improve usability and reliability in real-world driving conditions.

Night vision systems have gained traction due to the growing emphasis on reducing nighttime accidents, which have a higher fatality rate compared to daytime incidents. Integration with ADAS features such as automatic emergency braking and lane departure warning has improved overall safety performance. Luxury vehicle manufacturers in Germany, Japan, and the United States have been early adopters, offering night vision as a factory-installed option. In regions with wildlife crossing risks or poorly lit rural roads, adoption rates have been higher. Enhanced thermal imaging capabilities have allowed the detection of heat signatures from pedestrians and animals at greater distances, giving drivers more reaction time. The regulatory push for advanced safety features has also contributed to steady demand growth in certain markets.

Recent developments in automotive night vision systems have focused on improving image resolution, detection algorithms, and integration with digital dashboards or head-up displays. AI-based object recognition has been implemented to distinguish between living beings and static objects, reducing false alarms. Thermal cameras with higher sensitivity have been introduced to enhance performance in extreme weather conditions such as fog, rain, or snow. Manufacturers in South Korea, Europe, and North America have been working on compact sensor designs for easier integration into vehicle architecture. Some systems have been designed to overlay detection alerts directly on augmented reality windshields, further aiding driver awareness. These advancements have made night vision systems more precise, user-friendly, and compatible with evolving in-car display technologies.

The adoption of night vision systems has been most prevalent in luxury sedans, SUVs, and performance vehicles, where buyers are willing to invest in advanced safety and comfort features. Brands such as BMW, Audi, Mercedes-Benz, and Cadillac have positioned night vision as a differentiating technology in their flagship models. The feature has also been used as a selling point in premium electric vehicles to showcase cutting-edge safety capabilities. While mainstream adoption has been limited due to cost constraints, aftermarket solutions have emerged for high-end SUVs and specialty vehicles. The association of night vision with exclusivity and advanced technology has helped sustain demand in the premium segment, with gradual trickle-down expected as production costs decline.

Despite its safety benefits, automotive night vision technology has faced barriers to mass-market penetration due to high system costs and limited consumer awareness. Installation as an optional feature has often been restricted to high-end trims, leaving out cost-sensitive buyers. Many drivers remain unfamiliar with the capabilities and benefits of night vision, reducing demand outside luxury markets. The technology’s performance is also influenced by environmental factors, requiring ongoing improvements for consistent reliability. Additionally, integration with vehicle electronics adds complexity to installation and maintenance. Without significant cost reduction, targeted consumer education, and broader OEM inclusion, adoption is likely to remain concentrated in the premium automotive segment over the near term.

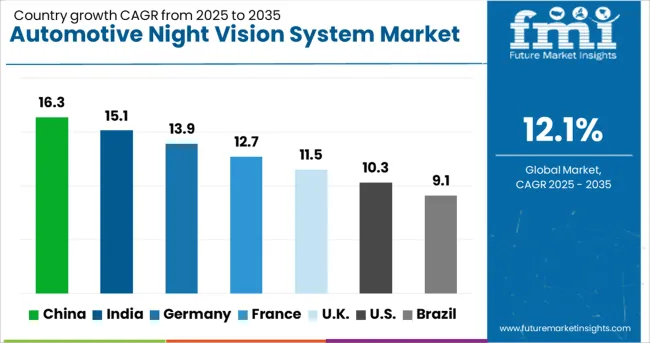

| Country | CAGR |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.7% |

| UK | 11.5% |

| USA | 10.3% |

| Brazil | 9.1% |

The automotive night vision system market is expected to grow at a global CAGR of 12.1% between 2025 and 2035, driven by increasing demand for advanced driver assistance systems, rising road safety concerns, and premium vehicle adoption. China leads with a 16.3% CAGR, supported by rapid luxury vehicle production and integration of advanced safety technologies. India follows at 15.1%, fueled by growing automotive electronics manufacturing and rising premium car sales. Germany, at 13.9%, benefits from strong R&D capabilities and leadership in automotive innovation. The UK, projected at 11.5%, sees growth from adoption in high-end vehicles and performance cars. The USA, at 10.3%, reflects steady uptake across SUVs, sedans, and defense vehicles. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 16.3% from 2025 to 2035 in the automotive night vision system market, supported by rising adoption in luxury vehicles, premium SUVs, and high-end electric cars. Domestic automakers such as NIO, BYD, and Hongqi are integrating night vision systems to enhance safety and differentiate models in competitive segments. Leading suppliers including Huawei, Hikvision Automotive, and Zhejiang Uniview Technologies are developing cost-effective thermal imaging modules for mass-market adoption. Government encouragement of advanced driver assistance system (ADAS) deployment in both domestic and export vehicles is accelerating growth. Partnerships between OEMs and semiconductor manufacturers are improving sensor performance under low-light and adverse weather conditions.

India is forecasted to achieve a CAGR of 15.1% from 2025 to 2035, driven by the premium vehicle segment and the expansion of high-speed expressway networks. Automakers such as Tata Motors, Mahindra & Mahindra, and Hyundai India are launching mid-range SUVs equipped with basic night vision capabilities to appeal to safety-conscious buyers. Component suppliers are focusing on affordable infrared camera systems tailored to the Indian market’s price sensitivity. Increasing adoption in police, emergency response, and defense vehicles is adding to demand. Technological advancements are also enabling integration with digital instrument clusters and head-up displays.

Germany is projected to post a CAGR of 13.9% from 2025 to 2035, supported by its luxury automotive manufacturing base and commitment to road safety innovations. OEMs such as BMW, Audi, and Mercedes-Benz are offering next-generation night vision systems with pedestrian detection, animal recognition, and adaptive illumination. Suppliers including Bosch, Continental, and ZF Friedrichshafen are focusing on enhanced image processing algorithms for sharper detection at longer ranges. Integration with semi-autonomous driving features is a growing trend, improving driver situational awareness during night-time and low-visibility conditions.

The United Kingdom is expected to record a CAGR of 11.5% from 2025 to 2035, driven by demand from luxury and performance car buyers seeking enhanced safety in rural and high-speed driving conditions. Automakers such as Jaguar Land Rover, Bentley, and Aston Martin are adopting high-resolution night vision cameras with AI-driven object recognition. Integration with adaptive headlight systems is becoming more common to improve illumination of detected hazards. Growth is also being driven by aftermarket installations catering to enthusiasts and fleet operators.

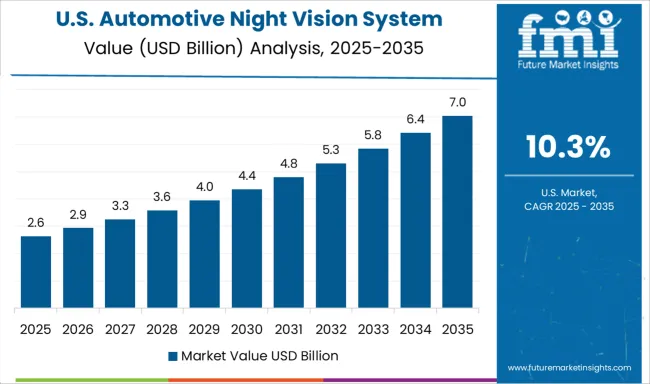

The United States is forecasted to grow at a CAGR of 10.3% from 2025 to 2035, supported by demand in SUVs, pickup trucks, and luxury sedans. OEMs such as General Motors, Ford, and Tesla are integrating night vision systems into high-end trims, particularly for models marketed in regions with wildlife collision risks. Suppliers like FLIR (Teledyne), Magna International, and Visteon are advancing thermal sensor miniaturization to reduce system cost and improve ease of integration. Rising popularity of advanced safety features in the premium vehicle market is fueling adoption.

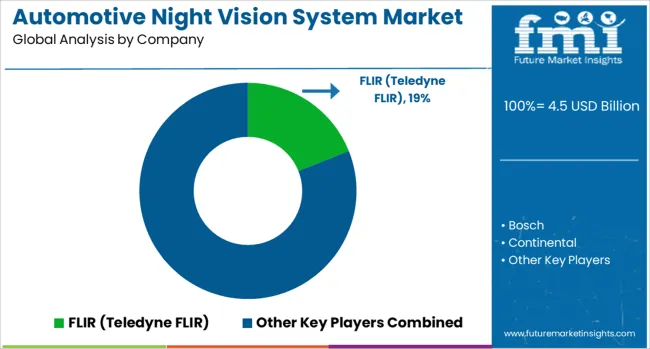

The automotive night vision system market is led by advanced driver assistance system (ADAS) suppliers and automotive technology companies specializing in thermal imaging, infrared sensing, and sensor fusion. FLIR (Teledyne FLIR) is a key provider of thermal camera modules integrated into luxury and high-performance vehicles, enabling long-range pedestrian and animal detection.

Bosch and Continental offer night vision systems combined with ADAS features such as automatic emergency braking and lane assist, targeting premium and safety-focused vehicle segments. DENSO Corporation and ZF Friedrichshafen supply OEMs with infrared-based night vision solutions that integrate seamlessly with in-vehicle displays and head-up projection systems.

Magna International and Valeo focus on camera and sensor modules optimized for all-weather performance, enhancing driver visibility in low-light conditions. Veoneer develops forward-looking infrared (FLIR) and radar fusion systems to improve detection accuracy, while Visteon Corporation integrates night vision feeds into digital cockpit platforms for improved driver awareness.

Omnivision contributes high-resolution image sensors specifically tuned for low-light performance, supporting system integrators across multiple vehicle platforms. Key strategies in this market include partnerships with automakers for factory-installed systems, advancements in sensor range and resolution, and integration with autonomous driving platforms. Entry into the sector is restricted by high R&D costs, stringent automotive safety and performance validation requirements, and strong relationships between established ADAS suppliers and global vehicle manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Product | Passive system and Active system |

| Display | Instrument cluster, Head-up display, and Navigation display |

| Component | Night vision camera, Sensors, and Controlling unit |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FLIR (Teledyne FLIR), Bosch, Continental, DENSO Corporation, Magna International, Omnivision, Valeo, Veoneer, Visteon Corporation, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by system type and vehicle application, demand dynamics across passenger, commercial, and electric vehicle segments, regional trends in infra‑red technologies (far‑ vs near‑infrared) and ADAS integration across North America, Europe, and Asia‑Pacific, innovation in AI-enhanced object detection, HUD and augmented‑reality display integration, and multi-modal sensor fusion, environmental impact of production costs, energy usage, and aftermarket retrofit waste, and emerging use cases in autonomous driving platforms, aftermarket safety retrofits, and fleet/night‑operation vehicle safety enhancements. |

The global automotive night vision system market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the automotive night vision system market is projected to reach USD 14.1 billion by 2035.

The automotive night vision system market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in automotive night vision system market are passive system and active system.

In terms of display, instrument cluster segment to command 45.0% share in the automotive night vision system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

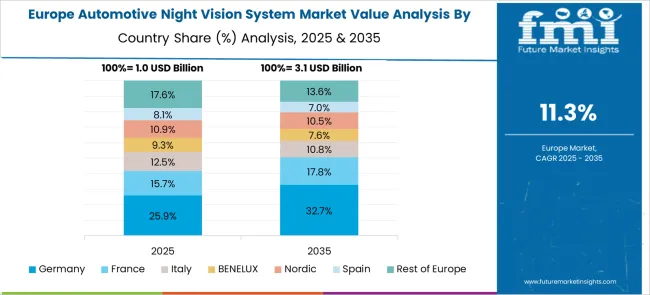

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA