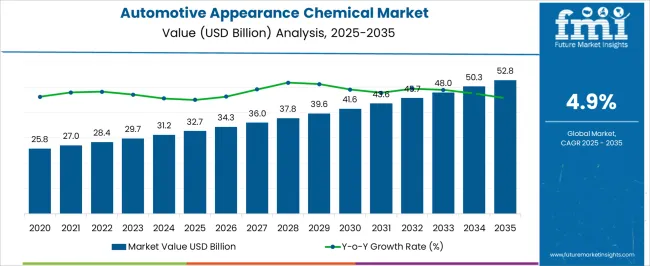

The Automotive Appearance Chemical Market is estimated to be valued at USD 32.7 billion in 2025 and is projected to reach USD 52.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The Automotive Appearance Chemical market is witnessing significant growth driven by the increasing emphasis on vehicle aesthetics and maintenance. The market outlook is influenced by rising consumer demand for high-quality automotive care products, particularly in regions with growing vehicle ownership. Continuous innovation in chemical formulations has enhanced the performance and longevity of products such as windshield washer fluids, coatings, and surface cleaners, making them more effective in maintaining vehicle appearance.

Environmental regulations and the shift toward eco-friendly formulations have further shaped product development strategies, enabling sustainable growth. Increasing aftermarket activities and growing awareness of vehicle maintenance among car owners are fueling product adoption. The integration of advanced technologies in vehicle care, such as smart coatings and multi-functional chemicals, is expanding application possibilities.

Moreover, the growth of the automotive industry, particularly passenger vehicles, combined with rising disposable incomes, has contributed to heightened demand for appearance chemicals As consumers increasingly prioritize vehicle aesthetics alongside protection, the market is expected to sustain steady expansion in both developed and emerging regions.

| Metric | Value |

|---|---|

| Automotive Appearance Chemical Market Estimated Value in (2025 E) | USD 32.7 billion |

| Automotive Appearance Chemical Market Forecast Value in (2035 F) | USD 52.8 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

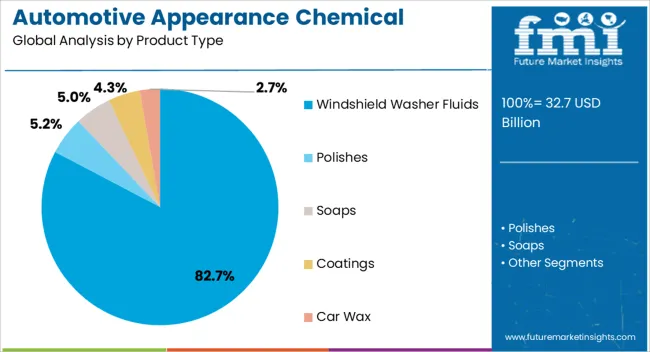

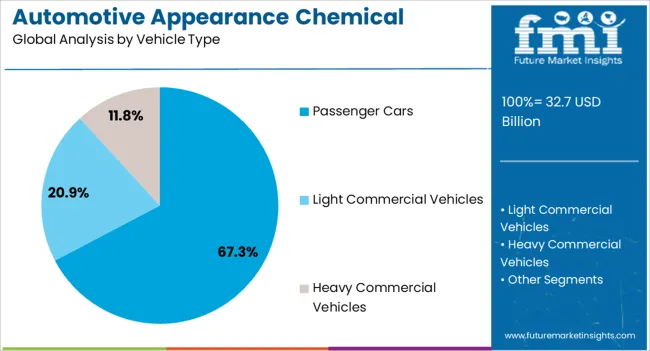

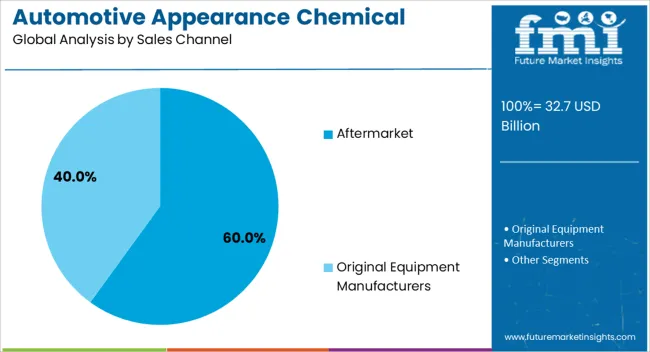

The market is segmented by Product Type, Vehicle Type, and Sales Channel and region. By Product Type, the market is divided into Windshield Washer Fluids, Polishes, Soaps, Coatings, and Car Wax. In terms of Vehicle Type, the market is classified into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Based on Sales Channel, the market is segmented into Aftermarket and Original Equipment Manufacturers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Windshield washer fluids are projected to hold 82.70% of the Automotive Appearance Chemical market revenue share in 2025, establishing them as the leading product type. This dominance is primarily driven by their essential role in ensuring clear visibility and safety during vehicle operation. The segment has benefited from innovations in chemical formulations that improve cleaning efficiency, reduce streaking, and enhance freeze resistance in diverse climates.

The growing adoption of multifunctional products that combine cleaning with anti-fog and water-repellent properties has reinforced demand. Increasing vehicle ownership and regulatory emphasis on road safety have further accelerated the consumption of windshield washer fluids.

Their widespread availability in retail and aftermarket channels ensures accessibility for consumers, while advancements in eco-friendly and biodegradable formulations cater to sustainability demands The robustness of distribution networks, combined with continuous product innovation, supports the sustained growth of the windshield washer fluids segment.

The passenger cars segment is expected to capture 67.30% of the Automotive Appearance Chemical market revenue share in 2025, positioning it as the leading vehicle type. This growth is influenced by the high penetration of passenger vehicles globally and the increased focus on maintaining vehicle aesthetics and performance.

Consumers are investing in chemical products to enhance vehicle longevity and visual appeal, driving higher adoption rates in this segment. The segment has benefited from growing awareness about preventive maintenance and protection against environmental damage such as UV exposure, pollution, and road debris.

Additionally, technological improvements in automotive appearance chemicals tailored for passenger cars, including multifunctional cleaners and protective coatings, have reinforced market growth Rising disposable incomes and increasing aftermarket activities further propel demand, making passenger cars the dominant vehicle type for appearance chemical applications.

The aftermarket sales channel is anticipated to account for 60.00% of the Automotive Appearance Chemical market revenue share in 2025, making it the leading distribution route. This growth is driven by the convenience and accessibility offered by aftermarket channels, allowing vehicle owners to purchase appearance chemicals as needed.

The segment has been supported by the proliferation of specialized retail outlets, automotive service centers, and e-commerce platforms that facilitate easy access to high-quality products. Increased awareness regarding regular vehicle maintenance and protective care has encouraged consumers to rely on aftermarket solutions.

Moreover, the flexibility of aftermarket channels to provide a wide range of products, including innovative and eco-friendly formulations, has enhanced adoption The continued expansion of passenger vehicles and rising consumer focus on vehicle aesthetics are further reinforcing the dominance of the aftermarket sales channel in the market.

Accelerating Wheels of Change are Driving Demand for Appearance Chemicals

Advancements in chemical formulations represent a significant leap forward in the automotive appearance chemical industry. Manufacturers, with a focus on innovation, are developing formulations that not only deliver superior performance but also prioritize environmental sustainability.

The technological breakthroughs have led to the creation of appearance chemicals that effectively clean, polish, and protect vehicle surfaces without causing harm to the environment.

Consumers are placing greater emphasis on sustainability when making purchasing decisions. The shift in consumer preferences has prompted a surge in demand for appearance chemicals that are eco friendly and biodegradable.

Manufacturers, in response to the growing trend, are investing in research and development to create formulations that minimize environmental impact while maintaining high performance standards.

Eco Evolved Elixirs, Pioneering the Green Revolution in Appearance Chemistry

The automotive industry is witnessing sustained growth, with emerging markets playing a pivotal role in driving the expansion. There is a surge in demand for vehicles, as economies develop and disposable incomes rise in regions such as Asia, Latin America, and Africa. The surge, coupled with increasing urbanization and infrastructure development, translates to higher vehicle ownership rates.

Greater responsibilities in terms of maintenance and upkeep come with higher vehicle ownership rates. Vehicle owners, both individuals and fleet operators, prioritize the visual appeal and longevity of the vehicles. Appearance chemicals play a crucial role, offering solutions for cleaning, polishing, and protecting various surfaces of automobiles.

Shine Stations, Fuelling the Revved up World of Appearance Chemistry

The expansion of professional car care centers and detailing services has revolutionized the automotive appearance chemical market. The facilities, ranging from standalone car washes to specialized detailing shops, offer comprehensive solutions for vehicle maintenance and aesthetics.

Equipped with state of the art equipment and expertise, professional car care centers utilize a wide range of appearance chemicals to cater to the diverse needs and preferences of customers.

Professional car care centers play a crucial role in driving the demand for automotive appearance chemicals by offering tailored solutions to meet the specific requirements of vehicle owners.

The facilities utilize an array of appearance chemicals to deliver superior results, whether customers seek basic washing and detailing services or advanced paint correction and ceramic coating treatments.

The scope for automotive appearance chemical rose at a 4.2% CAGR between 2020 and 2025. The global market is achieving heights to grow at a significant CAGR of 4.9% over the forecast period 2025 to 2035.

The market witnessed a significant demand during the historical period, owing to the factors such as consumer preference for aesthetics. Consumers placed greater importance on the appearance of the vehicles, driving the demand for appearance chemicals that could enhance and protect the exterior and interior surfaces. Trends such as customization and personalization further fueled the demand for specialized appearance products.

Technological advancements led to the development of more effective and eco friendly appearance chemicals. Manufacturers focused on improving formulations to provide superior performance, durability, and environmental sustainability, catering to evolving consumer preferences.

The expansion of professional car care centers, detailing services, and automotive aftermarket retailers provided consumers with convenient access to a wide range of appearance chemicals and services. Increased awareness of vehicle maintenance also contributed to the growth of the car care industry.

The forecast period will experience continued growth, attributed to shift towards electric and autonomous vehicles, as the increasing adoption of such vehicles will present opportunities for the automotive appearance chemical market.

Manufacturers will need to develop specialized products suited for the unique materials and surfaces used in electric vehicles, as well as solutions for autonomous vehicle sensors and cameras.

The integration of smart technologies such as AI, IoT, as well as mobile apps into car care solutions will revolutionize the industry. Smart car care products will offer real time monitoring, predictive maintenance alerts, and personalized recommendations, enhancing the user experience and efficiency of vehicle maintenance.

The following table shows the estimated growth rates of the top three markets. India and China are set to exhibit high demand in automotive appearance chemical, recording CAGRs of 7.3% and 5.5%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 2.7% |

| The United Kingdom | 1.9% |

| Japan | 2.1% |

| China | 5.5% |

| India | 7.3% |

The automotive appearance chemical market in the United States will expand at a CAGR of 2.7% through 2035.

American consumers value the appearance and condition of the vehicles, viewing them as investments. The emphasis on vehicle care and maintenance drives the demand for appearance chemicals that help preserve the exterior and interior aesthetics of cars, trucks, and SUVs.

The United States has one of the highest rates of vehicle ownership globally, with a significant portion of the population relying on personal vehicles for transportation. The demand for appearance chemicals to maintain vehicle aesthetics is growing, as the number of vehicles on the road increases.

The country has a vibrant automotive enthusiast culture, with enthusiasts investing in customizations, modifications, and detailing products to enhance the appearance and performance of the vehicles. The enthusiast market creates opportunities for specialty appearance chemicals and detailing services.

The automotive appearance chemical market in the United Kingdom to expand at a CAGR of 1.9% through 2035.

The country has a growing market for professional detailing services, with detailing shops, car wash facilities, and mobile detailers offering a wide range of services to vehicle owners. The expansion of professional detailing services drives the demand for high quality appearance chemicals used by professionals.

Continuous innovation in chemical formulations leads to the development of advanced appearance chemicals with superior cleaning, polishing, and protective properties. Technological advancements, such as nano coatings and ceramic coatings, cater to consumers seeking long lasting results and enhanced durability.

The rise of e-commerce platforms and digital marketing channels provides consumers in the country with convenient access to a diverse range of appearance chemicals. Online retailers and automotive specialty websites offer a wide selection of products, enabling consumers to compare options and make informed purchasing decisions.

Automotive appearance chemical trends in India are taking a turn for the better. A 7.3% CAGR is forecast for the country from 2025 to 2035.

The proliferation of car care products retail chains and specialty stores across India provides consumers with easy access to a wide range of appearance chemicals, detailing tools, and accessories. The retail chains offer a one stop shop for car care needs, driving the adoption of appearance chemicals among vehicle owners.

The expanding middle class population in India is increasingly able to afford car ownership, driven by rising incomes and improved access to financing options. The demand for appearance chemicals to maintain and enhance the vehicles grows, as more middle class families purchase cars.

The automotive aftermarket sector in India is witnessing significant growth, driven by the demand for replacement parts, accessories, and maintenance products. Appearance chemicals, including car wash shampoos, waxes, and interior cleaners, are essential products in the aftermarket segment, contributing to market growth.

| Segment | Windshield Washer Fluids (Product Type) |

|---|---|

| Value Share (2025) | 82.7% |

In terms of product type, the windshield washer fluids segment will dominate the market, and will account for a share of 82.7% in 2025.

Seasonal variations, such as winter weather with snow, ice, and road salt, significantly impact windshield cleanliness and visibility. The demand for specialized washer fluids formulated for cold weather conditions, which prevent freezing and effectively remove ice and snow residues, surges during winter months, driving segmental growth.

Windshield washer fluids play a crucial role in maintaining clear visibility for drivers by effectively removing dirt, debris, and road grime from windshields. The demand for high quality washer fluids that ensure optimal visibility and safety increases, as road safety remains a top priority for vehicle owners.

Technological advancements in washer fluid formulations lead to the development of innovative products with enhanced cleaning efficacy, streak free performance, and protection against windshield damage. Features such as water repellent coatings and anti glare additives appeal to consumers seeking advanced solutions for windshield maintenance, driving segmental growth.

| Segment | Passenger Cars (Vehicle Type) |

|---|---|

| Value Share (2025) | 67.3% |

In terms of vehicle type, the passenger cars segment will dominate the automotive appearance chemical market, and will account for a share of 67.3% in 2025.

Passenger car owners recognize the importance of regular maintenance to preserve the performance, longevity, and resale value of the vehicles. Appearance chemicals contribute to routine maintenance routines, providing effective cleaning, protection, and detailing solutions that help maintain the pristine condition of passenger cars, thus driving segmental growth.

The passenger car segment represents a significant portion of the automotive market, with rising levels of vehicle ownership globally. The demand for appearance chemicals to maintain vehicle aesthetics and cleanliness grows proportionally, as more consumers purchase passenger cars for personal transportation needs.

The passenger car segment offers a wide range of customization options, allowing consumers to personalize the vehicles according to the preferences and lifestyle. Appearance chemicals play a vital role in enhancing and protecting custom paint finishes, alloy wheels, interior trims, and other personalized features, driving demand within the segment.

The competitive landscape of the automotive appearance chemical market is characterized by intense competition among key players, each striving to gain market share through product differentiation, innovation, strategic partnerships, and market expansion initiatives.

The market encompasses a wide range of appearance chemicals used for cleaning, polishing, protecting, and enhancing the aesthetics of vehicles, including passenger cars, commercial vehicles, and two wheelers.

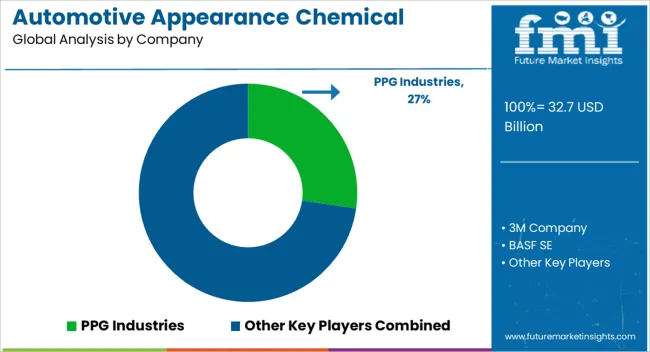

The market is dominated by several prominent players, including multinational corporations and regional manufacturers. The key players command significant market share through the extensive product portfolios, established distribution networks, and brand recognition.

Key players often form strategic partnerships and collaborations with automotive OEMs, car dealerships, professional detailing services, and retail chains to expand the market presence and enhance product visibility. The partnerships facilitate co branding initiatives, exclusive distribution agreements, and joint marketing campaigns, driving sales and brand awareness.

Kao Corporation is a leading Japanese manufacturer of consumer and chemical products, with a strong presence in the automotive care segment. Under its Magiclean brand, Kao Corporation offers a range of automotive appearance chemicals tailored for interior cleaning and maintenance.

The products include interior cleaners, air fresheners, and fabric protectants formulated to effectively remove dirt, stains, and odors while preserving the appearance and comfort of vehicle interiors.

PPG Industries is a global leader in coatings, paints, and specialty materials, serving customers in diverse industries worldwide. Under the automotive appearance chemical sector, the company offers a comprehensive portfolio of automotive refinish products under brands such as Envirobase, DELTRON, and Delfleet.

The products encompass primers, clearcoats, paints, and specialty coatings designed to deliver superior color matching, durability, and aesthetic appeal for automotive refinishing applications.

The report consists of key product types of automotive appearance chemical including polishes, windshield washer fluids, soaps, coatings, and car wax.

The market is classified into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV).

The market is bifurcated into aftermarket and original equipment manufacturers (OEMs).

The analysis of the automotive appearance chemical market has been carried out in key countries North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, The Middle East and Africa.

The global automotive appearance chemical market is estimated to be valued at USD 32.7 billion in 2025.

The market size for the automotive appearance chemical market is projected to reach USD 52.8 billion by 2035.

The automotive appearance chemical market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive appearance chemical market are windshield washer fluids, polishes, soaps, coatings and car wax.

In terms of vehicle type, passenger cars segment to command 67.3% share in the automotive appearance chemical market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA