The global automotive printed circuit board (PCB) market is poised for consistent growth, expected to rise from USD 10.98 billion in 2025 to USD 18.79 billion by 2035, registering a CAGR of 5.5% during the forecast period. This expansion is driven by rapid technological advancements in vehicle electronics, the increasing adoption of autonomous driving features, and the global shift towards electric mobility.

These transformative trends require high-performance PCBs that ensure efficient power management, support infotainment systems, and enable advanced driver-assistance systems (ADAS), elevating the need for reliable and complex PCB designs.

| Attribute | Detail |

|---|---|

| Industry Size (2025E) | USD 10.98 billion |

| Industry Size (2035F) | USD 18.79 billion |

| CAGR (2025 to 2035) | 5.5% |

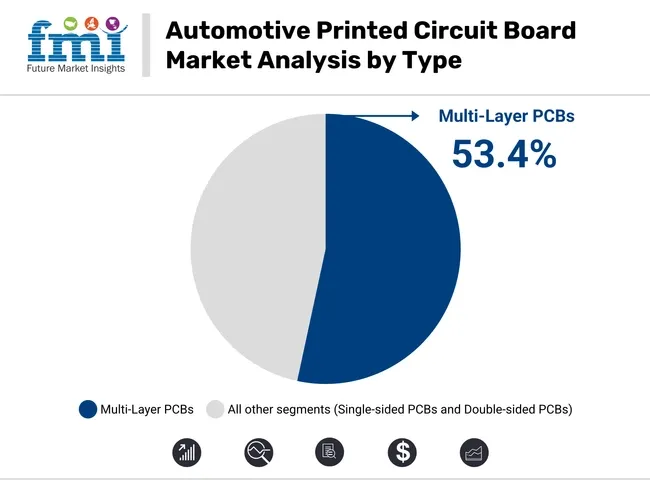

Among PCB types, Multi-Layer PCBs are projected to lead the market, capturing a 53.4% revenue share in 2025. Their capability to provide superior signal integrity, higher electrical performance, and the ability to house multiple functions within compact layouts make them essential for modern vehicles.

These PCBs are widely used in critical automotive modules, including powertrain control systems, collision avoidance technologies, and battery management systems in electric vehicles (EVs), highlighting their indispensable role in next-generation vehicle architectures.

In terms of vehicle type, Passenger Cars are set to dominate the market with an anticipated 72.1% share in 2025. Growing consumer demand for connected and autonomous features, alongside the expanding EV market, fuels this dominance. Automakers are increasingly investing in enhancing vehicle safety, intelligence, and user comfort, all of which depend heavily on advanced and dependable PCB technology. The rise in EV adoption across regions such as Europe, North America, and Asia Pacific further accelerates this trend.

A noteworthy industry development includes Syrma SGS’s inauguration of a cutting-edge manufacturing facility in October 2024 at Ranjangaon, India. Reported by The Economic Times Telecom, this move strengthens regional production capacity to meet surging automotive electronics demand globally. Major players like TTM Technologies, Chin Poon Industrial, Meiko Electronics, KCE Electronics, and Unimicron Technology remain committed to R&D and expansion strategies to cater to evolving market needs

In 2025, Multi-Layer PCBs are expected to dominate the type segment with a 53.4% market share, driven by the increasing demand for high-performance electronic systems in vehicles. On the basis of vehicle type, Passenger Cars are projected to hold a 72.1% share, as the integration of infotainment, safety, and ADAS technologies rises rapidly in this segment.

The Multi-Layer PCB segment is projected to lead with a 53.4% share of the global market in 2025. These PCBs are essential for modern automotive applications such as advanced driver-assistance systems (ADAS), infotainment systems, battery management systems (BMS), and electronic control units (ECUs).

Their ability to support complex circuit designs in a compact form factor makes them indispensable in next-generation electric vehicles and connected car platforms. Automotive OEMs and suppliers increasingly demand multi-layer PCBs to handle higher data transmission, heat dissipation, and miniaturization needs for intelligent mobility solutions, boosting this segment’s market presence.

The passenger cars segment is set to command a 72.1% share of the market in 2025, owing to the widespread adoption of electronics for enhanced comfort, connectivity, and safety features. The rapid growth of electric and hybrid vehicles, coupled with the integration of smart displays, autonomous driving features, and telematics systems, is fueling PCB demand in this vehicle category.

Increasing consumer expectations for technologically advanced passenger vehicles, especially in Asia-Pacific and Europe, further strengthen this segment’s leadership. Automakers are focusing heavily on electronics-rich models to meet stringent emission norms and driver assistance mandates, reinforcing passenger cars as the primary revenue source for PCB manufacturers.

Semi-autonomous vehicles are expected to dominate the automotive PCB market by level of autonomy in 2025, fueled by the widespread integration of advanced driver-assistance systems (ADAS). These vehicles balance automated functionalities with human oversight, necessitating high-performance PCBs to manage radar, LiDAR, and vision processing units.

Automakers like Tesla, BMW, and Hyundai are increasingly equipping vehicles with semi-autonomous capabilities, driving PCB demand for safety-critical applications. As regulatory agencies push for higher vehicle safety standards, PCBs supporting adaptive cruise control, lane-keeping assistance, and automatic emergency braking are becoming essential. This segment acts as the stepping stone toward fully autonomous mobility.

In 2025, ADAS and basic safety systems are set to lead the automotive PCB market by application, driven by rising consumer demand and regulatory mandates for vehicle safety. These systems-including collision avoidance, blind spot detection, and emergency braking-require robust PCBs with high signal integrity and environmental durability.

Tier 1 suppliers like Meiko Electronics and Nippon Mektron are enhancing multilayer PCB solutions to support complex sensor integration and real-time data processing. The shift toward semi-autonomous features across vehicle classes is further reinforcing ADAS as the leading PCB application, making it the cornerstone of safety and innovation in modern vehicles.

The automotive printed circuit board market is changing due to rising demand for electric vehicles, advanced safety features, and autonomous driving technologies. Manufacturers are focusing on innovation, miniaturization, and reliability to meet these evolving needs.

Rising Adoption of Electric Vehicles Driving PCB Demand

Increased adoption of electric vehicles (EVs) is boosting the need for high-performance printed circuit boards. These boards are required for battery management systems, inverters, and power control units. Companies like TTM Technologies and Meiko are expanding their production capabilities to serve this rising demand.

Multi-layer and high-density interconnect (HDI) PCBs are being used for energy efficiency and space-saving designs in EVs. Thermal management has become crucial, with metal core PCBs improving heat dissipation. Automakers are demanding boards with higher durability and performance for harsh operating environments. As EV production scales globally, the requirement for reliable and advanced PCBs is reshaping supplier strategies and investments.

Growing Integration of Advanced Driver-Assistance Systems (ADAS)

Expansion of advanced driver-assistance systems (ADAS) is fueling the demand for specialized automotive PCBs. Radar, LiDAR, camera modules, and sensors require highly reliable circuit boards with excellent signal integrity. Flexible PCBs and rigid-flex designs are being adopted to meet the design complexity of these systems.

Companies like AT&S and Chin-Poon are developing tailored PCB solutions for ADAS applications. These boards must withstand vibrations, temperature fluctuations, and electromagnetic interference in vehicles. As semi-autonomous and autonomous features become more common, PCBs with increased layer counts and precision manufacturing are essential. Automakers are pushing for innovative PCB technologies to ensure safety, performance, and system reliability.

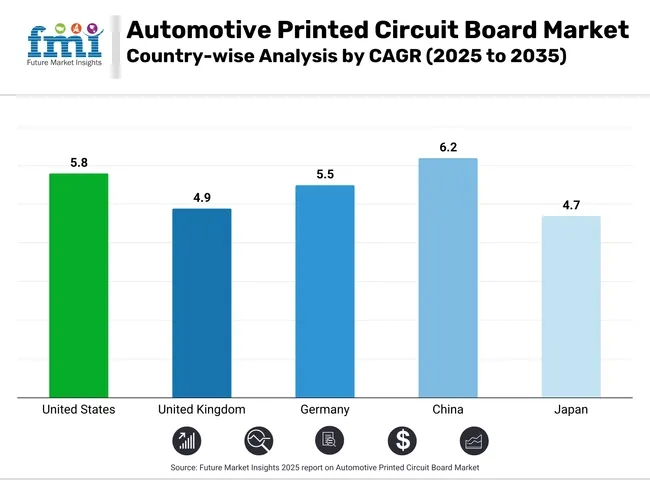

The automotive PCB market reveals top growth trends across key nations, helping manufacturers optimize production, technology, and distribution. The USA and Germany dominate demand for advanced automotive PCB solutions.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 4.9% |

| Germany | 5.5% |

| China | 6.2% |

| Japan | 4.7% |

The automotive PCB market in the United States is projected to expand at a CAGR of 5.8% between 2025 and 2035. The country's leadership is supported by early electric vehicle adoption and robust investments in autonomous driving technologies. Major OEMs such as Tesla, General Motors, and Ford are accelerating demand for advanced PCBs embedded in EV platforms and ADAS systems.

The USA market benefits from cutting-edge R&D in 5G integration, thermal management, and lightweight materials. Strategic alliances with Asian PCB suppliers and a strong domestic manufacturing ecosystem ensure the United States retains its dominant global market share throughout the forecast period.

The automotive PCB market in the United Kingdom is forecasted to grow at a CAGR of 4.9% from 2025 to 2035. Growth is fueled by the country’s aggressive shift toward electric and hybrid vehicles, supported by government incentives under the Road to Zero strategy. Expansion of EV manufacturing hubs, especially in Sunderland, drives PCB demand in battery management systems and onboard electronics.

Collaborative ventures with global PCB producers enhance product reliability and performance. Additionally, rising consumer preference for sustainable, energy-efficient vehicles is fostering technological innovation. The UK’s role in shaping Europe’s automotive PCB landscape remains significant, driven by eco-conscious market trends.

Automotive PCB market in Germany is set to record a CAGR of 5.5% through 2035, propelled by its prestigious automotive industry. Global giants such as BMW, Volkswagen, and Mercedes-Benz lead the integration of PCBs in infotainment, driver assistance, and powertrain control systems. The country’s adoption of Industry 4.0 practices enhances production precision, automation, and cost efficiency in PCB manufacturing.

Germany is also emphasizing EV development and hydrogen-fueled vehicles, diversifying PCB applications. Environmental policies and the EU Green Deal reinforce innovation in sustainable automotive electronics. These trends collectively ensure Germany’s continued prominence in the European and global automotive PCB sector.

China dominates the global automotive PCB market with the fastest projected CAGR of 6.2% between 2025 and 2035. Rapid electric vehicle adoption, large-scale government subsidies, and the presence of domestic OEMs like BYD and NIO drive this robust growth. China’s vertically integrated supply chain-from PCB fabrication to complete vehicle assembly-delivers production cost advantages and efficiency.

Investment in next-generation battery technologies and smart transportation solutions further boosts PCB utilization across models. Additionally, China’s expanding EV export market strengthens its influence on global supply dynamics, positioning the nation as a pivotal leader in the worldwide automotive PCB ecosystem.

Automotive PCB market in japan is expected to rise at a CAGR of 4.7% during 2025 to 2035. Leading automakers such as Toyota, Honda, and Nissan are at the forefront of incorporating high-performance PCBs into hybrid and electric vehicles. Japan’s renowned strengths in electronics miniaturization and reliability support the development of compact, durable PCB modules for advanced vehicle systems.

Active research in solid-state battery technology and connected vehicle infrastructure ensures continual innovation. Government initiatives aimed at carbon neutrality and the creation of intelligent transport networks further stimulate demand. Japan’s legacy of technological excellence keeps its automotive electronics market globally competitive.

The global automotive PCB market remains moderately fragmented, with Tier 1 companies like Chin Poon Industrial, Meiko Electronics, Nippon Mektron, TTM Technologies, and Unimicron Technology holding significant market share. These leaders benefit from high-volume production, advanced PCB technologies, and strong partnerships with global OEMs for EVs, ADAS, and infotainment systems.

Nippon Mektron and Meiko specialize in HDI and flexible circuits, while TTM and Unimicron focus on scalable production across regions. Tier 2 players such as KCE Electronics and Tripod Technology leverage vertical integration and cost advantages. Smaller firms like Amitron Corp address niche, flexible PCB needs in aftermarket and specialized applications.

Recent Automotive Printed Circuit Board Market News

| Report Attributes | Details |

|---|---|

| Market Size (2025E) | USD 10.98 billion |

| Projected Market Size (2035F) | USD 18.79 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value & million units for volume |

| By Type Outlook (Segment 1) | Double-Sided PCBs, Multi-Layer PCBs, Single-Sided PCBs |

| By Vehicle Type Outlook (Segment 2) | Passenger Cars, Commercial Vehicles |

| By Level of Autonomy Outlook (Segment 3) | Autonomous Vehicles, Conventional Vehicles, Semi-Autonomous Vehicles |

| By Application Outlook (Segment 4) | ADAS and Basic Safety, Body, Comfort, and Vehicle Lighting, Infotainment Components, Powertrain Components |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

| Countries Covered | United States, Canada, Germany, UK, France, China, India, Japan, South Korea, ASEAN Countries, Brazil, Mexico, GCC Countries, South Africa |

| Key Players Influencing the Market | Chin Poon Industrial; Meiko Electronics; Nippon Mektron; TTM Technologies; KCE Electronics; Tripod Technology; Unimicron Technology; Kingboard Chem GRP; Amitron Corp; CMK Corp. |

| Additional Attributes | Dollar sales, share, technology integration in EVs and ADAS systems, multi-layer PCB demand growth, emerging applications in semi-autonomous and autonomous vehicles globally |

The automotive PCB market is segmented by type into double-sided PCBs, multi-layer PCBs, and single-sided PCBs.

By vehicle type, the market covers passenger cars and commercial vehicles.

By level of autonomy, the market includes autonomous vehicles, conventional vehicles, and semi-autonomous vehicles.

By application, the market comprises ADAS and basic safety, body, comfort, and vehicle lighting, infotainment components, and powertrain components.

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The Automotive Printed Circuit Board Market is anticipated to reach USD 18.79 billion by 2035.

Double-Sided PCBs segment holds the largest share due to their cost-effectiveness and reliable performance in automotive applications.

The market is expected to grow at a CAGR of 5.5% during the forecast period.

Passenger Cars are driving the demand owing to the rising adoption of advanced electronic systems.

Chin Poon Industrial, Meiko Electronics, Nippon Mektron, TTM Technologies, and KCE Electronics are some of the major market players.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA